Dallas county has one of the highest median property taxes in the united states, and is ranked. The december 2020 total local sales tax rate was also 6.250%.

How To File And Pay Sales Tax In Texas Taxvalet

Dallas county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections.

Dallas county texas sales tax rate. The tax is collected by the retailer at the point of sale and forwarded to the texas comptroller on a monthly or quarterly basis. The median property tax (also known as real estate tax) in dallas county is $2,827.00 per year, based on a median home value of $129,700.00 and a median effective property tax rate of 2.18% of property value. Click any locality for a full breakdown of local property taxes, or visit our texas sales tax calculatorto lookup local rates by zip code.

If you need access to a database of all texas local sales tax rates, visit the sales tax data page. The current total local sales tax rate in dallas, tx is 8.250%. The median property tax in dallas county, texas is $2,827 per year for a home worth the median value of $129,700.

Ad earn more money by creating a professional ecommerce website. There is no applicable county tax. The dallas county property tax rate is determined by the commissioners’ court and combined with the rates decided by your appraisal district (based on an assessment of local property values).

The 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax, 1% dallas tax and 1% special tax. Let more people find you online. Dallas area rapid transit :

Has impacted many state nexus laws and sales tax collection requirements. The base dallas texas sales tax rate is 1%, and the dallas texas sales tax rate (dallas mta transit) is 1%, so when combined with the texas sales tax rate of 6.25%, the dallas texas sales tax rate totals 8.25%. Texas has a lot of different counties, 254 in total, which is the largest number of counties within a state in the u.s.

Yearly median tax in dallas county. The dallas sales tax rate is %. The dallas county sales tax rate is %.

Sales & use tax rates: Let more people find you online. The local sales tax rate in dallas county is 0%, and the maximum rate (including texas and city sales taxes) is 8.25% as of november 2021.

There is no applicable county tax. Ad earn more money by creating a professional ecommerce website. Ad valorem tax rate (per $100 assessed value) city of desoto 0.705144%:

Start yours with a template!. , tx sales tax rate. The table combines the base texas sales tax rate of 6.25% and the local county rates to give you a total tax rate for each county.

Use leading seo & marketing tools to promote your store. Dallas county, tx sales tax rate. 125 rows * 1.5% county tax rate;

This is the total of state, county and city sales tax rates. How does the dallas county property tax rate compare? Use leading seo & marketing tools to promote your store.

The county sales tax rate is %. What is the sales tax rate in dallas, texas? The texas sales tax rate is currently %.

The sales tax rate in dallas is 8.25 percent of taxable goods or services sold within c ity limits. The minimum combined 2021 sales tax rate for dallas, texas is. You can print a 8.25% sales tax table here.

Dallas county collects, on average, 2.18% of a property's assessed fair market value as property tax. The current total local sales tax rate in dallas county, tx is 6.250%. The 2018 united states supreme court decision in south dakota v.

You can find detailed information about how your rate is calculated on the dallascounty.org website. The average tax rate in. , tx sales tax rate.

The texas sales tax rate for most counties is 2%, which means that most counties, when combined. Start yours with a template!.

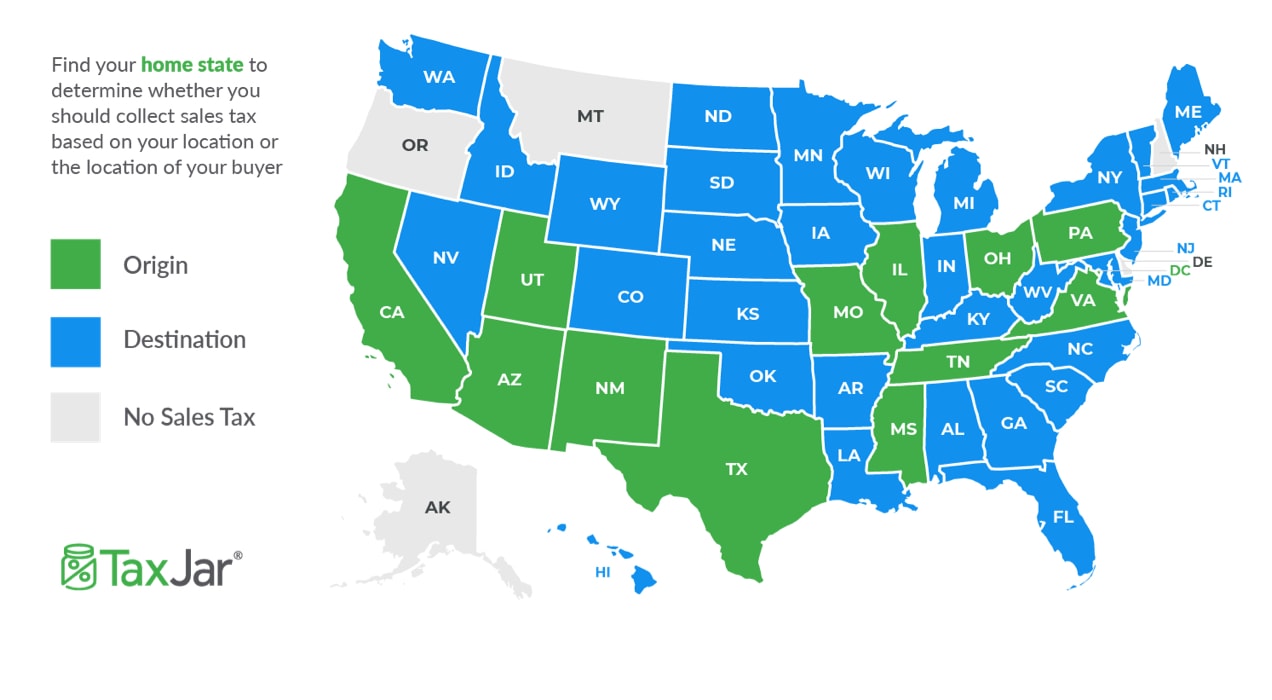

Origin Based Sales Tax Example And Automated Sales Tax Collection With Tax Jar Sales Tax Tax Archer City

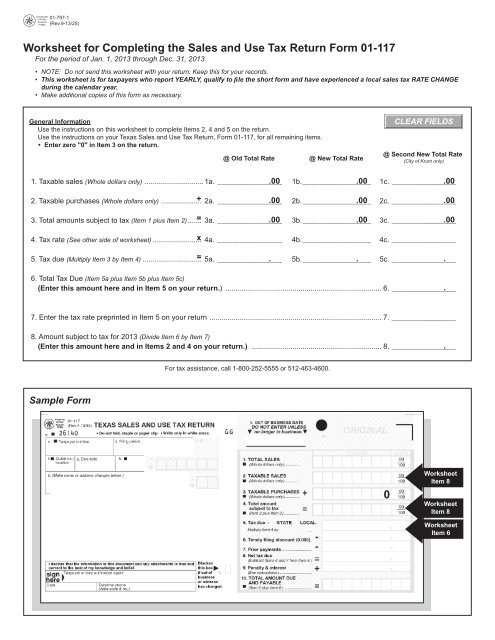

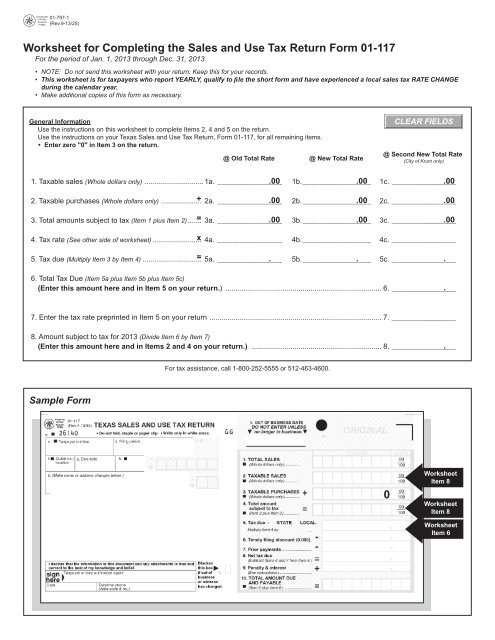

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax – Taxjar

How To File And Pay Sales Tax In Texas Taxvalet

Budget And Tax Facts City Of Lewisville Tx

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Rates By City County 2021

From 1500 To One Texas Considers Flat Sales Tax Rate For Remote Sellers

First Tax In The Universe Accounting Firms Payroll Taxes Filing Taxes

Business Intelligence Consultancy Services – How And Why Corporate Training Sales Coaching Marketing Consultant

2

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

How To Charge Your Customers The Correct Sales Tax Rates

2

Worksheet For Completing The Sales And Use Tax Return Form 01-117

States With Highest And Lowest Sales Tax Rates