According to the white house, eligible evs will need to be made in the us with union labor to qualify for the full $12,500 credit. Federal tax credit up to $7,500!

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

From april 2019, qualifying vehicles are only worth $3,750 in tax credits.

Virginia electric vehicle tax credit 2022. After that, the credit phases out completely. The minimum credit amount is $2,500, and the credit may be up to $7,500, based on each vehicle's. Small neighborhood electric vehicles do not qualify for this credit, but they may.

The big news for ev shoppers may not be the tax credit increases but that the measure turns the credit into a refund for eligible vehicles purchased as of jan. Enrollment is now closed but current participants may remain on the pricing plans. Nissan is expected to be the third manufacturer to hit the limit, but.

The hybrid tax credit will not increase your refund because it is nonrefundable. In its final form, the program, which would begin jan. In addition to credits, virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

On top of that, if you finance with toyota, you can get $500 off your car loan. Electric vehicle federal tax credit up to $7,500 a federal income tax credit up to $7,500 is available for the purchase of a qualifying ev. The bill favours vehicles made in the usa, by union workers, much to the opposition of other automakers such as toyota and tesla and even allies such as canada.

The full ev tax credit will be available to individuals reporting adjusted gross incomes of $250,000 or less, $500,000 for joint filers (decreased from $400,000 for individuals/$800,000 for joint. An “enhanced rebate” of $2,000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines. Visit fueleconomy.gov for an insight into the types of tax credit available for specific models.

Hybrids and electric vehicles may not be a tax write off, but may instead be eligible for a credit on your return. However, that amount rises by $4,500 if the car was made in a unionized u.s. The credit amount will vary based on the capacity of the battery used to power the vehicle.

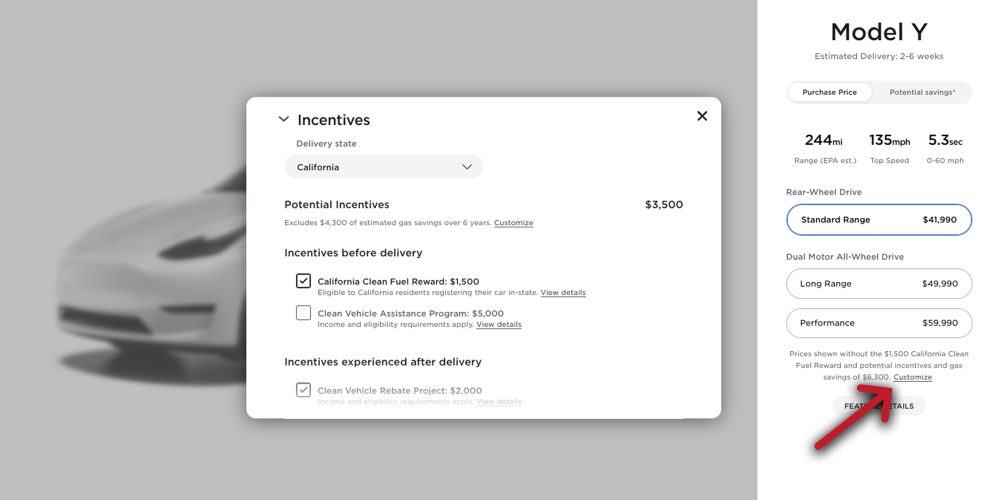

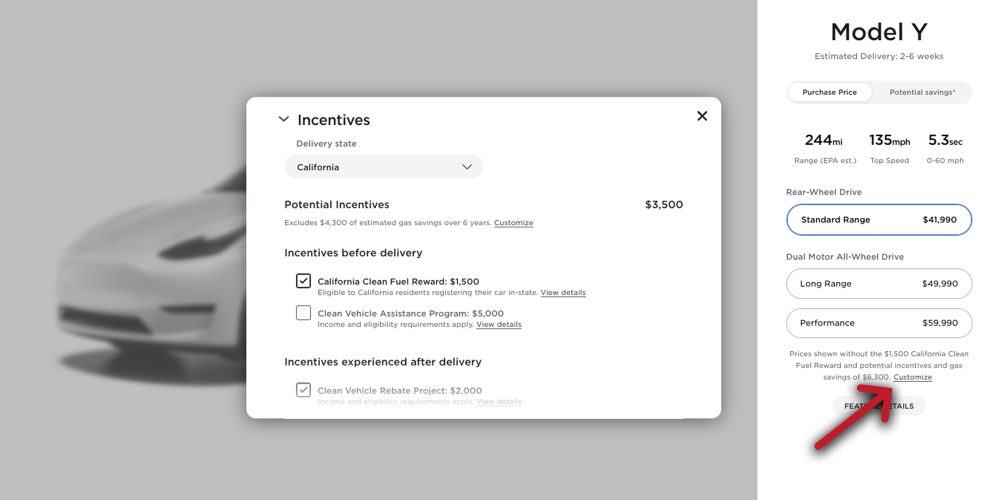

State and/or local incentives may also apply. $4,502 (applied when you file taxes) = net cost: The pilot program began in 2011 and ended november 30, 2018.

1, 2022, would offer buyers a $2,500 rebate for the purchase of a new or used electric vehicle. We launched the electric vehicle pricing plans pilot program to study the impacts of ev charging on the grid. Review the credits below to see what you may be able to deduct from the tax you owe.

To begin, the federal government is offering several tax incentives for drivers of evs. The current credit offered to ev buyers is for up to $7,500 usd, and is set to increase if the bill passes in the senate. If you take home a new pev that meets certain requirements, such as battery capacity, overall vehicle weight, and emission standards, you can also receive a federal tax credit of up to $2,500.

According to a white house statement, “the framework’s electric vehicle tax credit will lower the cost of an electric vehicle that is made in america with american materials and union labor by. The policy also set a cap. Depending on the vehicle you plan to purchase or currently own, there are several federal tax credits that may apply to your situation.

How much is the electric vehicle tax credit worth? A buyer of a new electric car can receive a tax credit valued at between $2,500 and $7,500. From october 2019 to march 2020, the credit drops to $1,875.

For more information, see the virginia dmv electric vehicles website. Drive electric virginia is a project of: The amount of credit you are entitled to depends on the battery capacity and size of the vehicle.

Other alternative fuel vehicle (afv). To learn more about the land preservation tax credit, see our land preservation tax credit page. You may be able to get a maximum of $7,500 back on your tax return.

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Electric Vehicle Buying Guide Kelley Blue Book

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

How Do Electric Car Tax Credits Work Kelley Blue Book

House Bill Expands Ev Credit Nacs

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

Answers To Your Electric Vehicle Questions Wfae 907 – Charlottes Npr News Source

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Rebates And Tax Credits For Electric Vehicle Charging Stations

What Electric Vehicles Are Coming In 2022

Ev Tax Credit Could Reach 12500 – Carsdirect

What Electric Vehicles Are Coming In 2022

Virginia State And Federal Tax Credits For Electric Vehicles – Pohanka Chevrolet

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

All Those Electric Vehicles Pose A Problem For Building Roads Wired

Virginia Maps Out Optional Per-mile Road Fee Program For 2022 Launch – Virginia Mercury

Ev Promotions Tax Credits