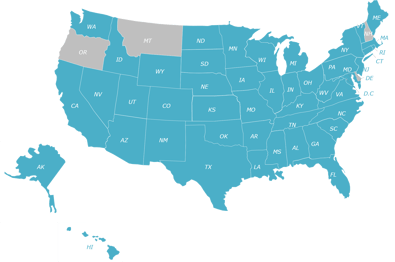

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Find the latest united states sales tax rates.

2

The montana state sales tax rate is 0%, and the average mt sales tax after local surtaxes is 0%.

Montana sales tax rate change. This was the situation faced by a louisiana taxpayer. In effect, that lowers the top capital gains tax rate in montana from 6.9% to 4.9%. • sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

Both these taxes are collected by the facility from the user and remitted to the department of revenue. The tax applies to charges for the use of the facility for lodging, and does not apply to charges for meals, transportation, 2020 rates included for use while preparing your income tax deduction.

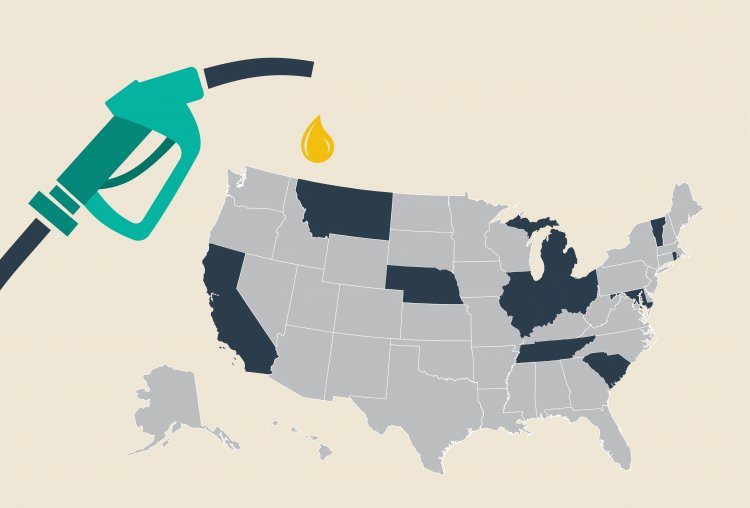

While montana does not collect a sales tax, excise taxes are levied on the sale of certain products, including alcohol, cigarettes & tobacco, and gasoline. Property taxes paid in montana are based on three components—the value of a property, the tax rate for that particular type of property, and the number of mills levied in that particular tax levy district. Steve bullock recently signed a bill that will increase montana’s lodging tax or bed tax by 1 percent.

It won’t take effect until january 2020, but. Gianforte signed another companion bill that cuts taxes for the top marginal tax rates from 6.9% to 6.75% in 2022, and then to 6.5% in 2024. You will be taxed at the standard rates for montana state taxes, and you will also get to apply regular allowances and deductions.

Montana does not have a real estate transfer tax; Montana llcs don’t have to buy their vehicles in montana to not pay the sales tax.” the website even features a photo of former secretary of. Detailed montana state income tax rates and brackets are available on this page.

*connecticut lowered its dollar threshold from $250,000 to $100,000, keeping the number of transactions the same, effective july 1, 2019. New jersey sales tax details. Any salaried employees will also need to pay personal state taxes.

The national median is 1.04 percent. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from. For example, if you live in louisiana, which has a 9% sales tax, and purchase a $350,000 motorhome, you'd have to pay over $31,000 in sales taxes.

2021 montana state sales tax. The montana income tax has seven tax brackets, with a maximum marginal income tax of 6.90% as of 2021. There are, however, 32 urban enterprise zones covering 37 economically distressed cities.

Nationwide, montana ranks 31st for its effective property tax rate of 0.86 percent. While montana has no statewide sales tax, some municipalities and cities (especially large tourist destinations) charge their own local sales taxes on most purchases. The new jersey (nj) state sales tax rate is 6.625%.

Establishes a new, fifth income tax bracket with a rate of 8 percent, up from the current top rate of 4.5 percent, with revenue from that marginal rate dedicated to education rather than to the general Unlike many states, nj does not allow the imposition of local sales tax—the entire state has a single rate. While there is no sales tax in montana, the state does collect excise taxes on alcoholic beverages.

Property values are reassessed on a regular basis by. 2021 montana tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. The montana state tax rates are between 1 and 6.9 percent, depending on earnings.

You only need to file a realty transfer certificate. If you receive income from montana real estate, you are required to file a montana tax return to report rents you receive. You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state.

Cutting income taxes was a top goal for the governor this legislative session as part his. There is no state sales tax in montana. Exact tax amount may vary for different items.

“transfer” includes sales, exchanges, gifts, inheritances or any other transaction where the property changes ownership. This difference, however, is due to the fact that montana does not have a sales tax like most other states.

Nomad States The Latest On Sales Tax

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Ebay Sales Tax Everything You Need To Know Guide – A2x For Amazon And Shopify – Accounting Automated And Reconciled

Montana Property Taxes Montana Property Tax Example Calculations

Sales Tax On Saas A Checklist State-by-state Guide For Startups

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Sales Taxes In The United States – Wikiwand

States With Highest And Lowest Sales Tax Rates

Montana – Sales Tax Handbook 2021

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Taxes In The United States – Wikiwand

Eqkdqb7mjbevtm

Montana State Taxes Tax Types In Montana Income Property Corporate

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Us Sales Taxes By State 2020 Us Tax Vatglobal

How Much Does Your State Collect In Sales Taxes Per Capita

Sales Taxes In The United States – Wikiwand