If that vehicle is three years old, that taxable value is then multiplied by a tax rate of 1.2 percent: Every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1.23%), the colorado springs tax rate (0% to 3.12%), and in some case, special rate (1%).

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Used Cars

All about taxes in colorado springs (cos)!

Colorado springs vehicle sales tax rate. Exact tax amount may vary for different items. Castle rock, co sales tax rate: The rate will drop in subsequent years until reaching a flat rate of $3 in the tenth model year.

The colorado springs sales tax rate is %. Sales tax rates in the city of glenwood springs. To find out your auto sales tax, take the sales price of your vehicle and calculate 7.72 percent of this price.

The sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. City sales tax must be collected by the vehicle leasing company (lessor) on each lease payment. Englewood, co sales tax rate:

These taxes are based on the year of manufacture of the vehicle and the original taxable value which is determined when the vehicle is new and. Fees are based on the empty weight and type of vehicle being registered, c.r.s. The maximum tax that can be owed is 525 dollars.

Groceries and prescription drugs are exempt from the colorado sales tax. Commerce city, co sales tax rate: 80901, 80903, 80904, 80905, 80906, 80907, 80909, 80910, 80914, 80916, 80917, 80918, 80919, 80920, 80922, 80923, 80924, 80927, 80932, 80933, 80934, 80935, 80936, 80937, 80938, 80939, 80941, 80942, 80946, 80947, 80949, 80950, 80960, 80962 and 80997.

The colorado sales tax rate is currently %. For example, if you owned a retail store selling books at the lakewood address you would charge 7.5% tax on each sale. The county sales tax rate is %.

The december 2020 total local sales tax rate was 8.250%. The colorado (co) state sales tax rate is currently 2.9%. Any business in these jurisdictions would be expected to collect sales tax on items they sell in the area.

State of colorado, el paso county, and pprta effective january 1, 2016 through december 31, 2020, the city of colorado springs sales and use tax rate is 3.12% for all transactions occurring during this date range. Companies doing business in colorado need to register with the colorado department of revenue. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

Colorado springs, co sales tax rate: Brighton, co sales tax rate: This is the total of state, county and city sales tax rates.

Motor vehicle dealerships, should review the dr 0100 changes for dealerships document, in addition to the information on the dr0100 changes web page. A motor vehicle leased for 30 or more days by a colorado springs resident (lessee) must be registered in the same manner as a purchased vehicle. The current total local sales tax rate in colorado springs, co is 8.200%.

The combined rate used in this calculator (5.13%) is the result of the colorado state rate (2.9%), the 80921's county rate (1.23%), and in some case, special rate (1%). Location tax rates and filing codes. 2021 colorado state sales tax.

This downloadable spreadsheet combines the information in the dr 1002 sales and use tax rates document and information in the dr 0800 local jurisdiction codes for sales tax filing in one lookup tool. The 80921, colorado springs, colorado, general sales tax rate is 5.13%. This is the estimated amount that you will have to pay.

Denver, co sales tax rate: On a $30,000 vehicle, that's $2,475. Please refer to the colorado website for more sales taxes information.

Tops, psst, 2c road tax; Depending on local municipalities, the total tax rate can be as high as 11.2%. However, a county tax of up to 5% and a city or local tax of up to 8% can also be applicable in addition to the state sales tax.

Broomfield, co sales tax rate: Colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. All *pprta pikes peak rural transportation authority:

Centennial, co sales tax rate: Colorado springs city rate(s) 2.9% is. If at the start of a lease the lessee was not a colorado springs

Our taxes are paid in several pieces: In colorado, localities are allowed to collect local sales taxes of up to 4.20% in addition to the colorado state sales tax. Fort collins, co sales tax.

For those who file sales taxes. Rate variation the 80921's tax rate may change depending of the type of purchase. Collected by the colorado department of revenue:

The colorado springs, colorado sales tax rate of 8.2% applies to the following 35 zip codes: For a more accurate figure, visit a branch office in person and keep your title papers handy. Taxes for auto dealers get a little trickier because we collect taxes based on a couple of different factors.

Additional fees may be collected based on county of residence and license plate selected. Effective with january 2014 sales tax return, the penalty interest rate has changed to.5%. Welcome to the city of colorado springs sales tax filing and payment portal powered by.

Colorado springs is considered a very low tax area of the country to live, especially compared to other major cities. Putting this all together, the total sales tax paid by colorado springs residents comes to 8.25 percent. The colorado springs's tax rate may change depending of the type of purchase.

The colorado state sales tax rate is 2.9%, and the average co sales tax after local surtaxes is 7.44%. The minimum combined 2021 sales tax rate for colorado springs, colorado is.

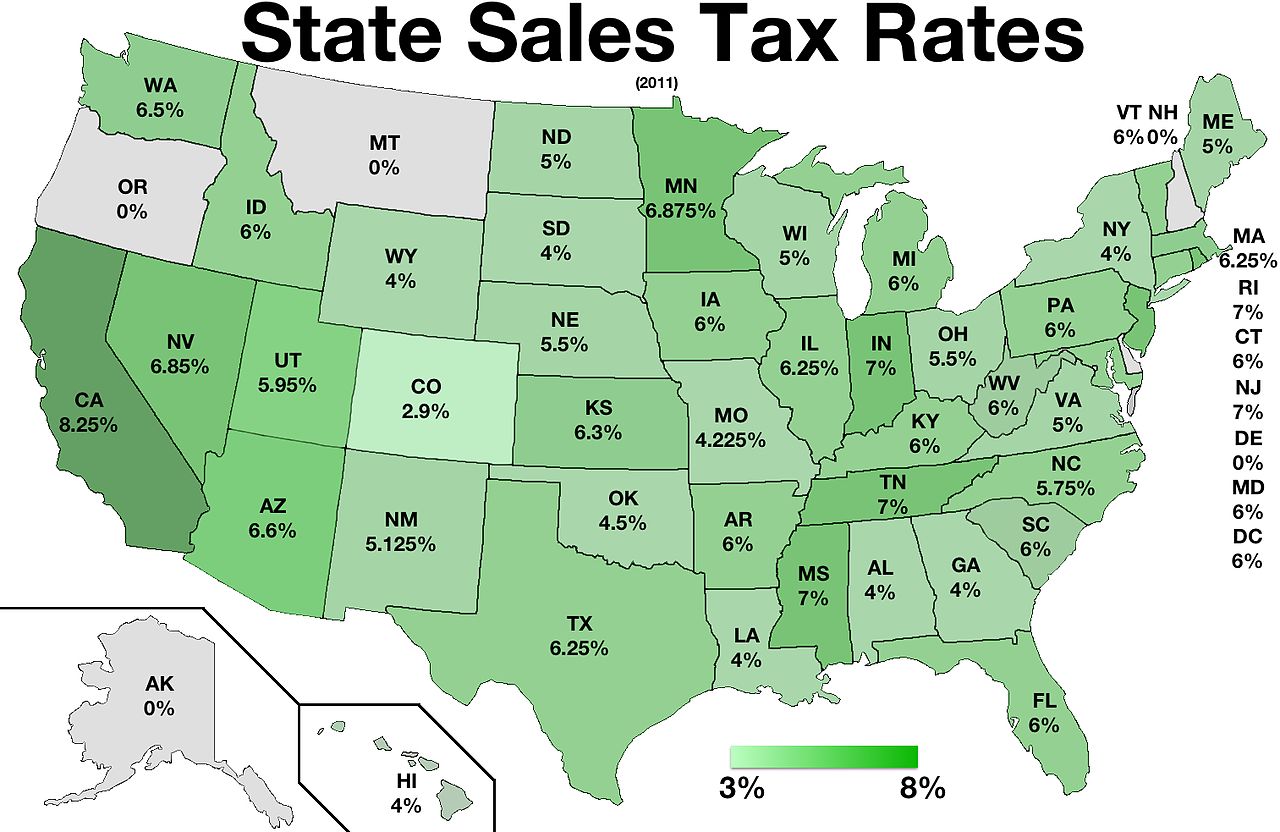

Sales Taxes In The United States – Wikiwand

Httpwwwwatsoncpagroupcomcoloradospringstaxesphp Tax Accountant Tax Services Tax

Health Insurance Tax Health Insurance Infographic Infographic Health Health Insurance

How Colorado Taxes Work – Auto Dealers – Dealrtax

Insurance Ads Life Health Life Insurance Banner – Banner Ads Web Template Psd Download Here Graphicr Insurance Ads American Life Insurance Life Insurance

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Income Tax Irs Tax Forms

Pin By Alicia Hunt On Budgeting Tax Prep Tax Prep Checklist Financial Tips

How Colorado Taxes Work – Auto Dealers – Dealrtax

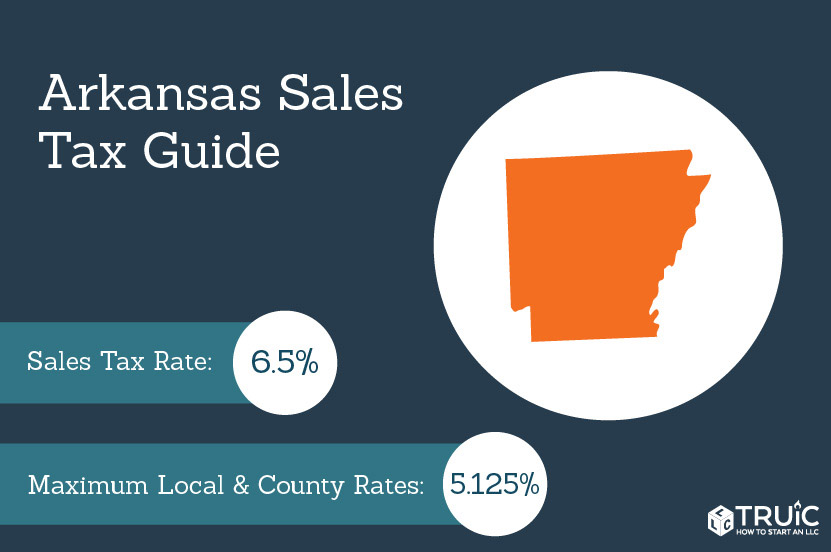

Arkansas Sales Tax – Small Business Guide Truic

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Sales Taxes In The United States – Wikiwand

How Colorado Taxes Work – Auto Dealers – Dealrtax

Colorado Sales Tax Rates By City County 2021

Sales Taxes In The United States – Wikiwand

2

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States – Wikiwand

Tax Benefits Of Living In Wyoming – Wyoming Real Estate Blog