For taxpayers in the state of new york, there’s new york city, and then there’s everywhere else. With taxjar’s sales tax api, all you need to do is let us know that you are selling a saas product by entering the product tax code that corresponds to your particular product.

New York Sales Tax Rates By City County 2021

Pursuant to the new york state real property tax law, the department of assessment and taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the city of buffalo.

Sales tax calculator buffalo ny. It is also worth noting that new york city has a different assessment system than the one described above. The new york sales tax rate is currently %. The erie county sales tax is collected by the merchant on all qualifying sales made within erie county.

8.05 cents per gallon of regular gasoline, 8.00 cents per gallon of diesel. 101 rows the 14225, buffalo, new york, general sales tax rate is 8.75%. Start yours with a template!.

Let more people find you online. The minimum combined 2021 sales tax rate for buffalo, new york is. The combined nyc and nys transfer tax for sellers is between 1.4% and 2.075% depending on the sale price.

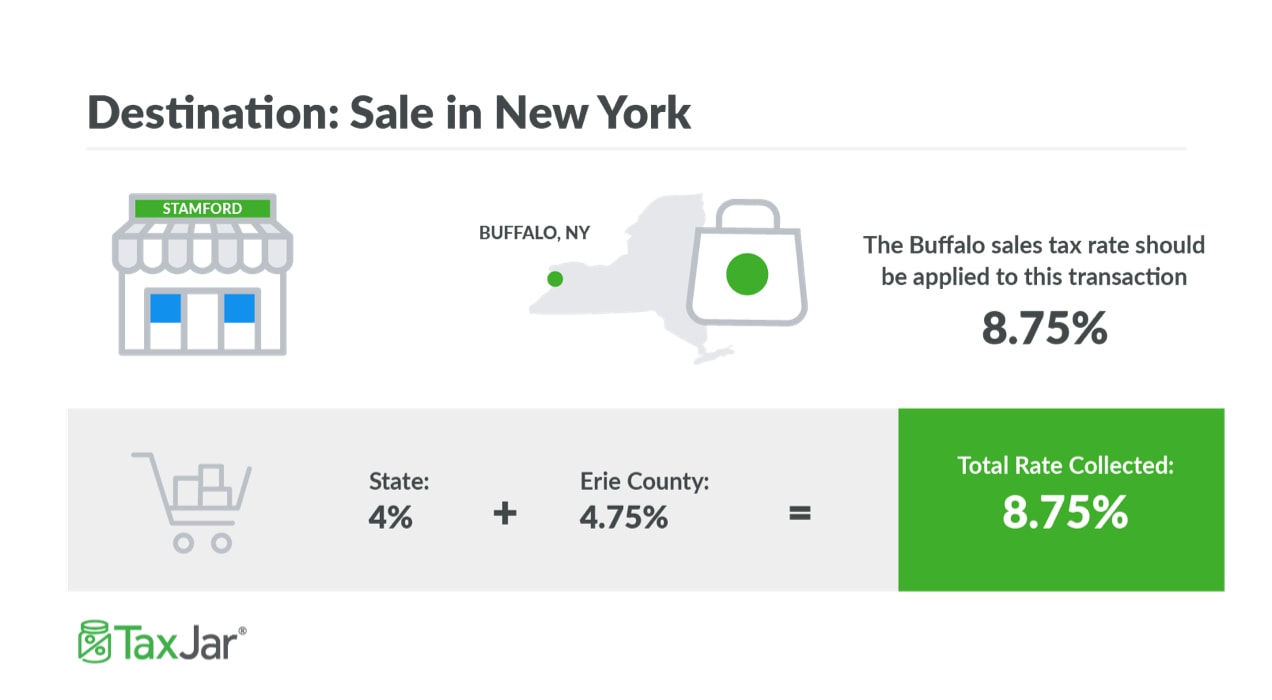

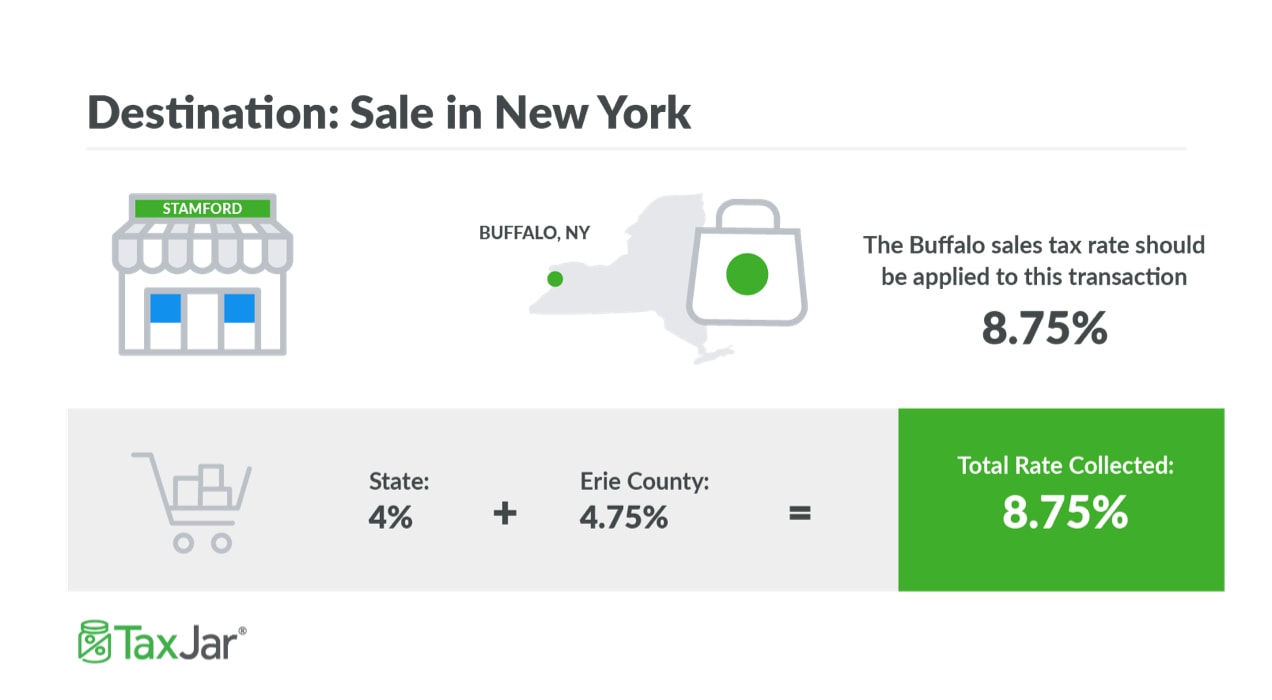

The city has four classes of property. The erie county, new york sales tax is 8.75% , consisting of 4.00% new york state sales tax and 4.75% erie county local sales taxes.the local sales tax consists of a 4.75% county sales tax. The calculator can also find the amount of tax included in a gross purchase amount.

Buffalo, ny sales tax rate. The sales tax added to the original purchase price produces the total cost of the purchase. How to automate sales tax when selling a saas product.

Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. The 8.75% sales tax rate in buffalo consists of 4% new york state sales tax and 4.75% erie county sales tax. Ad earn more money by creating a professional ecommerce website.

Calculate a simple single sales tax and a total based on the entered tax percentage. For state, use and local taxes use state and local sales tax calculator. In queens, the rate is 0.88%.

Sellers pay a combined nyc & nys transfer tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less. The department issues the appropriate annual tax bill predicated on the final assessed value. The december 2020 total local sales tax rate was also 8.750%.

There is no applicable city tax or special tax. Net price is the tag price or list price before any sales taxes are applied. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Let more people find you online. Our sales tax calculator will calculate the amount of tax due on a transaction. New york sales tax calculator.

The highest possible tax rate is found in new york city, which has a tax rate of 8.88%. In richmond county (staten island), the rate is 0.92%. Start yours with a template!.

Groceries are exempt from the erie county and new york. Total price is the final amount paid including sales tax. The bronx has the highest effective tax rate in new york city, at 0.98%.

From there, we ensure that you collect the right amount of sales tax. The county sales tax rate is %. Sales tax on saas can get tricky,, and that’s exactly why we built taxjar.

The buffalo sales tax rate is %. The current total local sales tax rate in buffalo, ny is 8.750%. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

This is the total of state, county and city sales tax rates. See reviews, photos, directions, phone numbers and more for sales tax calculator locations in buffalo, ny. Ad earn more money by creating a professional ecommerce website.

Use leading seo & marketing tools to promote your store. The average total car sales tax paid in new york state is 7.915%. New york is one of the five states with.

Use leading seo & marketing tools to promote your store. You can use our new york sales tax calculator to look up sales tax rates in new york by address / zip code. Find 399 listings related to sales tax calculator in buffalo on yp.com.

Wayfair, inc affect new york? In manhattan (new york county), the rate is 0.95%.

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

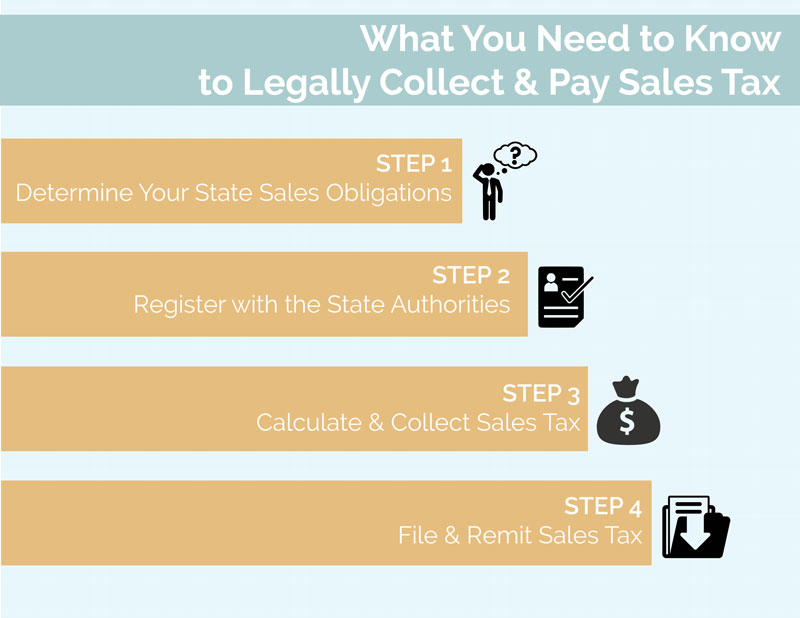

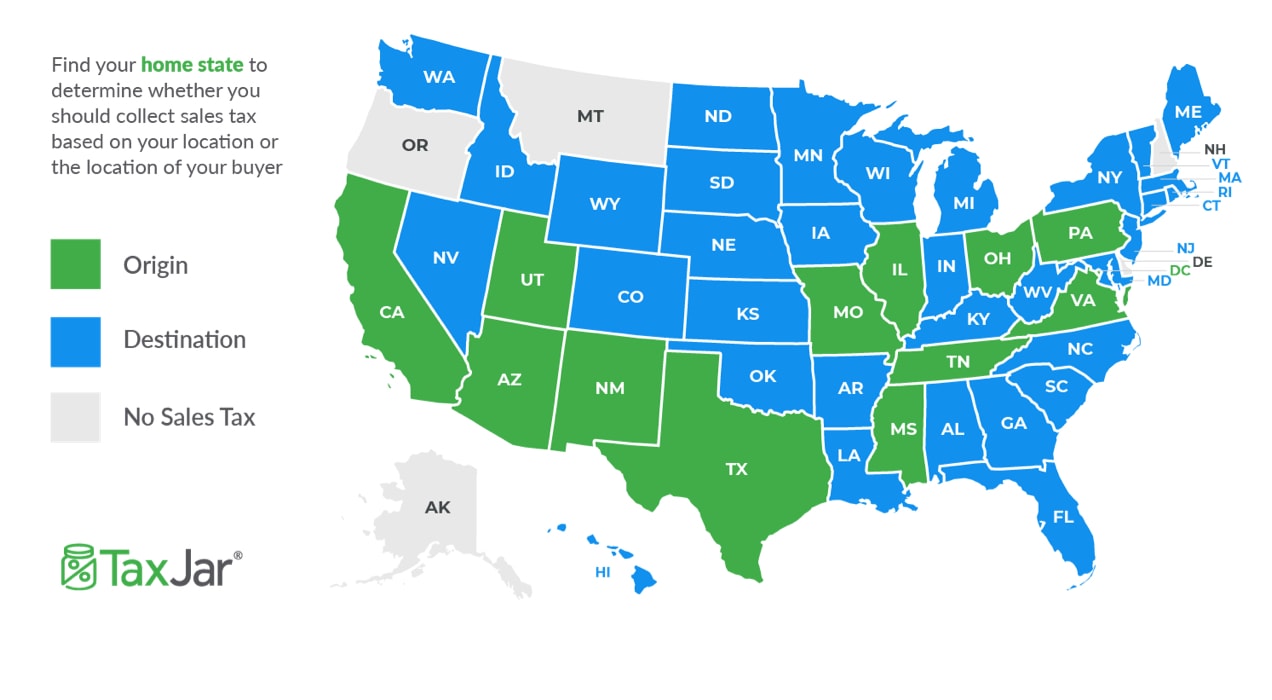

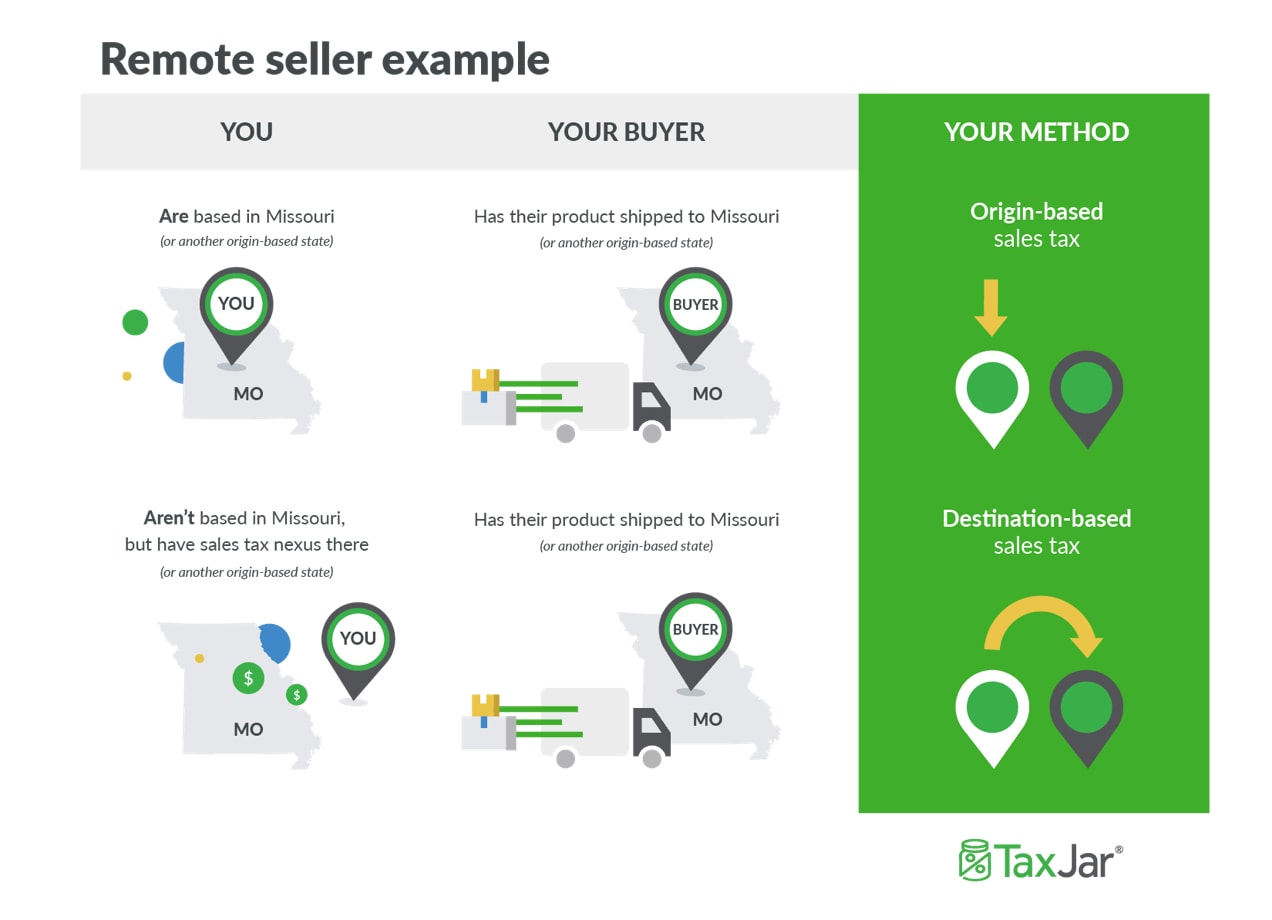

How To Charge Your Customers The Correct Sales Tax Rates

New York Sales Tax For Photographers – Bastian Accounting For Photographers

How To Charge Your Customers The Correct Sales Tax Rates

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

New York Sales Tax For Photographers – Bastian Accounting For Photographers

Certificate Of Authority – New York Sales Tax Truic

New York Vehicle Sales Tax Fees Calculator

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

Is Saas Taxable In New York – Taxjar

Is Saas Taxable In New York – Taxjar

2021 Top Tax Law Boutiques Canadian Lawyer

Minnesota Sales Tax Calculator Reverse Sales Dremployee

What Canadian Businesses Need To Know About Us Sales Tax – Madan Ca

How To Charge Your Customers The Correct Sales Tax Rates

New York Property Tax Calculator – Smartasset

New York Sales Tax For Photographers – Bastian Accounting For Photographers

How To Charge Your Customers The Correct Sales Tax Rates