Personal service corporations may be taxed at a different rate. The corporate tax rate in wyoming may also differ from the individual tax rate.

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

If your business is responsible for collecting and remitting wyoming sales tax, you need to register with the wyoming department of revenue.

Wyoming tax rate for corporations. This does not mean if you form a wyoming llc or a wyoming corporation that all your profits will instantly be tax free. You can find more information on wyoming’s excise (sales & use) tax division site. When the mineral companies’ share of property taxes are also calculated, the industry’s stake in wyoming’s tax revenue gets closer to 50 percent, dean tempte, a fiscal analyst with the lso, said.

Wyoming is the least taxed state in america if you figure there is no personal or corporate income tax. In fiscal year 2014, the year used in lso’s comparisons, 25 percent of wyoming’s tax revenue came from severance taxes — namely on coal, oil and gas. There is no tax except in two limited circumstances:

Wyoming has no corporate or personal income tax. There is no tax return to file with the state. Wyoming tax forms are sourced from the wyoming income tax forms page, and are updated on a yearly basis.

What is the wyoming corporate net income tax rate? Corporations pay a 21 percent income tax rate to the federal government, the tax foundation reported, but they also pay additional corporate taxes in 44 states and washington, d.c. Before the official 2021 wyoming income tax rates are released, provisional 2021 tax rates are based on wyoming's 2020 income tax brackets.

All profits or losses pass through and are taxed to the members. How about a 7 percent corporate income tax? Additionally, counties may charge up to an additional 2% sales tax.

One tax rate of 21% applies to taxable income. The 2021 state personal income tax brackets are updated from the wyoming and tax foundation data. If the holding company owns property in wyoming, the company should expect to pay property taxes at the following rates:

Even with added taxes within different counties or municipalities, the tax rate is normally no higher than 6 percent. South dakota and wyoming do not have state corporate income taxes. Corporations earning less than ,000 a year pay a 15% corporate tax rate, and there are a few tax brackets in between.

Corporations pay a 21 percent income tax rate to the federal government, the tax foundation reported, but they also pay additional corporate taxes in 44 states and washington, d.c. But, not all states levy a corporation tax rate. Wyoming has no corporate income tax at the state level, making it an attractive tax haven for incorporating a business.

For comparison, the federal income tax for persons maxes out at 33%. Wyoming department of insurance | 106 e 6th ave | cheyenne, wy 82002 main phone: Property tax is assessed at 11.5% for industrial property and assessed at 9.5% for commercial, residential and all other property.

Although it will be tax free in wyoming, you should understand that just forming a wyoming company does not magically get you out of. The sales tax is about 5.42%, which is fairly low. The state of wyoming charges a 4% sales tax.

Learn about wyoming tax rates, rankings and more. Explore data on wyoming's income tax, sales tax, gas tax, property tax, and business taxes. Nonprofit corporations and cooperative marketing associations:

There is no tax to the llc on llc income. In the united states, as of 2020, corporations must pay a federal tax rate of 21 percent. In 2017 this rate was pushed up to 35% but was reduced by the tax cuts and jobs act.

Corporations in wyoming are mostly spared from double taxation through this system where entity taxes are not required, and employees are able to keep more of their income by avoiding personal income taxes. This is typically at a rate of 15.3 percent. Wyoming corporations still, however, have to pay the federal corporate income tax.

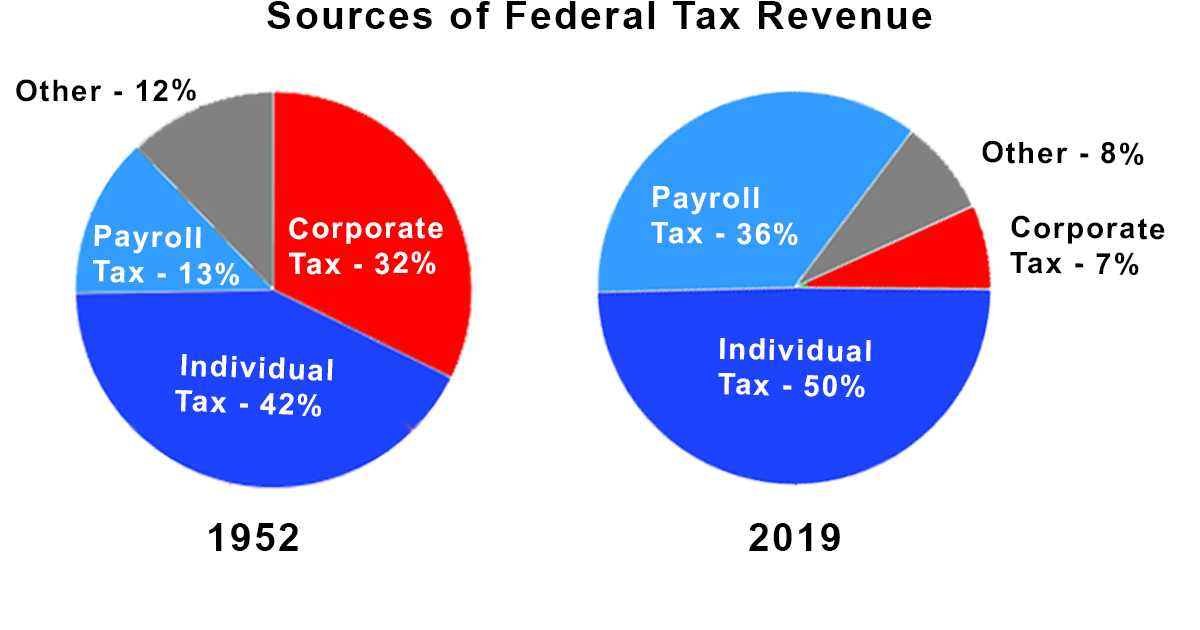

The tax rate is 20 percent (the rate is reduced to 15 percent for certain specific items.) accumulated earnings tax: There is a huge amount of revenue generated from corporate income tax. Nevada, ohio, texas, and washington levy gross receipts taxes instead of corporate taxes.

On average, homeowners in wyoming pay about $1,352 per year in property taxes. The states with tax rate ranges apply tax rates based on how much the corporation earns.

Corporate Taxes By State In 2021 – Balancing Everything

Free Snap Payroll App Now Available For Small Businesses Small Business Payroll Business

25 Percent Corporate Income Tax Rate Details Analysis

Does Your State Have A Corporate Alternative Minimum Tax

Corporate Tax Rates By State Where To Start A Business

Tax Games Corporations Play

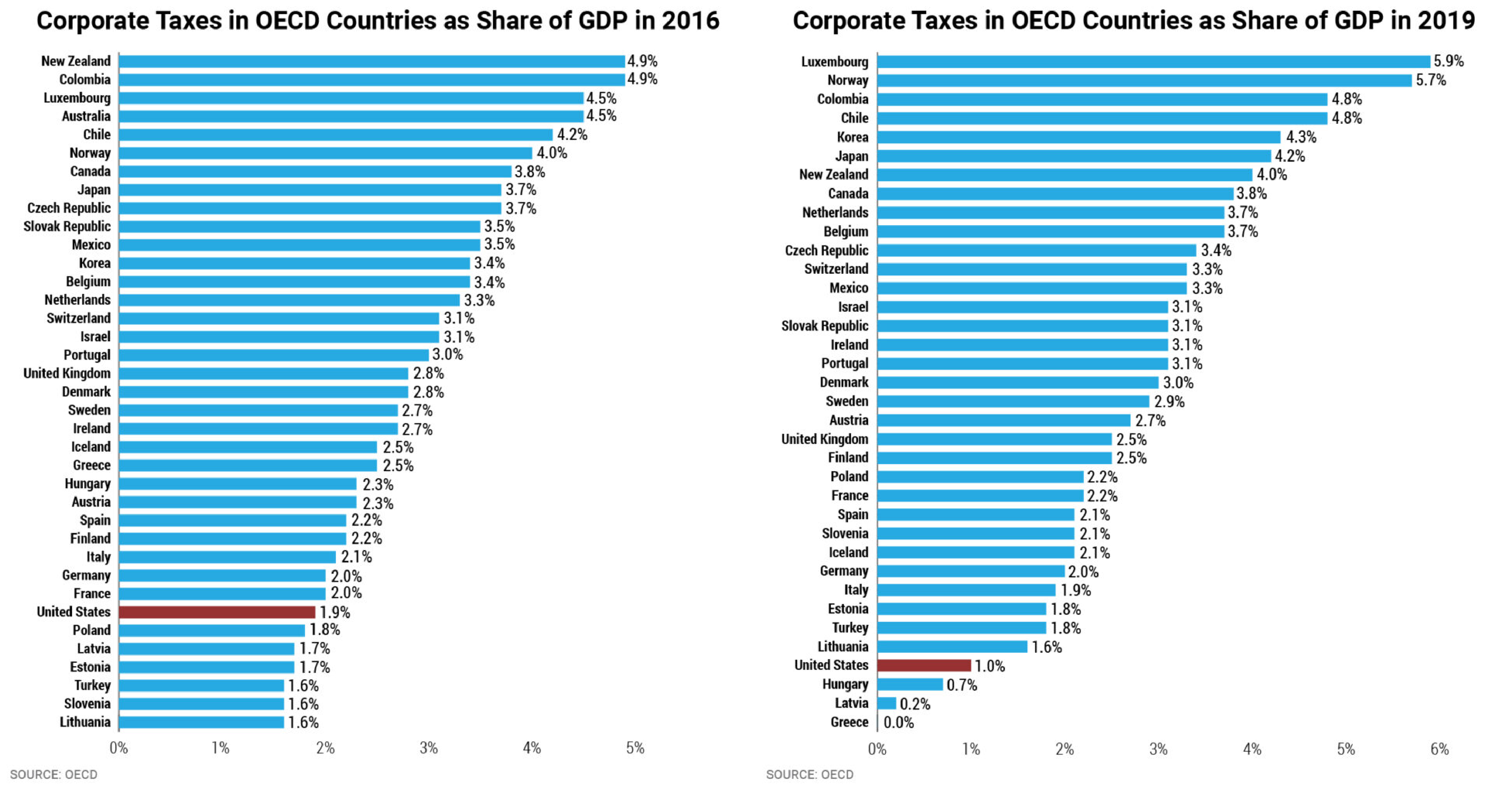

House Democrats Tax On Corporate Income Third-highest In Oecd

Share Of State Taxes Contributed By Corporate Income Tax Download Table

Corporate Tax Rates By State Where To Start A Business

Pdf State Corporate Tax Revenue Trends Causes And Possible Solutions

Why Congress Should Reform The Federal Corporate Income Tax Itep

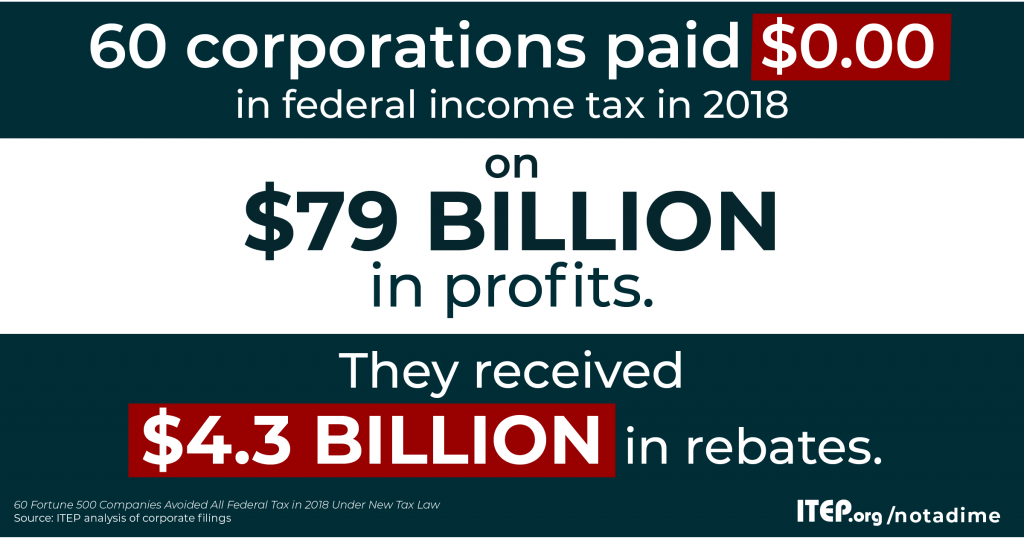

Corporate Tax Avoidance Remains Rampant Under New Tax Law Itep

The Gaming And Decline Of Oregon Corporate Taxes Oregon Center For Public Policy

The Dual Tax Burden Of S Corporations Tax Foundation

Business State Tax Obligations 6 Types Of State Taxes

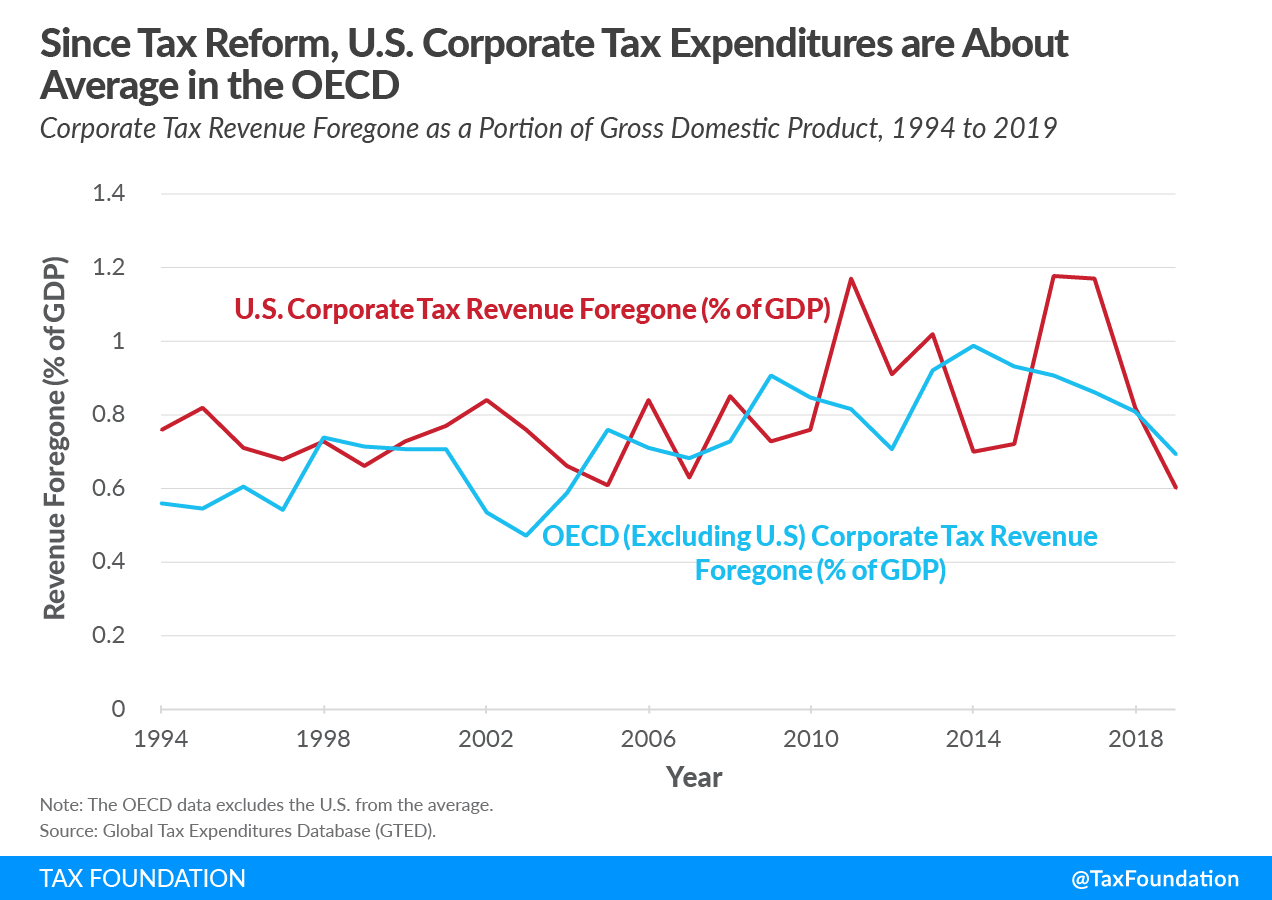

Us Corporate Tax Expenditures Effective Tax Rates In Line With Peers

Us Corporate Tax Expenditures Effective Tax Rates In Line With Peers

Corporate Tax In The United States – Wikiwand

Oregons Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy