The city of lakewood does not mail return forms. The city charges an application fee of $15 for a sales tax.

Crece Tu Negocio Ahorrando Impuestos Tax Services Payroll Accounting Business Tax

The retailer is not required to have a.

Lakewood co sales tax license. Businesses can also file the account change or closure form ( dr 1102) to close the account or. Retail sales tax a 3.5% sales tax is charged on all sales in the city of englewood except groceries. Must have a retail sales tax license when purchasing product from a licensed colorado cigarette wholesaler/distributor or wholesale subcontractor and will collect and file the sales tax with the colorado department of revenue.

Please determine if your sale occurred in lakewood by accessing one of the colorado department of revenue's address databases. Sales tax returns must be filed monthly. Tax sales www.lakewood.org city of lakewood account please mail this return along with a check or money order to:

Manage my business/tax account (password required) online payment options! South carolina sales tax application registration. The retailer must apply for and obtain a sales tax license and begin collecting colorado sales tax by the first day of the first month commencing at least 90 days after the retailer’s aggregate colorado sales in the current year exceed $100,000.

To apply for this license, you can either fill the application in and print it from the city of lakewood website or you can visit the finance department at 480 south allison parkway in lakewood to pick up an application. Sales and use tax license. Revenue division po box 17479 denver, co 80217 letter revenue division po box 17479 denver, co 80217 city use tax account number gross sales and services (total receipts from city activity must

The colorado sales tax rate is currently %. Business license & sales tax reporting. Business licensing & tax license, file and pay returns for your business.

Any alteration made on this license will automatically make it null and void. All businesses selling goods in. $300 or more per month:

Monthly returns are due the 20th day of month following reporting period. Prepared sales and use tax license application. The business licenses listed below are required according to title 5 of the englewood municipal code (emc).

Businesses that pay more than $75,000 per year in state sales tax must pay by electronic funds transfer (eft). The department will then close the tax account for the entire business or for a specific location/site. Obtain a sales/use tax license from the city of lakewood.

A fee of $15 is required to obtain a sales tax license. Returns must be filed for each site individually, but payment can be made for the combined amount of tax due. Businesses can close the account or site through revenue online.

How do i determine where my sale occurred? License my business determine if your business needs to be licensed with the city and apply online. These licenses are in addition to the sales,.

Options for getting your business license forms in lakewood, co. All tax reporting is due by the 20th of the month following the month you are reporting. There is no fee for a use tax license.

Returns are due on the 20th of month following the end of the period. The lakewood sales tax rate is %. The minimum combined 2021 sales tax rate for lakewood, colorado is.

Your sales/use tax filing frequency has been initially set as monthly. Apply for the license at sbg.colorado.gov. This is the total of state, county and city sales tax rates.

This will include all online businesses. Businesses that have more than one location in the city of lakewood must have separate licenses. Community, government and strategic partnerships allow lakewood to provide your business with all the information necessary to succeed and thrive in our community.

Sometimes taxpayers refer to this as a business registration, but it is an application for a colorado sales tax account or sales tax license. The county sales tax rate is %. Any business that sells goods or taxable services within the state of south carolina to customers located in south carolina is required to collect sales tax from that buyer.

Applicants can also choose to complete the online application in person with the assistance of taxpayer services. Those that operate a business in lakewood will need to obtain a sales and use license from the lakewood finance department. An application can be completed online in lakewood business pro (accessed via.

For definition purposes, a sale includes the sale, lease or rental of tangible personal property. The city of englewood requires all businesses making retail sales to have a sales tax license. Please note that a sales/use tax return is due even if no tax is due.

Business Licensing Tax – City Of Lakewood

Pin On Miscellaneous

How To Organize Your Receipts For Tax Time Tax Time Small Business Tax Business Tax

Computing Your Tax Basis Infographic Real Estate Infographic Helping People

How To Look Up A Colorado Account Number Can Department Of Revenue – Taxation

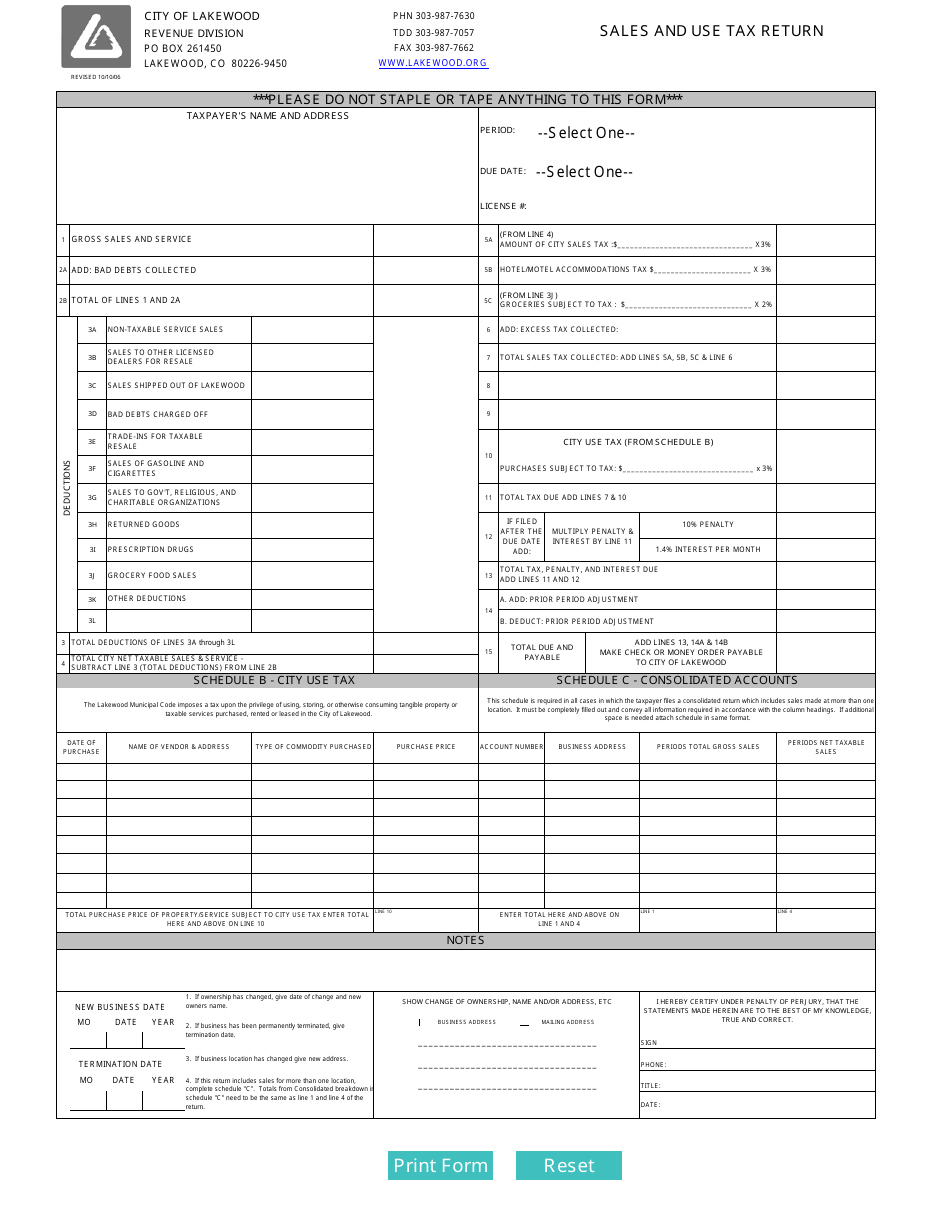

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

Sales Use Tax – City Of Lakewood

Business Licensing Tax – City Of Lakewood

How To Protect Yourself Against Tax Refund Fraud Tax Refund Identity Theft Tax Help

Taxes Fees In Lakewood – City Of Lakewood

How To Look Up A Colorado Account Number Can Department Of Revenue – Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue – Taxation

License My Business – City Of Lakewood

Business Licensing Tax – City Of Lakewood

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator – Clevelandcom

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

License My Business – City Of Lakewood

Pin By Lenay Notary And More On Httpslenaynotarycom Passport Photo Immigration Forms Live Scan Fingerprinting

Business Licensing Tax – City Of Lakewood