The county’s average effective property tax rate is 1.41%. The median property tax (also known as real estate tax) in fall river county is $1,125.00 per year, based on a median home value of $86,800.00 and a median effective property tax rate of 1.30% of property value.

These Are The Safest States To Live In Life Map States In America Us State Map

Special assessments are due by april 30 th also.

South dakota property tax rates by county. South dakota property taxes by county. Ad valorem refers to a tax imposed on the value of something (as opposed to quantity or some other measure). The median property tax (also known as real estate tax) in day county is $925.00 per year, based on a median home value of $64,800.00 and a median effective property tax rate of 1.43% of property value.

Combined with the state sales tax, the highest sales tax rate in south dakota is 6.5% in the. • the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. The median property tax (also known as real estate tax) in jackson county is $783.00 per year, based on a median home value of $54,600.00 and a median effective property tax rate of 1.43% of property value.

(605) 353 8408 (phone) (605) 353 8410(fax) the beadle county tax assessor's office is located in huron, south dakota. Median property tax is $1,620.00. The bon homme county tax assessor is the local official who is responsible for assessing the taxable value of all properties within bon homme county,.

This eastern south dakota county has the highest property taxes in the state. A home with a full and true value of $230,000 has a taxable. The median property tax (also known as real estate tax) in douglas county is $1,022.00 per year, based on a median home value of $58,300.00 and a median effective property tax rate of 1.75% of property value.

The property tax is the primary source of revenue for local governments. This is the value upon which your south dakota property taxes are based. The jackson county tax assessor is the local official who is responsible for assessing the taxable value of all properties within jackson county, and may.

Jackson county assessor's office services. Lincoln county collects the highest property tax in south dakota, levying an average of $2,470.00 (1.46% of median home value) yearly in property taxes, while mellette county has the lowest property tax in the state, collecting an average tax of $510.00 (1.02% of median home value) per year. The voters of south dakota repealed the state inheritance tax effective july 1, 2001.there is also no estate tax.

South dakota does not have an inheritance tax. Roberts county assessor's office services. Brookings county collects very high property taxes, and is among the top 25% of counties.

You can use the south dakota property tax map to the left to compare haakon county's property tax to other counties in south dakota. Click here for a larger sales tax map, or here for a sales tax table. (605) 589 4210 (phone) the bon homme county tax assessor's office is located in tyndall, south dakota.

The roberts county tax assessor is the local official who is responsible for assessing the taxable value of all properties within roberts county, and. If the county is at 100% of full and true value, then the equalization factor (the number to get to 85% of taxable value) would be.85. Then the property is equalized to 85% for property tax purposes.

Get driving directions to this office. In addition, all taxes under $50 are due and payable in. The taxing authorities then apply an 85% equalization ratio to get the property's taxable value.

Fall river county collects very high property taxes, and is among the top 25% of. This interactive table ranks south dakota's counties by median property tax in dollars, percentage of home value, and percentage of median income. In all cases when you select a month, you will be viewing data compiled from returns filed with the department during that month.

Get driving directions to this office. (605) 837 2424 (phone) the jackson county tax assessor's office is located in kadoka, south dakota. Beadle county assessor's office services.

Day county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections. Any taxes that are paid late will be returned to the remitter with the proper. Bon homme county assessor's office services.

The first half of your real estate taxes are due by midnight on april 30 th. What is the property tax? Get driving directions to this office.

Get driving directions to this office. Second half are due by october 31 st. In the year 2020, property owners will be paying 2019 real estate taxes.) real estate tax notices are mailed to the property owners in either late december or early january.

South dakota has state sales tax of 4.5%, and allows local governments to collect a local option sales tax of up to 6%.there are a total of 193 local tax jurisdictions across the state, collecting an average local tax of 1.125%. Fall river county, south dakota. It may cover a variety of taxpayer filing periods, such as monthly, bi.

The typical homeowner here pays $2,535 in property taxes each year. The beadle county tax assessor is the local official who is responsible for assessing the taxable value of all. Real estate taxes are paid one year in arrears.

Sully county collects very high property taxes, and is among the top 25% of counties in the united. First half property taxes are due by april 30 th; The second half of your real estate taxes are due by midnight on october 31 st.

For instance, if your home has a full and true value of $250,000, the taxable value will add up to ($250,000 multiplied by 0.85) $212,500. (605) 698 3205 (phone) the roberts county tax assessor's office is located in sisseton, south dakota. Lincoln county collects the highest property tax in south dakota, levying an average of $2,470.00 (1.46% of median home value) yearly in property taxes, while mellette county has the lowest property tax in the state, collecting an average tax of $510.00 (1.02% of median home.

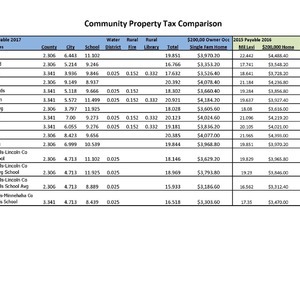

The median property tax (also known as real estate tax) in brookings county is $1,913.00 per year, based on a median home value of $138,300.00 and a median effective property tax rate of 1.38% of property value. The median property tax (also known as real estate tax) in sully county is $772.00 per year, based on a median home value of $72,200.00 and a median effective property tax rate of 1.07% of property value. 2022 (proposed) tax r ates.

Historical sales tax statistical reports are organized in the expand/collapse regions below.

Pa Unconventional Natural Gas Production By County Jan-jun 2012 Graphing Charts And Graphs Drill

Property Tax South Dakota Department Of Revenue

Our Free Online Sales Tax Calculator Calculates Exact Sales Tax By State County City Or Zip Code County Sales Tax South Dakota

4 Questions To Ask Before Buying A Home Ryan Serhant Property Tax Buying A New Home Home Buying

Tax Information In Tea South Dakota City Of Tea

Property Tax South Dakota Department Of Revenue

Cityplanningnewscom County Natural Disaster Risk Map Natural Disasters Map Disasters

Economics Chart Math

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator – Smartasset

Pin On Lugares Que Visitar

Tax Information In Tea South Dakota City Of Tea

Pin On Misc Library

Where Should I Retire Infographic – Blog – Boca Raton Fort Lauderdale Homes Real Estate Infographic House Prices Best Places To Retire

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Americans Are Migrating To Low-tax States United States Map Native American Map States

South Dakota Sales Tax – Small Business Guide Truic

Tuition And Fees Over Time – Trends In Higher Education – The College Board Tuition Native American Spirituality College Board

South Dakota Property Tax Calculator – Smartasset