The nebraska sales tax rate is 5.5% as of 2021, with some cities and counties adding a local sales tax on top of the ne state sales tax. With local taxes, the total sales tax rate is between 5.500% and 8.000%.

Nebraska Sales Tax – Taxjar

Exemptions to the nebraska sales tax will vary by state.

Omaha nebraska sales tax rate 2021. Every 2021 combined rates mentioned above are the results of nebraska state rate (5.5%), the omaha tax rate (0% to 1.5%). Nebraska (ne) sales tax rates by city (a) the state sales tax rate in nebraskais 5.500%. In counties containing a city of the metropolitan class, 18% is allocated to the county and 22% to the city or village.

2021 nebraska state sales tax rates the list below details the localities in nebraska with differing sales tax rates, click on the location to access a supporting sales tax calculator. The nebraska state sales and use tax rate is 5.5% (.055). The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax.

Topics in brown’s sights include expanding indiana’s 7% sales tax that covers merchandise purchases ranging from clothing to cars so that it also is. 18% is allocated to the city or village, except that: In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

There is no county sale tax for omaha, nebraska. The nebraska tax rate is unchanged from last year, however, the income. The budget would keep the tax rate at just over 29.5 cents per $100 in valuation, although the rate won’t be set in stone until august, after final valuations are certified.

Corporations (domestic and foreign), limited liability partnerships, and limited liability companies are required to submit a tax report or annual report due no later than april 15 of each required reporting year. You can print a 7% sales tax table here. The omaha area’s rate in october was 1.7%, while the lincoln area’s was 1.3%.

Nebraska has recent rate changes(thu jul 01 2021). 535 rows 2021 list of nebraska local sales tax rates. The state sales tax rate in nebraska is 5.500%.

Lowest sales tax (5.5%) highest sales. There is no applicable county tax or special tax. , 5.5% rate card 6% rate card 6.5% rate card 7% rate card 7.25% rate card 7.5% rate card 8% rate card , nebraska jurisdictions with local sales and use tax local sales and use tax rates effective january 1, 2021 local sales and use tax rates effective april 1, 2021

Valuation, taxes levied and tax rate data The national, seasonally adjusted unemployment rate in october was 4.6%, down 0.2 percentage points from the previous month. Nebraska has recent rate changes (wed.

33.20 cents per gallon of regular gasoline and diesel. There is no special rate for omaha. Sales tax calculator| sales tax table.

Foreign and domestic corporations filing llc/llp filings. There is no applicable county tax or special tax. With local taxes, the total sales tax rate is between 5.500% and 8.000%.

If the tax district is not in a city or village 40% is allocated to the county and;

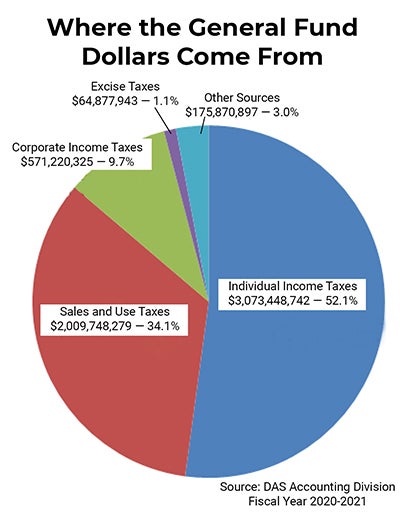

General Fund Receipts Nebraska Department Of Revenue

Cell Phone Taxes And Fees 2021 Tax Foundation

Nebraskas Sales Tax

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nebraskas Sales Tax

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Nebraskas Sales Tax

Nebraska Sales Tax Rates By City County 2021

Taxes And Spending In Nebraska

New Payment Option In Nebfile For Business Sales And Use Tax Nebraska Department Of Revenue

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Tax Values Are Up Where Are The Biggest Increases In Douglas And Sarpy Counties Money Omahacom

Nebraskas Sales Tax

Nebraska State Tax Things To Know Credit Karma Tax

Nebraska Sales Tax – Small Business Guide Truic

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

How High Are Cell Phone Taxes In Your State Tax Foundation