If you fulfill the program conditions , you are eligible for tax rebate. Anyone who is approved will receive an additional rebate from waste and recycling services.

Property Tax Breakdown

Through the city’s property tax assistance program, residential property owners of any age may be eligible for a credit/grant of the increase on their property tax account.

Property tax assistance program calgary. Apply for property tax assistance. Programs offered through fair entry include assistance with recreation fees, calgary transit passes, property tax assistance, and the seniors home maintenance program. Property tax assistance program web programs and services.

You may qualify for individual programs such as a recreation fee assistance and calgary transit low income transit pass program or household programs such as property tax assistance program, seniors services home maintenance program or no cost spay neuter program. Have experienced an increase in property tax from the previous year. Property tax assistance program this is an annual program that provides a credit/grant of the increase in property tax for your property;

Visit www.calgary.ca/fairentry for more information or call 311. Even if you are not eligible for the property tax. If you are experiencing financial hardship, you can apply for property tax assistance program (the city of calgary).

As of april 1, 2018, the government of alberta will administer the program. Under the city’s property tax assistance program, residential property owners of any age may be eligible for a credit/grant of the increase on their property tax. For more information about our programs call 311.

Providing additional revenue to support calgary homeowners in genuine need as part of the city's property tax assistance program. Calgary transit low income transit pass (other), senior services home maintenance program (other), recreation fee assistance (other), city of calgary subsidized programs application (other), property tax assistance program. Programs are available to help low income homeowners experiencing financial hardship.

Own no other city of calgary residential property. Owners experiencing financial hardship may apply for a credit for the annual increase in their property tax. Own the property for a minimum of one year from date of purchase.

The seniors property tax deferral program previously partnered with alberta treasury branches to administer approved loans. Apply now, through fair entry, and your one application can also get you access to additional subsidized programs and services. Property tax bills are mailed in may and due june 30, 2021.

Even if you are not eligible for the property tax assistance program we may be able to help you access other resources. To learn about what is fair entry, click to watch our short animation here: Senior citizens (over 65 years of age) are eligible for property tax assistance for seniors program, which offers rebates of tax increases (based on 2004 tax).

Seniors may also be eligible for provincial support. This service is provided at 2 location (s) located next to historic city hall, lrt system and is connected via +15 system. City of calgary preliminary information.

Last year, the city approved roughly 3,400 applications through its property tax assistance program, up from just 700 in 2014. If you have any questions about your loan, call the alberta. The process will assess your income eligibility for multiple city programs.

2020 property tax bills were mailed out to homeowners on may 25. In march 2021, city council approved $13 million in tax relief for calgary businesses who have experienced the most significant municipal property tax increases for 2021. For the 2021 tax year, council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship:

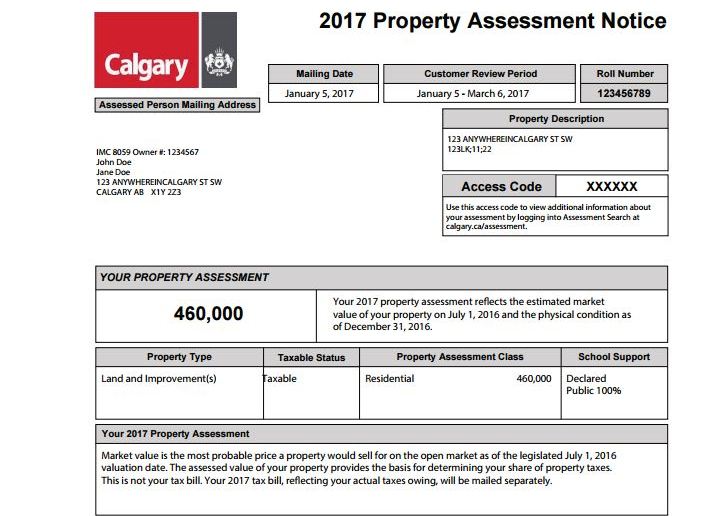

Calgary Property Tax Assessments 2017 What You Need To Know – Calgary Globalnewsca

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Property Tax Notices – City Of Edmonton – Local Government Facebook

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

How Our Property Tax And Utility Charges Measures Up Nationally

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

How Our Property Tax And Utility Charges Measures Up Nationally

Understanding Californias Property Taxes

How Our Property Tax And Utility Charges Measures Up Nationally

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

Vancouver Property Tax 2021 Calculator Rates – Wowaca

Halifax Property Tax 2021 Calculator Rates – Wowaca

Property Tax Solutions Our Main Task To Help Property Owners Delinquent Property Tax Lampasa Property Tax Lampasas Co Tax Help Tax Preparation Property Tax

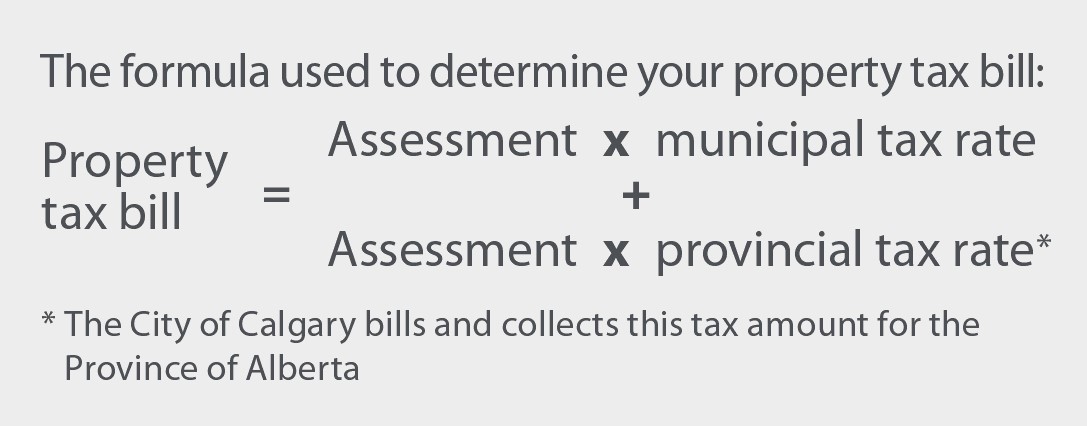

Property Tax Tax Rate And Bill Calculation

Property Taxes Strathcona County

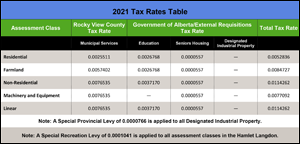

Property Tax Rates Rocky View County

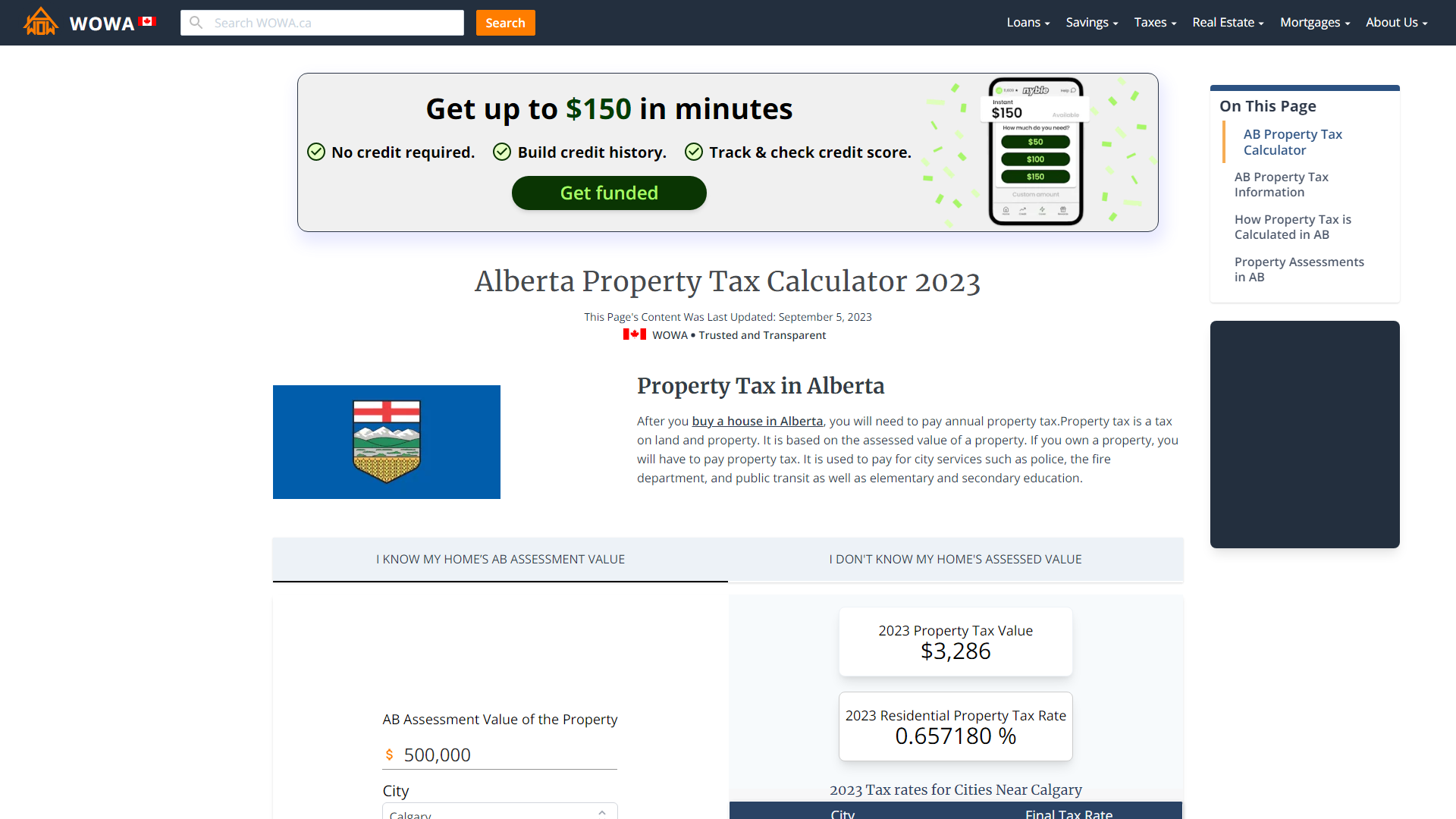

Alberta Property Tax – Rates Calculator Wowaca

How Your Property Taxes Are Calculated