Prices and payments do not include tax, titles, tags, finance charges, documentation charges, emissions testing charges, or other fees required by law, vehicle sellers or lending organizations. Business and sales tax licenses are handled by.

2021 Arizona Car Sales Tax Calculator Valley Chevy

Under $250 program assumes 10% down, plus tax, title license, and $499.50 doc fee.

Glendale az vehicle sales tax. For tax rates in other cities, see arizona sales taxes by city and county. Find information on obtaining a business license or sales tax license in the city of peoria, arizona. This includes liquor licenses, pawn shop licenses, and other types of business licenses as required by law.

Arizona collects a 6.6% state sales tax rate on the purchase of all vehicles. File your return (prior to 2017) file previous sales tax returns using this form (pdf)did you have to pay file and sales tax collected (prior to january 1, 2017), complete a self reporting form. New & used cars for sale in glendale, az.

The december 2020 total local sales tax rate was also 9.200%. You can print a 9.2% sales tax table here. Click any locality for a full breakdown of local property taxes, or visit our arizona sales tax calculator to lookup local rates by zip code.

There is no applicable special tax. All specifications, prices and equipment are subject to change without notice. In addition to taxes, car purchases in arizona may be subject to other fees like registration, title, and plate fees.

Advertised price does not include taxes, title, tint, warranty, license, registration and $489.00 doc fees. File your return (current) to file your current sales tax return, please visit the arizona department of revenue's website at aztaxes.gov. Rates as low as 1.9% and financing available regardless of your credit score.

Find used cars, pickup trucks and suv's near phoenix and glendale az at best auto. 30,990 cars within 30 miles of glendale, az Ge stands for city of glendale.

The minimum combined 2021 sales tax rate for glendale, arizona is. This is the total of state, county and city sales tax rates. The 9.2% sales tax rate in glendale consists of 5.6% arizona state sales tax, 0.7% maricopa county sales tax and 2.9% glendale tax.

Oac,price plus tax,lic,$395doc.promos cannot be combined,customer chooses the program. Under $250 program assumes 10% down, plus tax, title license, and $499.50 doc fee. The county sales tax rate is %.

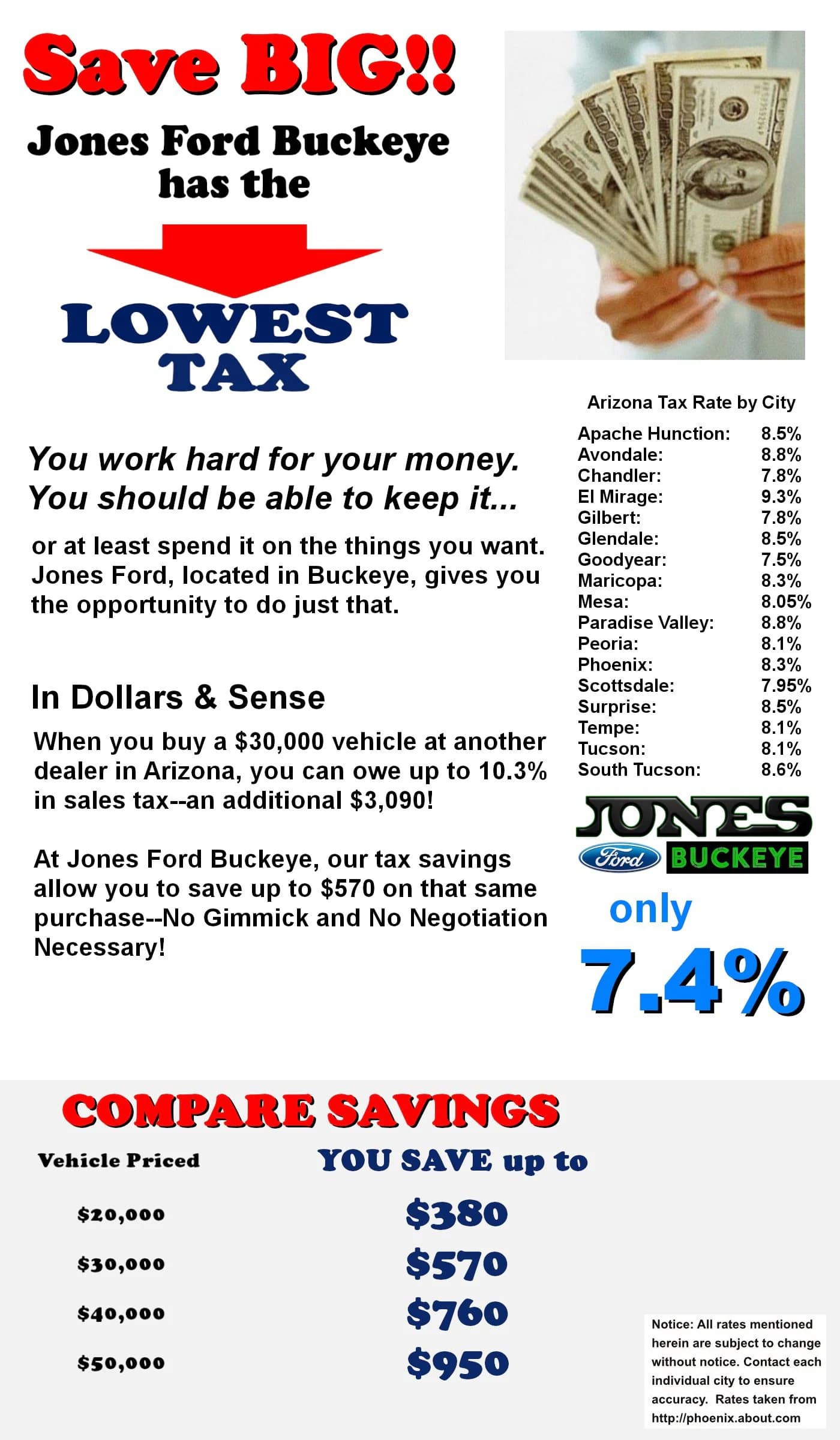

Maricopa county local general sales tax % az state sales tax % apache junction 4.00 5.60 avondale 3.20 5.60 buckeye 3.70 5.60 carefree 3.70 5.60 2.90% (effective august 01, 2012) 2.20% (effective november 1, 2007) 1.80% (effective january 01, 2002) County tax can be as high as 0.7% and city tax can be up to 2.5%.

Equity auto center number one price leader in arizona. However, the total tax may be higher, depending on the county and city the vehicle is purchased in. The arizona sales tax rate is currently %.

Glendale, az sales tax rate the current total local sales tax rate in glendale, az is 9.200%. When the sales tax is greater than 5.6%, you. Largest selection of late model used cars.

Limited warr subject to $299. You can find these fees further down. Call or email for complete vehicle information.

The glendale sales tax rate is %. 101 rows how 2021 sales taxes are calculated for zip code 85301. View our arrowhead bmw inventory to find the right vehicle to fit your style and budget!

The rate imposed is equal to the state rate where the car will be registered. 2.90% (effective august 01, 2012) 2.20% (effective november 1, 2007) 1.80% (effective january 01, 2002) 1.30% (effective april 14, 1994) 1.20% (effective july 01, 1993) 1.00% (through june 30, 1993) use tax. Taxes reported for the city of glendale must be on a separate line of the state return with a city code of ge.

New bmw x4 for sale at arrowhead bmw in glendale, az. All prices and payments plus tax, title, license, and $499.50 doc fee. All prices and payments plus tax, title, license, and $499.50 doc fee.

For states that have a tax rate that is less than arizona’s 5.6%, tax is collected by the state of arizona at the time of purchase. If you need access to a database of all arizona local sales tax rates, visit the sales tax data page. Prices and payments do not include tax, titles, tags, finance charges, documentation charges, emissions testing charges, or other fees.

Sales Tax Glendale Az – Fill Online Printable Fillable Blank Pdffiller

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable

Filing Requirements Arizona Department Of Revenue

New Bmw X2 For Sale In Glendale Az – Arrowhead Bmw

Oil Change Glendale Az The Best Coupons For Oil Changes

New 2021 Land Rover Discovery Sport S 4d Sport Utility In Glendale Mh884749 Land Rover Arrowhead

Service Loaner Vehicles For Sale In Glendale Az

Best Porsche Cayenne Lease Deals In Glendale Az Edmunds

Used Cars In Glendale Az Quality Pre-owned Autos For Sale

2021 Arizona Car Sales Tax Calculator Valley Chevy

Jones Ford Buckeye Has The Lowest Tax Rate Jones Ford Buckeye

2

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Sales Tax Rates By City County 2021

Best Kia Soul Lease Deals In Glendale Az Edmunds

New Chevrolet Traverse Suvs For Sale At Sands Chevrolet – Glendale New Used Cars For Sale Glendale Phoenix

2021 Volvo Xc40 For Sale In Glendale Az Volvo Cars Arrowhead

Used 2014 Jeep Grand Cherokee Laredo For Sale In Glendale Az – 1c4rjfag2ec204386

Sales Tax – City Of Glendale