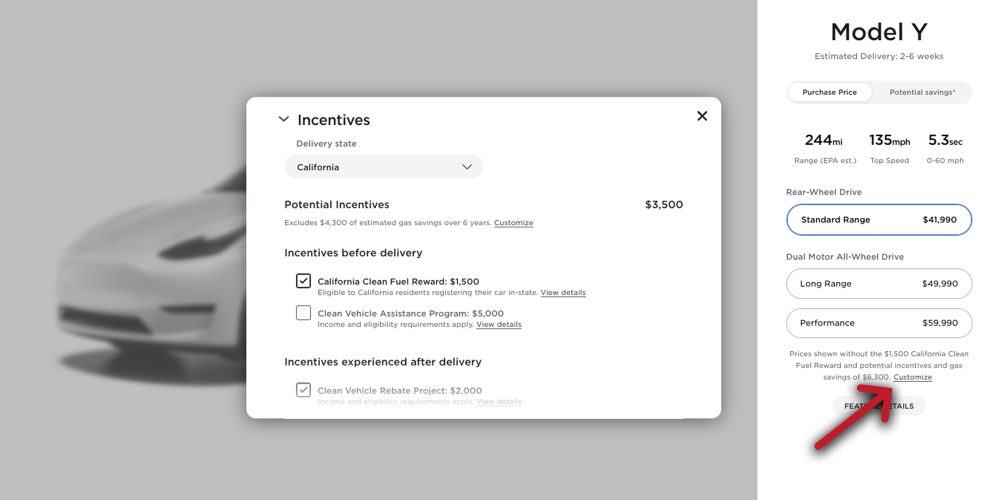

Xcel’s new vehicle lease or purchase rebates are richer than colorado’s state new ev tax credit, which in 2021 fell to $2,500 per vehicle, sobczak noted. At up to $6,000, colorado bets big.

Electric Vehicle License Plate Bill Passes

Stephen edelstein october 29, 2021 comment now!

2021 colorado ev tax credit. Tax credits are available through december 31, 2021. The proposed clean energy for america bill could see evs assembled in the united states qualify for a $10,000 tax credit, while evs built. If they really wanted to move units they could just say if you take delivery before the end of the year you get fsd for free.

Colorado’s ev tax credits are among the best in the u.s. But charge ahead colorado, a joint program from the regional air quality council and the colorado energy office, could open applications again at any time; Drive electric colorado and its affiliates are not tax advisors.

“so we’ve got $5,500 off a new ev purchase or lease, and $3,000 off of used.” Similar data wad reported cox automotive and kelley blue book. This credit has been reduced to $2,500.

The credit may also be increased to a maximum of $12,500. The financing entity may collect an administrative fee of no more than $150. The full ev tax credit will be available to individuals reporting adjusted gross incomes of $250,000 or less, $500,000 for joint filers (decreased from $400,000 for individuals/$800,000 for joint.

Based on how the federal ev tax credit currently works, it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your ev. Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for 5 years add an additional $4,500 for. Thats a small % to be subsidized by everyone's taxes.

A purchaser of a converted hydraulic hybrid trailer may assign the tax credit to the financing entity, allowing the purchaser to realize the value of the tax credit at the time of conversion. Federal tax credits of up to $7,500 are still available for most evs, though tesla met its max at the end of last year and general motors phases out by april. Hypothetically, if you were to buy an ev in 2021 before a 2022 increase in credit amount, you would only be eligible for what was in effect in 2021.

The proposed $12,500 electric vehicle tax credit would include $4,500 for evs built in the united states by union workers, effective after 2027. The new proposal limits the full ev tax credit for individual taxpayers reporting adjusted gross incomes of $250,000 or $500,000 for joint filers, down from $400,000 for individual filers and $800,000 for joint filers. State income tax credits for innovative fuel vehicles.

Colorado’s credit for new ev purchases dropped to $4,000 in january and will be reduced again next year. Some people might bite on that since it’s a $10k item to offset losing the $10k tax credit and it wouldn’t cost tesla anything. The $4,000 no longer applies for 2021.

It is included in the biden administration's. As it stands, the credit provides up to $7,500 in a tax credit when you claim an ev purchase on taxes filed for the year you acquired the vehicle. No credit is allowed for the purchase or lease of a used.

Colorado electric vehicle tax credits updated as of 1/4/21: They typically hold application rounds in january, may, and.

Colorado Ev Incentives Ev Connect

Become A Volunteer Ev Coach

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Tax Credits – City Of Fort Collins

Colorado Is Top State For Electric Car Rebates

Xcel Energy Will Now Help Pay For An Electric Car Depending On Your Income Colorado Public Radio

Tax Credits – Drive Electric Northern Colorado

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Eligible Vehicles For Tax Credit – Drive Electric Northern Colorado

Ev Incentive Hike Faces Tortuous Path Through Congress – Forbes Wheels

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

A3spypssl3ruwm

Zero Emission Vehicle Tax Credits Colorado Energy Office

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicle Fast-charging Corridors Colorado Energy Office

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Charge Ahead Colorado Colorado Energy Office

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra