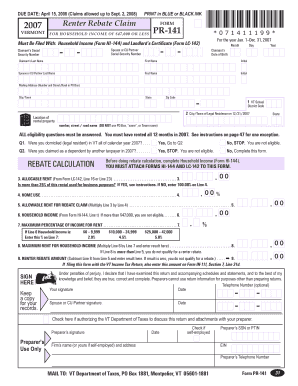

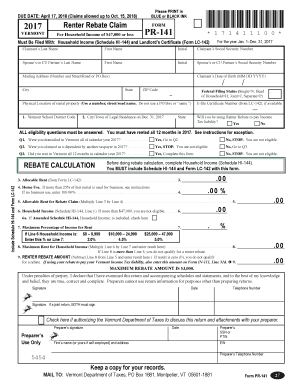

Renter rebate claim for vermont residents only; Use these forms from the vermont department of taxes to claim the renter rebate.

Vermont Department Of Taxes – Renter Rebates And Refunds Are Processed Separately And May Arrive At Different Times Heres More About The Renter Rebate Including How To Claim It Httpstaxvermontgovindividuals Renter-rebate Facebook

Vita and aarp tax aide sites can usually help with vermont tax returns, vermont renter rebates and vermont property tax adjustments.

Vt dept of taxes renters rebate. This section of the website has information for vermonters who rent their home or apartment from a landlord. The vermont department of taxes, part of the agency of administration, is tasked with the collection of. Vt renter rebate claim and household income:

Use these forms from the vermont department of taxes to claim the renter rebate. You're a minnesota resident, or spent more than 183 days in the state, and. The vermont legislature made substantial changes to the renter rebate program in act 160 of 2020.

(link is external) for details. Lived and paid rent in minnesota. You may qualify for a renter's property tax refund depending on your income and rent paid.

Vermont department of taxes, montpelier, vt. Pay estimated income tax by voucher; You can find information about lockouts and other illegal actions by your landlord, rent increases, the eviction process, moving out, security deposits, the renter rebate or subsidized housing.

Pay estimated income tax online; The vermont apartment owners association is a statewide trade association for vermont landlords. This document can be found on the website of the vermont department of taxes.

Looking for information for renters? The 2020 property tax credit is based on 2019 household income and 2019/2020 property taxes. Some irs free file vendors also offer free.

The credit is applied to your property tax and the town issues a bill for any balance due. The renter rebate program is designed to offset a portion of rent that is attributable to the cost of property taxes. See the vermont department of taxes website.

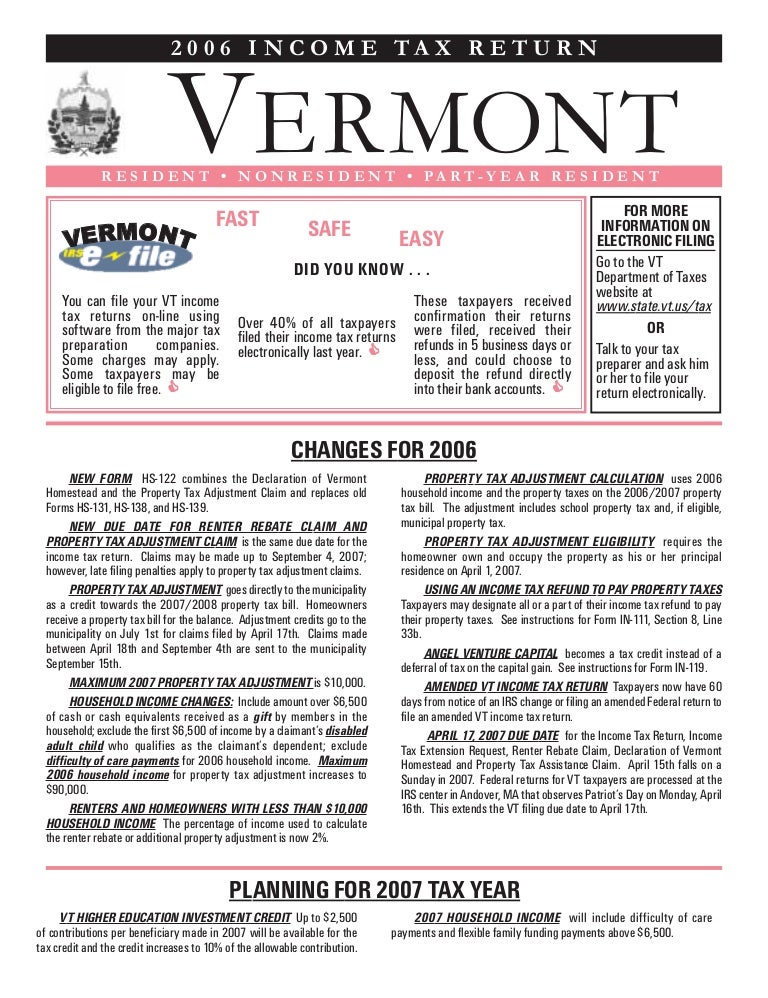

Established in 1970, vermont’s tax circuit breaker programs promote tax equity and provide targeted relief from property tax burdens to lower income renters and homeowners. The vermont taxpayer advocate works to resolve taxpayers’ issues with the vermont department of taxes. There are very specific requirements for you to get the credit :

These changes will take effect in the 2021 tax year, impacting claims filed during the 2022 income tax filing season. You can't be claimed as a dependent on someone else’s tax return, and. Personal income tax you may view your account, check the status of your refund, and make payments;

Lived in a building where the owner was assessed property tax or. You can print other vermont tax forms here. Vt renter rebate claim and household income:

The renter rebate is a tax credit. You qualify for the renter’s property tax refund if. A valid social security number or individual tax identification number.

When to file file as early as possible. Signature i certify the rental information on this landlord certificate is, to the best of my knowledge and belief, true, correct, and complete. Vt renter rebate claim and household income:

A person who rents their home is called a tenant. 850 likes · 18 talking about this · 88 were here. It can be used to pay your taxes, or added to your refund check, or, if you don’t have taxable income, sent to you in a check.

Below is a summary of the important changes to the program that landlords should know about. It is based out of shelburne, vermont and advocates for, and educates landlords to assist them with providing quality rental housing. Homestead declaration return for vermont residents only;

How do i check the status of my renters rebate.

Pr-141 – Renter Rebate Claim

Vermont Department Of Taxes – Vermont Renter Rebate Claims Will Be Accepted Until October 15 2020 Check To See If You Qualify Httpstaxvermont Govindividualsrenter-rebate Facebook

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Renters Rebate Form 2020 – Fill Online Printable Fillable Blank Pdffiller

Fillable Online Tax Vermont Form Pr-141 Renter Rebate Claim – Vermont Department Of Taxes Fax Email Print – Pdffiller

Vermont Tax Forms And Instructions For 2020 Form In-111

Ct-3 – Cigarette Tax Stamp Order Form

2

Vermont Tax Information Town Of Craftsbury

Vt Dept Of Taxes Vtdepttaxes Twitter

2

Vermont Tax Information Town Of Craftsbury

Vt Officials Look To Streamline Renter Rebate Program

/cloudfront-us-east-1.images.arcpublishing.com/gray/FRXJBXMMRZM6NMKHIYNXHEIWJE.jpg)

Vt Officials Look To Streamline Renter Rebate Program

Facebook

2

2

Vermont Department Of Taxes – If We Send You A Letter To Verify Your Return Or A Refund Please Follow The Instructions In The Letter To Respond Promptly So We Can Restart

2