78201, 78202, 78203, 78204, 78205, 78206, 78207, 78208, 78209, 78210, 78211, 78212, 78213, 78214, 78215, 78216, 78217, 78218, 78219, 78220, 78221, 78222, 78223, 78224, 78225, 78226, 78227, 78228, 78229, 78230, 78231, 78232, 78233, 78234, 78235, 78237, 78238, 78240, 78241, 78242,. In 2019/20, the estimated revenue of the national basketball association franchise.

Sanantoniogov

This is the total of state, county and city sales tax rates.

San antonio sales tax 2020. 6.25% is the smallest possible tax rate (, texas) 6.3%, 6.5%, 6.75%, 7%, 7.25%, 7.5%, 7.75%, 8%, 8.125% are all the other possible sales tax rates of texas cities. The san antonio sales tax rate is %. 65 rows san antonio isd:

San antonio voters cast the final decision on two sales tax propositions that use the same pot of money at different times. On november sales tax vote bruce selcraig aug. Name local code local rate total rate;

0.250% san antonio atd (advanced transportation district); This rate includes any state, county, city, and local sales taxes. “ready to work sa workforce program for job training and scholarships, a reallocation of an existing sales and use tax resulting in no net tax increase.

The latest sales tax rate for garden ridge, tx. First, the three measures do not assess new taxes. The san antonio, texas, general sales tax rate is 6.25%.

The texas sales tax rate is currently %. 1.000% city of san antonio; San antonio’s current sales tax rate is 8.250% and is distributed as follows:

Comments via metropolitan transit buses are seen in the foreground last april at its headquarters north of downtown san antonio. The san antonio, texas sales tax rate of 8.25% applies to the following 71 zip codes: 0.125% dedicated to the city of san antonio ready to work program;

8.25% is the highest possible tax rate (, texas) the average combined rate. Texas state rate (s) for 2021. The county sales tax rate is %.

It was an overwhelming victory for both propositions. The statistic shows the revenue of the san antonio spurs franchise from the 2001/02 season to the 2019/20 season. 11 rows the westside 211 special improvement district is located in the eastern.

Published august 7, 2020 at 6:34 pm cdt. Depending on the zipcode, the sales tax rate of san antonio may vary from 6.3% to 8.25% depending on the zipcode, the sales tax rate of san antonio may vary from 6.3% to 8.25% This notice provides information about two tax rates used in adopting the current tax year’s tax rate.

Here’s how the city of san antonio’s “proposition b” reads on the november 3 ballot: The state sales tax rate in texas is 6.25%, but you can customize this table as needed to. 2020 rates included for use while preparing your income tax deduction.

0.500% san antonio mta (metropolitan transit authority); The minimum combined 2021 sales tax rate for san antonio, texas is. Calling it a historic day for san antonio, emotional via metropolitan transit board members voted

Joey palacios | texas public radio.

Proposition B Explained How Ready To Work Sa Plans To Build The Workforce

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Sales Tax Revenues Show Big Texas Cities On Mend From Pandemic Houston Public Media

Annexation

Annexation

The San Antonio Real Estate Market Stats Trends For 2021

Texas Sales Tax – Small Business Guide Truic

San Antonio Election Results Prop A Prop B And Via

Sanantoniogov

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/H75PSAXF4ZBH3NOO3U5Q7TFUIU.jpg)

Ksat 12 News

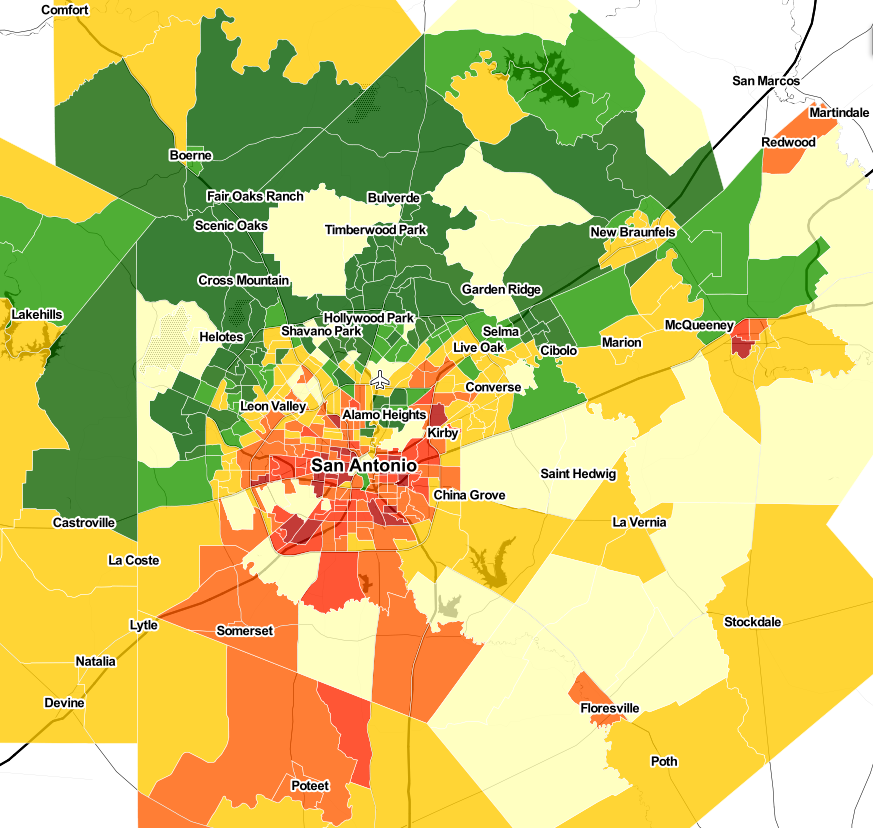

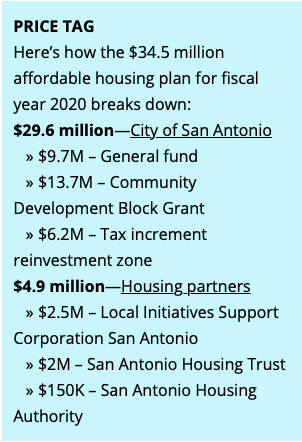

Heres How San Antonio Plans To Tackle Affordable Housing San Antonio News San Antonio San Antonio Current

Annexation

San Antonio City Council Gets First Glimpse At Sa Ready To Work Plan

Annexation

Economic Indicators For South Texas Show Steady Growth For 2020 – Virtual Builders Exchange

San Antonio City Budget Where Is The Investment On The West Side Lake Front News

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tax Preparers

Which Texas Mega-city Has Adopted The Highest Property Tax Rate