Excise tax is an annual tax that must be paid when you are registering a vehicle. More exemptions exist for veterans that are paraplegic and for spouses with certain circumstances.

Maine Lawmakers Consider Bill That Would Waive Vehicle Taxes For Disabled Veterans Wgme

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Maine excise tax exemption for veterans. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Or became 100% disabled while serving is eligible for $6,000. Update from washington health officer.

Maine offers property tax exemptions to wartime veterans, disabled veterans, surviving spouses, minor children and. It does not matter if the veteran has obtained dv plates, but he/she must be approved for them. [bill could allow maine kids to operate.

View the town of wade’s 2020 annual report here. Where do i pay the excise tax? § 653) veterans organizations (36 m.r.s.

Excise tax is paid at the local town office where the owner of the vehicle resides. Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Financial guide for maine veterans' (pdf) property tax exemption (pdf) veterans property tax statutes.

If the veteran owns additional vehicles, excise tax must be paid for those vehicles. § 652(1)(e)) tree growth tax law reimbursement (36 m.r.s. 434, §20, is further amended to read:

This exemption is available to the following veterans as defined by the state of maine in general: View the town of wade’s 2021 annual report here. Estates of veterans, real and personal, including property held in joint tenancy with the veteran's spouse or held in a revocable living trust for the benefit of that veteran, are exempt up to $6,000.

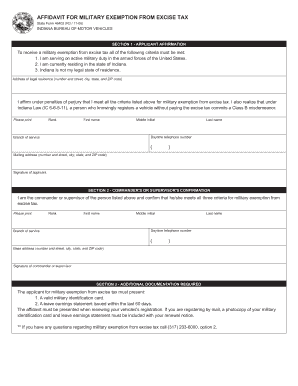

Ld 1193 (hp 871) an act to exempt certain disabled veterans from the motor vehicle excise tax. Application for the excise tax exemption must be made to the board of assessors of the city or town where the vehicle is registered. Or is receiving 100% disability as a veteran;

Where do i pay the excise tax? This exemption is available for any veteran who served during a recognized war period and is 62 years or older; Sponsored by representative heidi brooks.

Or, is receiving 100% va disability; Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

Maine veterans who served on active duty during periods of war may qualify for a property tax exemption under a maine law. Title 36, §1482 excise tax. Excise tax is paid at the local town office where the owner of the vehicle resides.

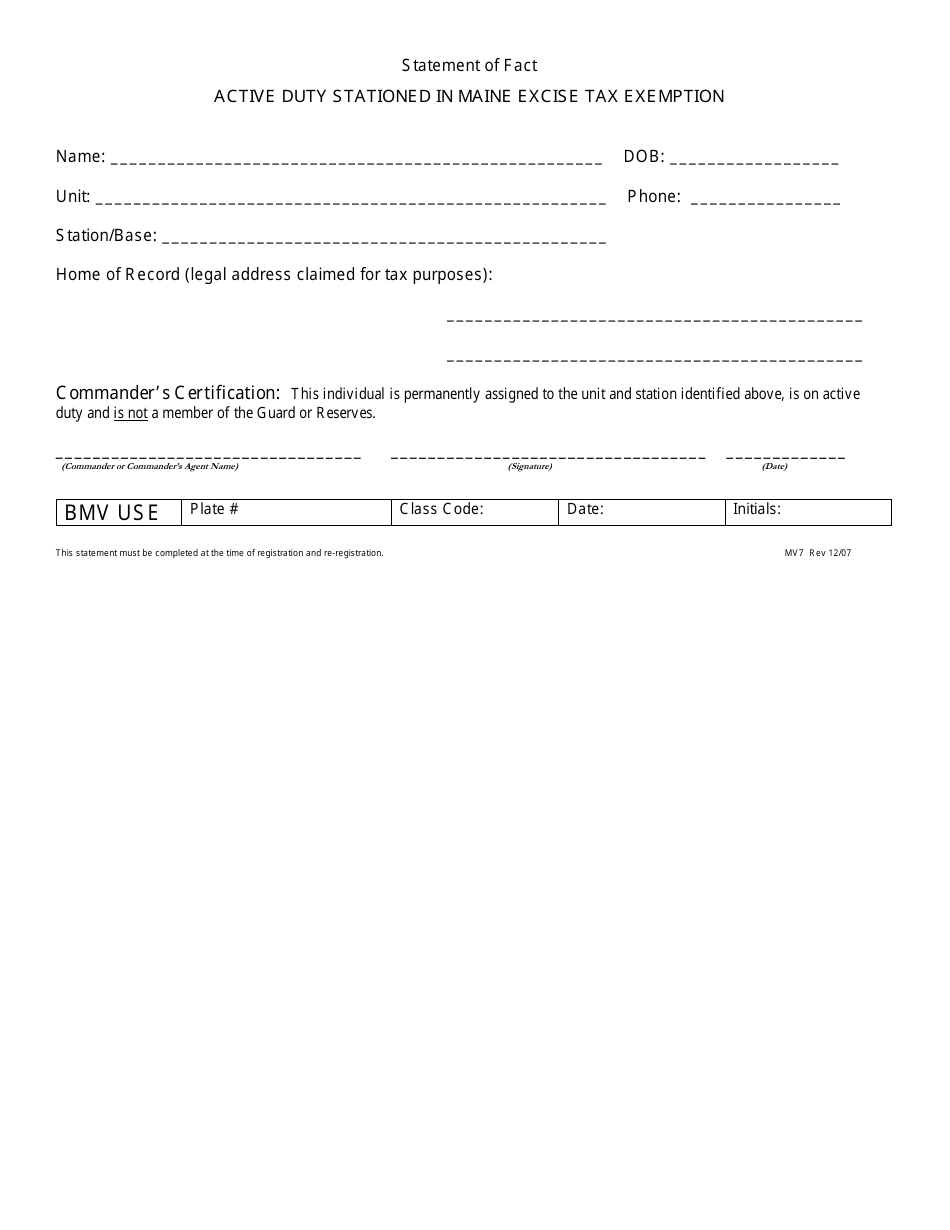

For the privilege of operating a motor vehicle or camper trailer on the public ways, each motor vehicle, other than a stock race car, or each camper trailer to be so operated is subject to excise tax as follows, except as specified in subparagraph (3), (4) or (5): Military exemption from vehicle excise tax city of portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the armed forces and who are permanently stationed at a military or naval post, station or base outside of the state of maine or who are deployed for military service for more than 180 days. Therefore, any veteran who obtains a mab determination letter or has a dv plate on his or her vehicle during any excise calendar year may obtain an exemption of that year’s excise.

Office hours and contact information. Automobiles owned by veterans who are granted free registration of those vehicles by the. A sum equal to 24 mills on each dollar of the maker's list price for the first or current year of.

Automobiles owned by veterans who are granted free registration of those vehicles by the secretary of state under title 29‑a, section 523, subsection 1 or who are disabled by injury or disease incurred or aggravated during active military service in the line of duty and are receiving any form of pension or compensation from the united states government for total, service. Once the assessors have granted the exemption on this basis, they should retain the letter to document that the veteran qualifies for the exemption in subsequent years. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Be it enacted by the people of the state of maine as follows: Maine veterans property tax exemption: An act to exempt certain disabled veterans from the motor vehicle excise tax.

2

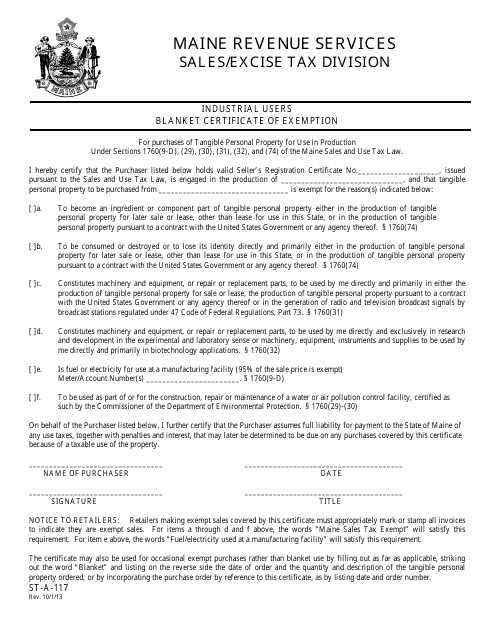

Form St-a-117 Download Printable Pdf Or Fill Online Industrial Users Blanket Certificate Of Exemption Maine Templateroller

Information On Veteran Benefits – Community Resource Guide

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

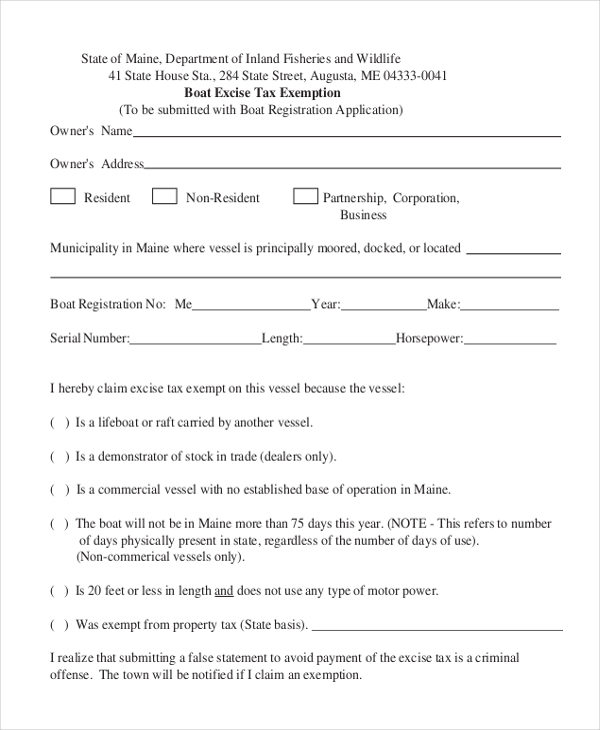

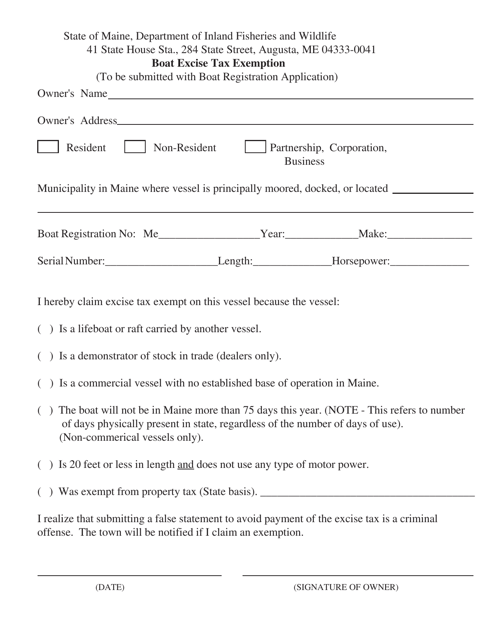

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Bureau Of Motor Vehicles Registrations

Graymaineorg

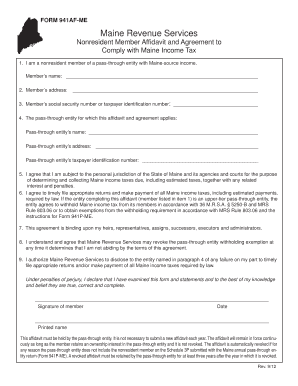

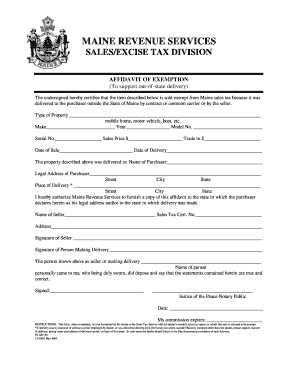

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates – Fillable Printable Samples For Pdf Word Pdffiller

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates – Fillable Printable Samples For Pdf Word Pdffiller

Maine Military And Veteran Benefits The Official Army Benefits Website

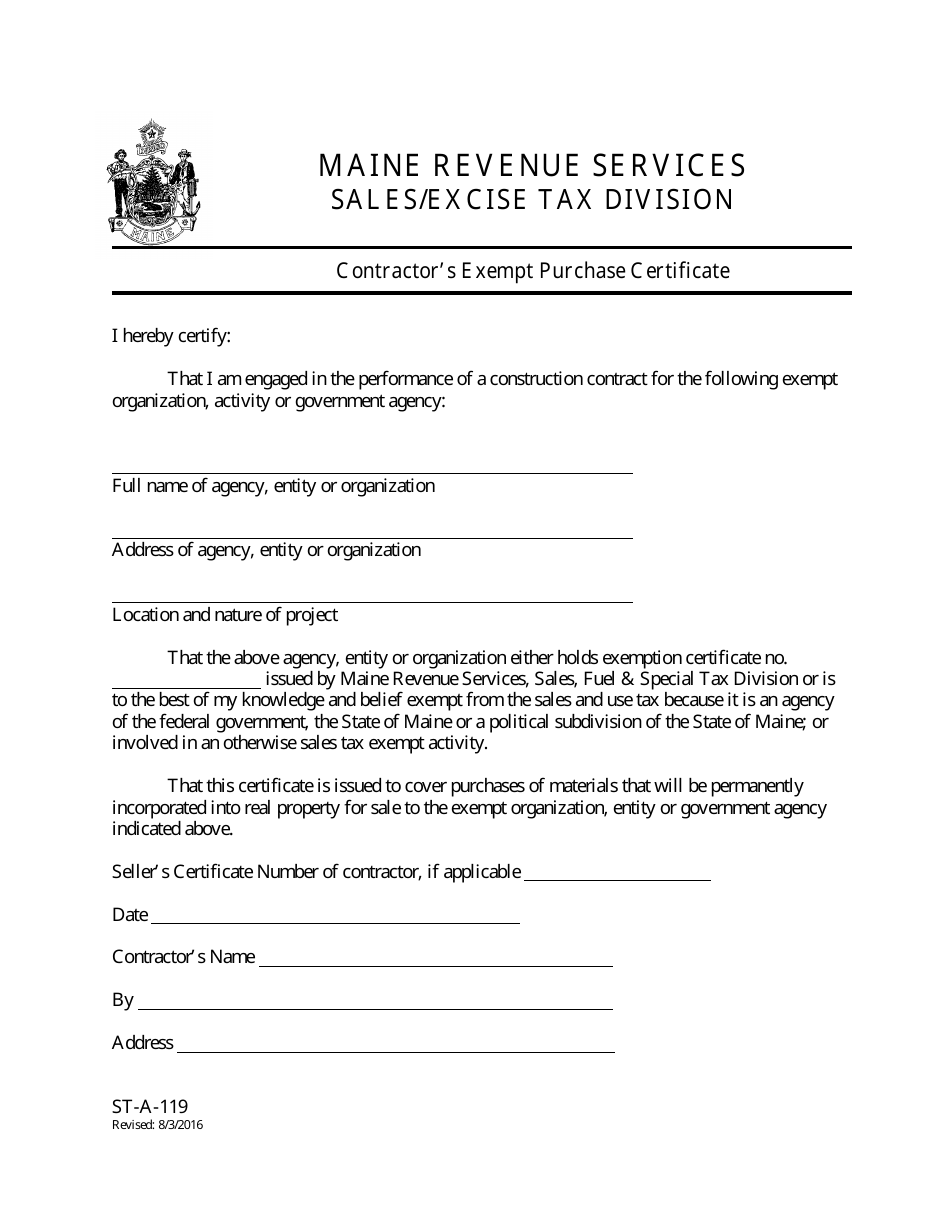

Form St-a-119 Download Printable Pdf Or Fill Online Contractors Exempt Purchase Certificate Maine Templateroller

Form Mv7 Download Fillable Pdf Or Fill Online Active Duty Stationed In Maine Excise Tax Exemption Maine Templateroller

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates – Fillable Printable Samples For Pdf Word Pdffiller

2

2

2

Lewiston Lawmaker Proposes Bill That Would Lower Taxes For Maine Veterans Who Are 100 Disabled – Lewiston Sun Journal

2

Winthropmaineorg