Tax imposed on motor vehicle lease. Average sales tax (with local):

Classic Roadsters 1990 Sebring Healey 5000 Roadsters Classic Cars Mustang Ii

Any motor vehicle purchased or acquired either in or outside of the state of north dakota for use on the streets and highways of this state and required to be registered under the laws of this state.

Nd sales tax on vehicles. North dakota assesses local tax at the city and county levels, but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities. North dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%. Taxes would be due on the purchase price (based on exchange) at a rate of 5%.

The north dakota (nd) state sales tax rate is currently 5%. For vehicles that are being rented or leased, see see taxation of leases and rentals. The north dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle, including every trailer or semi trailer as defi ned in n.d.c.c.

Any motor vehicle owned by or in possession of the federal or state government, including any South dakota collects a 4% state sales tax rate on the purchase of all vehicles. North dakota collects a 5% state sales tax rate on the purchase of all vehicles.

In addition to taxes, car purchases in north dakota may be subject to other fees like registration, title, and plate fees. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota.

Of the vehicle is responsible to remit the motor vehicle excise tax to the north dakota department of transportation’s motor vehicle division at the time the vehicle is titled and registered. Be sure the seller has signed, dated, and completed part 1, including the odometer reading if the car is less than 10 years old. Depending on local municipalities, the total tax rate can be as high as 8.5%.

Minnesota collects a 6.5% state sales tax rate on the purchase of all vehicles. If you have recently purchased a vehicle in another state, and taxes were paid to that state, we would require proof of tax paid to exempt you from north dakota excise tax. If the vehicle was purchased outside of the united states there is no tax reciprocity.

In addition to taxes, car purchases in minnesota may be subject to other fees like registration, title, and plate fees. Selling a vehicle with north dakota title • part 1 (seller’s assignment & warranty of title) must be signed and dated by seller, completed showing selling price, date of sale, and current odometer reading which is required on all motor vehicles less than ten (10) years old. With respect to any lease for a term of one year or more of a motor vehicle with an

The december 2020 total local sales tax rate was also 7.500%. There are a total of 177 local tax jurisdictions across the state, collecting an average local tax of 0.765%. North dakota has a statewide sales tax rate of 5%, which has been in place since 1935.

You can find these fees further down on the page. Licensed motor vehicles are not subject to local option taxes. The tax is calculated on the vehicle purchase price or the total of the lease consideration depending on the lease period and vehicle weight.

For more detailed information about sales tax on vehicle. The current total local sales tax rate in fargo, nd is 7.500%. With local taxes, the total sales tax rate is between 5.000% and 8.500%.

The following are exempt from payment of the north dakota motor vehicle excise tax: In addition to taxes, car purchases in south dakota may be subject to other fees like registration, title, and plate fees. This means that, depending on your location within north dakota, the total tax you pay can be significantly higher than the 5% state sales tax.

You can find these fees further down on the page. You will also need to pay a $5 title transfer fee, 5% sales tax, and registration fees based on the vehicle's age and weight. North dakota (nd) sales tax rates by city.

There are specifically exempted from the provisions of this chapter and from computation of the amount of tax imposed by it the following: Owner telephone number mailing address city state zip code. If deducting sales taxes on the schedule a, the amount you should deduct for this vehicle is 7% of the car’s cost (the general rate), and you should not deduct the additional 3% local vehicle sales tax.

The state sales tax rate in north dakota is 5.000%. The north dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle, including every trailer or semi trailer as defi ned in n.d.c.c. North dakota has a 5% statewide sales tax rate, but also has 177 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.762% on top of the state tax.

North dakota has recent rate changes (thu jul 01 2021). When you buy a car in north dakota, be sure to apply for a new registration within 5 days. Any motor vehicle acquired by, or leased and in the possession of, a resident disabled veteran under the provisions of pub.

You can find these fees further down on the page.

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Pin By Space-frame Graca Gaspari On Mg Advertising British Cars Cool Cars Mg Midget

Eco-driving Save Fuel Save Money Save Fuel How To Save Gas Car Fuel

Lews Guy Stuff Campers For Sale Fleetwood Campers Camper Parts

Honda Cb125f 2019 Review Price And Specifications Honda New Motorcycles Motorcycle Manufacturers

Cccampers Nissan Nv200 Off Road Camper Car

Chart Diesel And Petrol Cars Losing Ground In The Eu Statista

Minnesota Sales Tax On Cars

Plaza Toyota How To Drive Efficiently In New York Visually Driving Economy Cars Car Buying Tips

Pin On Bmw M

No Extra Tax For Second Car In Garage Cough Up More For Diesel Vehicles Hyderabad News – Times Of India

Tcs On Sale Of Motor Vehicles And Goods Or Services

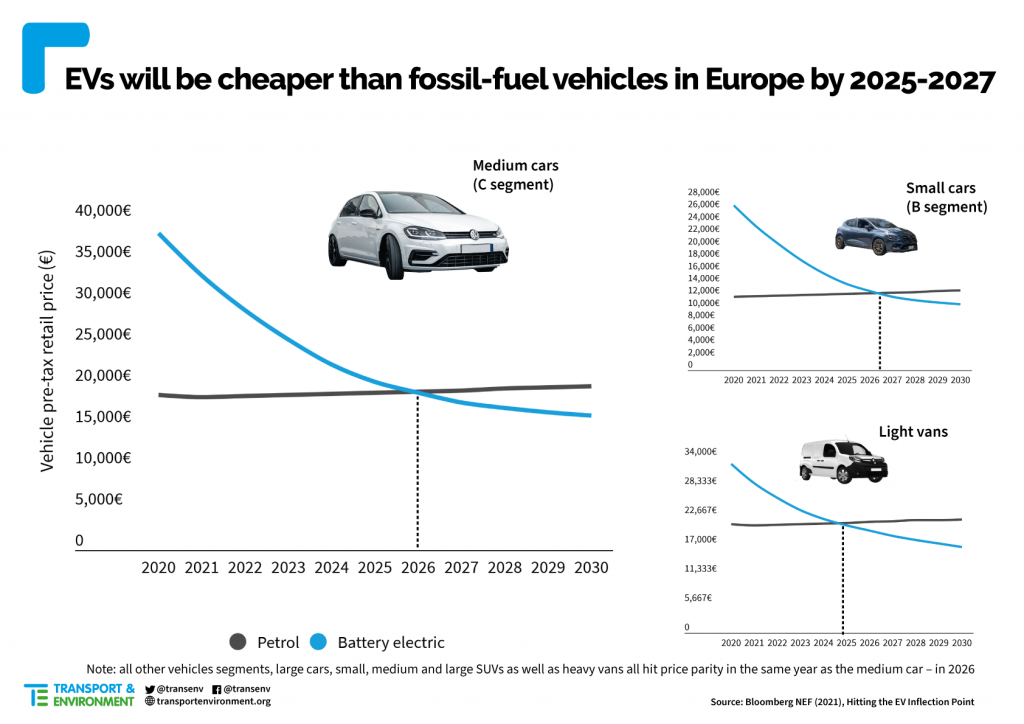

Evs Will Be Cheaper Than Petrol Cars In All Segments By 2027

Tunjangan Karyawan Tujuan Dan Jenis-jenisnya Akuntansi Laporan Laba Rugi Tujuan

Indonesias Car Sales Tax Cut May Harm The Environment Requiring Another Policy To Reduce Emissions

Gst Impact On Supply Of Used Car

Nj Car Sales Tax Everything You Need To Know

Top 10 Most Expensive Cars In The World Poutedcom Bugatti Veyron Super Sport Super Sport Cars Bugatti Veyron Sport

Chart Volkswagen Take The Wheel Statista