Most states do not have taxes governing the sale of vehicles, but the buyer may have to pay state taxes in order to bring the new vehicle into his or her home state. However, no depreciation is admissible on personal effects.

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

No taxes are due if you purchase or acquire a vehicle from an immediate family member.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Who pays sales tax when selling a car privately in michigan. When selling your vehicle, accompany the purchaser of the vehicle to a secretary of state branch office to assure the title is transferred into your purchaser's name. You will pay it to your state's dmv when you register the vehicle. Do michigan vehicle taxes apply to.

Therefore, the profit on its sale or transfer will not be subjected to income tax. Yes, you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. A record of the sale can be either a photocopy of the reassigned title or a form or document.

When you sell your car, you must declare the actual selling/ purchase price. Car used for personal purpose will be personal effect and not treated as capital asset as per definition in section 2 (14). It depends on the length of the permit.

To calculate how much sales tax you’ll owe, simply multiple the vehicle’s price by 0.06625. However, you do not pay that tax to the car dealer or individual selling the car. In most states, you’ll need to bring your bill of sale and signed title to the department of motor vehicles (dmv) or motor vehicle registry agency to pay your taxes and obtain your registration, new title, and.

And, permits valid 60 days cost 20% of the annual registration fee or $40, whichever is more. You can find these fees further down on the page. Under the vehicles tab, you can print a seller's permit.

So if you bought a car which still had three months of tax left, you didn’t have to renew it for three months. Before october 2014, a used car could be sold with any existing road tax (officially known as vehicle excise duty or ved) being carried over to the new owner. In addition to taxes, car purchases in michigan may be subject to other fees like registration, title, and plate fees.

2018 taxes and business vehicles. But, permits valid 30 days cost 10% of the annual registration fee or $20, whichever is higher. The tax due in is called use tax rather than sales tax, but the tax rate is the same:

Private vehicle transactions in michigan require a 6% tax due on the full purchase price or fair market value of the vehicle, whichever is greater. In such a sale, the buyer must pay the required state tax on the transaction when he or she registers the car with the department of motor vehicles. When i told them that i would rather sell it privately, they said “well, if.

Proof of sale once a car is sold between parties in michigan, the seller is protected from any damages caused by the. When you purchase a vehicle through a private sale you must pay the associated local and state taxes. Yes you must pay sales tax when you buy a used car if you live in a state that has sales tax.

If you cannot do this, maintain a record of the sale for not less than 18 months. By law a dealer has 20 days to send your title transfer and sales tax to the secretary of state s office. For example, a $15,000 car will cost you $993.75 in state sales tax.

Taxes.when selling your car reporting a wrong purchase price is fraud. In the vast majority of circumstances, selling your old car to a private party or to a dealer shouldn’t bring a tax bill with it. When you purchase a vehicle through a private sale, you must pay the associated local and state taxes.

Sellers name, buyers name, date of sale, make/model/year of vehicle, and conditions of sale. According to nj.com, the state assesses a 6.625 percent sales tax on the purchase price of any used or new vehicle. 6.35% or 7% if the car ' s value is more than $50,000.

For a business where the car is a business expense or asset. The buyer must pay any sales taxes when the new title is applied for, or provide proof that the sales taxes have been paid. Admittedly, the op did not explain if there is a business use component in relation to this vehicle.

However, if you bought it for $14,000 and sold it for $15,000, earning a $1,000 capital gain, you would report this on your tax return, using schedule d on form 1040 that's appropriately titled capital gains and losses. the form. So if you bought the car for $14,000 and sold it for $8,000, you would have a capitol loss of $6,000. The michigan department of treasury administers the collection of the tax.

You can obtain a seller's permit by creating an account on mysdcars.sd.gov. Michigan collects a 6% state sales tax rate on the purchase of all vehicles. He must produce a sales receipt from you.

The internal revenue service considers all. The receipt can be hand written and must contain: But first, upon selling your vehicle, remove your license plates and provide the buyer with a seller's permit.

Be sure to check in with your local dmv and have the buyer do the same with his or her local dmv branch office for more information on these taxes. “ a ‘record of the sale’ ( or sometimes called the bill of sale) can be either a photocopy of the reassigned title or a form or document that includes the year, make, vehicle identification number, name, address, driver license number, and signature of the person to whom the vehicle is sold and the purchase price and date of sale of the vehicle,” according to the. The 6 percent use tax isn’t charged when transferring the vehicle title to any of the following:

If you purchased the vehicle in another state you should pay the sales tax in that state and bring proof of. Tax obligation when you buy a car through a private sale. The buyer must pay 95 to the secretary of state and a tax to the department of revenue.

However, the new law eliminates that option, so your only choice. For a vehicle owned privately used for private use, there are no tax implications. Saying a “sale” is a “gift” is fraud.

You can only reprint this permit once online within 7 days of first obtaining it. You would not have to report this to the irs.

Authorization Letter To Claim – Writing An Authorization Letter For Claiming Documents Is To Be Very Specific And Deta Lettering Letter Writing Samples Writing

Do You Have To Pay Sales Tax On Internet Purchases – Findlaw

Car Tax By State Usa Manual Car Sales Tax Calculator

When Should You Pay Tax Title And License Fees On A Car Loan

Vehicle Repair Invoice For Excel Invoice Template Word Invoice Template Auto Repair

Car Tax By State Usa Manual Car Sales Tax Calculator

The Owner-operators Quick Guide To Taxes – Truckstopcom

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Which Us States Charge Property Taxes For Cars – Mansion Global

Avoid Paying Taxes On Cryptocurrency Legally – Youtube

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Pay Little To No Taxes For The Rest Of Your Life

Saving Money Ways To Pay Off Your Mortgage Sooner En 2020

Car Tax By State Usa Manual Car Sales Tax Calculator

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

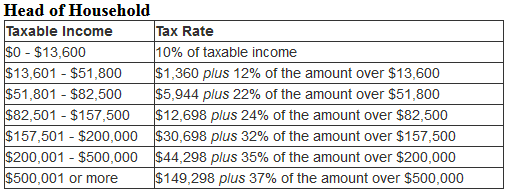

State Taxes

Do You Have To Pay Taxes On Your Car Every Year – Carvana Blog

The Definitive Guide To Paying Taxes As A Real Estate Agent – Aceableagent