Often, the parent with the higher income will gain a larger tax benefit from claiming a child. It is the parent who spends the most time with the children.

I Have Shared Custody Of My Child Should I Get Monthly Child Tax Credit Payments Kiplinger

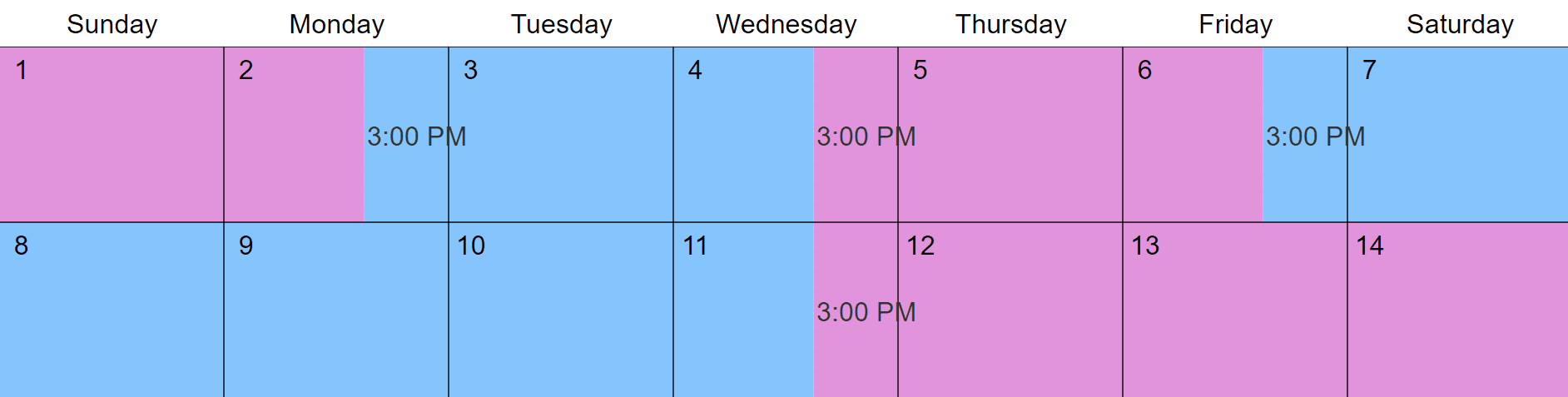

The court has ruled joint “parenting time” or custody, with both you and your spouse spending approximately equal time with your child.

Who claims child on taxes with 50/50 custody georgia. Where two or more taxpayers eligible to claim a specific dependant cannot agree on who will receive the credit, it is denied to all of them. In general, the parent who houses the child for most of the year is going to count as the custodial parent. However, if you and your former spouse follow a 50/50 child custody order, determining who can claim the children as dependents when filing taxes can become more complicated.

Both parents cannot claim head of household, only. Any individual seeking legal advice for their own situation should retain their own legal counsel as this response provides information that is general in nature and not specific to any person's unique situation. Who claims child on taxes with 50 50 custody?

When parents divorce or separate, the law allows only one of them to claim their child as a tax dependent. He must file with his tax return irs form 8332, release of claim to exemption for child of divorced or separated parents, signed by the mother. The parent who has a higher income for the tax year in question should claim the child.

Georgia child custody laws are written to be in accordance with the uniform child custody act. When you address the issue of claiming children on. By default, the irs gives this right to the custodial parent—that is, the parent with whom the child lives for more than half of the year.

To obtain the most accurate child custody information for your situation you should consult with a child custody lawyer. If no parent can claim the child as a qualifying child, the child is treated as the qualifying child of the person who had the highest agi for the year; Every divorce has its own unique circumstances.

The court may award joint custody or sole custody. In most cases, the primary care giver will receive primary physical custody. This can free up some extra money in tax savings,.

But if the father furnishes over 50% of the child's support, he is entitled to the exemption. (this is true for parents without an exact 50/50 custody split.) With joint legal custody, both parents have equal rights and responsibilities to make major decisions concerning the child.

However, there are exceptions to. If a parent can claim the child as a qualifying child but no parent does so claim the child, the child is treated as the qualifying child of the person who had the highest agi for the year. Often, with joint custody arrangements, the court will order that the parents take turns claiming the child, with one parent claiming the child one year, the other parent the next year.

Which parent claims the children on taxes with equal parenting time can be decided between the parents, and with the help of an accountant, you both may be able to work out an arrangement that saves you both on taxes. Whether you have primary custody or joint custody of a child after divorce, the fact remains that only one person can claim the child on each year’s tax forms. For shared custody arrangements, both parents would normally qualify to claim each child.

Unless ordered or agreed otherwise, those are the rules. Legal custody is the right to make major decisions regarding the child. However, two restrictions can cause issues:

The irs has developed a basic tiebreaker rule to deal with this: Child custody laws in georgia this article provides an overview of child custody laws in georgia. Again, the rule for claiming children on your taxes is relatively simple:

If he had them for 50% or more of the time, and if he covers more than 50% their costs, he gets to claim them. Typically, only a parent who has a child living in their household will claim an exemption for their dependent child. The parent that has over 50 percent of the time is the custodial parent and gets the deduction.

In cases where one person has physical custody and the other one does not, the parent with the child in their house should be claiming the exemption. The irs explains, “generally, the custodial parent is the parent with whom the child lived for a longer period of time during the year.” Legal custody and physical custody.

Transferring tax credit to your ex in a 50/50 custody arrangement. 50/50 custody is usually the preferred solution for the colorado divorce courts as it is seen as beneficial to the child for both parents to contribute equally to his or her upbringing. The irs rule is whomever has the kids for the majority of the time claims them, and in cases with 50/50, the parent providing more than 50% of their costs claims them.

The one who had custody for more than 1/2 of the year can claim the child as a dependent, child care expenses, earned income tax credit and, if eligible, head of household. Ok let me explain, uc is based on the adults circumstances on income and circumstances so it is available for unemployed or people on a low income to top up your salary, it is not available for people who earn money, ie your ex/ the child element of uc pays out for how ever many kids you have, check the gov website in actually fact it is really easy to understand. Only one person can claim a specific dependant.

Who claims child on taxes with joint custody? When it comes to child custody laws, georgia awards two types of custody: The standard in georgia is to determine custody based on the best interests of the minor child.

Section 152.) this usually means the mother because she most often gets primary physical custody. If you were named the primary possessor and you adhere to the pso, you will have the right to claim children as dependents on your tax returns. | (equal) the parent who qualifies as the “custodial parent” under federal tax law is the one who claims the children as dependents.

The income rule is the tie breaker if the number of days are equal. Unless one parent has been a danger to the child, the beginning point is to typically establish who has been the primary care giver for the minor child. The parent with physical custody will claim the child on his or her taxes unless the court has said otherwise.

Who claims the child with 50/50 parenting time?

Georgia Child Custody Questions – Cordell Cordell

Can I Get Joint 5050 Custody Of My Child In Georgia

Divorce And Taxes – Findlaw

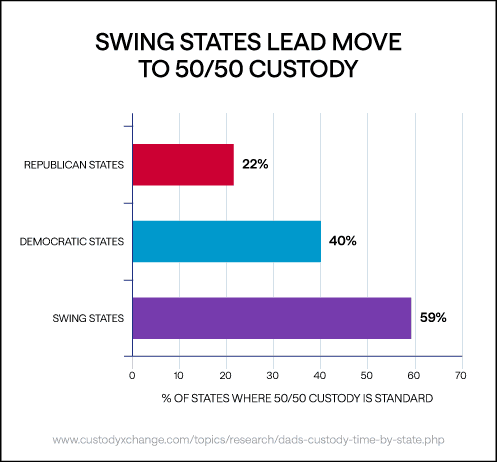

How Much Custody Time Does Dad Get In Your State

Do I Have To Pay Child Support If I Share 5050 Custody

Joint Custody Vs Shared Custody Legalmatch

Is Withholding A Child From Visitation Against The Law Family Law Rights

Can I Get Joint 5050 Custody Of My Child In Georgia

Who Claims Children On Taxes With 5050 Joint Custody In 2020

/114274370-56a870af3df78cf7729e1a2a.jpg)

Irs Tiebreaker Rules For Claiming Dependents

How To File For Child Custody In Georgia Legalzoomcom

How Is Child Support Calculated In Georgia In 5050 Custody Arrangements

Can I Get Joint 5050 Custody Of My Child In Georgia

What Is Joint Custody In Georgia – Stearns Law

Custody Does Matter When Filing Your Taxes – 2020 Update Andalman Flynn Law Firm

Florida 5050 Parenting Plan 5050 Custody And Child Support –

Can I Get Joint 5050 Custody Of My Child In Georgia

Who Claims A Child On Taxes Custodial Parent Rights Child Tax Credit Md Custody Lawyers Andalman Flynn Law Firm

Georgia Custody And Visitation Schedule Guidelines Ga