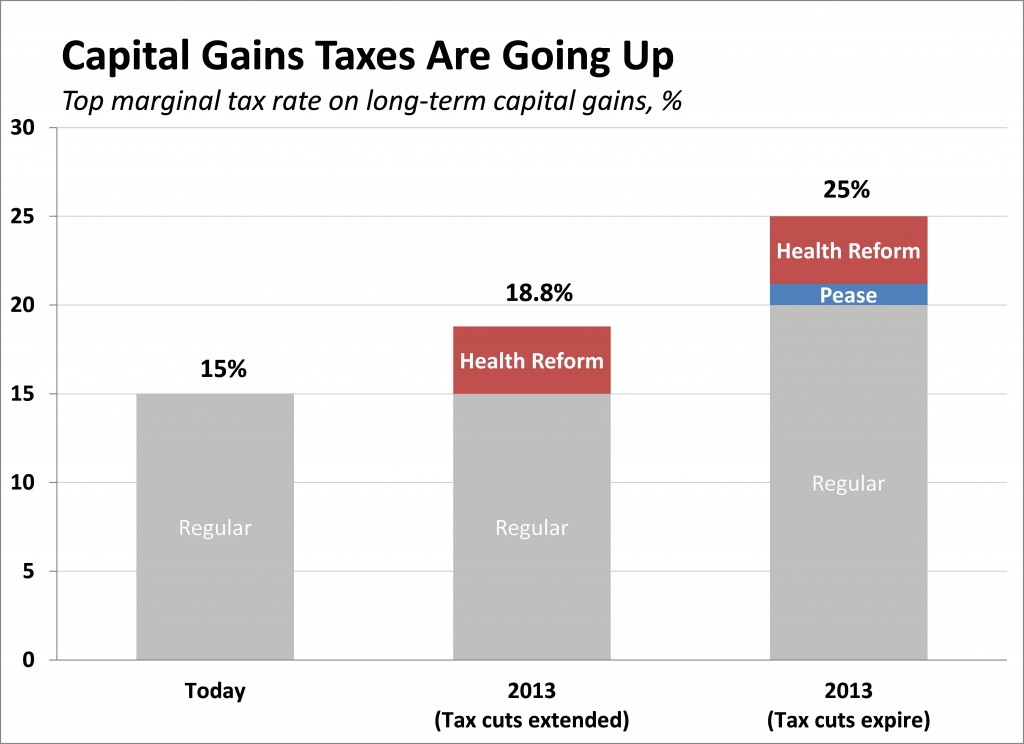

Tue 26 oct 2021 11.00 edt. Ots proposals suggested bringing capital gains tax in line with income tax, currently charged at a basic rate of 20 percent, and rising to 40 percent for higher rate taxpayers.

Capital Gains Tax Examples Low Incomes Tax Reform Group

Is capital gains tax going to increase?

When will capital gains tax increase uk. Once again, no change to cgt rates was announced which actually came as no surprise. After that amount, capital gains on assets like shares or bonds are taxed at 10% for basic rate taxpayers and 20% for higher or additional rate payers. At the moment, any gains on investments not held in vehicles such as an isa or pension are liable to cgt, with each of us allowed to make £12,300 of gains each year before the tax applies.

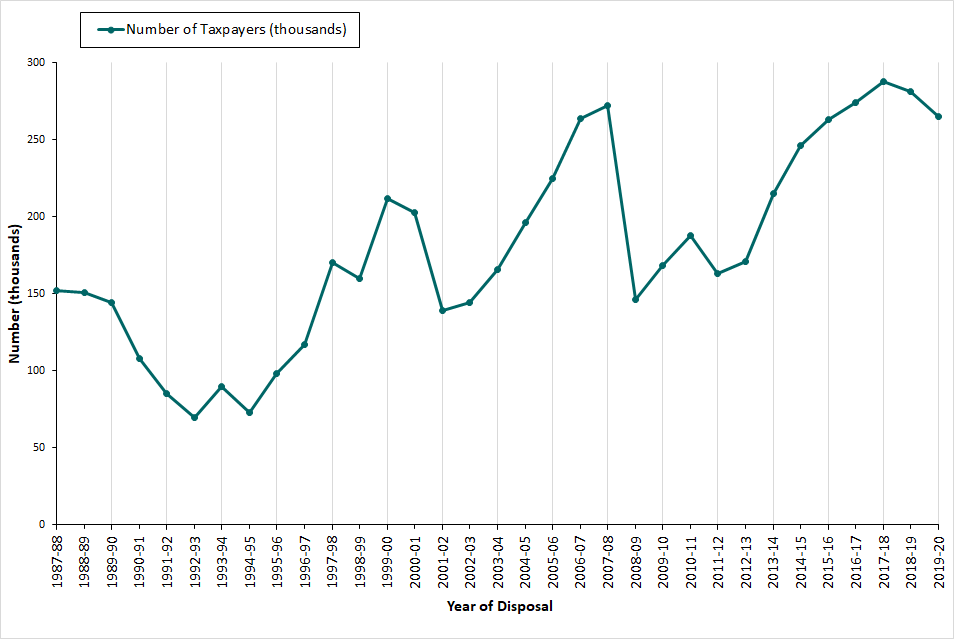

Chancellor rishi sunak’s budget did not ignore capital gains tax after all. The first £12,300 of capital gains each year is exempt from tax. Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the.

You know at the end of the day it's a tax on profits, they are actually realised profits. Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. Have you heard of any potential cgt increases in the uk?

The estimated additional tax that will be raised by the last budget is around £60 billion so there is a very big hole in public finances yet to fill and the chancellor will be looking for ways to fill it. It’s the gain you make that’s taxed, not the. The increase would be substantially bigger from 20% to 45% therefore it would be good to know if this does take place, should assets be sold off before the end of this tax year.

In the past year, the office of tax simplification (ots), a statutory body, has published two reports into cgt at the behest of chancellor rishi sunak and concluded that the. Capital gains tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value. Cgt is charged at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers, or 18 per cent.

Capital gains tax looks like a very tempting target because more than 99 per cent of uk tax payers did not pay any cgt last year.” Capital gains tax will rise this year (2021) in the us and the uk. It will affect online businesses (especially ecommerce business owners), and because the changes aren’t exactly positive, it’s a really smart idea to learn more about them if.

Because the combined amount of £20,300 is less than £37,500 (the basic rate band for the 2020 to 2021 tax year), you pay capital gains tax at 10%. About £14bn could be raised by cutting exemptions and doubling rates, according to the. Chancellor swerves changes to capital gains tax by katey pigden 27 th october 2021 3:47 pm

No tax rise 'horror show', sunak tells tory mps. Date published april 30, 2021 categories. There's talk of cgt (capital gains tax) increasing in the us if biden gets in.

There is an annual allowance of an initial £12,300 on which no cgt would be paid. July 15, 2020 by nick grogan category: The chancellor will announce the next budget on 3 march 2021.

The government could raise an extra £16bn a year if the low tax rates on profits from shares and property were increased and. Yes, so i think capital gains tax potentially will increase. The biggest question asked of private client advisors over the past couple of years is when do we expect capital gains tax (cgt) to increase.

The amount of tax levied on capital gains could be raised by billions of pounds, according to a new report. Capital gains tax review ‘standard practice’. Us president joe biden’s plans to increase capital gains tax in the us might see an increase in uk tax revenue as american citizens may declare income in the uk for tax credits,.

On 14 july it emerged the chancellor had written a letter to the office of tax simplification (ots) requesting it ‘undertake a review of capital gains tax (cgt)’. The uk has shelved proposals to raise capital gains tax rates to align them with income tax and slash the levy’s annual allowance, moves that would have hit the wealthy. Or, could the tax rate be retroactively applied to the 2021/22 tax year?

Last modified on tue 26 oct 2021 11.01 edt.

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

Capital Gains Tax Commentary – Govuk

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Guide To Capital Gains Tax – Times Money Mentor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Taxes Are Going Up Tax Policy Center

Uk Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atkinson2 Capital Gains Tax Budgeting The Borrowers

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Commentary – Govuk

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunaks List Autumn Budget 2021 The Guardian

Can Capital Gains Push Me Into A Higher Tax Bracket

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Pin On Ipa