And $137,700 for 2020.your employer must pay 6.2% for you that doesn’t come out of your pay. The federal government determines the percentages employees will pay for payroll taxes.

Federal Income Tax Brackets Brilliant Tax

For medicare taxes, 1.45% is deducted from each paycheck, and your employer matches that amount.

What percentage of taxes are taken out of my paycheck in ohio. Exit and check step 2 box otherwise fill out this form. You pay 12% on the rest. This ohio hourly paycheck calculator is perfect for those who are paid on an hourly basis.

The result is the percentage of taxes deducted from a paycheck. Ohio’s department of job and family services notes that the exact tax. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

So if you elect to save 10% of your income in your company’s 401 (k) plan, 10% of your pay will come out of each paycheck. Beginning with tax year 2019, ohio income tax rates were adjusted so taxpayers making an income of. Fica taxes are commonly called “the payroll” tax, however, they don’t include all taxes related to payroll.

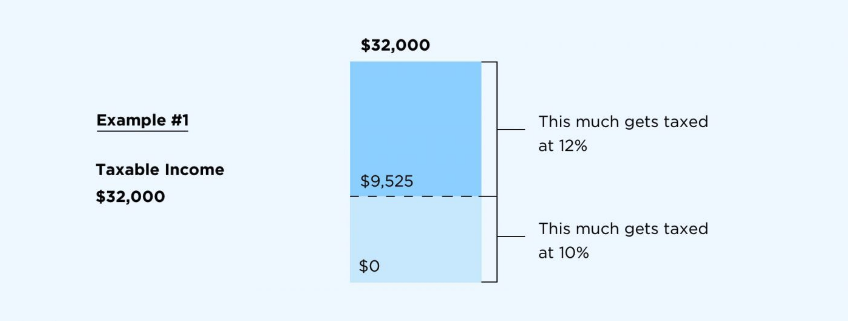

(look at the tax brackets above to see the breakout.) example #2: The medicare tax rate is 1.45%. Under the federal unemployment tax act (futa), employers are required to pay 0.6 percent on an employee’s first $7,000 of earnings.

A total of 15.3% (12.4% for social security and 2.9% for medicare) is applied to an employee’s gross compensation. Income tax rates range from 0% to 4.797% with varying tax brackets. The social security tax provides retirement and disability benefits for employees and their dependents.

Determine if state income tax and other state and local taxes and withholdings apply. Each employer withholds 6.2% of your gross income for social security up to income of $132,900 for 2019. Also divided up so that both employer and employee each pay 1.45%.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. State income taxes, which vary by state, are a percentage of your earned or unearned income that you pay to the state government. As mentioned above, ohio state income tax.

Here’s a breakout of the various tax brackets, courtesy of the ohio department of taxation. Any income exceeding that amount will not be taxed. To use our ohio salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

What is ohio income tax rate? Divide the sum of all applicable taxes by the employee’s gross pay. If you have a household with two jobs and both pay about the same click this button and exit.

The ohio tax rate ranges from 0 to 4.797%, depending on your taxable income. Using our ohio salary tax calculator. Due to the tax cuts and jobs act, you may see a change in the taxes coming out of your paycheck.

Tax rates range from a high of 13.3 percent in california to those in lower income brackets paying percentages less than one percent, in several. However, an extra.9% must be withheld for employees making in excess of $200,000 per year (the employer does not share this extra tax, it is paid only be the employee). These amounts are paid by both employees and employers.

The payroll taxes taken from your paycheck include social security and medicare taxes, also called fica (federal insurance contributions act) taxes. These are contributions that you make before any taxes are withheld from your paycheck. The income tax brackets have shifted, with those making between $38,701 and $82,500 owing taxes of $4453.50 plus 22 percent of the amount over $38,700.

Once the federal government has taken its share, state and local tax authorities also take a piece of an employee paycheck. There is no wage base limit for medicare. In ohio, most employers are required to pay unemployment compensation taxes and report wages each quarter.

Fica taxes consist of social security and medicare taxes. Because ohio collects a state income tax, your employer will withhold money from your paycheck for that tax as well. If you had $50,000 of taxable income, you’d pay 10%.

Calculations, however, are just one piece of the larger paycheck picture. The 24 percent tax bracket has those making between $82,501 and $200,000 paying $14,089.50 plus 24 percent of the amount over $82,500. Both employee and employer shares in paying these taxes each paying 7.65%.

Medicare taxes, unlike social security tax, go to pay for expenditures for current medicare beneficiaries. Tax rates vary from state to state with 43 states taxing individual income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

Hi @hal_al , me and my wife are in a similar situation. If your household has only one job then just click exit. Additional state taxes can apply.

For 2021, employees will pay 6.2% in social security on the first $142,800 of wages. State tax is imposed by ohio on your income each year. If i live and work in 2 different cities in ohio, will city taxes for both be taken out of my paycheck?

From each of your paychecks, 6.2% of your earnings is deducted for social security taxes, which your employer matches. Actually, you pay only 10% on the first $9,875; Ohio payroll taxes can be a little hard to keep track of.

You pay the tax on only the first $137,700 of your earnings in 2020;

The Owner-operators Quick Guide To Taxes – Truckstopcom

Compare Car Insurance Rates Ohio Upcomingcarshqcom Compare Car Insurance Car Insurance Car Insurance Rates

Tax Withholding Calculator For W-4 Form In 2021

Ohio Tax Rates Things To Know Credit Karma

Its Tax Season Will My Alimony Be Tax Deductible In 2021

Taxes On Military Bonuses Military Benefits

1155g1 Gross Income Vs Net Incomeevan Earns 160000 Personal Financial Literacy Financial Literacy Income

Federal Income Tax Brackets Brilliant Tax

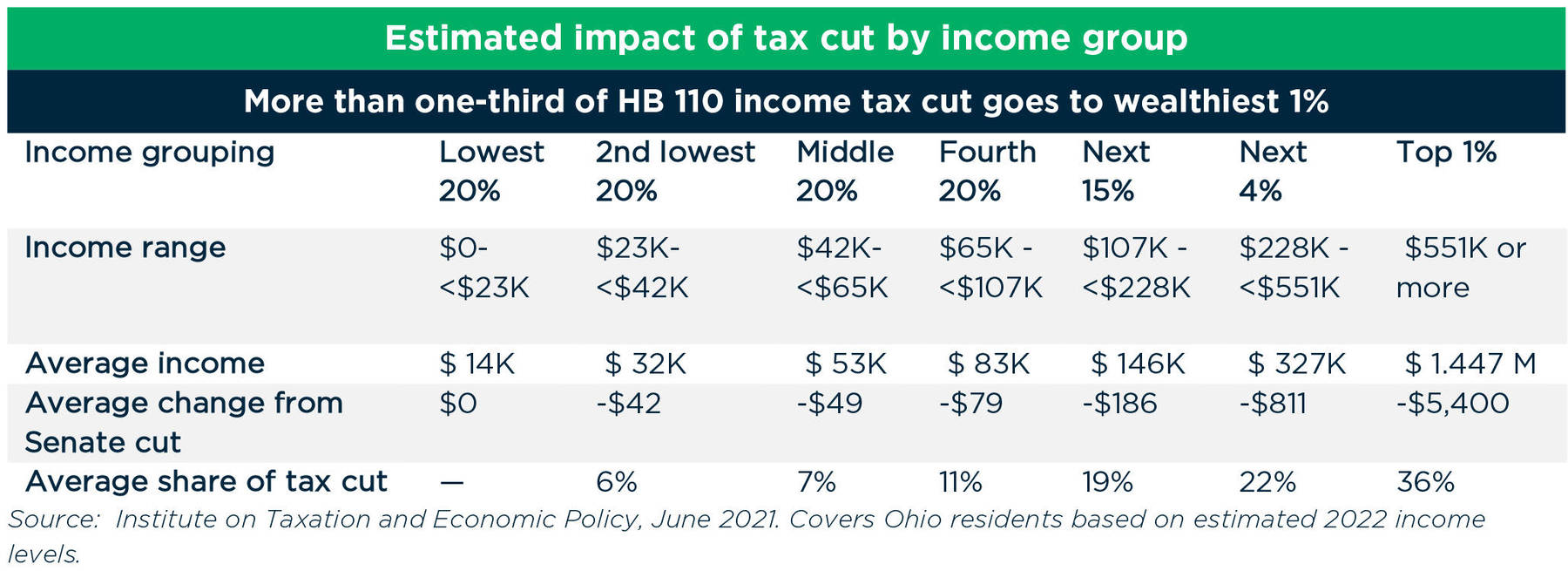

Ohio Tax Cuts Would Go Mostly To The Very Affluent

Income Tax City Of Gahanna Ohio

There Are 3 Major Credit Reporting Agencies An Act Was Passed In The United States That Makes You Able T Credit Reporting Agencies Hillsborough County Patton

Federal Income Tax Brackets Brilliant Tax

2

2

My First Job Or Part-time Work Department Of Taxation

Ohio Tax Rate Hr Block

The Breakdown Of Local And State Ohio Taxes

How Much Does An Employer Pay In Payroll Taxes Examples More

Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others