How to file a homestead declaration: The definition of a homestead is as follows:

Vermont Department Of Taxes – Do You Have Questions About The Vermont Homestead Declaration See Our Homestead Declaration Page Including Videos Answering Many Common Questions About Declaring Your Vermont Homestead Httptaxvermontgovproperty

A vermont homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by a resident individual as the individual’s domicile on april 1, 2021.

Vermont department of taxes homestead declaration. If your homestead is leased to a tenant on april 1, you may still claim it as a homestead if it is not leased for more than 182 days in the 2020 calendar year. Vermont tax statutes, regulations, vermont department of taxes rulings, or court decisions supersede information provided in this fact sheet. May 17 vermont personal income tax and homestead declaration due date.

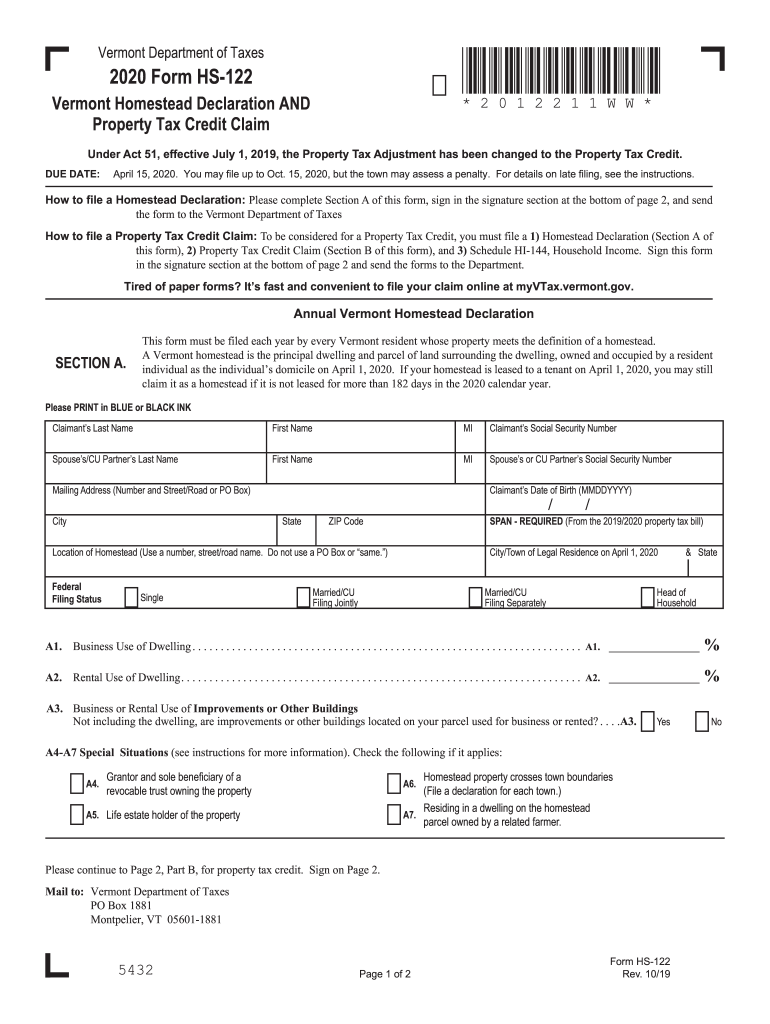

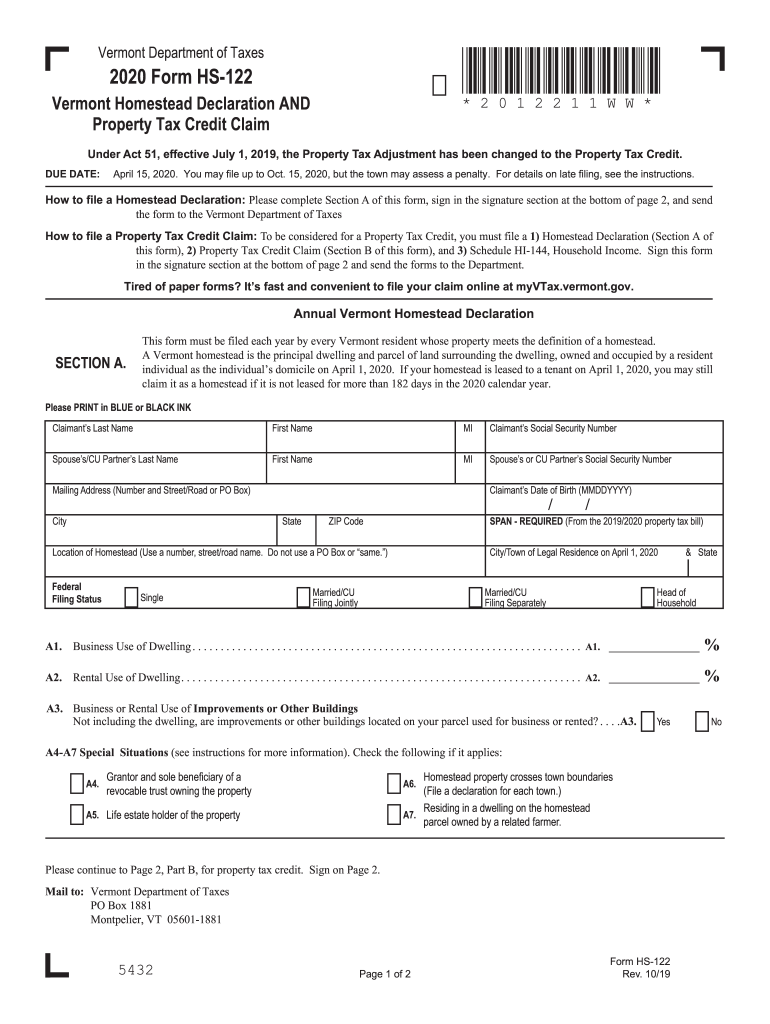

If you do not file by this date, then you will receive a penalty. When a portion of the property is the homestead and a portion is used for business purposes or rented, the following rules apply for reporting the use. Please complete section a of this form, sign in the signature section at the bottom of page 2, and send the form to the vermont department of taxes how to file a property tax credit claim:

The vermont homestead declaration by vermont law, property owners whose homes meet the definition of a vermont “homestead” must file a homestead declaration annually by the april due date. The declaration identifies the property as the homestead of the vermont resident. This form is found on the website of the vermont department of taxes.

Tax examiners in this division can answer questions about vermont personal income tax, homestead declaration, property tax adjustment. If eligible, you must file so that you are correctly assessed the homestead tax. Homestead declaration and property tax adjustment filing | vermont.gov

The vermont department of taxes website is the best resource for vermont taxes. Homestead declarations and property tax adjustments it is important that new homeowner are aware of their responsibility to file the vermont homestead declaration yearly with the vermont department of taxes to receive the homestead property tax rate. The vermont department of taxes website is the best resource for vermont taxes.

Vermont business magazine the vermont department of taxes wants to remind vermonters of the upcoming may 17, 2021 due date for federal and vermont personal income taxes. How can we contact the vermont department of taxes for questions about vermont personal income taxes? Information on upcoming tax filing deadlines and these programs is available on the department’s website at tax.vermont.gov.

Annual vermont homestead declaration this form must be filed each year by every vermont resident whose property meets the definition of a homestead. Even if you do not believe you owe property taxes, you must declare homestead in order to qualify for property tax adjustment. Of taxes reminds vermonters of the upcoming may 17 due date for federal and vermont personal income taxes.

Earlier this year, the federal and state filing due dates were extended to provide taxpayers additional time. The property is your primary residence as of april 1 each year The irs provides a comprehensive website with federal forms, instructions, and more.

Due to the current health situation, the due date has been moved from april 15, 2020 to july 15, 2020. Please be sure to file your homestead and or property tax adjustment claim even if you do not have to file federal. A reminder to everyone to please file your homestead declarations as soon as possible.

Check return or refund status / pay your taxes. To be considered for a property tax credit, you must file a 1) homestead declaration (section a of this form), 2) property tax credit claim (section b of this form), and 3). This fact sheet is intended to provide an overview only.

The homestead declaration must be filed annually by every vermont resident homeowner on their primary residence as of april 1 of the calendar year. Filing a homestead declaration is easy and can be done online at the vermont department of taxes website. If your property fulfills the criteria to be declared a homestead, you can file a vermont homestead declaration and property tax adjustment every year.

These forms are due by april 15 (the state income tax filing deadline), even if you file an extension on your income taxes.

Taxvermontgov

Vermont Tax Information Town Of Craftsbury

Taxvermontgov

Vt Homestead Declaration – Fill Out And Sign Printable Pdf Template Signnow

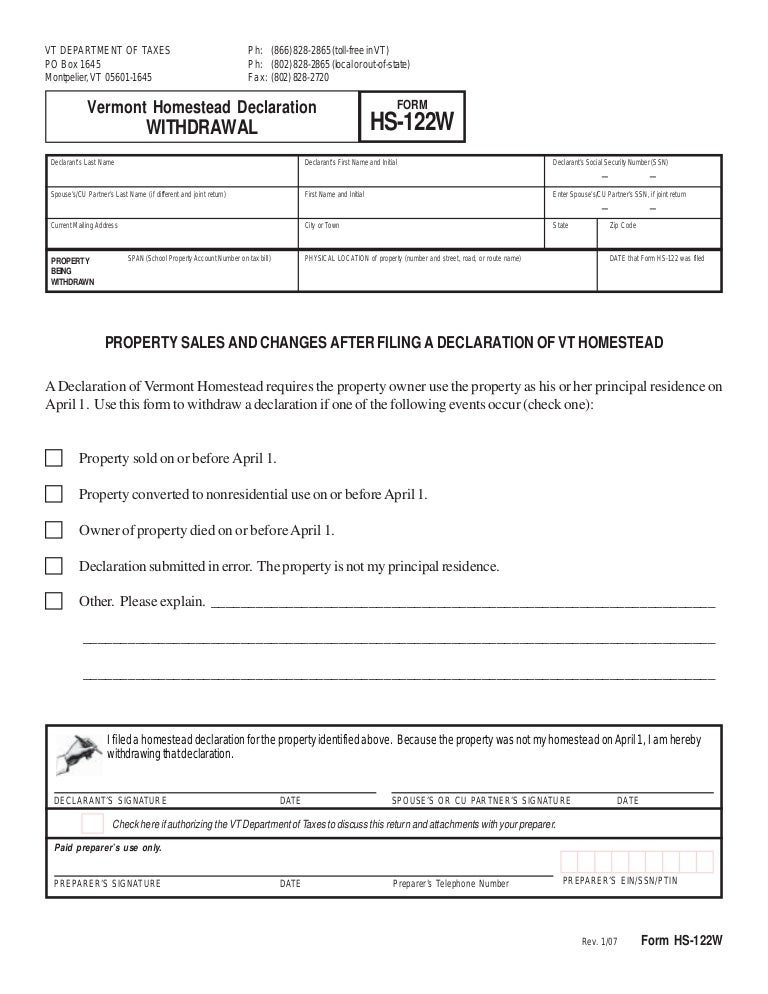

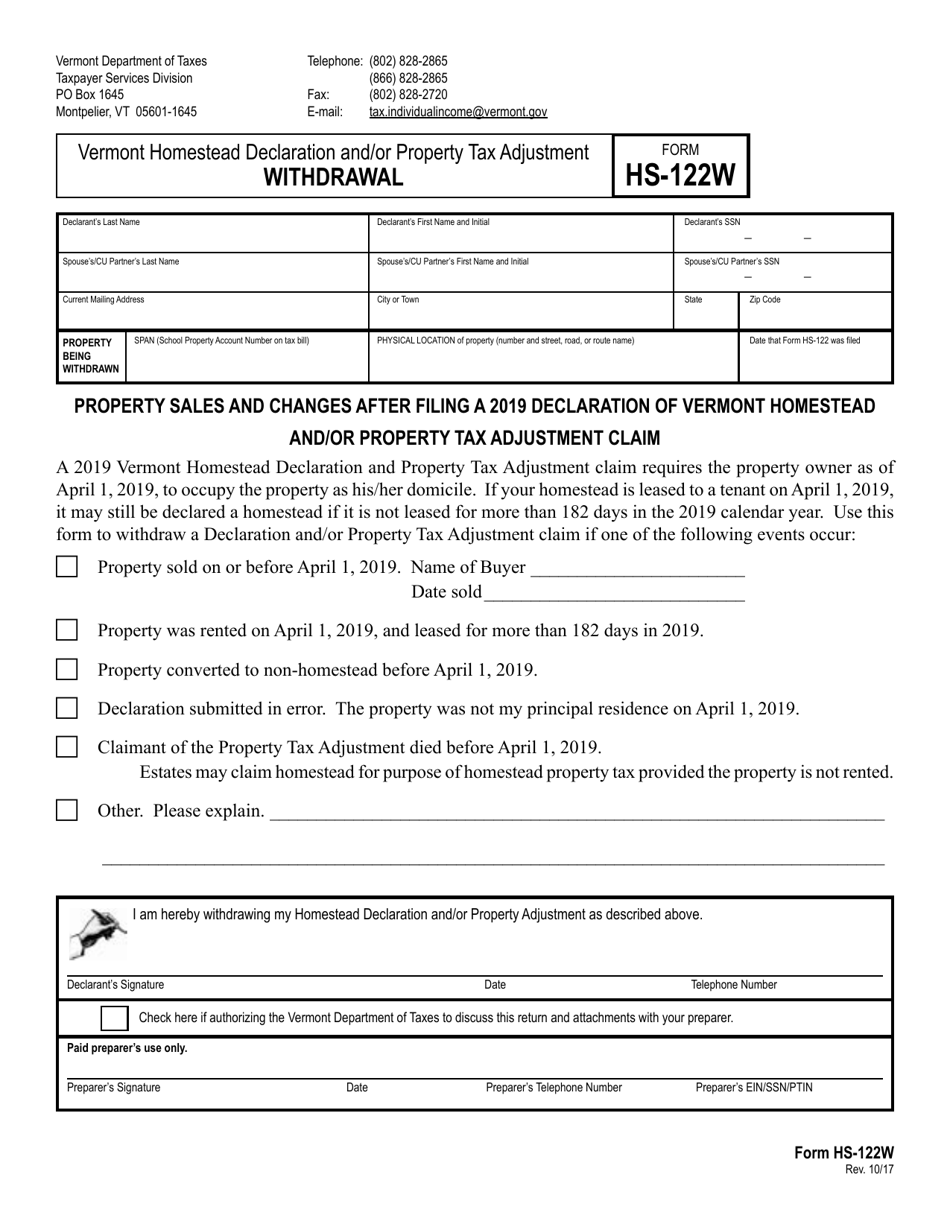

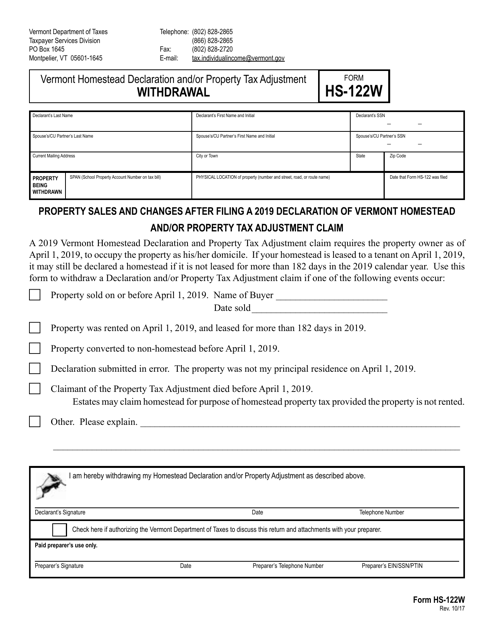

Hs-122w – Homestead Declaration Withdrawal

Vermont Homeowners Must File Homestead Declaration Vhfaorg – Vermont Housing Finance Agency

Vt Form Hs-122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration Andor Property Tax Adjustment Withdrawal Vermont Templateroller

Vt Form Hs-122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration Andor Property Tax Adjustment Withdrawal Vermont Templateroller

Westfieldvtgov

Fillable Online Tax Vermont New Lister Training – Department Of Taxes – Vermontgov Fax Email Print – Pdffiller

Taxvermontgov

Vt Dept Of Taxes On Twitter How To File A Homestead Declaration Andor Property Tax Credit Claim For Free At Httpstcof2l3pmye96 Httpstco1njpwuyhye Httpstcobozgav9vd9 Twitter

Homestead Declaration Is Due – Vermont Department Of Taxes Facebook

Taxvermontgov

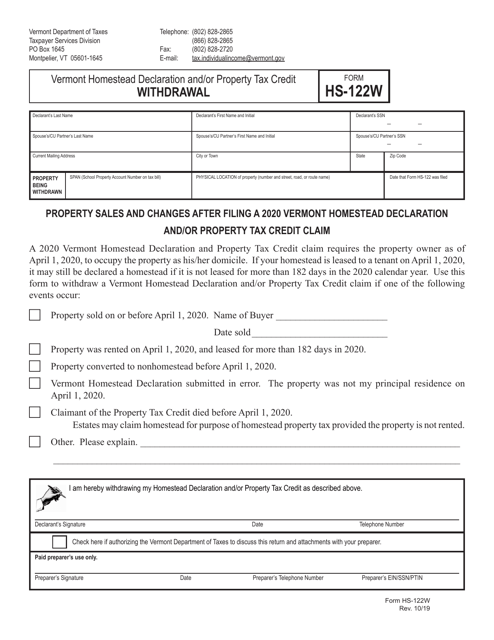

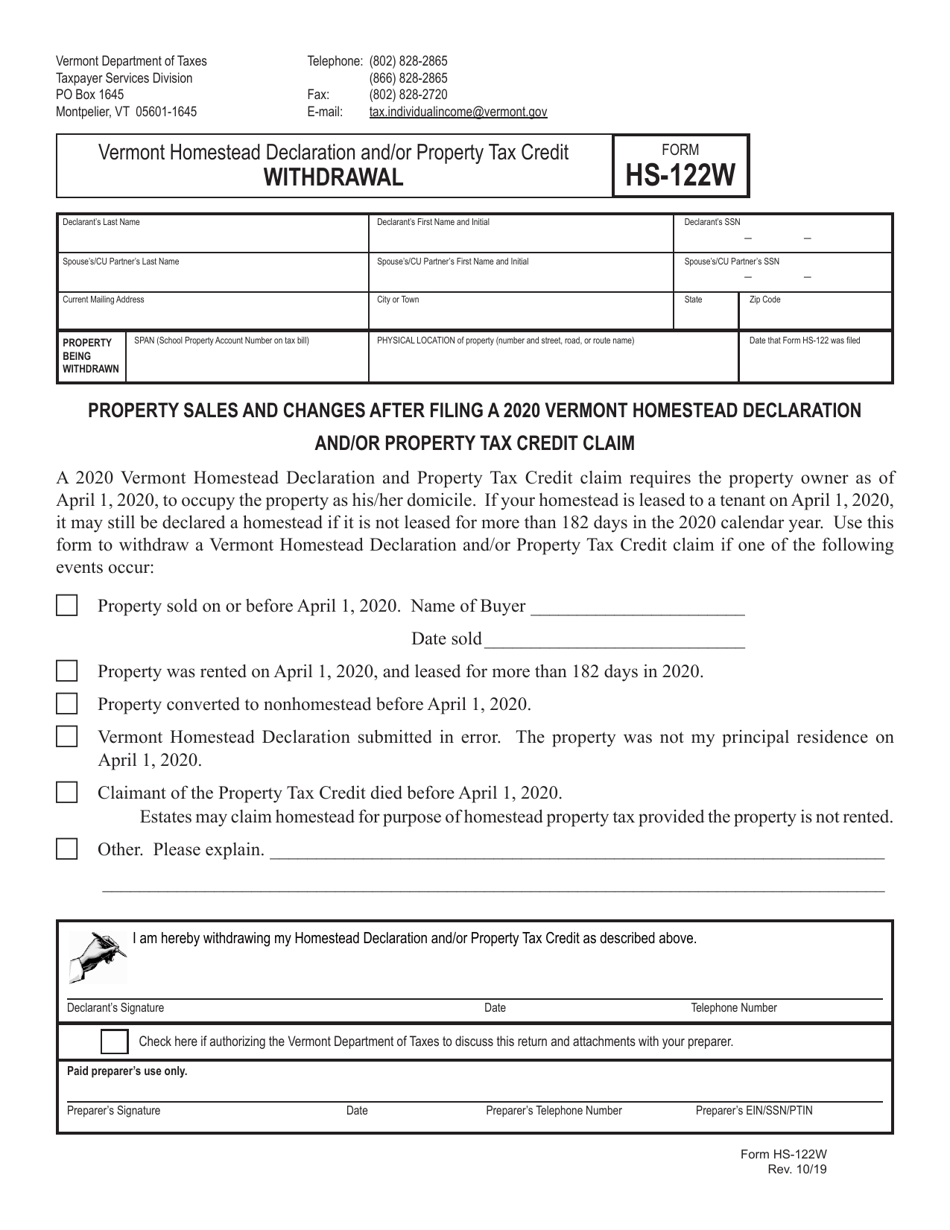

Form Hs-122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration Andor Property Tax Credit Withdrawal – 2020 Vermont Templateroller

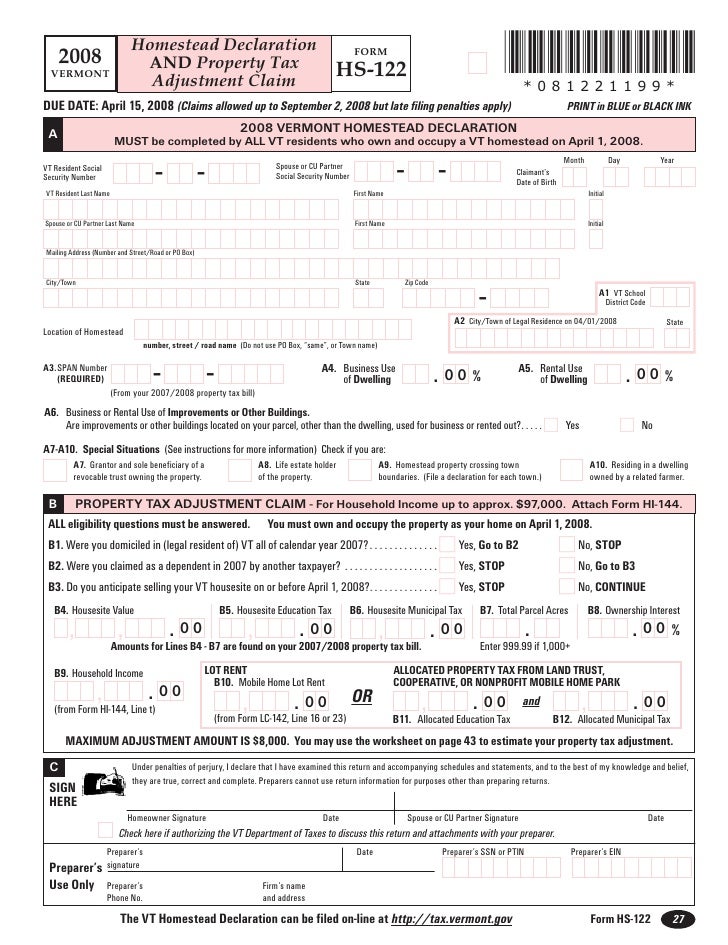

Hs-122 – Homestead Declaration And Property Tax Adjustment

Miltonvtgov

Form Hs-122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration Andor Property Tax Credit Withdrawal – 2020 Vermont Templateroller

2020 Form Vt Hs-122 Hi-144 Fill Online Printable Fillable Blank – Pdffiller