Expect the notice within 30 days of when the correction is made. Who are getting these refunds?

Still Waiting On Your 10200 Unemployment Tax Break Refund How To Check The Status

The irs already has given notice that the tax refunds on 2020 unemployment benefits are expected to start hitting eligible u.s.

When to expect unemployment tax break refund indiana. With wages, you are expected to pay taxes on your income as you earn it. The irs will send you a notice explaining any corrections. At the federal level, unemployment benefits are counted as part of your income, along with your wages, salaries, bonuses, etc.

The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020. The irs has provided some information on its website about taxes and unemployment compensation. Indiana law allows dwd to collect that money back in a.

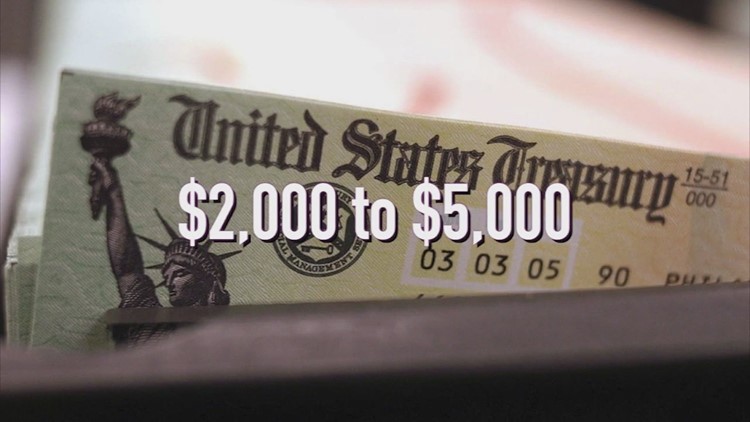

With these new changes the irs owes us about $4,500. These letters are sent out within 30 days of a correction being made and will tell you if you'll get a refund, or if the cash was used to offset debt. Normally, unemployment income is taxable on the federal level and in most states.

Bank accounts within this month. Keep any notices you receive for your records, and make sure you review your return after receiving an irs notice. Sadly, you can't track the cash in the way you can track other tax refunds.

And taxed according to your federal income tax bracket. It comes after lawmakers debated a bill that would have temporarily. For many people, the agency will calculate the refunds automatically.

Unemployment taxes at the federal level. Irs unemployment tax refund details still to be determined. At this stage, unemployment compensation received this.

What you’re looking for is an entry listed as refund issued, and it should have a date in late may or june. Specifically, the rule allows you to exclude the first $10,200 of benefits (up to $10,200 for each. Some tax returns may take longer to process due to factors like return errors or incomplete information.

It forgives $20,400 for couples filing jointly. Americans who took unemployment in 2020, but filed their taxes before passage of the american rescue plan on march 11. Indiana will tax unemployment benefits received in 2020 as income in legislation headed to the governor.

The irs said that unemployment tax refunds will start going out to taxpayers in may and continue throughout the summer months. The indiana department of revenue screens every return in order to protect taxpayer ids and refunds. The internal revenue service recently announced that tax refunds on 2020 unemployment benefits are expected to start landing in eligible u.s.

“if your modified adjusted gross income (agi) is less than $150,000, the american rescue plan enacted on march 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you don’t have to pay tax on unemployment compensation of up to. We explain all you need to know about the tax break and who's eligible. The indiana department of revenue issued guidance tuesday on how hoosiers who got unemployment benefits last year should file taxes after weeks of the department asking.

Indiana will tax unemployment benefits received in 2020 as income in legislation headed to the governor. Let’s recap what we know. In the meantime, you may be interested in irs refunds going to those who were taxed on their 2020 unemployment benefits.

The irs just sent more unemployment tax refund checks with the latest batch, uncle sam has now sent tax refunds to over 11 million americans for the $10,200 unemployment compensation tax exemption. Refunds should be hitting mail boxes and bank accounts — however you normally receive tax refunds — within the next couple of weeks. The refunds are also subject to.

An overpayment happens when the state pays someone unemployment benefits and later determines they’re ineligible for those benefits. The bill forgives taxes on the first $10,200 for individuals, including those who are married but file taxes separately. Other states, like indiana and wisconsin, are only offering a partial tax break.

That’s pretty bs though to be honest. Dor says if people with benefits have already filed, there’s no need to. Another way is to check your tax transcript, if you have an online account with the irs.

Note that pursuant to the irs webpage, the following now applies to your federal taxes: If you claimed unemployment last year but filed your taxes before the new $10,200 unemployment tax break was announced, the irs says you can expect an automatic refund starting in may, if you qualify. If you don’t have that, it likely means the irs hasn’t gotten to your return yet.

The exemption does not apply to state taxes. All hoosiers still need to pay their taxes by may 17 this year to avoid late fees. Here’s more information about the advance child tax credit payments that started going out july 15.

The timings aren't confirmed yet, but the refunds are expected to go out from this month and carry on throughout the summer.

Dwd Will Collect Unemployment Overpayments From Tax Refunds

Whats The Deadline For States To Choose To Offer 10200 Unemployment Tax Break – Ascom

When Will Irs Send Unemployment Tax Refunds Wthrcom

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

Unemployment 10200 Tax Break Some States Require Amended Returns

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

2020 Unemployment Tax Break Hr Block

Irs Refund Checks For 10200 Unemployment Tax Break Coming In May

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

2020 Taxes Everything You Need To Know About Filing This Year – Wish-tv Indianapolis News Indiana Weather Indiana Traffic

Tax Refund Irs Recalculates Unemployment Benefit Taxes For Millions

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khoucom

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Irs Issues Another Round Of Unemployment Tax Refunds To 15m Americans Fox Business

Irs Sending Out 4 Million Surprise Tax Refunds This Week Fox 59

Dor Unemployment Compensation State Taxes

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check – Abc7 Chicago

When Will Irs Send Unemployment Tax Refunds Wthrcom