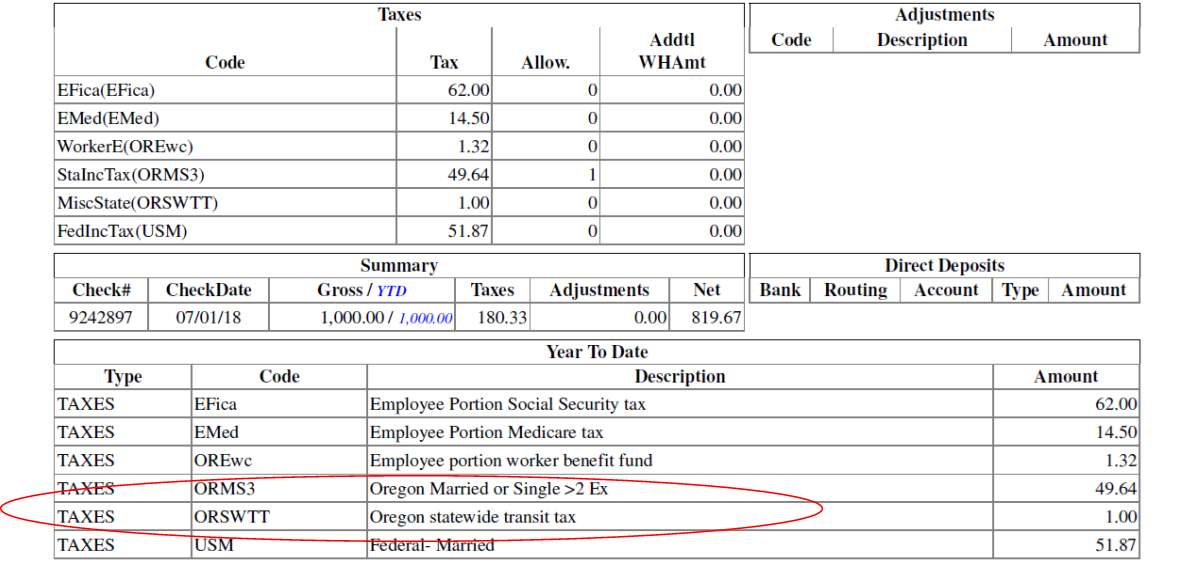

The statewide transit tax is a tax on employee wages that are deducted, withheld, reported, and paid to the department of revenue by the employer. Enter a negative adjustment if it is a reduction in the liability balance and a positive adjustment if it is an increase in the tax liability.

Oregongov

How does this tax apply to me as an employer?

Oregon statewide transit tax exemption. Oregon statewide transit tax starting july 1, 2018, you'll see a new item on your paystub: The tax rate is 0.10 percent. A statewide transit tax is being implemented for the state of oregon.

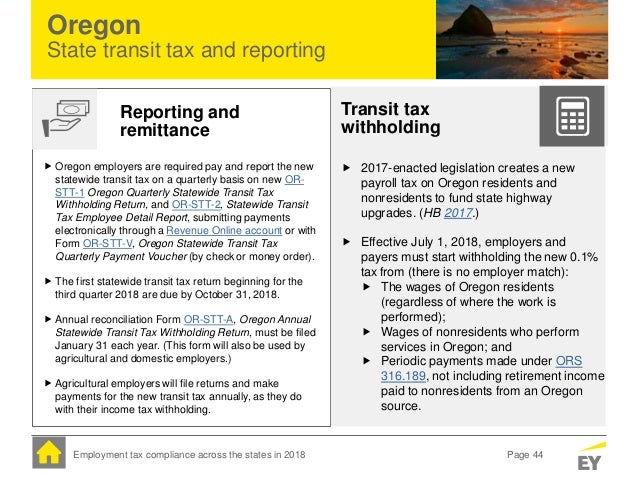

Statewide transit tax—july 1, 2018. A payroll tax is imposed at the rate of 0.1% on wages of residents of oregon or wages earned by nonresidents in oregon. Domestic service in a private home.

For minimum tax purposes, include only gross oregon unrelated business income in your oregon sales. Employees who aren’t subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding, or other factors are still subject to statewide transit tax withholding. Those nonresident employers who are currently performing courtesy income tax withholding for oregon resident employees should have received a letter.

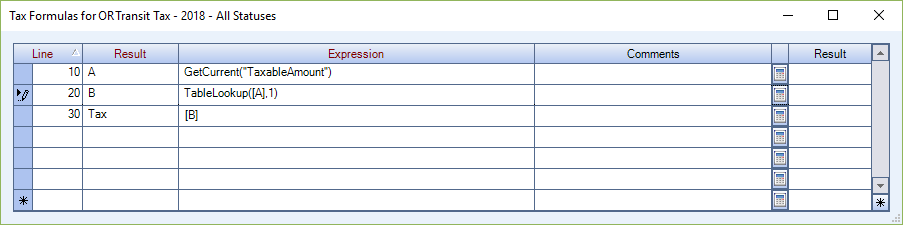

The statewide transit tax is calculated based on the employee’s wages as defined in ors 316.162. As the employer, you do not pay the oregon transit tax. Employees who aren’t subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding.

The statewide transit tax is not the same as transit payroll taxes (trimet and lane transit). The 2017 oregon legislature passed house bill (hb) 2017, which included the new statewide transit tax. Employees are not exempt from the statewide transit tax withholding, even if they are exempt from federal income tax withholding.

Income tax, there’s no withholding exemption for this tax. The statewide transit tax is calculated based on the employee’s wages as defined in ors 316.162. Wages of nonresidents who perform services in oregon.

Additionally, note that even employees who aren’t subject to regular income tax withholding are subject to oregon’s statewide transit tax withholding. Exempt payroll the following are exempt from transit payroll taxes: Unless there is a regulation under texas law, if they have employees in oregon, they need to withhold oregon tax.

For more information on how the tax revenues will be used, take a look at the oregon department of transportation’s keep oregon moving page. (1) wages paid to residents of oregon regardless where they work; Effective july 1, 2018, employers must begin withholding the new 0.1% oregon statewide transit tax from the wages of oregon residents (regardless of where the work is performed, provided the employer has nexus) and the wages of nonresidents who perform services in oregon.

This requirement mirrors the requirements for state income tax withholding. Insurance companies (except domestic insurers). This includes employees with high exemptions or who have wages below the threshold for income tax withholding.

The tax is generally referred to as the “statewide transit tax.” the tax is required to be withheld by the employer from applicable employee wages. You are only responsible for withholding, reporting, and remitting withheld taxes to the state government. Please note, those exempt from income tax withholding, aren't exempt from withholding for this tax.

The new statewide transit tax is calculated based on the employee's gross wages before any exemptions or deductions. The stt is calculated based on the employee's wages as defined in ors 316.162. (2) wages paid to nonresidents of oregon while they are working in oregon;

There is no maximum wage base. Employees who aren't subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding, or other factors are subject to statewide transit tax withholding. Wages of oregon residents (regardless of where the work is performed).

This tax must be withheld on: Southland data processing has added the new tax codes to your company and. Nonresident employers who are outside of oregon's taxing jurisdiction may deduct, withhold, report, and remit the statewide transit tax for oregon resident employees similar to oregon income tax withholding.

The transit tax will include the following: Employees who aren’t subject to regular income tax withholding due to high exemptions, wages below the threshold for income tax withholding, or other factors are subject to statewide transit tax withholding. Click accounts affected, choose do not affect accounts or affect liability and expense accounts.

Revenue from the statewide transit tax will go to expanding public transportation throughout oregon. Unlike the personal income tax, there’s no withholding exemption for this tax. Withholding the tax from employee wages,.

The statewide oregon transit tax goes to the statewide transportation. Why are they exempt from deducting the transit tax? From the oregon department of revenue website:

Portion of the oregon quarterly combined tax report (form oq). Revenue from the statewide transit tax will go to expanding public transportation throughout oregon. All wages paid for domestic service described in 316.162 (definitions for ors 316.162 to 316.221)(c) are exempt from withholding and transit payroll tax.

Oregongov

Ezpaycheck How To Handle Oregon Statewide Transit Tax

New Transit Tax – Cardinal Services

Oregongov

What Is The Oregon Transit Tax How To File More

.jpg)

Or – Statewide Transit Tax Das

Oregon Statewide Transit Tax

Oregongov

Oregongov

Oregon Statewide Transit Tax

Payroll Systems Attn Oregon – Statewide Transit Tax Effective July 1 – Payroll Systems

What Is The Oregon Transit Tax How To File More

Oregongov

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregongov

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Employment Tax Compliance Across The States In 2018

Oregon Transit Statewide Tax

Oregon Statewide Transit Tax