Because the city of philadelphia is expecting an extreme increase in the number of refund petitions for 2020, they have attempted to make the process easier. Philadelphia does allow residents employees working in a pennsylvania local earned income tax (eit) jurisdiction to take a credit.

Pin On Templates

Who pays the tax the city wage tax is a tax on salaries, wages, commissions, and other compensation.

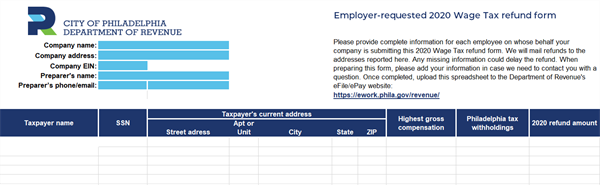

Where is my philadelphia wage tax refund. Eligible nonresident employees may file a refund claim for the wage tax withheld while they worked from home, as required by the employer during 2020. All philadelphia residents owe the city wage tax, regardless of where they work. We are writing to provide important updates about 2020 wage tax refunds in philadelphia.

Refund requests can be submitted to the philadelphia department of revenue after the end of a tax year, or in 2021 for days worked outside the city during the current crisis. The city wage tax rate in philadelphia is a flat 3.93% for residents and 3.50% for nonresidents who work in the city. If so, your employer can file with the city on your behalf for the first time, and your 2020 wage tax refund will be mailed directly to you.

For more information about the current policy, you can read the guidance. This line should reflect time worked outside of philadelphia as noted above. The tax applies to payments that a person receives from an employer in return for work or services.

The earnings tax and the wage tax refer to the same tax, and an employer with nexus in philadelphia will normally withhold and remit the philadelphia wage tax on its employees. 4 weeks after you mailed your return. The tax applies to payments that a person receives from an employer in return for work or services.

In response to these new challenges, we’re introducing new ways to. Box 1137 philadelphia, pa 19102. Prior to 2020, to request a refund of wage taxes paid, employees had to file and submit a wage tax refund petition to the city.

Online account allows you to securely access more information about your individual account. The city wage tax is a tax on salaries, wages, commissions, and other compensation. The employee wage tax refund claim form will be available the first week of february 2021, via the city of philadelphia's website.

Employees who are nonresidents of philadelphia and who are required to work at various times outside of philadelphia within a calendar year may file for a wage tax refund directly with the city of philadelphia. The only place in nj return related to taxes paid to other jurisdiction is schedule a&b (gross income tax). This form could not be filed electronically.

Ad review the guidelines and steps to apply for the child tax relief program with our guide. The coronavirus pandemic has caused unprecedented disruption to businesses and employees. When we file our taxes, we all.

Unless you’re applying for a wage tax refund, you will need to complete and send a general refund petition form to: Requests for a 2013 refund must be filed by april 15. All philadelphia residents owe the city wage tax, regardless of where they work.

Refund applications require an employer’s signature verifying time worked outside of the city. But for most philly workers, it appears unlikely that your employer will take this collective action — for reasons described below. Check how to qualify for the child tax relief program with our guide.

To avoid processing delays, please include all. Please use the refunds date and location cover letter and worksheet for work outside of philadelphia, verified and signed by your employer and attach to petition. If you’re eligible, you may receive a refund for some of.

Ad review the guidelines and steps to apply for the child tax relief program with our guide. Will display the status of your refund, usually on the most recent tax year refund we have on file for you. You don’t need a username and password to request a.

The philadelphia refunds for 2013 and 2014 came in 2015, so it was added on federal forms as income for 2015. Generally, the deadline to request a refund is three years after the filing date of the return. Starting in november 2021, wage tax refund requests must be submitted through the philadelphia tax center.

Check how to qualify for the child tax relief program with our guide.

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

2

Some Pennsylvanians May Be Missing Out On Pa Tax Refunds

Who Pays Wage Tax And When Department Of Revenue City Of Philadelphia

If You Are Suffering From Dwi Charges Near Long Island And Want A Best Lawyer Who Make You Risk Free From These Charges Attorney At Law Good Lawyers Attorneys

Second Coronavirus Relief Package What Does It Mean For You And A Second Stimulus Check The Turbotax Blog

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Limits Of Salary Deductions Surcharges And Salary Advances Wage Garnishment Wage Tax Debt

W9 Form Download Fillable Form W 9 Request For Taxpayer Identification Fillable Forms Form Blank Form

Pennsylvania State Tax Refund – Pa State Tax Brackets Taxact Blog

Five Facts About The New Advance Child Tax Credit

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refund Opportunities – Tax Year 2020 – Baker Tilly

Irs Child Tax Credit Payments Start July 15

Stimulus Payments Have Been Sent Irs Says – The New York Times

![]()

Philadelphia Wage Tax Refunds Whats New For 2020 Plenty

Theres A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

How To Track A Pennsylvania Tax Refund Credit Karma Tax

2015 Irs W9 Form Top 22 W 9 Form Templates Free To In Pdf Format Fillable Forms Form Blank Form