Property tax division, series 6611, are the ratio work papers used to create the studies. It 1 respondent’s response to property tax division’s motion for summary judgment.

2

The clerk/auditors office calculates the property tax rate based on budget requirements and the total.

Utah state tax commission property tax division. The recorder's office and the surveyor's office records the boundaries and ownership of each property in the county. This is done electronically via gentax. Property tax division of the utah state tax commission created date:

Property tax division, series 22324, include summaries of. Before the utah state tax commission (the “commission”) in cases where the alleged value does not meet the 50% threshold requirement.”1 the county cites to utah const. The assessors office estimates the fair market value of each property.

The following information is for county software developers designing files. Pay directly to the utah county treasurer located at 100 e center street suite 1200 (main floor) provo, ut. The division of finance processes tax refunds sent from the utah tax commission.

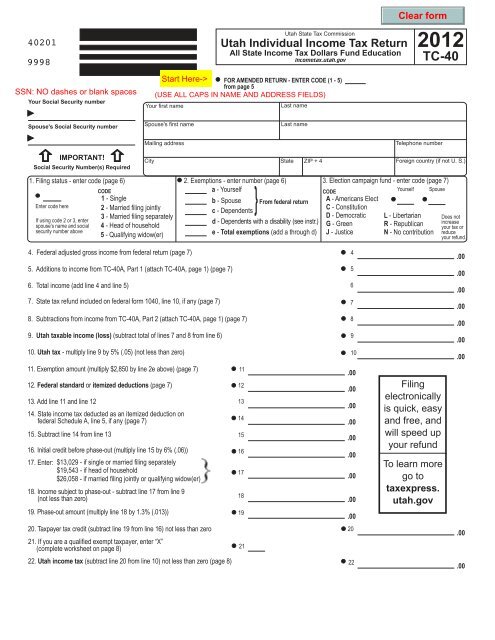

When a match is made, an administrative offset may be taken against the refund or. File electronically using taxpayer access point at tap.utah.gov. Articles i, §11 and xiii, §2(1).

Annual statistical reports from the utah state tax commission. These are then matched against debts owed to state agencies, institutions, courts, and the irs. Property taxes in utah are managed through the collaborative effort of several elected county offices.

Cover Letter – Utah State Tax Commission – Utahgov

Utah Property Taxes Utah State Tax Commission

2

Fillable Online Propertytax Utah Utah State Tax Commission – Property Tax Division – Propertytax Utah Fax Email Print – Pdffiller

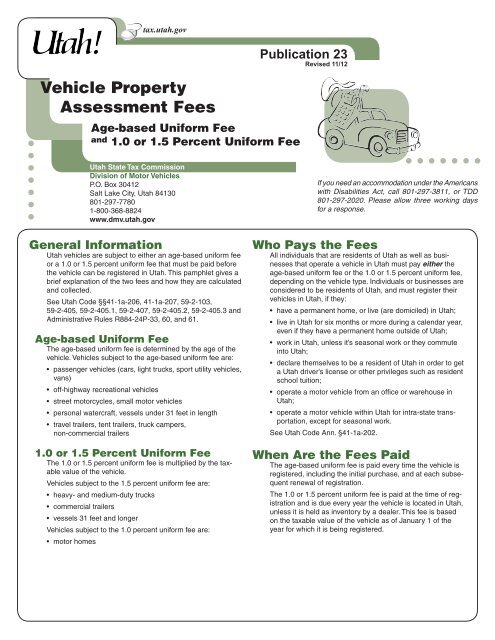

Pub-23 Utah Vehicle Property Assessment Fees – Utah State Tax

Centrally Assessed Property

2

Cotooeleutus

Utah State Tax Commission Notice Of Change Sample 1

Fillable Online Propertytax Utah 2013sched2xlsx Form Dvsse-claim For Property Tax Exemption On Dwelling House Of Disabled Veteran Or Surviving Spousesurviving Civil Union Partnersurviving Domestic Partner Of Disabled Veteran Or Serviceperson

2

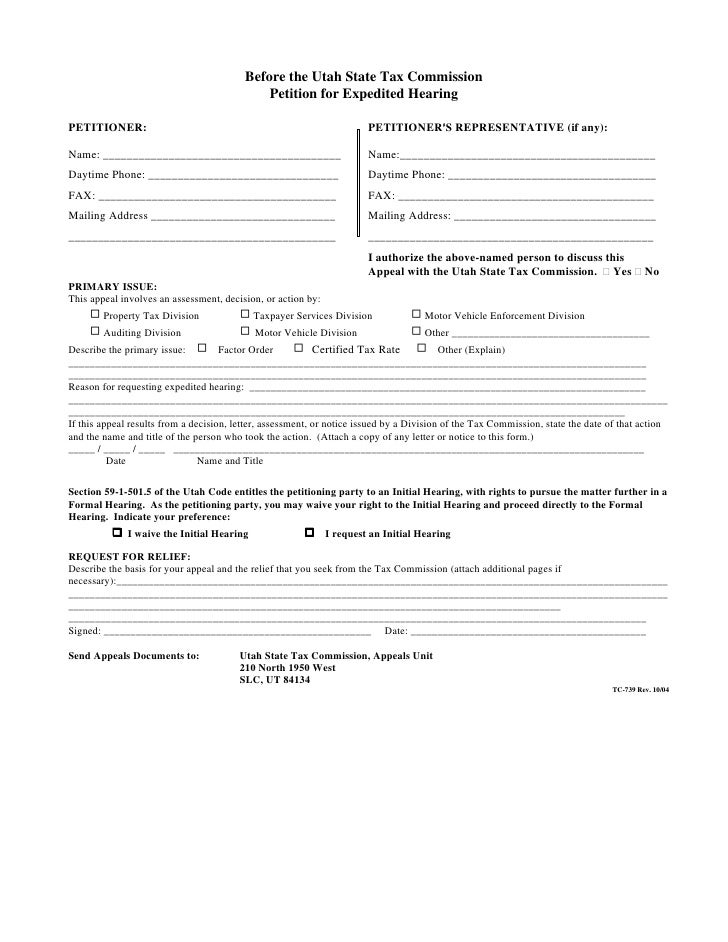

Taxutahgov Forms Current Tc Tc-739

Fillable Online Propertytax Utah Pdf Form – Property Tax Division – Utahgov – Propertytax Utah Fax Email Print – Pdffiller

Utah State Tax Commission Official Website

Lincolninstedu

Centrally Assessed Property

Form Tc-40 – Utah State Tax Commission – Utahgov

Utah Property Taxes Utah State Tax Commission

Property Tax – Utah State Tax Commission – Utahgov