If you form a montana llc and have it purchase and take title to a motorhome or rv, you won't owe any sales tax in montana. You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state.

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Montana has no state sales tax, and allows local governments to collect a local option sales tax of up to n/a.

Montana sales tax rate on vehicles. $5 insurance verification fee if existing plates are kept on the vehicle It can only work with llcs formed in montana because montana is the only state which imposes no sales tax on the purchase of vehicles by its residents, including resident llcs. Montana llcs don’t have to buy their vehicles in montana to not pay the sales tax.

The registration fee on a $23,407 vehicle in montana is $153. Montana’s tax rate for a statewide sales tax is limited to 4 percent in (1) a sales tax of the following percentages is imposed on sales of the following property or services:

Here is the pertinent statute: Fortunately, there are several states with low car sales tax rates, at or below 4%: Knowing how much sales tax to pay when purchasing a vehicle also helps you to know when asking for financing from a lender.

(a) 4% on accommodations and campgrounds; The mt sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. Avoid sales tax and high licensing fees.

(2) the sales tax is imposed on the purchaser and must be collected by the seller and paid to. Montana local resort areas and communities are authorized. 4 years old and under:

Additionally, registration fees in montana are normally less than the other states. Add in a personal property tax rate of 0.16 percent and that brings up the total cost to $190.45. For example, alaska, delaware, montana, new hampshire, and oregon do not levy sales tax on cars.

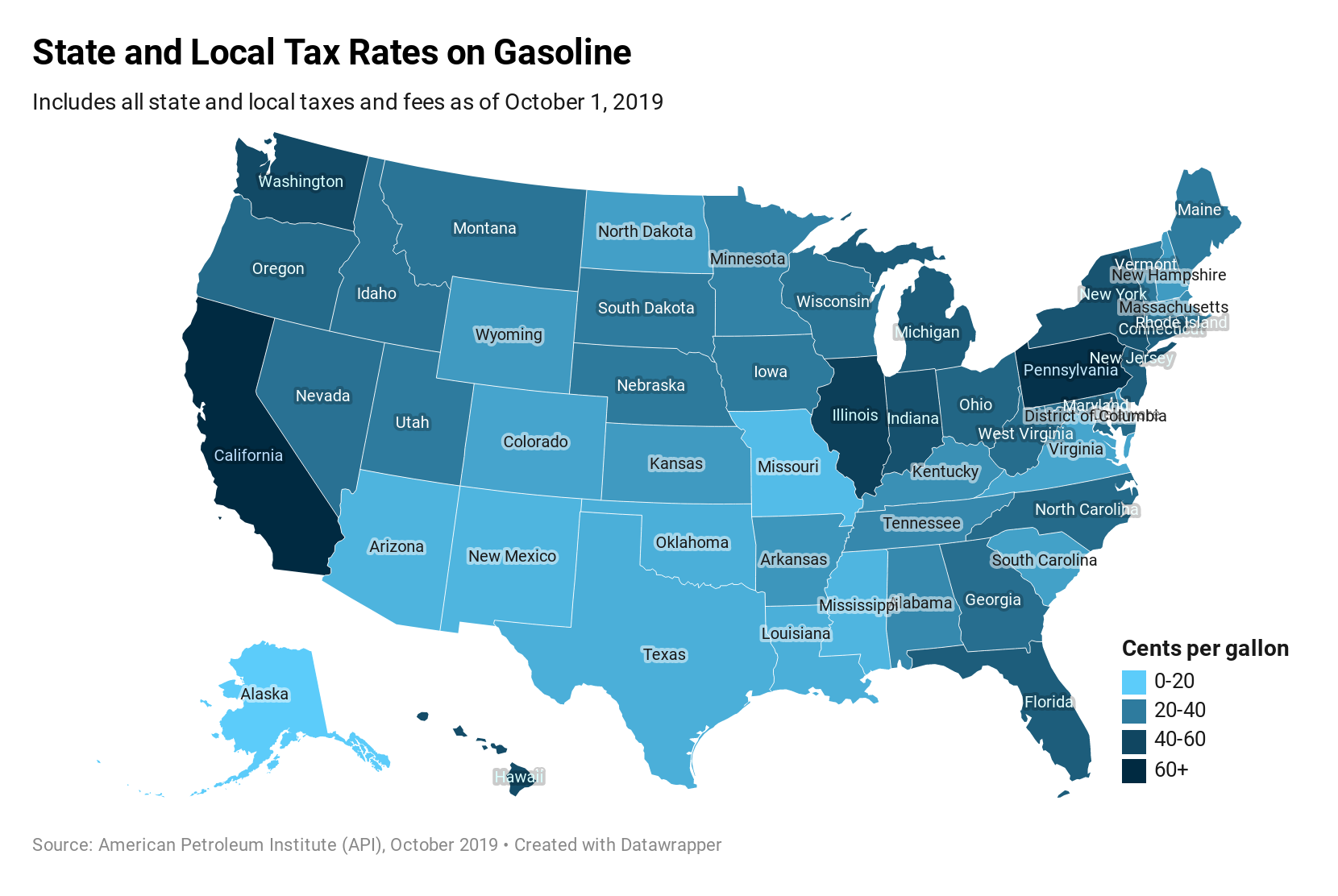

The state also has no state income tax and a low sales tax (4.5%) and it’s easy to establish residency in the state. The sales tax ranges from 0% to 11.5% depending on which state the car will be registered in. Click here for a larger sales tax map, or here for a sales tax table.

There are a total of 105 local tax jurisdictions across the state, collecting an average local tax of n/a. Is there a sales tax when buying a new car? We collect the best resources in the state to help taxpayers file and pay taxes, get help they need, and work with the department to stay in compliance.

Sales tax returns must be filed either monthly, quarterly, or annually. Are there states with little to no sales tax on new cars? Which states have low car sales tax rates?

States like montana, new hampshire, oregon, and delaware do not have any car sales tax. However, the state does impose a tax on sales of medical marijuana products, a sales and use tax on accommodations and campgrounds, a lodging facility use tax, and a limited sales and use tax on the base rental charge for rental vehicles. Thus, many rv owners will register their vehicles in south dakota also.

Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. The sales tax rates of some areas above their statewide level, with combined rates that can exceed 10 percent. $10 montana highway patrol salary and retention fee;

If you spend $7,000 on a car and an additional $1,000 on improvements but you sell the car for $7,000, it's considered a capital loss, and you don't need to pay tax on the sale. And montana law allows for a montana entity to register vehicles in the state. But that’s not even the best part.

5 to 10 years old: (b) 4% on the base rental charge for rental vehicles. County tax, $9 optional state parks support, certain special plate fees and, for light trucks, the gross vehicle weight (gvw) fees;

Montana is a state with no sales tax. Sales tax rates for items like food and telecommunications are lower than the state tax rate, while gasoline, textbooks, some healthcare products, and products for resale are exempt. Additionally, montana vehicles are not subject to personal property tax, because in montana the licensing fees are in lieu of personal property tax.

Most states require a sales tax when purchasing a new car. But if the original sales price plus the improvements add up to $8,000 and you sell the car for $10,000, you'll have to pay capital gains tax on your $2,000 profit. Luckily, some states are more relaxed on their minimum sales tax requirements, and a handful don't charge sales tax at all.

6.35% for vehicle $50k or less By establishing a montana holding company you can legally avoid paying sales taxes on any purchases you make under that holding company name. While montana has no statewide sales tax, some municipalities and cities (especially large tourist destinations) charge their own local sales taxes on most purchases.

Montana's sales tax rates for commonly exempted items are as follows:

Planning To Register Your New Rv In A Montana Llc To Save On Sales Tax And Annual Tags There Are Reasons To Stop And Consider Whe Rv Rv Life Cheap Sports

Whats The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Indiana Sales Tax – Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

Bill Of Sale For Motorcycle Bill Of Sale Template Templates Bills

Pin On Rv Tips

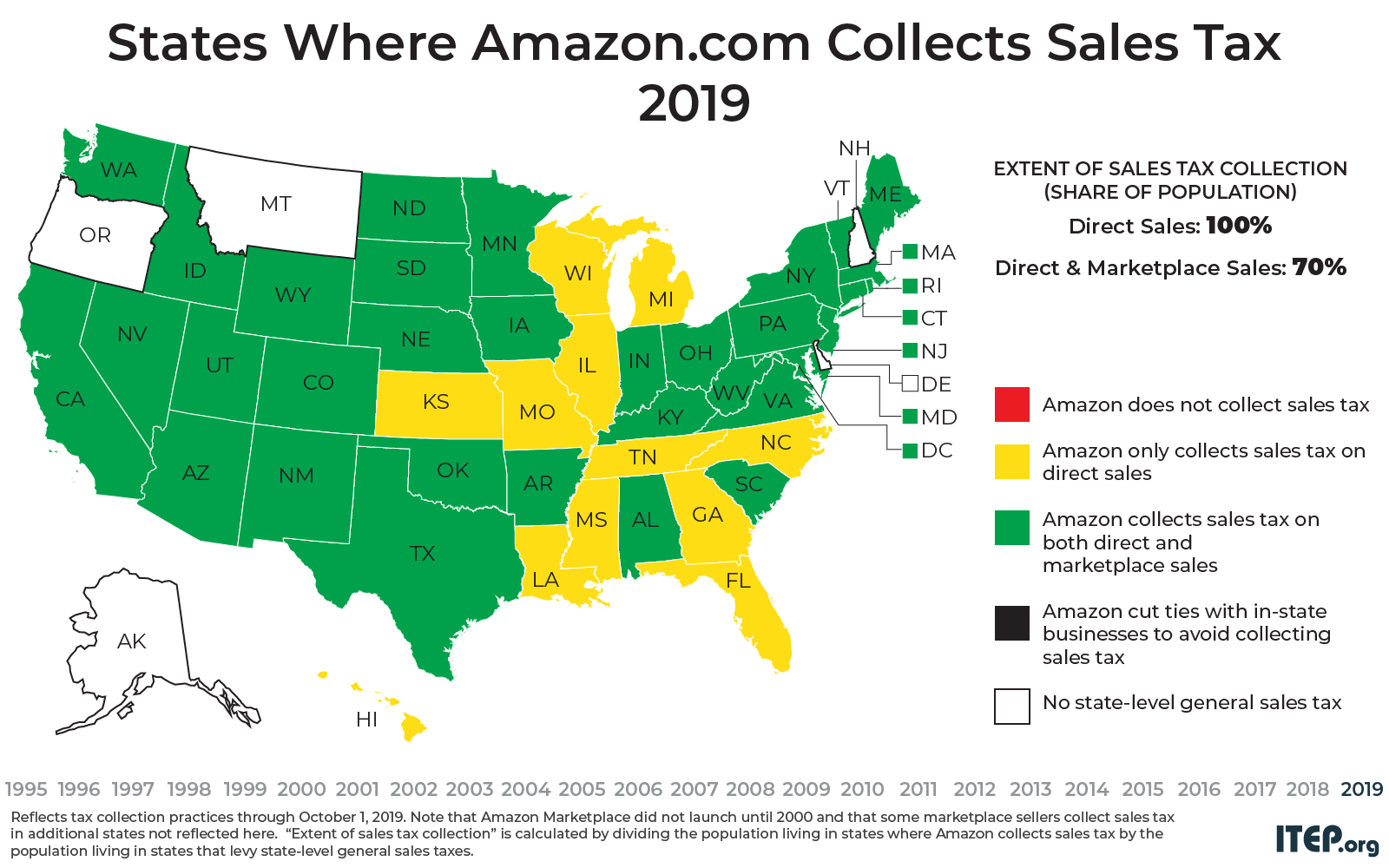

Maps Itep

Vintage 1938 Plymouth 2dr Auto Title Only Historical Document From Michigan Historical Documents State Of Michigan Car Title

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Alaska Vehicle Sales Tax Fees Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Oregon Vehicle Sales Tax Fees Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Which Us States Charge Property Taxes For Cars – Mansion Global

Maps Itep

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool