Census bureau) number of cities that have local income taxes: 104 rows total tax rate.

Texas Income Tax Calculator – Smartasset

Top individual income tax rate in texas still 0% in 2020.

What is the income tax rate in dallas texas. Dallas, houston and san antonio all have combined state and local sales tax rates of 8.25%, for example. Texas corporations still, however, have to pay the federal corporate income tax. Both texas' tax brackets and the associated tax rates have not been changed since at least 2001.

Texas has no individual income tax as of 2021, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. Maximum tax rate for 2021 is 6.31 percent. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021.

On top of that, the state sales tax rate is 6.25%. Future job growth over the next ten years is predicted to be 45.1%, which is higher than the us average of 33.5%. The average property tax rate in texas is 1.80%.

Your effective tax rate for 2021 = general tax rate (gtr) + replenishment tax rate (rtr) + obligation assessment rate (oa) + deficit tax rate (dtr) + employment and training investment assessment (etia) minimum tax rate for 2021 is 0.31 percent. If you make $55,000 a year living in the region of texas, usa, you will be taxed $9,295. Texas has no corporate income tax at the state level, making it an attractive tax haven for incorporating a business.

The combined state and federal corporate tax rate in texas now stands at 21 percent, representing a tie for the lowest levy among the 50 states and the district of columbia, according to a new study from the tax foundation. The base dallas texas sales tax rate is 1%, and the dallas texas sales tax rate (dallas mta transit) is 1%, so when combined with the texas sales tax rate of 6.25%, the dallas texas sales tax rate totals 8.25%. Also called a privilege tax, this type of income tax is based on total business revenues exceeding $1.18 million.

The following table provides the most common 2017 total combined property tax rates for 177 dallas fort worth area cities and towns. When compared to other states, texas property taxes are significantly higher. The county sales tax rate is %.

256 rows while texas’ statewide sales tax rate is a relatively modest 6.25%, total sales taxes (including county and city taxes) of up to 8.25% are levied. Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year. The us average is 7.3%.

Texas income tax rate and tax brackets shown in the table below are based on income earned between january 1, 2021 through december 31, 2021. Property taxes in texas are calculated based on the county you live in. It follows el paso, which had an.

Outlook for the 2019 texas income tax rate is to remain unchanged at 0%. Texas state income tax rate for 2021 is 0% because texas does not collect a personal income tax. This is the total of state, county and city sales tax rates.

The texas sales tax rate is currently %. Dallas mta transit stands for, metropolitan transit authority of dallas. According to the tax foundation, that makes the overall state and local tax burden for.

The minimum combined 2021 sales tax rate for dallas, texas is. To make matters worse, rates in most major cities reach this limit. Your average tax rate is 16.9% and your marginal tax rate is 29.7%.

Highland park, which has a combined total rate of 1.67 percent, has the lowest property tax rate in the dfw area and hawk cove, with a combined rate of 3.17 percent, has the highest tax rate. Detailed texas state income tax rates and brackets are available on this page. Every person (entity) owning, operating, managing, or controlling any hotel in the city of dallas (city) shall collect hotel occupancy tax (hot) in the amount of 7% of net room receipts from their guests, and report the collections and pay the tax to the city.

The dallas sales tax rate is %. This marginal tax rate means that your immediate additional income will be taxed at this rate. While the national average tends to fall between 1.08% and 1.21%, texas’ average effective property tax rate is above 1.83%.

What is the sales tax rate in dallas, texas? That means that your net pay will be $45,705 per year, or $3,809 per month. The margin tax base is then apportioned to texas using a single gross receipts factor (sales factor) and is then multiplied by a tax rate of 0.375% for retailers and wholesalers or.75% for all other taxpayers.

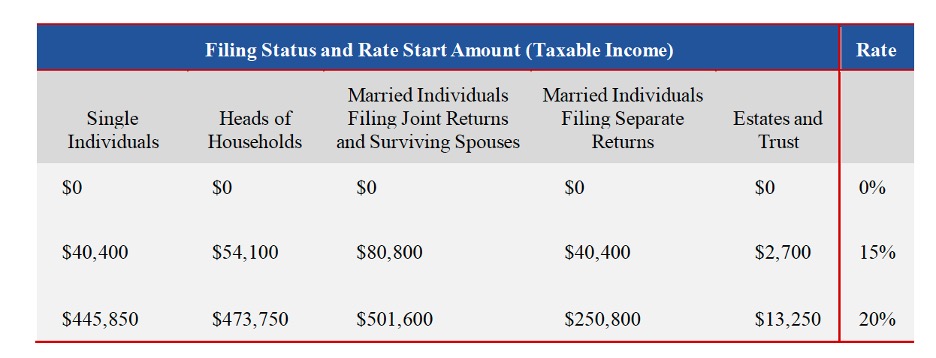

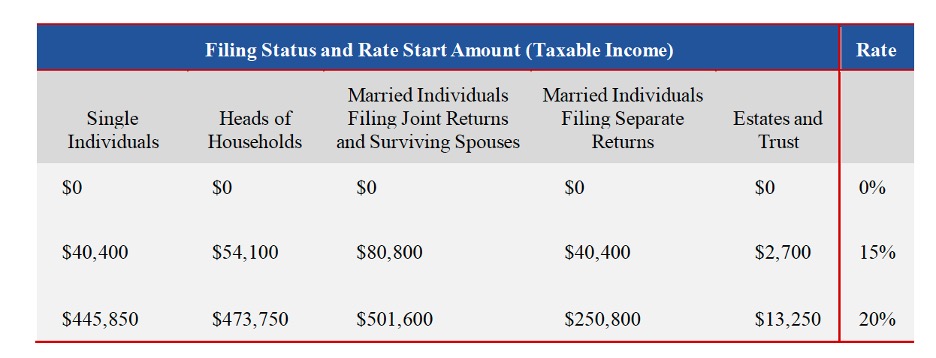

Here Are The New Income Tax Brackets For 2019 Cnbc 11-16-18 Tax Brackets Income Tax Brackets Personal Finance

Amerika Serikat – Tarif Pajak Individu 2004-2021 Data 2022-2023 Perkiraan

Map Of Fort Worth With Outlying Suburbs Notice 820 Freeway Circles Around I-20 And I-30 Go East And West Dallas Is Appro Fort Worth Texas Fort Worth Fort

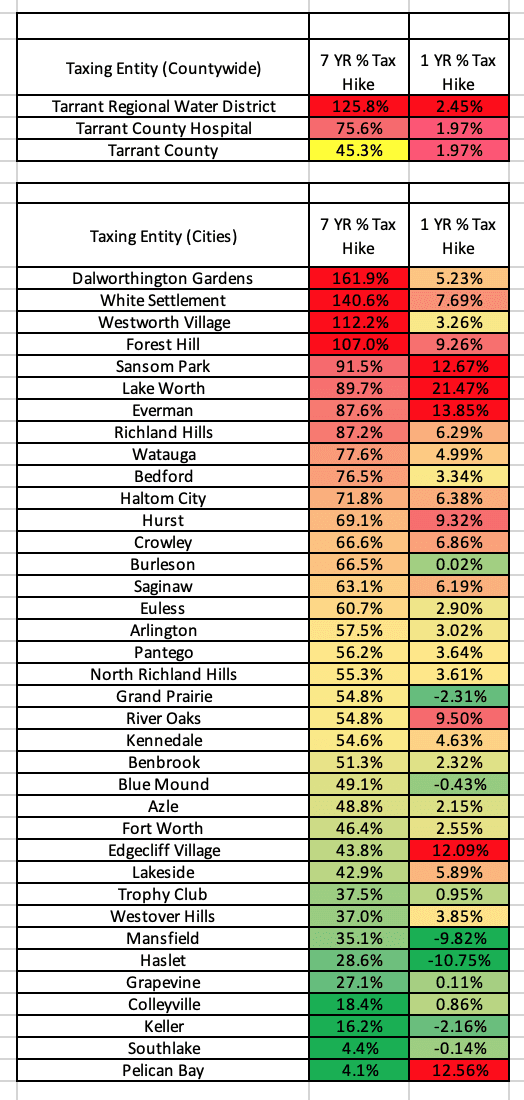

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Congress Readies New Round Of Tax Increases – Freeman Law

90th Birthday For Him 90th Birthday Decoration 90th Birthday Etsy In 2021 Birthday Poster Birthday For Him 80th Birthday

Why Are People Moving To Texas Moving To Texas Texas Quotes Texas Life

Conversion Of Partnership To Company Procedure Rules Tax Effect Company Types Of Taxes Tax

Dallas Tax Attorneys Tax Attorney Tax Refund Tax

Average Rental Rates For A One-bedroom Apartment In Houston Tx Neighborhoods Apartment Rent Renting Ho Houston Apartment Houston Living Bedroom Apartment

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Cool Things To Buy

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

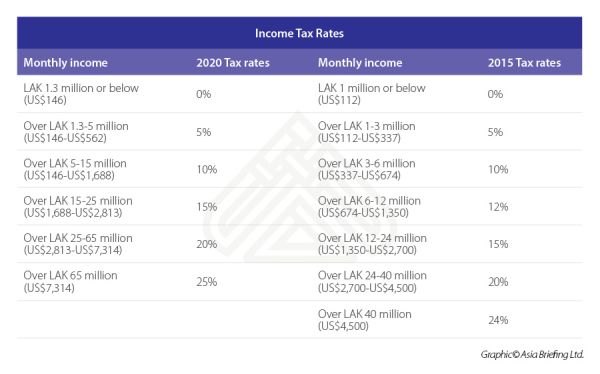

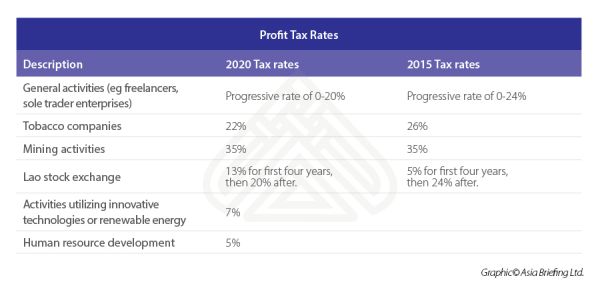

Laos To Implement New Income Tax Rates – Tax – Lao Peoples Democratic Republic

Estate Tax Primer For German Investors In Us Real Estate Partnerships Dallas Business Income Tax Services

Laos To Implement New Income Tax Rates – Tax – Lao Peoples Democratic Republic

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Httpswwwdfwincomepropertiescom Dfw Income Properties Real Estate Sales Dallas Fort Worth Area Reale Multi Family Homes Income Property Foreclosed Homes

Budget And Tax Facts City Of Lewisville Tx

Rate Calculator Lawyers Title Dfw Title Insurance Lawyer Estate Lawyer