For the purpose of this blog, we will be applying for the standard sales and use permit. The austin sales tax rate is %.

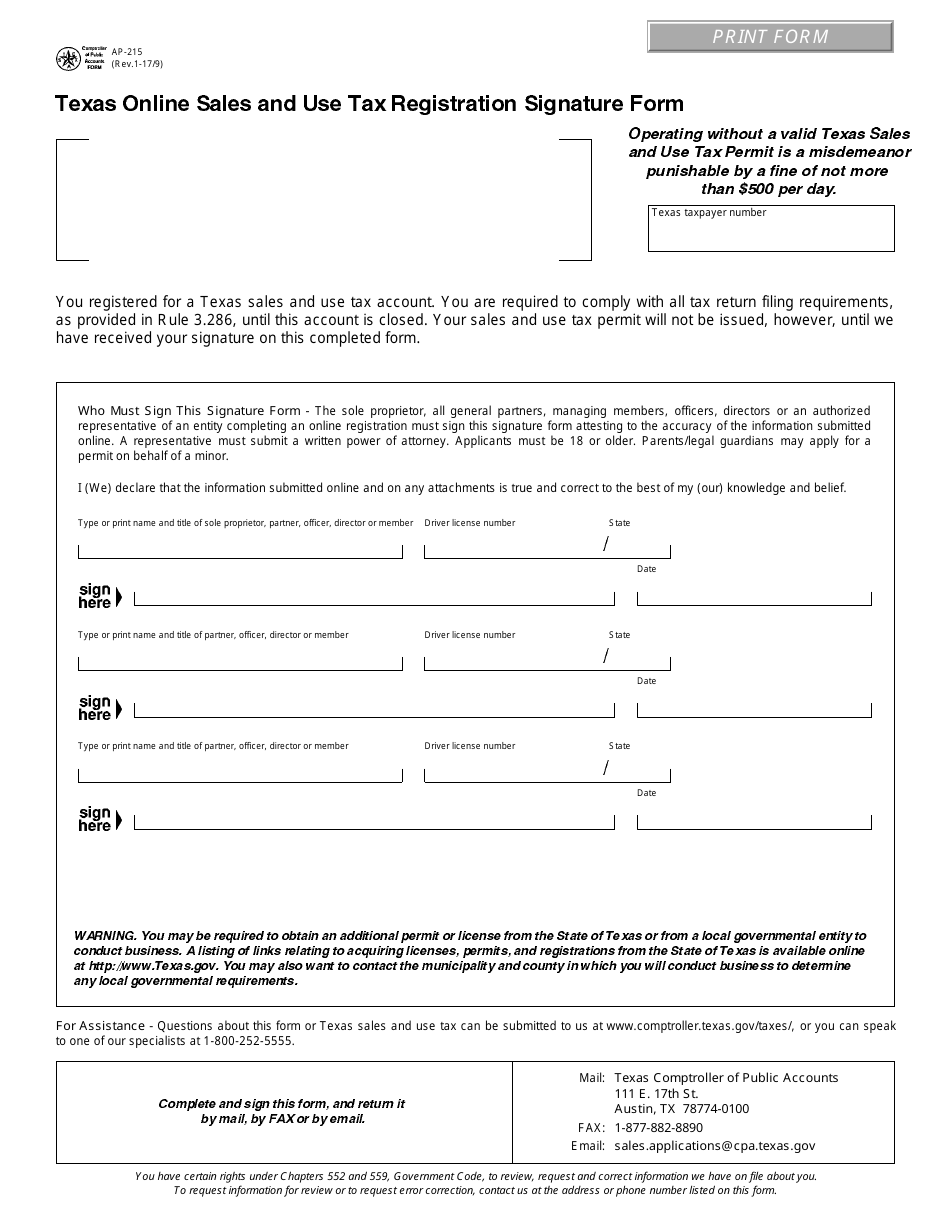

Form Ap-215 Download Fillable Pdf Or Fill Online Texas Online Sales And Use Tax Registration Signature Form Texas Templateroller

Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

Sales tax permit austin texas. In tx you may also need a sales tax id aka seller's permit if you sell merchandise that is taxable. Texas sales tax, reseller’s permit, resale tax certificates. In texas, this sellers permit lets your business buy goods or materials, rent property, and sell products or services tax free.

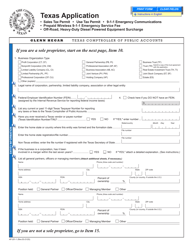

Business owners’ social security number Lease or rent tangible personal property in texas; Sales tax surcharge on diesel equipment;

Single & multi state resale certificate application portal | state tax exemption, sales tax permit info, help, and support. Texas offers both a sales and use tax permit and effective october 1, 2019, texas offers a single local tax rate for remote sellers. The county sales tax rate is %.

Please note that the results below are for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. How to obtain a sales tax permit in texas. This is the total of state, county and city sales tax rates.

Any business in texas that plans to sell or lease tangible goods or personal property needs a sales and use tax permit. See our publication taxable services for more information. Apply for sales tax resale permit certificate online.

What do you need to register? Terms sales and use tax permit corrections form taxpayer name shown on the permit lucis solar, llc lf you need to make changes tolocalsalestaxauthoriti How long does it take to get a texas sales tax permit?

What information do you need to register for a sales tax permit in texas? You can register for a texas sales tax permit online at the texas comptroller of public accounts website here. You can print a 8.25% sales tax table here.

For tax rates in other cities, see texas sales taxes by city and county. The 8.25% sales tax rate in austin consists of 6.25% texas state sales tax, 1% austin tax and 1% special tax. Top apply for your texas sales tax permit now:

Almost any business that sells goods or taxable services within the state of texas to customers located in texas is required to report and / or collect sales tax from that buyer. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. The minimum combined 2021 sales tax rate for austin, texas is.

Applicants must be at least 18 years of age. Austin collects the maximum legal local sales tax. You can easily apply for a sales tax permit online through the comptroller’s site here.

The austin county sales tax is 0.5%. The texas sales tax rate is currently %. Individuals, llcs, corporations, partnerships, and even businesses who’s corporate office is outside of texas.

There currently is no charge to apply for a texas sales tax permit. In texas, there is no fee charged to register for the permit; Independent sales reps of direct sales organizations (direct sales organizations are required to collect sales tax from the independent distributors) persons requesting a sales tax permit solely for the purpose of purchasing items at wholesale prices;

You must obtain a texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in texas and you: Nonetheless, you may be mandated to post a bond or security. Sell tangible personal property in texas;

Registering for a texas sales tax / reseller’s permit / tax resale certificate is a must for all businesses. Sell taxable services in texas. Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying.

As a remote seller, if you exceed the $500,000 safe harbor amount, you are required to obtain a permit and begin collecting and remitting use tax on sales to customers in texas beginning no later than the first day of the fourth month after the month that a remote seller exceeds the $500,00 safe harbor amount. There is no cost for a sales tax permit in the state of texas, however, some businesses are required to post a security bond. We have all the rules and requirements for obtaining this certificate down, and are ready to.

Some cities and local governments in austin county collect additional local sales taxes, which can be as high as 1.5%. Registering for a sales tax permit in texas. You will need a federal and a state ein if you will hire.

( also called a txseller's permit, state id, wholesale, resale, reseller certificate). That includes any business or entity type: Use this application to register for these taxes and fees.

Comptroller of public accounts 111 e. One of the initial things you ought to do as a new business in texas or when doing business within the state for the first time is to obtain for a sales and use tax permit. Taxes and fees covered by this permit.

Although these items are technically different, the terms are often used interchangeably because they almost always accompany one another. You can find more information about the remote seller option here. Business licenses required at all levels of government for businesses in austin, texas.

Parents/legal guardians may apply for a permit on behalf of a minor. Get your texas sales tax permit online Similarly, you can download the application form and mail it to:

There is no applicable county tax. For example, if during the period of july 1, 2020, through june 30,. You sell taxable services in texas.

Persons registering for an ag/timber exemption number to purchase certain items used in the production of agricultural and timber. See prepayment discounts, extensions and. A resale certificate and a sales and use tax permit go hand in hand.

Obtaining your sales tax certificate allows you to do so.

Bar Ama Tex-mex Restaurant Los Angeles – Dailycandy Bar Restaurant Interior Bar Restaurant

Como Sacar El Sales Tax Permit En Texas Ganar Dinero Por Internet Como Ganar Dinero Texas

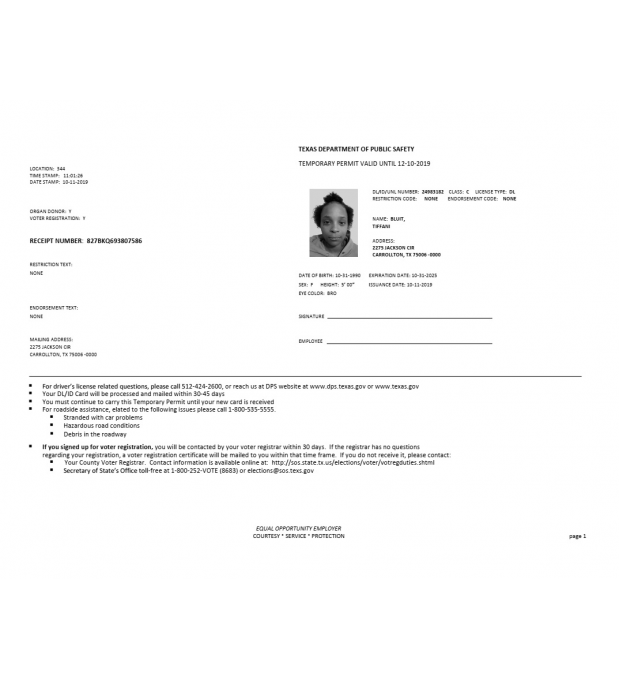

Permit Texas Temporary

How To Apply For The Texas Sales Tax Permit – 2020 Step By Step – Youtube

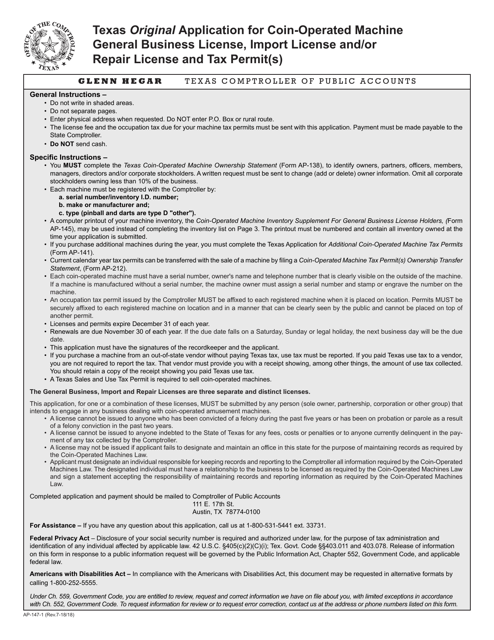

Form Ap-147 Download Fillable Pdf Or Fill Online Texas Original Application For Coin-operated Machine General Business License Import License Andor Repair License And Tax Permits Texas Templateroller

How To Get A Resale Certificate In Texas – Startingyourbusinesscom

Pin By Larry Payne Aia Leed Ap Bdc On Hospitality Restaurant Design Restaurant Design Modern Restaurant Restaurant Interior

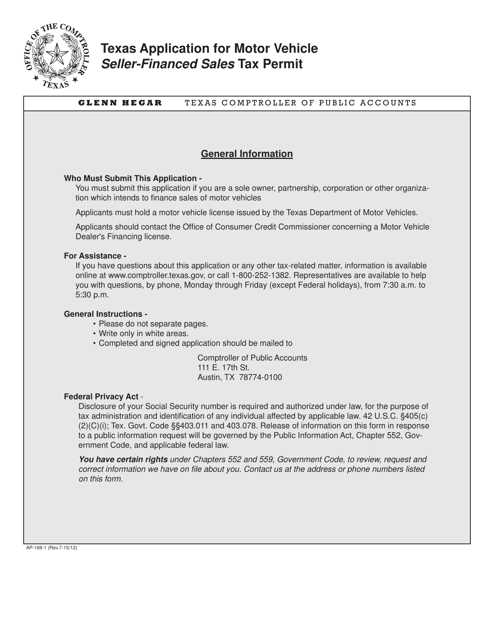

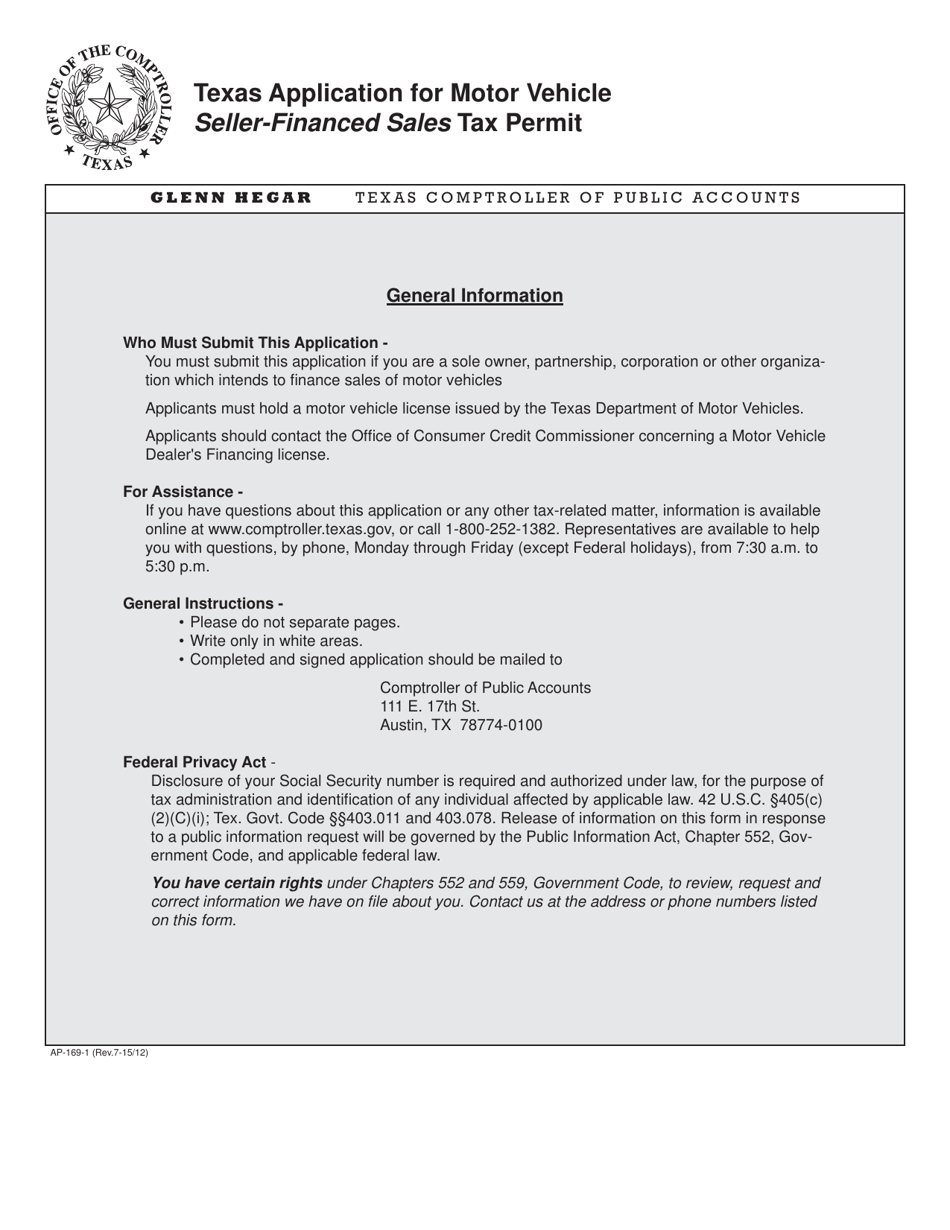

Form Ap-169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller-financed Sales Tax Permit Texas Templateroller

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

Form Ap-169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller-financed Sales Tax Permit Texas Templateroller

Do I Need A Sellers Permit For My Texas Business Legalzoomcom

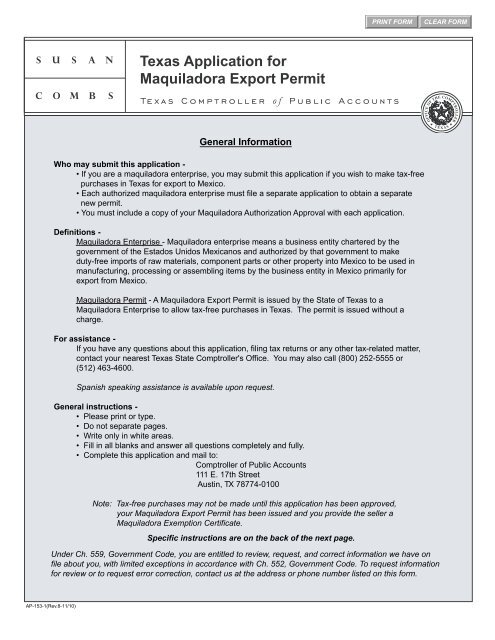

Ap-153 Texas Application For Maquiladora Export Permit

2

Texas Comptroller Of Public Accounts Forms Pdf Templates Download Fill And Print For Free Templateroller

How To Register For A Sales Tax Permit In Texas – Taxjar

Texas Sales Tax – Small Business Guide Truic

Farmers Markets Austintexasgov

Its Template Drivers License State Texas File Photoshopversion 2 You Can Change Nameaddressbi Id Card Template Drivers License Birth Certificate Template