Click any locality for a full breakdown of local property taxes, or visit our colorado sales tax calculatorto lookup local rates by zip code. Additional fees may be collected based on county of residence and license plate selected.

Pin On Wilcoxson Auto Specials

Directions to prepare colorado vehicle gift bill of sale in 4 steps.

Colorado springs sales tax on cars. The colorado springs sales tax rate is %. Sales tax is charged on car purchases in most states in the u.s. This bill of sale document frees the buyer from paying the sales tax on the vehicle;

Any business in these jurisdictions would be expected to collect sales tax on items they sell in the area. On a $30,000 vehicle, that's $2,475. Collections of the combined lodger’s and auto rental tax declined 18.9 percent for the month.

While you may be used to paying sales tax for most of your purchases, the bill for sales tax on a vehicle can be shocking. The 0.62% road repair, maintenance, and improvements tax will expire five years from the date of implementation and will apply to all transactions that are currently taxable under the city sale sand use tax code. Enter buyer’s legal name as it should appear on the duly endorsed title of.

The maximum tax that can be owed is 525 dollars. All applicable sales and/or use taxes must be paid before the department or any county clerk acting as the department's authorized agent may issue a certificate of title. To cite an example, the total sales tax charged for residents of denver amounts to 7.72 percent.

Browse search results for tax cars for sale in colorado springs, co. However, a county tax of up to 5% and a city or local tax of up to 8% can also be applicable in addition to the state sales tax. The colorado springs, colorado, general sales tax rate is 2.9%.

Putting this all together, the total sales tax paid by colorado springs residents comes to 8.25 percent. Pretty much anything that is deductible for federal taxes is also deductible for state purposes. We take anything on trade!

80901, 80903, 80904, 80905, 80906, 80907, 80909, 80910, 80914, 80916, 80917, 80918, 80919, 80920, 80922, 80923, 80924, 80927, 80932, 80933, 80934, 80935, 80936, 80937, 80938, 80939, 80941, 80942, 80946, 80947, 80949, 80950, 80960, 80962 and 80997. Although the taxes charged vary according to location, the taxes include colorado state tax, rtd tax and city tax. The county sales tax rate is %.

The colorado sales tax rate is currently %. The colorado springs, colorado sales tax rate of 8.2% applies to the following 35 zip codes: Taxes for auto dealers get a little trickier because we collect taxes based on a couple of different factors.

All *pprta is due if the address is located in el paso county, cities of colorado springs, manitou springs, ramah, and green mountain falls. City sales tax is due on the net purchase price of the vehicle. On november 3, 2015, colorado springs voters approved a sales and use tax rate increase of 0.62% to fund road repair, maintenance and improvements.

For more information see the colorado department of revenue web site. Depending on the zipcode, the sales tax rate of colorado springs may vary from 2.9% to 8.25% every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1.23%), the colorado springs tax rate (0% to 3.12%), and in some case, special rate (1%). Fees are based on the empty weight and type of vehicle being registered, c.r.s.

Americanlisted features safe and local classifieds for everything you need! This is the total of state, county and city sales tax rates. Welcome to the city of colorado springs sales tax filing and payment portal powered by.

The minimum combined 2021 sales tax rate for colorado springs, colorado is. For example, if you owned a retail store selling books at the lakewood address you would charge 7.5% tax on each sale. Colorado springs combined sales and use tax collections increased 9.61 percent in january, compared with revenue collected in the previous month, according to the february report from the city's finance department.

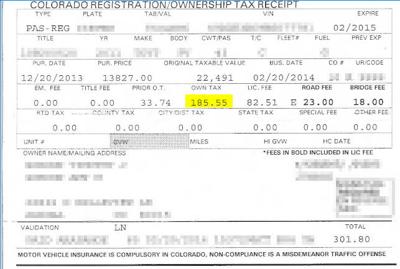

However, it does not exempt the new buyer from paying annual ongoing ownership tax. All vehicles tax, title, license and dealer fees. The fees that have to be paid along with the taxes are calculated according to the vehicle's date of purchase, year, weight and taxable component.

These taxes are based on the year of manufacture of the vehicle and the original taxable value which is determined when the vehicle is new and. Colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. Any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence located within the city of unless the vehicle is permanently operated and maintained at a different location.

If you need access to a database of all colorado local sales tax rates, visit the sales tax data page.

Dxpia0hkhuljmm

Possible Text That Says Apply For A Car Loan

The Best Used Car For Outdoor Adventurists In Colorado – The Faricy Boys

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Used Cars

Profit And Loss Form Check More At Httpsnationalgriefawarenessdaycom2586profit-and-loss-for Profit And Loss Statement Statement Template Invoice Template

Used Cars In Colorado Springs Co For Sale

How Colorado Taxes Work – Auto Dealers – Dealrtax

Off The Grid Homes Outdoor Folding Bed Camping Mat Ultralight Single Cot Sturdy Comfortable Portable Sleeping Camping Mat Colorado Springs Camping Camping Bed

Taxes And Fees Department Of Revenue – Motor Vehicle

Letters Insatiable Urge To Tax Citizens Electoral College Disgrace Opinion Gazettecom

Brandmark Logos Shell Logo Target Logo Twitter Logo Logo Terminology By Kettle Fire Creative Twitter Logo Brandmark Blog Images

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Free Colorado Bill Of Sale Form – Pdf Template Legaltemplates

Mrsmfexzz6of1m

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

New Chevrolet Colorado Cars Trucks Suvs For Sale In Phoenix Az

Projekt E Continues Development For 2020 Rally Car Automobile Engineering Electricity

Motor Vehicle – Douglas County Government

Eight Reasons To Purchase A Used Car In Colorado Massa Auto Pawn