When you contribute to fica, your employer does too. The rates apply to taxable income—adjusted gross income minus either the standard deduction or.

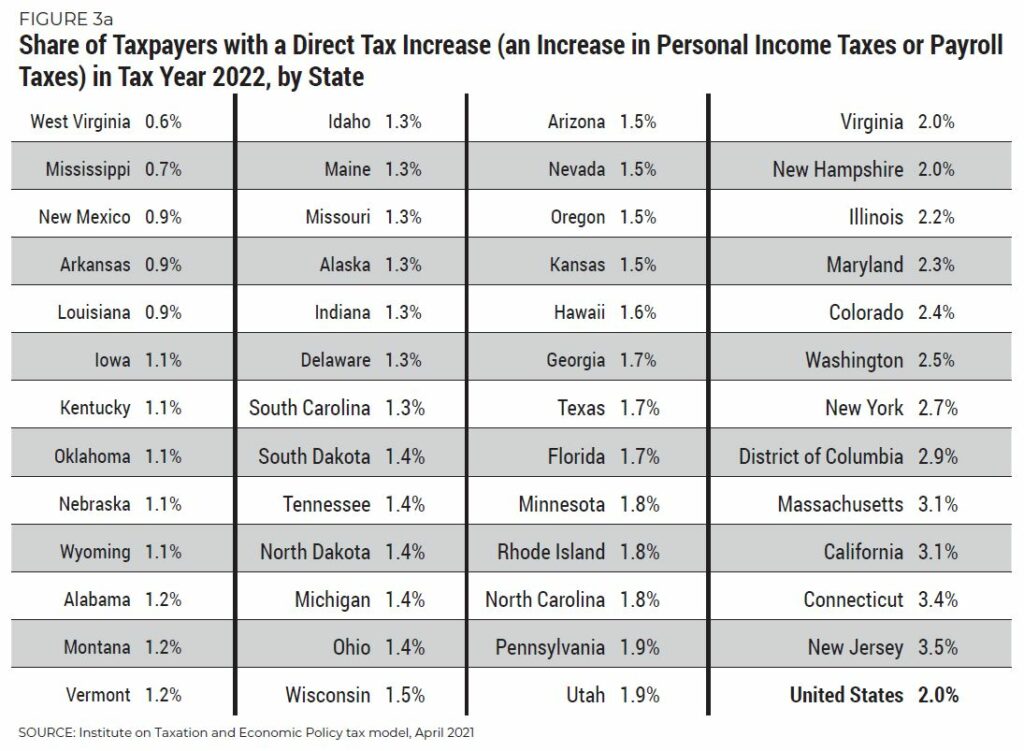

National And State-by-state Estimates Of President Bidens Campaign Proposals For Revenue Itep

The medicare tax rate is 1.45%.

What is the percentage of taxes taken out of a paycheck in colorado. Exit and check step 2 box otherwise fill out this form. At the time of publication, the employee portion of the social security tax is assessed at 6.2 percent of gross wages, while the medicare tax is assessed at 1.45 percent. The 2017 social security withholdings total 12.4 percent and medicare withholding rates total 2.9 percent, according to the irs.

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. Using our colorado salary tax calculator. All data was collected on and up to date as of jan.

Luckily, the colorado state income tax rate isn’t quite as high. The federal government determines the percentages employees will pay for payroll taxes. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1).

Both employee and employer shares in paying these taxes each paying 7.65%. For example, if your gross pay is $4,000 and your total tax payments are $1,250, then your percentage tax is 1,250 divided by 4,000, or 31.25 percent. A total of 15.3% (12.4% for social security and 2.9% for medicare) is applied to an employee’s gross compensation.

For example, if your gross pay is $4,000 and your total tax payments are $1,250, then your percentage tax is 1,250 divided by 4,000, or 31.25 percent. Ad 9 tax professionals will answer now questions answered every 9 seconds. There is no universal federal income tax percentage that is applied to everyone.

Supports hourly & salary income and multiple pay frequencies. This free, easy to use payroll calculator will calculate your take home pay. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

In the federal tax code, there are 7 different tax brackets, ranging from 10% to 37%. Colorado state directory of new hires p.o. Fica taxes are commonly called “the payroll” tax, however, they don’t include all taxes related to payroll.

The payroll taxes taken from your paycheck include social security and medicare taxes, also called fica (federal insurance contributions act) taxes. These amounts are paid by both employees and employers. There are variations in the income tax brackets depending on your filing status.

Fica (federal insurance contributions act) tax is a federal payroll tax paid by both employees and employers. Both taxes combine for a. Amount taken out of an average biweekly paycheck:

Your employer matches these rates,… can you claim federal tax deductions in south. Census bureau) number of cities that have local income taxes: The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

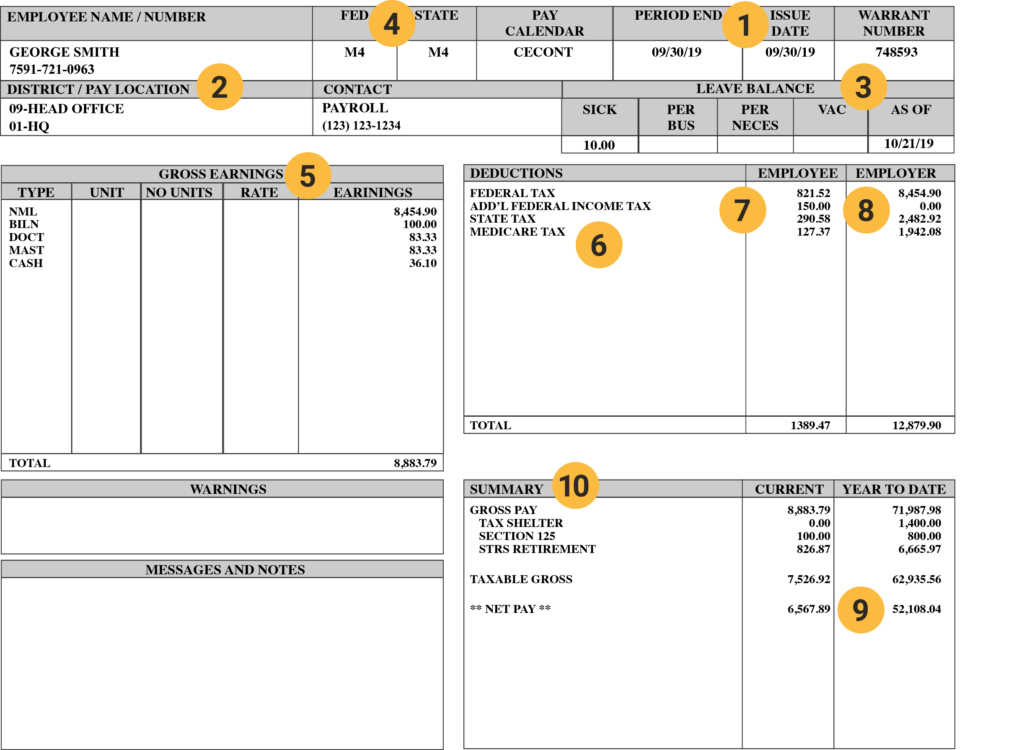

How your north carolina paycheck works. Tips there is no standard language for how items are listed on a pay stub or earnings statement. However, employees working in aurora, denver, glendale, sheridan, or greenwood village must take into account what’s called the occupational privilege tax into consideration.

Social security tax is 6.2%, and medicare is 1.45%, totaling 7.65% of your paycheck going to fica. Amount taken out of an average biweekly. If your household has only one job then just click exit.

When first hired at a job, employees fill out several forms. The tax is made up of both social security and medicare taxes. How can you avoid the same fate?

For 2021, employees will pay 6.2% in social security on the first $142,800 of wages. What percentage is taken out of paycheck taxes? The amount of fica taxes withheld will vary, because it’s not a set amount, but a percentage of your paycheck.

Combined, the fica tax rate is 15.3% of the employees wages. What is the percentage of federal taxes taken out of a paycheck? Your tax bracket is different if you file as single, married (filing jointly or.

To use our colorado salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. The social security tax provides retirement and disability benefits for employees and their dependents. Social security is taxed at 6.2% of your salary and medicare at 1.45%.

So if you elect to save 10% of your income in your company’s 401 (k) plan, 10% of your pay will come out of each paycheck. If you have a household with two jobs and both pay about the same click this button and exit. What percentage of a paycheck would go to pay taxes?

These are contributions that you make before any taxes are withheld from your paycheck. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Texas does not have state income tax, and we also do not pay any.

Calculates federal, fica, medicare and withholding taxes for all 50 states. Fica taxes consist of social security and medicare taxes. Add up all your tax payments and divide this amount by your gross (total) pay to determine the percentage of tax you pay.

An employer withholds these funds from the paycheck as well as income taxes and other deductions. Check out our new page tax change to find out how federal or state tax changes affect your take home pay. The information an employee provides on this form.

Find out what percentage of taxes are taken out so you can plan to tax season. What percent of taxes gets taken out of my paycheck?

Barber Salary In Colorado Springs Co Comparably

Colorado Paycheck Calculator – Smartasset

Individual Income Tax Colorado General Assembly

Individual Income Tax Colorado General Assembly

Colorado Paycheck Calculator – Smartasset

The Income Tax Rate In Colorado Is 463 – This Is Not The Only Tax You Will Pay On Your Earnings

How Much Tax Is Taken Out Of My Paycheck Indiana – Tax Walls

Heres How Much Money You Take Home From A 75000 Salary

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

New Tax Law Take-home Pay Calculator For 75000 Salary

Paycheck Calculator – Take Home Pay Calculator

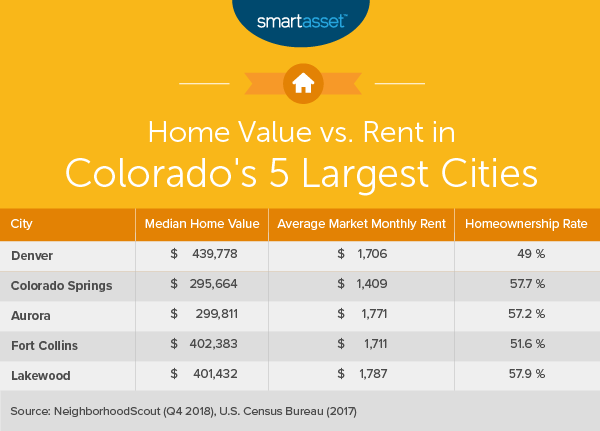

The Cost Of Living In Colorado – Smartasset

Colorado Sales Tax Calculator Reverse Sales Dremployee

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

New Tax Law Take-home Pay Calculator For 75000 Salary

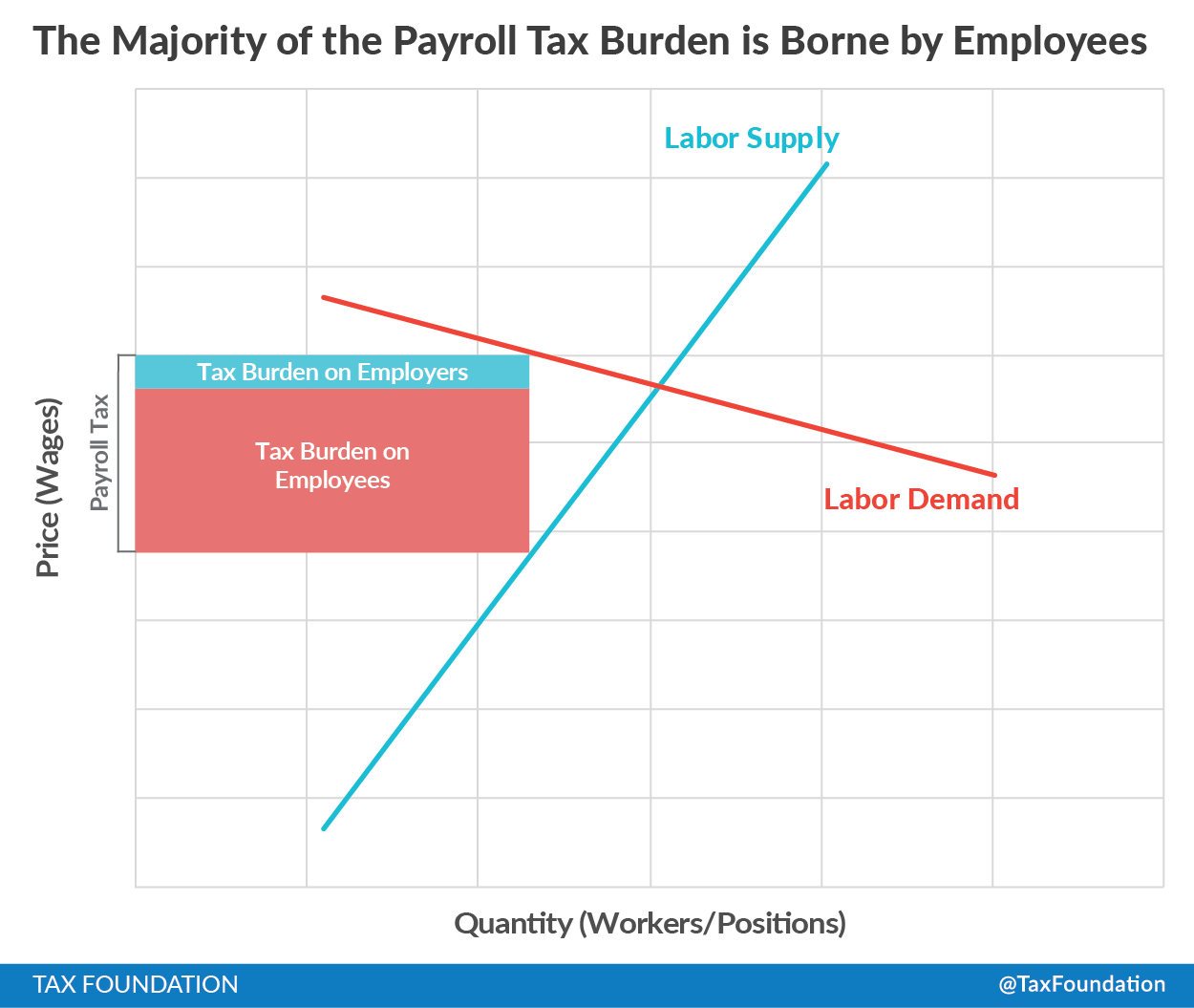

What Are Payroll Taxes And Who Pays Them Tax Foundation

How Much Should I Set Aside For Taxes 1099

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Individual Income Tax Colorado General Assembly