There is no applicable special tax. While alabama law allows municipalities to collect a local option sales tax of up to 3%, huntsville does not currently collect a local sales tax.

Bridge Street In Huntsville Nearing Deal To Bring In Major Department Store Restaurant More – Alcom

A foreign passport issued by a visa waiver country with the corresponding entry stamp and unexpired.

Huntsville al sales tax department. You are given ten calendar days from the date on the price quote to remit your payment. What is the sales tax rate in huntsville, alabama? Madison county sales tax department madison county courthouse.

Department of homeland security indicating the bearer's admission to the u.s. Your lawyer may provide town of huntsville with an ownership update at closing of sale; Huntsville tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in huntsville, alabama.

2% lower than the maximum sales tax in al. The minimum combined 2021 sales tax rate for huntsville, alabama is. If you have questions please contact us;

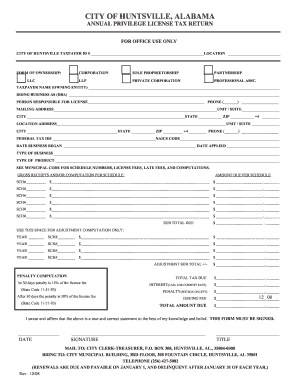

File return and payment electronically (if you file electronically with the state of alabama, then you are required to file electronically with the city of huntsville. The county sales tax rate is %. The 9% sales tax rate in huntsville consists of 4% alabama state sales tax, 0.5% madison county sales tax and 4.5% huntsville tax.

The city follows the same rules, regulations, definitions, and procedures as are adopted by the alabama department of revenue for the purposes of collection and administration of sales, use, rental/leasing, or lodgings taxes. Once your price quote is processed it will be emailed to you. 819 cook avenue, suite 123, huntsville, al 35801.

View one spot filing instructions. To help alabama business owners better understand and master these requirements, the alabama department of revenue (ador) invites business owners to ador’s free business essentials for state taxpayers […] The huntsville sales tax rate is %.

Property tax department will send the next tax bill to the new owner. The alabama sales tax rate is currently %. The huntsville, alabama sales tax is 4.00% , the same as the alabama state sales tax.

Visit our website at www.huntsvilleal.gov/tax for detailed instructions.) file return and payment by mail. Certain tax records are considered public record, which means they are available to the. The owner is responsible for paying property taxes on account in time for the due date

The sales tax jurisdiction name is huntsville (madison co), which may refer to a local government division. You may request a price quote for state held tax delinquent property by submitting an electronic application. This is the total of state, county and city sales tax rates.

The city of huntsville requires electronic filing for all sales, use, rental/lease, and lodging tax returns. Consumer use, gasoline, liquor, lodging, rental/leasing, sales, tobacco, and wine. Rev.8/16 monthly quarterly tax filing method:

Huntsville collects and administers the following taxes: The huntsville sales tax is collected by the merchant on all qualifying sales made within huntsville. An investigation by the alabama department of revenue revealed nasseri had underpaid business sales tax by $73,449.82, marshall said.

100 north side square, huntsville, al 35801 physical address: Tax records include property tax assessments, property appraisals, and income tax records.

Huntsville Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Madison City Schools – Heritage Elementary School Madison Huntsville Alabama City

We Solve Tax Problems Debt Relief Programs Tax Debt Payroll Taxes

Tour The New Madison County Service Center

Huntsville Store Owner Convicted Of Failure To Pay Sales Tax

File A Claim – City Of Huntsville

Bob Jones High School – Bob Jones High School Huntsville Alabama Sweet Home Alabama

Huntsvillemadison County Convention Visitors Bureau

Irs Installment Agreement Franklin Park Il 60131 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

Liquor Sticker Shock Why The Tax On Your Receipt Appears Higher At Some Huntsville Bars Whntcom

Cool How Construction Laborer Resume Must Be Rightly Written

Business License Huntsville Al – Fill Online Printable Fillable Blank Pdffiller

Satellite Offices Madison County Al

2

Huntsville Finance Director Reviews Covid-19 Impact On Municipal Budget – City Of Huntsville

Huntsville Alabama – Wikiwand

Liquor Sticker Shock Why The Tax On Your Receipt Appears Higher At Some Huntsville Bars Whntcom

Huntsville-madison County Public Library Adds New Digital Service Whntcom

Madison County Sales Tax Department Madison County Al