A vehicle owned or leased by religious or charitable institution Vermont's sales tax laws and rules for manufacturers.

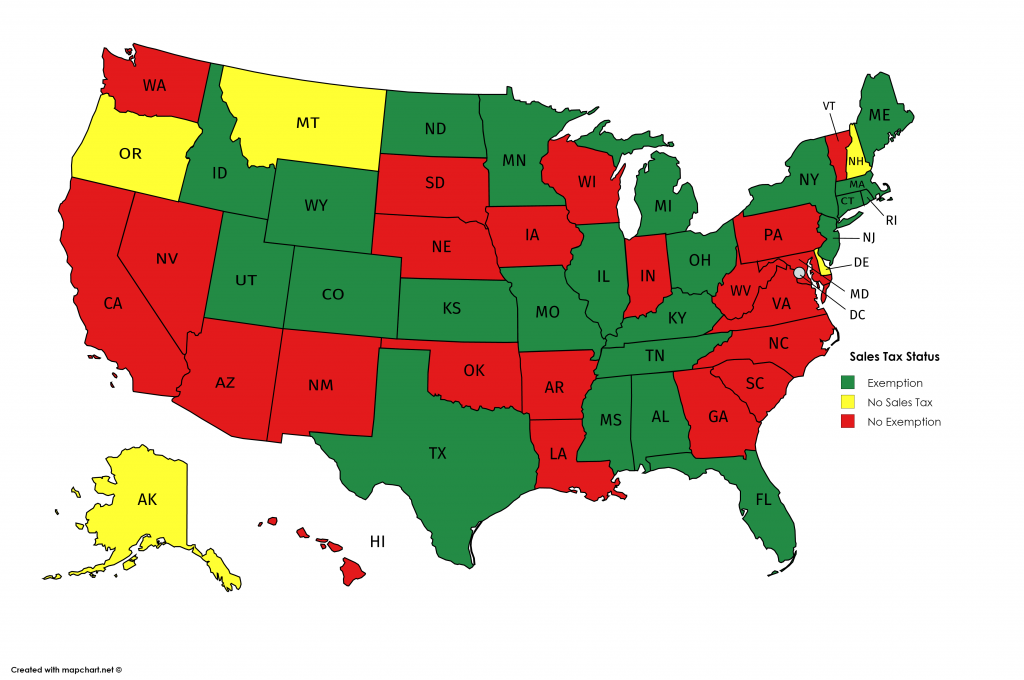

Other States Tax Exemption Tax Office The University Of Alabama

How to use sales tax exemption certificates in vermont.

Vermont sales tax exemptions. Sellers should collect vermont sales tax on tpp delivered to. The maximum local tax rate allowed by vermont law is 1%. The city of new westminster,.

Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the use tax imposed under section 9773 of this title: 1st floor lobby | 133 state street. Vermont sales and use tax sales tax.

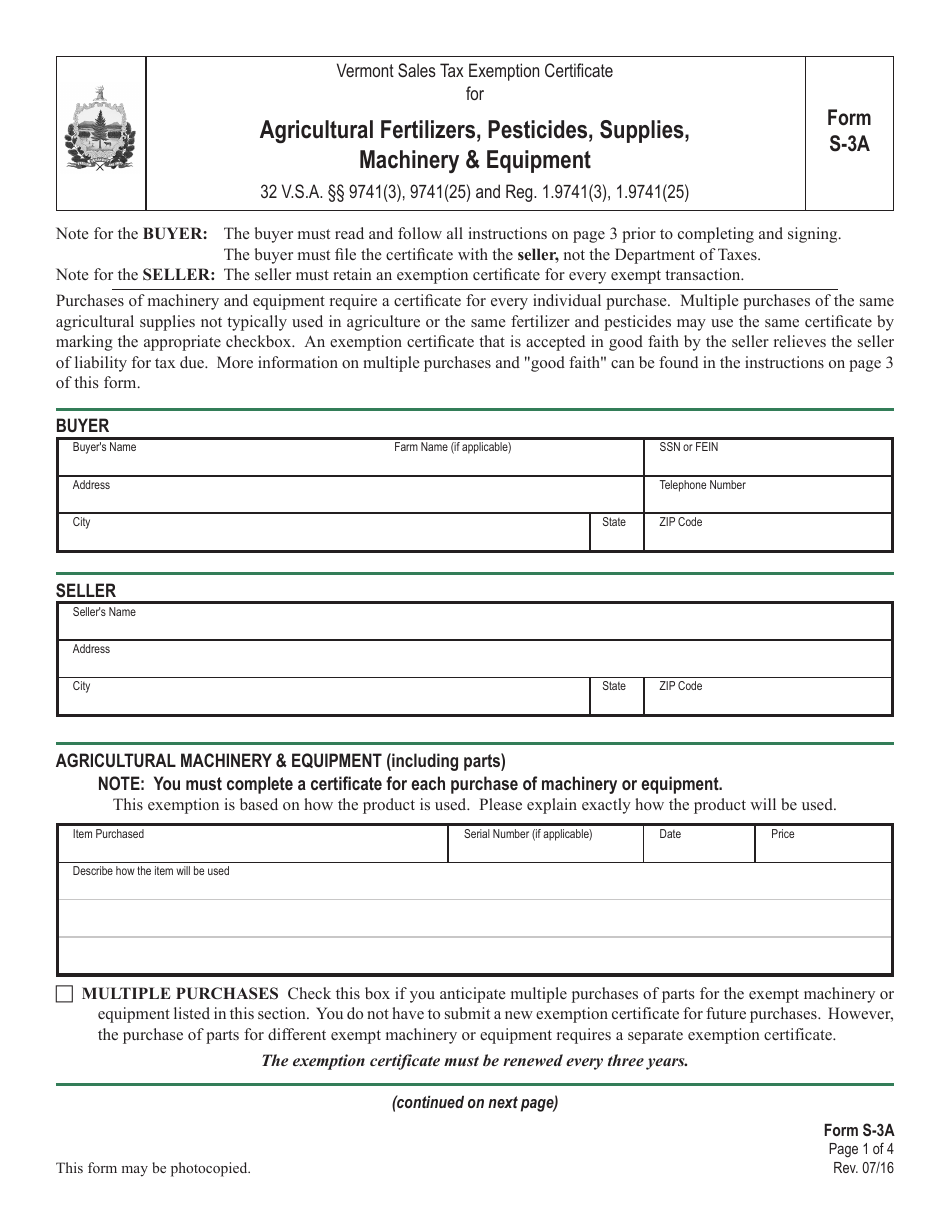

This is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and use tax agreement. The law requires the seller to collect, and remit sales tax on retail sales of tangible personal property and certain services. The vermont department of taxes has updated its fact sheet on the taxability of agricultural machinery, equipment and supplies.

On making an exempt purchase, exemption certificate holders may submit a completed vermont sales tax exemption form to the vendor instead of paying sales tax. 53 rows present state sales tax exemption certificates to vendors, hotels, restaurants, and. What is exempt from vermont sales tax?

What is exempt from sales tax in vermont? Most states have exemptions for basic needs. Other ways to make the sales tax progressive could be to exclude the first 10,000$ of a car price from sales tax (in most states, especially vermont, a car is a necessity).

Salestaxhandbook has an additional one. Sales tax exemptions in vermont. When the seller accepts the certificate in good faith, the seller is not liable for collecting and remitting vermont sales tax.

Vermont's legislative joint fiscal office estimates that the sales tax exemption on these products will result in a $685,000 reduction in tax revenues in the education fund. Other vermont sales tax certificates: The state of vermont levies a 6% state sales tax on the retail sale, lease or rental of most goods and some services.

Vermont and maine are the only nearby states that currently tax menstrual products, according to a sponsor of the bill. Managing sales tax exemptions in the agriculture industry. If i recollect, a notable exception is new york, at least for clothes.

Most items of tangible property are taxable in vermont. An exemption certificate is received at. A sales tax of 6% is imposed on the retail sales of tangible personal property (tpp) unless exempted by vermont law.

Accepting an exemption certificate in “good faith” the buyer must present to the seller an accurate and properly executed exemption certificate for the exempted sale. Here is a sample list of exemptions: Vermont's legislators have enacted sales tax laws, usually referred to as tax statutes.

(1) sales not within the taxing power of this state under the constitution of the united states. You will be required to submit proof of government ownership. A vehicle owned or leased by government.

Vermont sales tax exemptions | sales tax by state | agile consulting. Please note that vermont may have specific restrictions on. An example of an item that is exempt from vermont sales tax are items which were specifically purchased for resale.

It is designed to help businesses determine the agricultural machinery and equipment that qualifies for an exemption from vermont sales and use tax. The following is a list of conditions that will allow you to register your vehicle exempt of payment of the vermont purchase and use tax: They do have a handy page with a detailed list of what is exempt from sales tax in vermont.

For information on vermont sales and use tax and exemptions, see vermont law at 32 v.s.a chapter 233 and vermont regulation at reg. This is a streamlined sales tax certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the streamlined sales and use tax agreement.please note that vermont may have specific restrictions on how exactly this form can be used.

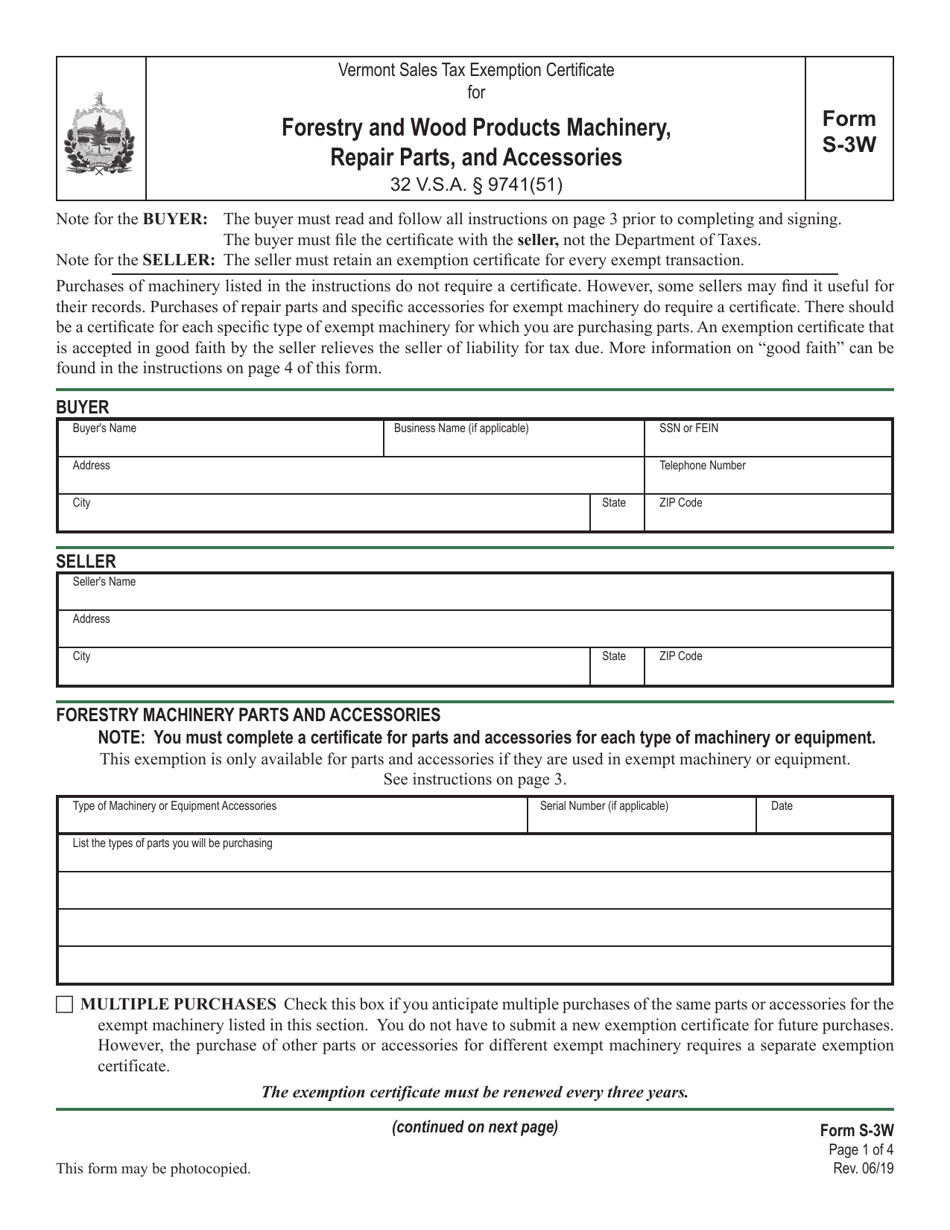

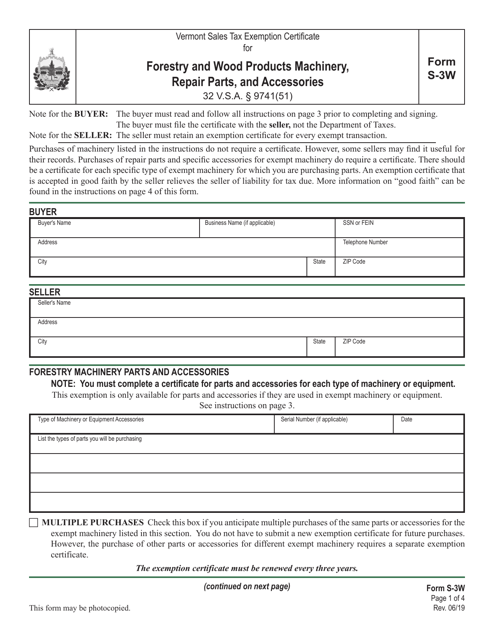

Form S-3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Exemptions From The Vermont Sales Tax

Newborn Baby Favorites Newborn Newborn Baby Baby List

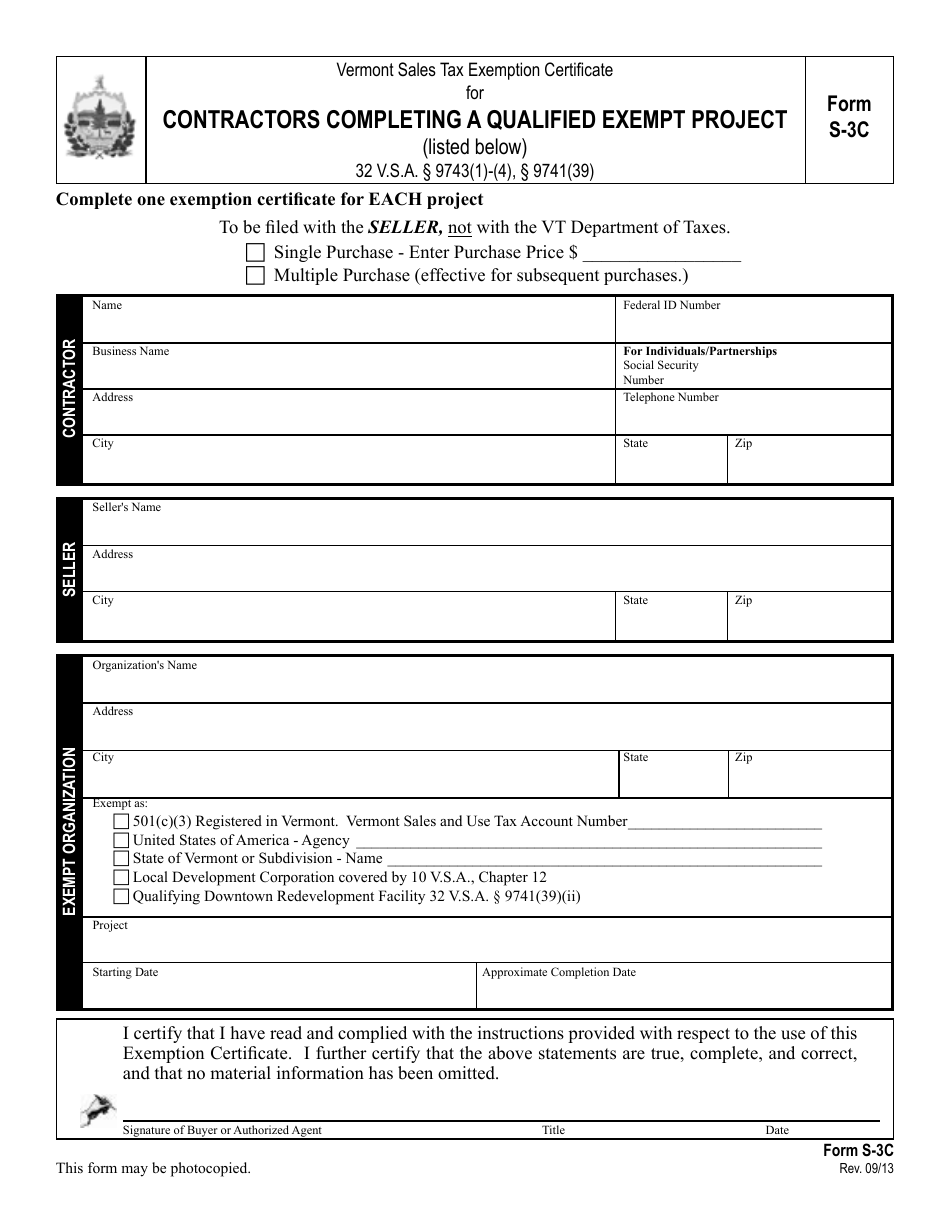

Vt Form S-3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Printable Vermont Sales Tax Exemption Certificates

2

The Most Deadly States To Drive In Driving Dead States

Form S-3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Vermont Sales Tax – Taxjar

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

2

Form S-3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

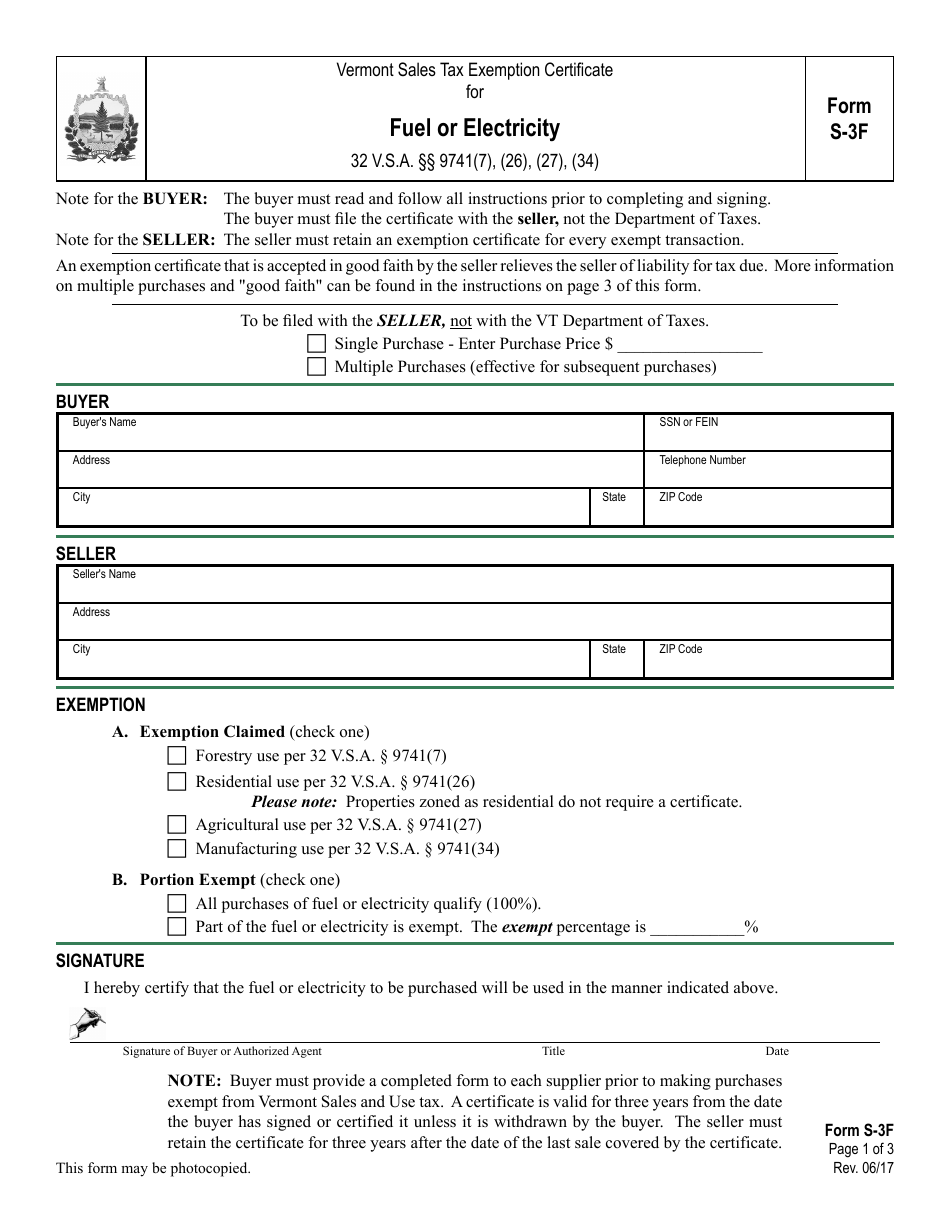

Form S-3f Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Fuel Or Electricity Vermont Templateroller

States With Highest And Lowest Sales Tax Rates

Concentration Of Millennials In The Us Map United States Map Fun Facts

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep