This unique tax parcel identifier is assigned by the wayne county tax assessment office. A service of the wayne county treasurer eric r.

Wayne County West Virginia

The public hearings will be held at the wayne county administration building, 1st floor tax map office, 428 w liberty st, wooster, oh 44691 hearing one:

Wayne county tax map office. You can pay online by visiting the wayne county treasurer's office website at the following link. For those who wish to simply view the county’s gis data online, a web map has been created for this purpose. The tax bill data and payment history provided herein is periodically copied from the wayne county tax office billing and collection system.

Welcome to wayne county's geographic information systems (gis) data hub. Welcome to the wayne county, mississippi online record search. For more details about the property tax rates in any of michigan's counties, choose the county from the interactive map or the list below.

Maps are for tax purposes only not to be used for conveyance of property. 1 | p a g e wayne county tax map office formatting examples 428 w liberty st wooster, oh 44691 p: The mapping department receives documents recorded in the recorder of deeds office.

Sabree our website allows taxpayers to view delinquent property tax information for all municipalities in wayne county at no cost to the user, by entering the parcel id number or street address and city. In michigan, wayne county is ranked 81st of 83 counties in assessor offices per capita, and 2nd of 83 counties in assessor offices per square mile. Mississippi has 82 counties, with median property taxes ranging from a high of $1,204.00 in madison county to a low of $281.00 in amite county.

The wayne county treasurer's office offers many remote payment options for your property taxes. This site provides public access to property tax data, including delinquent tax claim lists. Assessment & equalization wayne county gis parcel data assessment data annual reporting county apportionment county equalization historical tax maps employee directory benefits &.

Consequently, there will be a short delay between the time a bill is satisfied (either in our offices or using our online payment vendor) and when payment is reflected. Click the links above for contact information and additional details about the offices themselves. The wayne county tax services department comprises the tax assessment office and tax claim bureau.

Property lines have been registered to the 1969 wayne county, new york photogrammetric base maps, and, as a result, dimensions and acreages may vary. The assessment office is administered under title 53, chapter 28 of the consolidated assessment law. The bills are computed based on the assessed values of real and personal property as determined by the chief appraiser and board of assessors of wayne county and the millage rates set by the board of commissioners and the school board.

You can pay by mail by sending a check to wayne county treasurer p.o. Here you can download gis data, use map applications, and find links to other useful information. This search engine will return property tax, appraisal and other information of record in wayne county.

The main wayne county website is available at www. Currently this data is update hourly. Wayne county is a sixth class county.

Interested parties can search for specific locations via the county’s six digit “control number.”. For more details about the property tax rates in any of mississippi's counties, choose the county from the interactive map or the list below. Thursday, november 18, 2021 at 4:30pm

The board of tax assessors is responsible to appraise all property at the fair market value as georgia law dictates. After approval, tax bills are issued to the owner of record as of january 1 of the current tax year. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Wayne county property records are real estate documents that contain information related to real property in wayne county, pennsylvania. The information is uploaded to this server frequently but may lag behind actual activity at. Two public hearings have been scheduled to discuss the adoption of the wayne county conveyance standards per ohio revised code section 319.203.

There are 8 assessor offices in wayne county, michigan, serving a population of 1,763,822 people in an area of 612 square miles.there is 1 assessor office per 220,477 people, and 1 assessor office per 76 square miles. Paying online is easy and convenient. All tax maps are referenced to the new york state plane coordinate system using the 1983 north american datum (nad 83).

These documents are reviewed and processed by mapping technicians who update property tax maps and property ownership. Search for parcels by control #, tax map #, or owner name. Michigan has 83 counties, with median property taxes ranging from a high of $3,913.00 in washtenaw county to a low of $739.00 in luce county.

Home Treasurer

Map Of Wayne Co Pennsylvania Library Of Congress

Wayne County Illinois Public Records Directory

Home

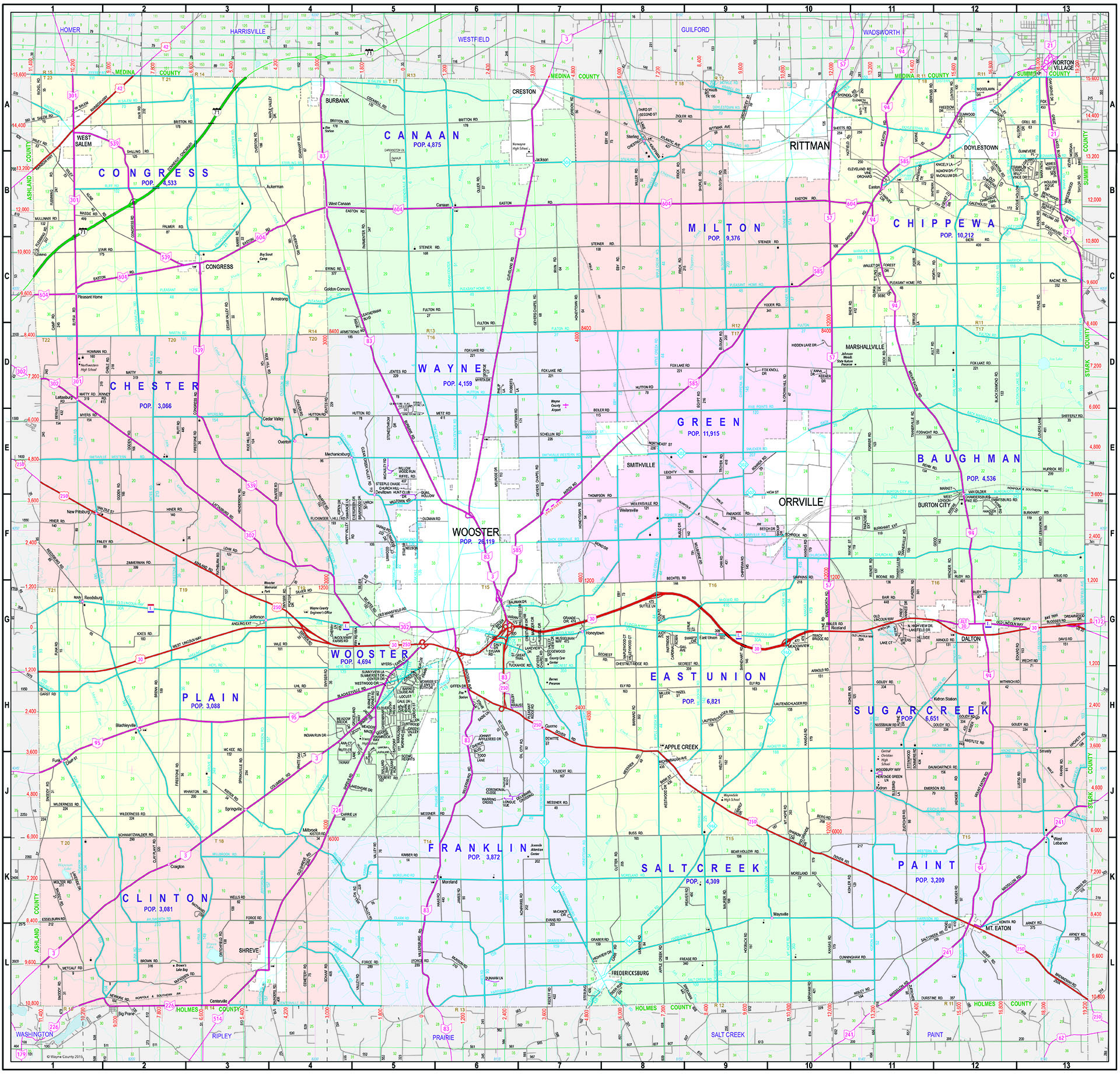

County Map Wayne County Engineers Office

Tax Map Office Wayne County Ohio

Sodus Assessor

Wayne County Tax Assessors Office

Map Of Wayne County New York Library Of Congress

2020 Residential Assessments Show 20 Surge In Home Values Across Most City Neighborhoods City Of Detroit

Countywide Property Tax Reassessment Wayne County Pa

Auditors Office Wayne County Ohio

Wayne County Collector

Wayne County Michigan Public Records Directory

Tax Map Wayne County Engineers Office

Countywide Property Tax Reassessment Wayne County Pa

Deed Transfer Process Wayne County Nc

Countywide Property Tax Reassessment Wayne County Pa

Wayne County Missouri Public Records Directory