To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate for transactions occurring after september 13, 2021. Understanding capital gains and the biden tax plan.

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

The table also shows the / % inclusion eligible

When will capital gains tax increase be effective. Could capital gains taxes increase in 2021? If this were to happen, it may not only seem unfair, but it is also bad tax policy. The house ways and means committee released their tax proposal on september 13, 2021.

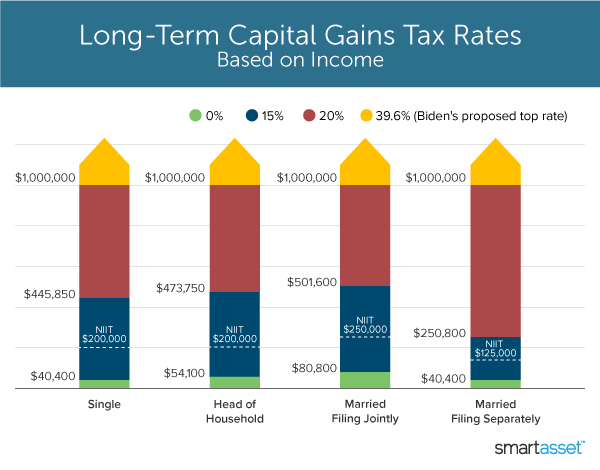

If the capital gains tax rate were to increase to 39.6% prior to the date of sale, the sale price would have to increase by 32%—to $13.2 million—to net the same $8 million after tax. Specifically, the current top capital gains rate is 23.8% (20% plus a 3.8% net investment income credit on high earners). Biden proposed raising the top capital gains tax from 20% to 39.6% before a joint session of congress on april 28.

This may be why the white house is seeking an april 2021 effective date for the retroactive capital gains tax increase, as president biden announced the proposal on april 28, 2021, although it was not widely publicized at the time and investors are still becoming aware of. The effective date for this increase would be september 13, 2021. Wages can face federal tax of 40.8% once you include payroll tax, but hiking the top 23.8% capital gain rate to 43.4% would be a staggering 82% increase.

The current estimate of that effective date ranges from october 15, 2021 on the early. A summary can be found here and the full text here. In his budget plan released may 28, biden proposed making the capital gains tax changes retroactive to april 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the.

A much smaller capital gains rate increase than originally proposed could certainly impact the economics of decisions such as whether to accelerate gains to 2021. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill, and the potential effective date is critical for many investment decisions. Posted on january 7, 2021 by michael smart.

Faq on capital gains outlook and effective date. The white house is now calling for a 39.6% top federal tax rate, nearly double the current amount. To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased.

It’s time to increase taxes on capital gains. The current tax preference for capital gains costs upwards of $15 billion annually. Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is.

Some tax policy experts have similarly suggested that the capital gains rate could end up in the 25% to 30% range, rather than nearly doubling to 39.6% as proposed by president biden. Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though congress must ok any hikes and retroactive effective dates, the. The proposal would increase the maximum stated capital gain rate from 20% to 25%.

2022 capital gains tax rate thresholds The irs has already released the 2022 thresholds (see table below), so you can start planning for 2022 capital asset sales now.

The Tax Impact Of The Long-term Capital Gains Bump Zone

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax Capital Gain Integrity

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax Calculator For Relative Value Investing

How To Calculate Capital Gains Tax Hr Block

The Tax Impact Of The Long-term Capital Gains Bump Zone

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax 101

What You Need To Know About Capital Gains Tax

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Double Taxation Definition Taxedu Tax Foundation

The Tax Impact Of The Long-term Capital Gains Bump Zone

The Tax Impact Of The Long-term Capital Gains Bump Zone

Whats In Bidens Capital Gains Tax Plan – Smartasset

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What You Need To Know About Capital Gains Tax