The program’s purpose is to make funds available for eligible applicants who are interested in purchasing a home but need financial help to pay the upfront costs associated with a mortgage. Gross sales of products from the land must average at least $1,000 per year for the first 5 acres.

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Heating assistance rebates will be issued starting on october 18, 2021.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/T7BKLA5ULVFWPFN4PIW5LBNSXU.jpg)

Property tax assistance program nj. The pilot program allows municipalities to exempt developers from full property taxes for a set period of time when making improvements to existing buildings or creating new projects in areas in need of redevelopment, aiming to encourage commercial, residential, and industrial development. If you are a senior, you can qualify for property tax assistance programs in most states, counties, or towns. Senior citizen and disabled persons property tax reimbursement program.

Since 2003, njhmfa has championed energy efficiency and green building practices for low income housing tax credit program projects in new jersey. For more information on the senior freeze program, including eligibility requirements and how to apply, visit the nj treasury department's senior freeze program page. Energy star certification has been a continuing threshold requirement in the qap, helping to create buildings that.

Eligibility criteria are set at the state or local level and may differ. Home energy and home energy assistance program; If you are a qualified veteran, widow of a veteran, senior citizen, disabled person, or surviving spouse, you may be eligible for deductions which reduce your property tax liability by $250.

Helping seniors drive safer & longer. Complete this questionnaire to see if you may be eligible for a 2017 senior freeze. We in new jersey have one of the highest property taxes in the nation.

The property tax reimbursement plan, also called the “senior freeze,” and the homestead benefit program. The new jersey housing and mortgage finance agency provides a variety of programs to assist prospective homebuyers and homeowners. The state has two programs that are supposed to help seniors with the costs:

Universal service fund and weatherization Last year, new jersey's average bill was $8,953. If the home is valued at less than $70,000, please see financial.

Counselors will provide assistance to help homeowners avoid potential foreclosure. The property must have a current market value of $70,000 or more. Seniors can receive assistance in the following:

Guide to car safety for seniors. The rules were tightened up in 2013, making it tougher to qualify for the program — including. Edison senior services provide a wide variety of services to senior residents of edison township.

Forms are sent out by the state in late february/early march. In some cases this may mean working with. Donotpay provides information on available property tax assistance for seniors in the following text and some of.

The state of new jersey offers tax relief in various forms to certain property owners. The program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence. The new jersey housing and mortgage finance agency (njhmfa) is dedicated to increasing the availability of and accessibility to safe, decent and affordable housing to families in new jersey.

If you qualify for this year’s property tax rebate for seniors program, you also qualify for this year’s heating assistance rebate program. Counseling is free, available now, and can be provided remotely. The most common programs are as follows:

Rsf properties does business across the united states, and there must be a wide margin between what is owed and the home's value. Senior freeze (property tax reimbursement) program. Take the senior resident wellness pledge.

The senior freeze (property tax reimbursement) program reimburses eligible new jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence (home). In addition, the new jersey housing and mortgage finance agency offers homeowners free counseling through its foreclosure mediation assistance program (fmap). Njeda small business emergency assistance grant program.

Tax Assessor – Chester Township Nj

Congress May Restore Your Property Tax Break But Just For A Little While Nj Congressman Says – Njcom

Freehold Township Sample Tax Bill And Explanation

Tax Assessment Summit Nj

The Official Website Of The Borough Of Roselle Nj – Tax Collector

/cloudfront-us-east-1.images.arcpublishing.com/pmn/T7BKLA5ULVFWPFN4PIW5LBNSXU.jpg)

These Nj Democrats Have Their Own Demands For Their Partys Big Bill And Yes Its About Property Taxes

Disabled Veterans Property Tax Exemptions By State

Reforming New Jerseys Income Tax Would Help Build Shared Prosperity – New Jersey Policy Perspective

The Official Website Of City Of Union City Nj – Tax Department

Road To Recovery Reforming New Jerseys Income Tax Code – New Jersey Policy Perspective

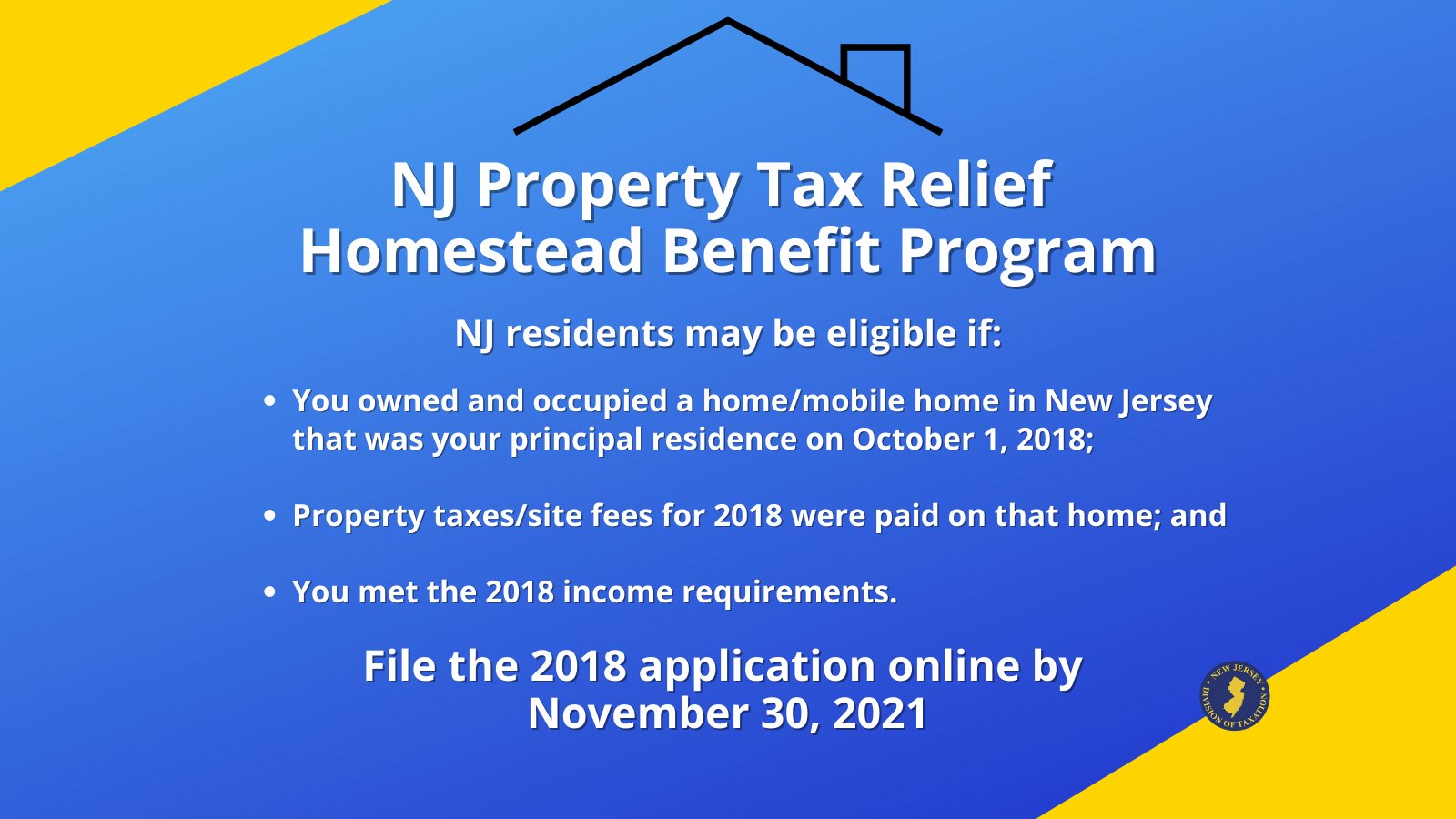

Nj Property Tax Relief Program Updates Access Wealth

Nj Div Of Taxation Nj_taxation Twitter

Nj Property Tax Relief Program Updates Access Wealth

Deducting Property Taxes Hr Block

How To Appeal Property Taxes And Win Over The Appraiser We Did – Njcom

Reforming New Jerseys Income Tax Would Help Build Shared Prosperity – New Jersey Policy Perspective

Changing Senior Freeze Program So Those Who Move Arent Penalized – Whyy

Bidens Proposal Doesnt Address Property Tax Breaks But The Final Bill Will Nj Lawmakers Say – Njcom

Freehold Township Sample Tax Bill And Explanation