New changes to star program: You should register for the star credit if you are:

Assessor

Star is new york’s school tax relief program that provides a partial exemption from school property taxes.

Www tax ny gov online star program. Star enhanced changes beginning 2019/2020. However, by law, the program expired after 2019. New applicants who qualify for star will register with new york state instead of applying with their assessor.

However, there is one great tax savings program that is alive and well, and offers a great benefit to homeowners who sign up for it.on august 7, 1997, a property tax savings program was enacted by governor. If you are using a screen reading program,. This new registration requirement does not apply to senior citizens who are receiving enhanced star;

You only need to register for the star credit once, and the tax department will send you a star credit check each year, as long as you’re eligible. The star program can save homeowners hundreds of dollars each year. What is the income verification program (ivp)?

Recent changes to real property tax legislation, now require any property owner who receives the star enhanced exemption to enroll in the mandatory income verification program (ivp). The following security code is necessary to prevent unauthorized use of this web site. All new yorkers who own and live in their one, two, or three family home, condominium, cooperative apartment, manufactured home, or farm dwelling are eligible for a star exemption on their primary residence.

May be filed now, up to but no later than march 1st, 2022. Who can apply homeowners not currently receiving the star exemption who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and. The property tax relief credit has expired.

New york state school tax relief (star) program. Your benefit may increase by as much as 2% each year. New star recipients will receive a check directly from new york state instead of receiving a school property tax exemption.

Of taxation & finance to verify Seniors must continue to apply annually or participate in the income verification program. If you are receiving this message, you have either attempted to use a bookmark without logging into your account, or you have timed out.

Homeowners not currently receiving star who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and finance. Receive your star check directly from new york state. Eligible homeowners received property tax relief checks in 2017, 2018, and 2019.

The deadline for registration is. The star exemption program is closed to new applicants. The following security code is necessary to prevent unauthorized use of this web site.

New york state star program changes budget cuts, slashed programs, and loss of services seem to be the theme of the day for new york state residents. Responding to a department notice demonstration. Ny tax gov star program.

You can only access this application through your online services account. If you don’t already have an account, it’s easy to create one! Nys star program long island| house savings.

State to take over monitoring star rebate program. If you are using a screen reading program,. See the star resource center to learn more about the star program.

Please log back into your account to access this application. With an online services account, you can make a payment, respond to a letter from the department, and more—anytime, anywhere. The star program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

The amount of the benefit will be the same. If you expect to receive a star credit check and. This application is for owners who had a star exemption on the same property in the 2015/2016 tax year and wish to apply for enhanced star.

The village of freeport has no role in administering this program. Enter the security code displayed below and then select continue. Only available to homeowners who have been receiving the star exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill.

Enter the security code displayed below and then select continue. • the ivp allows the new york state dept. Online services is the fastest, most convenient way to do business with the tax department.

As a result of recent law changes, the star program is being restructured. There have been some changes in how certain homeowners will apply for star, and in how they receive their star benefit.

Assessor

The School Tax Relief Star Program Faq Ny State Senate

Pin On Social Media Marketing

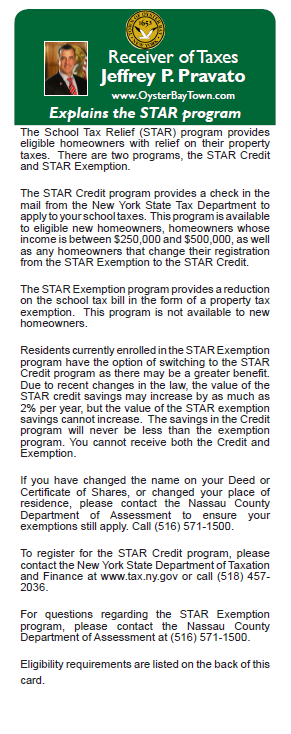

Tax Exemptions Town Of Oyster Bay

Tax Exemptions Town Of Oyster Bay

Assessor

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

Tax Basics Military Personnel And Veterans

Receiver Of Taxes Town Of Oyster Bay

2

How Can I Start A Dollar Store Business Penny Stocks To Buy Penny Stocks Dollar Stores

Brian Barnwell Facebook

Windows 10x Leak Reveals A Mix Of Desktop And Mobile Interfaces Engadget Mobile Interface Interface Leaks

Sample Of Thank You Notes For Gifts Wedding Ideas Blog Penulisan Kreatif Tulisan Kreatif

Msme Registration Process In India Small And Medium Enterprises Registration Goods And Service Tax

Did Onondaga County Residents Win Or Lose In First Year Of Us Income Tax Reform First Stats Are In Income Tax Onondaga County Win Or Lose

Pin On Articles Worth Reading

Jennifer Lawrence Josh Hutcherson And Liam Hemsworth Prove True Friendship Love Exists Liam Hemsworth Jennifer Lawrence News China

Digital Strategy Digital Strategy Open Data Nasa