Inside the city limits of tulsa, the sales tax and use tax is 8.517%, which is allocated between three taxing jurisdictions: The current total local sales tax rate in tulsa, ok is 8.517%.

Tax Forms Tax Information Tulsa Library

Oklahoma has a statewide sales tax rate of 4.5%, which has been in place since 1933.

Sales tax oklahoma tulsa ok. An example of an item that exempt from oklahoma is prescription medication. The combined rate used in this calculator (8.517%) is the result of the oklahoma state rate (4.5%), the. The 74106, tulsa, oklahoma, general sales tax rate is 8.517%.

The state general sales tax rate of oklahoma is 4.5%. Tulsa, ok sales tax rate. 74117 zip code sales tax and use tax rate | tulsa {tulsa county} oklahoma sales tax and use tax rate of zip code 74117 is located in tulsa city, tulsa county, oklahoma state.

The current total local sales tax rate in tulsa county, ok is 4.867%. The tulsa sales tax rate is %. This means that an individual in the state of oklahoma who sells school supplies and books would be required to charge sales tax, but.

While oklahoma law allows municipalities to collect a local option sales tax of up to 2%, tulsa does not currently collect a local sales tax. 101 rows the 74130, tulsa, oklahoma, general sales tax rate is 4.867%. The tulsa, oklahoma, general sales tax rate is 4.5%.

There is no applicable special tax. Depending on the zipcode, the sales tax rate of tulsa may vary from 4.5% to 8.517% depending on the zipcode, the sales tax rate of. Oklahoma has recent rate changes(thu jul 01 2021).

This is the total of state, county and city sales tax rates. Oklahoma collects a 3.25% state sales tax rate on the purchase of all vehicles. The minimum combined 2021 sales tax rate for tulsa, oklahoma is.

The december 2020 total local sales tax rate was also 8.417%. The tulsa, oklahoma sales tax is 4.50%, the same as the oklahoma state sales tax. , ok sales tax rate.

Rates and codes for sales, use, and lodging tax. The maximum local tax rate allowed by oklahoma law is 6.5%. In the state of oklahoma, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer.

The county sales tax rate is %. The state sales tax rate in oklahomais 4.500%. In general, for businesses based in oklahoma, the amount of sales tax collected is dependent on where the item is shipped.

1912 bristow 4% to 5% sales and use increase july 1, 2021 5805 commerce 4% to 3% sales and use decrease july 1, 2021 3304 east duke 2% to 3.5% sales and use increase july 1, 2021 5507 edmond 4% lodging new july 1, 2021 2419 lahoma 4% to 4.5% sales and use increase july 1, 2021 Cities and/or municipalities of oklahoma are allowed to collect their own rate that can get up to 5.1% in city sales tax. The oklahoma (ok) state sales tax rate is currently 4.5%.

Depending on local municipalities, the total tax rate can be as high as 11.5%. Every 2021 combined rates mentioned above are the results of oklahoma state rate (4.5%), the county rate (0% to 3%), the oklahoma cities rate (0% to 5.1%). Select the oklahoma city from the list of cities starting with 'a' below to see its current sales tax rate.

For vehicles that are being rented or leased, see see taxation of leases and rentals. Some local sales taxes are for general purposes and some are dedicated, or “earmarked,” for specific purposes, such as public safety, major capital investments, or jails. The 8.517% sales tax rate in tulsa consists of 4.5% oklahoma state sales tax, 0.367% tulsa county sales tax and 3.65% tulsa tax.

The cost for the first 1,500 dollars is a. The combined rate used in. The december 2020 total local sales tax rate was also 4.867%.

The tulsa sales tax is collected by the merchant on. Sales & use tax retailer and vendor information information for cities and counties sales & use tax publications/charts sales & use tax tools business sales tax business use tax business forms withholding alcohol & tobacco motor fuel miscellaneous taxes This page covers the most important aspects of oklahoma's sales tax with respects to vehicle purchases.

There is no applicable special tax. The oklahoma sales tax rate is currently %. Sales in the two largest cities, oklahoma city and tulsa, are taxed at total rates between 8 and 9 percent.

The december 2020 total local sales tax rate was also 8.517%. However it must be noted that the first 1,500 dollars spent on the vehicle would not be taxed in the usual way; With local taxes, the total sales tax rate is between 4.500% and 11.500%.

Oklahoma Sales Tax – Small Business Guide Truic

Total Sales Tax Per Dollar By City – Oklahoma Watch

The New Oklahoma Sales Tax Law What Online Sellers Need To Know Taxjar Blog

Economy In Tulsa Oklahoma

2

Oklahoma Sales Tax – Taxjar

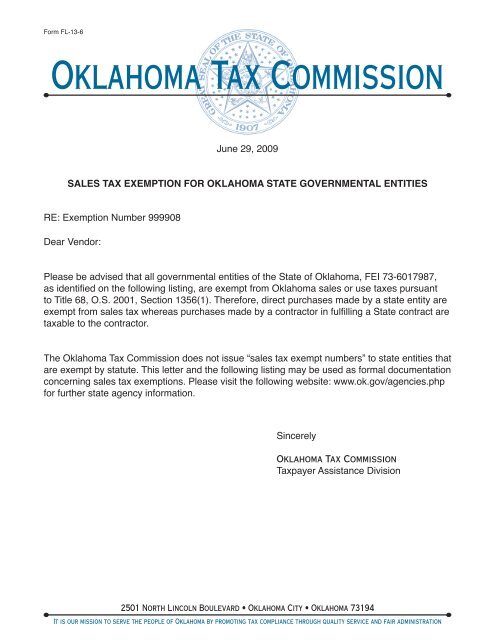

Sales Tax Exemption Letter For Oklahoma State Govt Entities

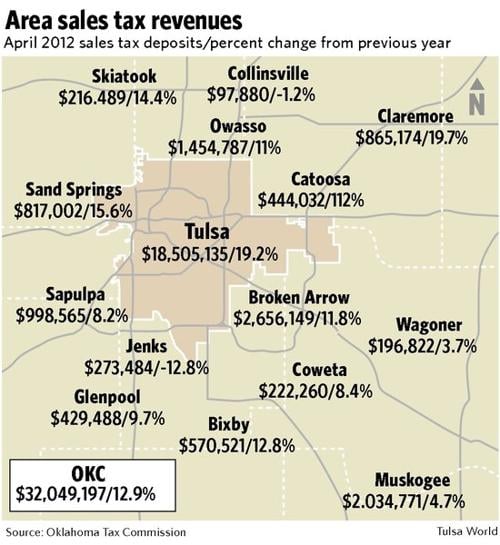

City Sales-tax Revenue Up 19 Percent For Month Politics Tulsaworldcom

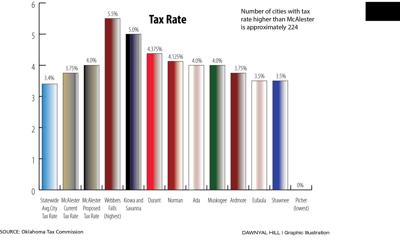

Many Sales Tax Rates Across Oklahoma Higher Than Mcalesters Local News Mcalesternewscom

Rates And Codes For Sales Use And Lodging Tax – Oklahoma Tax

Oklahomas Tax Mix – Oklahoma Policy Institute

Ok Sales Tax Rebate – Tulsa City – Fill Out Tax Template Online Us Legal Forms

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4867

State And Local Tax Distribution – Oklahoma Policy Institute

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Oklahoma Taxes Compare – Oklahoma Policy Institute

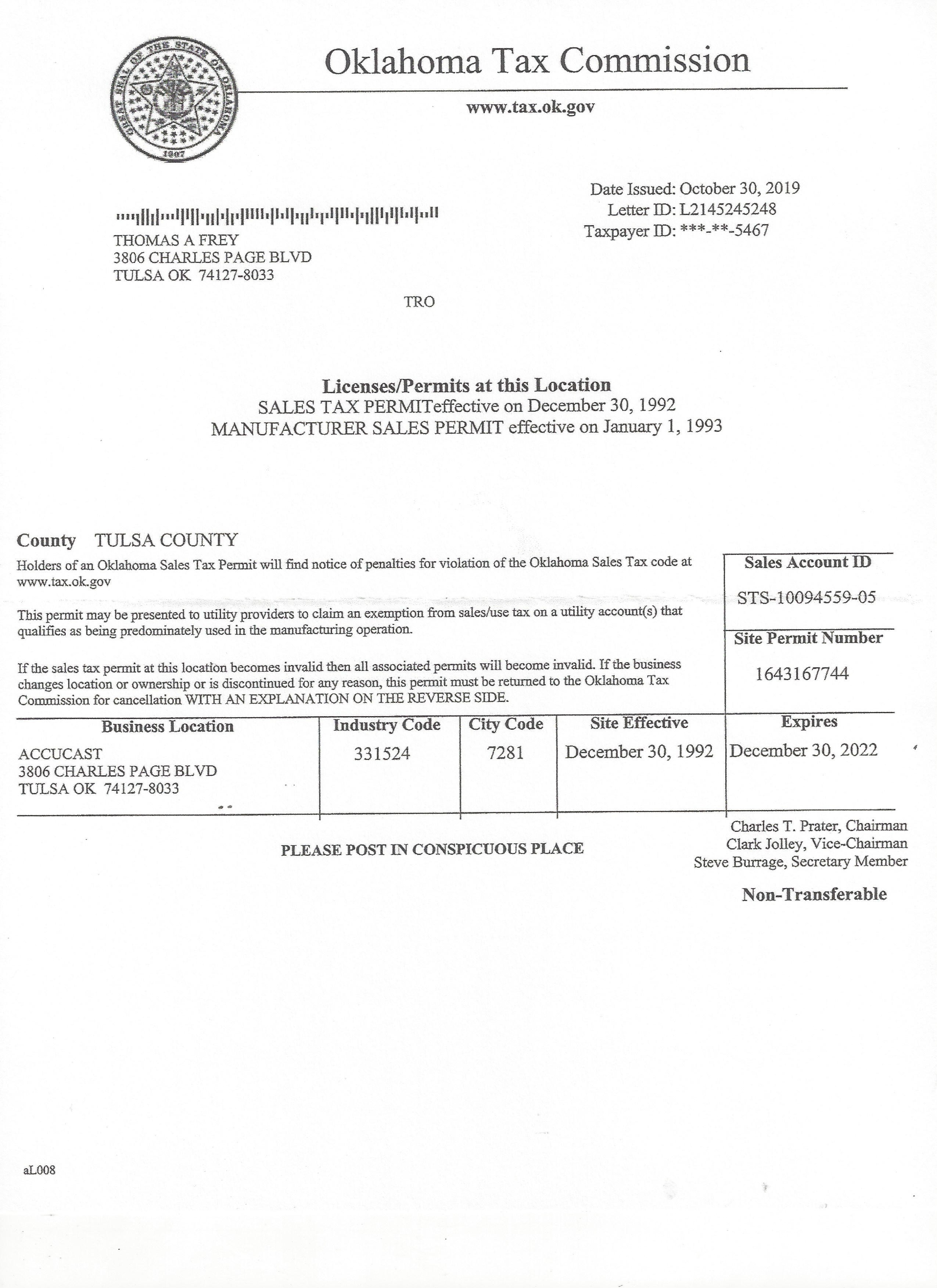

Accu-cast

5 Things You Should Know About Oklahoma Taxes – Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes – Oklahoma Policy Institute