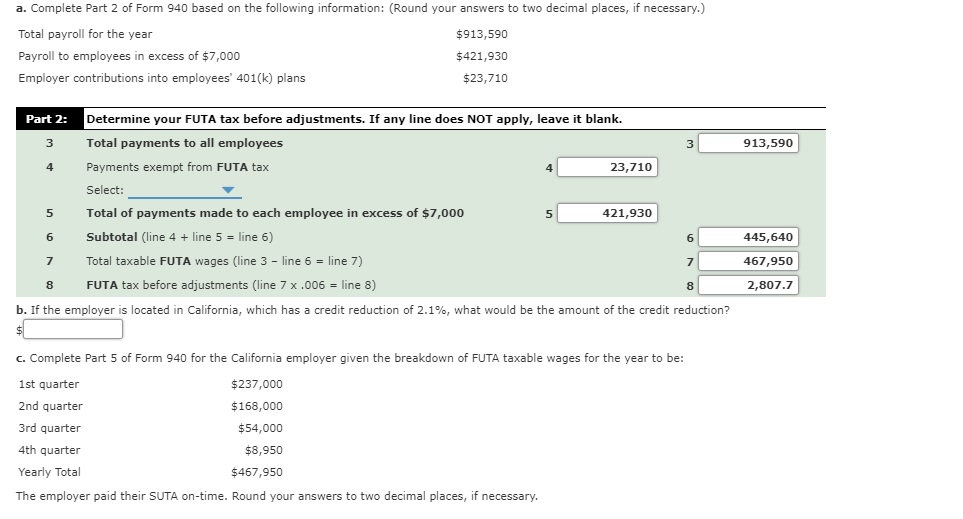

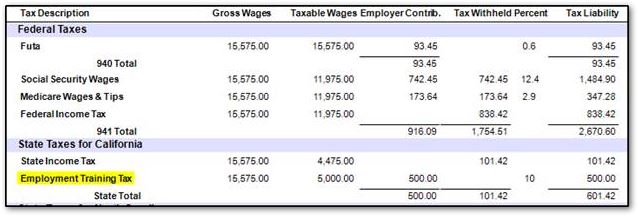

The futa and suta taxes are filed on form 940 each year, regardless if a business has an employee on unemployment insurance. As a result of the ratio of the california ui trust fund and the total wages paid by all employers continuing to fall.

I Know This Looks A Bit Lengthy But I Could Really Cheggcom

Some states require that both the employer and employee pay suta taxes.

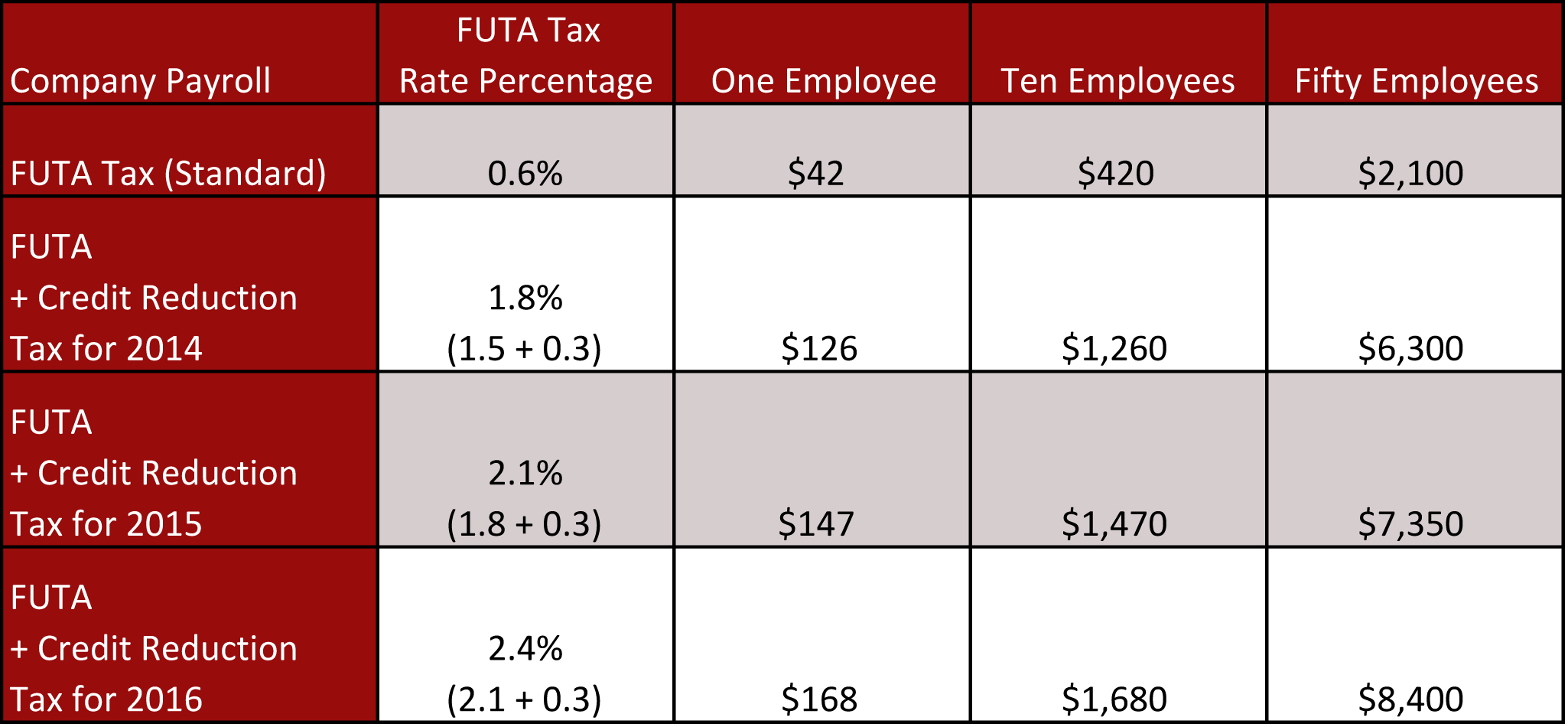

What is suta tax california. The new employer sui tax rate remains at 3.4% for 2021. Doing so will allow you to get a credit that. The minimum futa tax is 0.6 percent.

The company is the retailer of the materials with sales tax applying to its gross receipts from the sale of the materials. Of that percentage, 12.4% goes to social security and is collectible up to $118,500 of net earnings. The remaining 2.9% goes to medicare without any collectible earnings limit.

These contributions provide monetary support to displaced workers. The futa tax is 6 percent of an employee’s first $7,000 of gross pay, but employers are entitled to a substantial rate deduction if the state they operate in complies with futa guidelines. Employers contribute to the state unemployment program by paying suta tax every quarter, depending on the suta tax rate and the wage base.

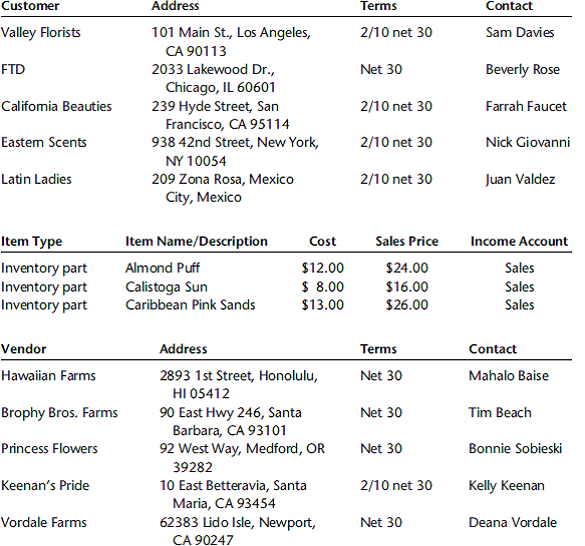

The state unemployment tax act, known as suta, is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. The two contracts are treated as one integrated agreement for california sales and use tax purposes. Unemployment insurance (ui) and employment training tax (ett) are employer contributions.

What is the state unemployment tax act (suta)? Suta was established to provide unemployment benefits to displaced workers. The obligation of the company to furnish and install is without substance for california sales and use tax purposes.

Suta, or the the state unemployment tax act (suta), is a payroll tax paid by all employers at the state level. Just as futa taxes fund federal unemployment programs, suta taxes fund your state’s unemployment insurance program. The futa tax rate is a flat 6% but is reduced to just 0.6% if it’s paid on time.

States may also refer to suta tax as state unemployment insurance, sui, or reemployment tax in florida. The state unemployment tax act (suta) requires employers to pay a type of payroll tax. The sui taxable wage base for 2021 remains at $7,000 per employee.

Get an indepth analysis of how unemployment insurance ui and state unemployment taxes / suta are calculated. Suta (state unemployment tax act) dumping, one of the biggest issues facing the unemployment insurance (ui) program, is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low ui tax rates. States use funds to pay out unemployment insurance benefits to unemployed workers.

Wages are generally subject to all four payroll taxes. The employee pays for disability insurance through withholding, meaning the employer deducts the payment from his or her wages. 52 rows this means you will only contribute unemployment tax until the employee.

California has four state payroll taxes which are administered by the edd: 52 rows suta, the state unemployment tax act, is the state unemployment insurance program to benefit workers who lost their jobs. Unlike suta tax, however, the futa tax rate does not vary by state.

2021 sui tax rates and taxable wage base. Essentially, futa is a payroll tax paid by employers on employee wages. The futa tax rate is 6.0% for all employers, regardless of where they do business.

The money collected through suta tax funds the state unemployment insurance to employees who lost their job through no fault of their own. The suta program was developed in each state in 1939 during the great depression, when the u.s. However, virgin island employers must pay 2.4% to the government since this territory owes the us government money.

The state unemployment tax, also called the state payroll tax or simply ‘ suta ,’ is a payroll tax you pay into your state’s unemployment benefits fund. It’s important to calculate suta taxes in conjunction with the futa tax. It is often (wrongly) called “unemployment insurance” or “sui.” the term suta is often used to refer to the employer's suta rate, that is, the percent of payroll that is assessed on that particular employer.

It is a tax assessed on employers to fund unemployment benefits. It is the employer's responsibility to withhold the tax and make payments. However, it is always a simple percentage of the employee’s pay up to a yearly earnings limit.

As with almost all state regulations, the rules that company owners must follow for suta vary by state. The suta tax is the state version of the futa tax. Some states apply various formulas to determine the taxable wage base, others use a percentage of the state’s average annual wage,.

State disability insurance (sdi) and personal income tax (pit) are withheld from employees’ wages. The employer submits unemployment and disability payments to the california. If one of your employees ever gets laid off and starts collecting state unemployment insurance, it’s likely that money will come from your state’s state unemployment tax act fund.

State unemployment tax assessment (suta) is based on a percentage of the taxable wages an employer pays. The percentage of the suta tax varies from state to state. Taxes must be reported and paid on a 940 or 941 form (quarterly) and many states now require the employee level wage and tax reports to be submitted on magnetic media (like diskettes or cds).

The wage base and tax rates are subject to change by an act of congress, but that hasn’t happened since 1983. Suta was developed in each state alongside the. The federal unemployment tax act (futa) is similar to suta in that it’s a tax paid by employers.

Suta tax is experience rated. Employers are required to pay both state unemployment payroll taxes (suta) and federal unemployment payroll taxes (futa). When employees lose their jobs through no fault of their own, the state or territory where they work provides temporary compensation while.

According to the edd, the 2021 california employer sui tax rates continue to range from 1.5% to 6.2% on schedule f+. The state unemployment tax act (suta) tax is a type of payroll tax that states require employers to pay.

The True Cost Of Hiring An Employee In California Hiring True Cost California

4.jpg)

Ca Sdi Deduction Das

2

1.jpg)

Ca Sdi Deduction Das

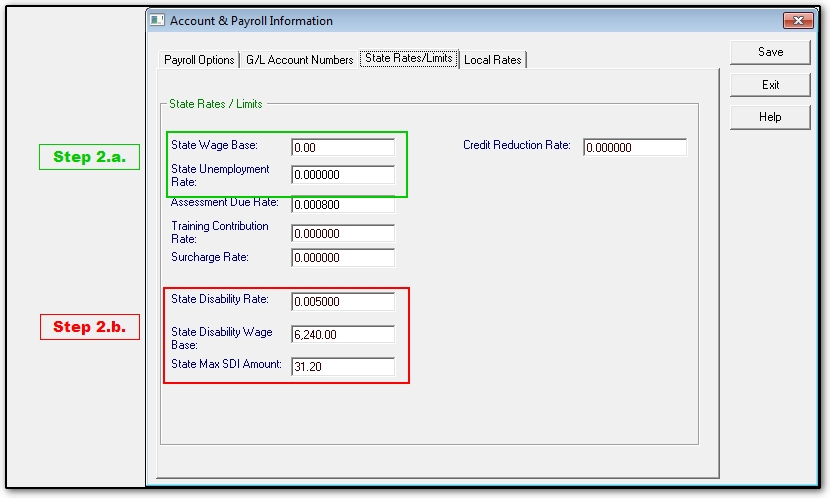

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop – Youtube

Futa Federal Unemployment Tax Act San Francisco California

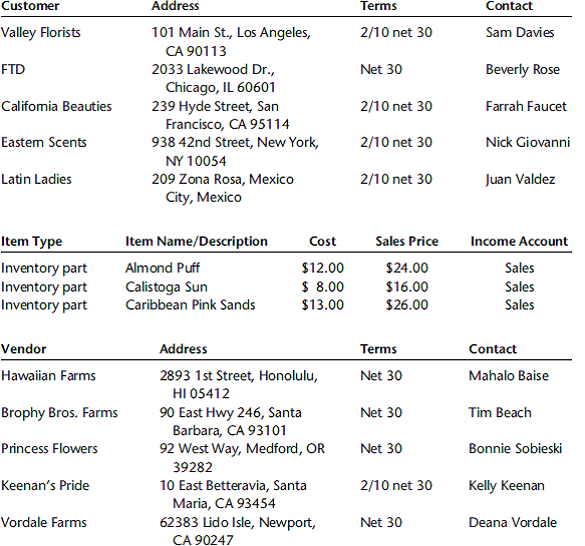

Ocean View Flowersocean View Flowers Is In The Wholesale D Cheggcom

Log In To Online Services

Federal Unemployment Insurance Taxes California Employers Paying More – Advocacy – California Chamber Of Commerce

What Is Sui State Unemployment Insurance Tax Ask Gusto

A Complete Guide To California Payroll Taxes Rjs Law

Our Company Is Agricultural And Not Required To Pa

How Do I Get My California Employer Account Number

Setting The Ca Sdi Deduction In Cwu

Update Suta And Ett Tax For Quickbooks Online – Candus Kampfer

What Is Sui State Unemployment Insurance Tax Ask Gusto

Ca – Employment Training Tax Das

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

2