When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. Has impacted many state nexus laws and sales tax collection requirements.

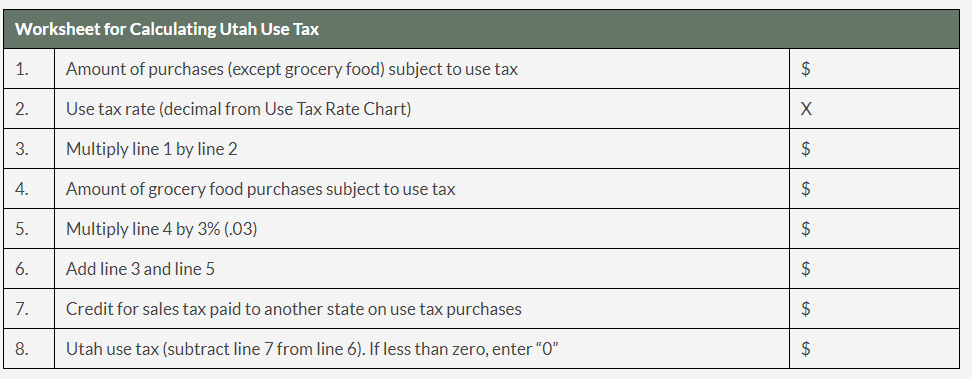

Do I Owe Utah Use Tax Support

Utah has a higher state sales tax than 53.8% of states

Utah county sales tax calculator. The state of utah has a single personal income tax, with a flat rate of 4.95%. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax; This rate includes any state, county, city, and local sales taxes.

Local tax rates in utah range from 0% to 4%, making the sales tax range in utah 4.7% to 8.7%. 2020 rates included for use while preparing your income tax deduction. Total rates in utah county, which apply to assessed value, range from.

This rate includes any state, county, city, and local sales taxes. Find your utah combined state and local tax rate. Utah sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

Counties and cities can charge an additional local sales tax of up to 2.4%, for a maximum possible combined sales tax of 8.35%; How 2021 sales taxes are calculated in utah. The latest sales tax rate for elk ridge, ut.

The state general sales tax rate of utah is 4.85%. Questions answered every 9 seconds. The median annual property tax paid by homeowners in utah county is $1,517.

You can use our utah sales tax calculator to look up sales tax rates in utah by address / zip code. Ad a tax advisor will answer you now! This rate includes any state, county, city, and local sales taxes.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Utah has a 4.85% statewide sales tax rate , but also has 208 local tax. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates.

Questions answered every 9 seconds. The 7.25% sales tax rate in santaquin consists of 4.85% utah state sales tax, 1.55% utah county sales tax, 0.35% santaquin tax and 0.5% special tax. That’s why we came up with this handy utah sales tax calculator.

The utah county, utah sales tax is 6.75%, consisting of 4.70% utah state sales tax and 2.05% utah county local sales taxes.the local sales tax consists of a 1.80% county sales tax and a 0.25% special district sales tax (used to fund transportation districts, local attractions, etc). The utah county sales tax rate is %. This table shows the total sales tax rates for all cities and towns in utah county, including all.

Overall, taxpayers in utah face a relatively low state and local tax burden. Every 2021 combined rates mentioned above are the results of utah state rate (4.85%), the county rate (0.35% to 1.35%), the salt lake city tax rate (0% to 1%), and in some case, special rate (0.8% to 1.05%). Homeowners in utah also pay exceptionally low property taxes, with an average effective rate of just 0.58%.

The latest sales tax rate for salem, ut. 2020 rates included for use while preparing your income tax deduction. Utah has 340 cities, counties, and special districts that collect a local sales tax in addition to the utah state sales tax.click any locality for a full breakdown of local property taxes, or visit our utah sales tax calculator to lookup local rates by zip code.

89 rows the combined sales and use tax rates chart shows taxes due on all transactions subject to. 2020 rates included for use while preparing your income tax deduction. If you need access to a database of all utah local sales tax rates, visit the sales tax data page.

The utah state sales tax rate is 5.95%, and the average ut sales tax after local surtaxes is 6.68%. Utah has a 4.85% sales tax and utah county collects an additional 0.8%, so the minimum sales tax rate in utah county is 5.65% (not including any city or special district taxes). Sales taxes in utah range from 6.10% to 9.05%, depending on local rates.

The latest sales tax rate for spring lake, ut. The utah (ut) state sales tax rate is 4.7%. 262 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option.

This rate includes any state, county, city, and local sales taxes. You can print a 7.25% sales tax table here. The latest sales tax rate for woodland hills, ut.

Ad a tax advisor will answer you now! The salt lake city's tax rate may change. Cities and/or municipalities of utah are allowed to collect their own rate that can get up to 2.1% in city sales tax.

This level of accuracy is important when determining sales tax rates. The 2018 united states supreme court decision in south dakota v. 2020 rates included for use while preparing your income tax deduction.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. Depending on the zipcode, the sales tax rate of salt lake city may vary from 4.7% to 7.75%. Depending on local jurisdictions, the total tax rate can be as high as 8.7%.

For tax rates in other cities, see utah sales taxes by city and county.

How To Charge Your Customers The Correct Sales Tax Rates

Utah Sales Tax – Small Business Guide Truic

Utah Sales Tax On Cars Everything You Need To Know

The Utah Income Tax Rate Is 495 – Learn How Much You Will Pay On Your Earnings

Utah State Sales Tax – Slide Share

How To Charge Your Customers The Correct Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

California Sales Tax Calculator Reverse Sales Dremployee

Utah State Sales Tax – Slide Share

Sales Tax Calculator

Utah Use Tax

Grocery Food

Utah Sales Tax – Taxjar

Utah Sales Tax Information Sales Tax Rates And Deadlines

Us Sales Tax Calculator Reverse Sales Dremployee

Utah Sales Tax Rates By City County 2021

Utah Income Tax Calculator – Smartasset

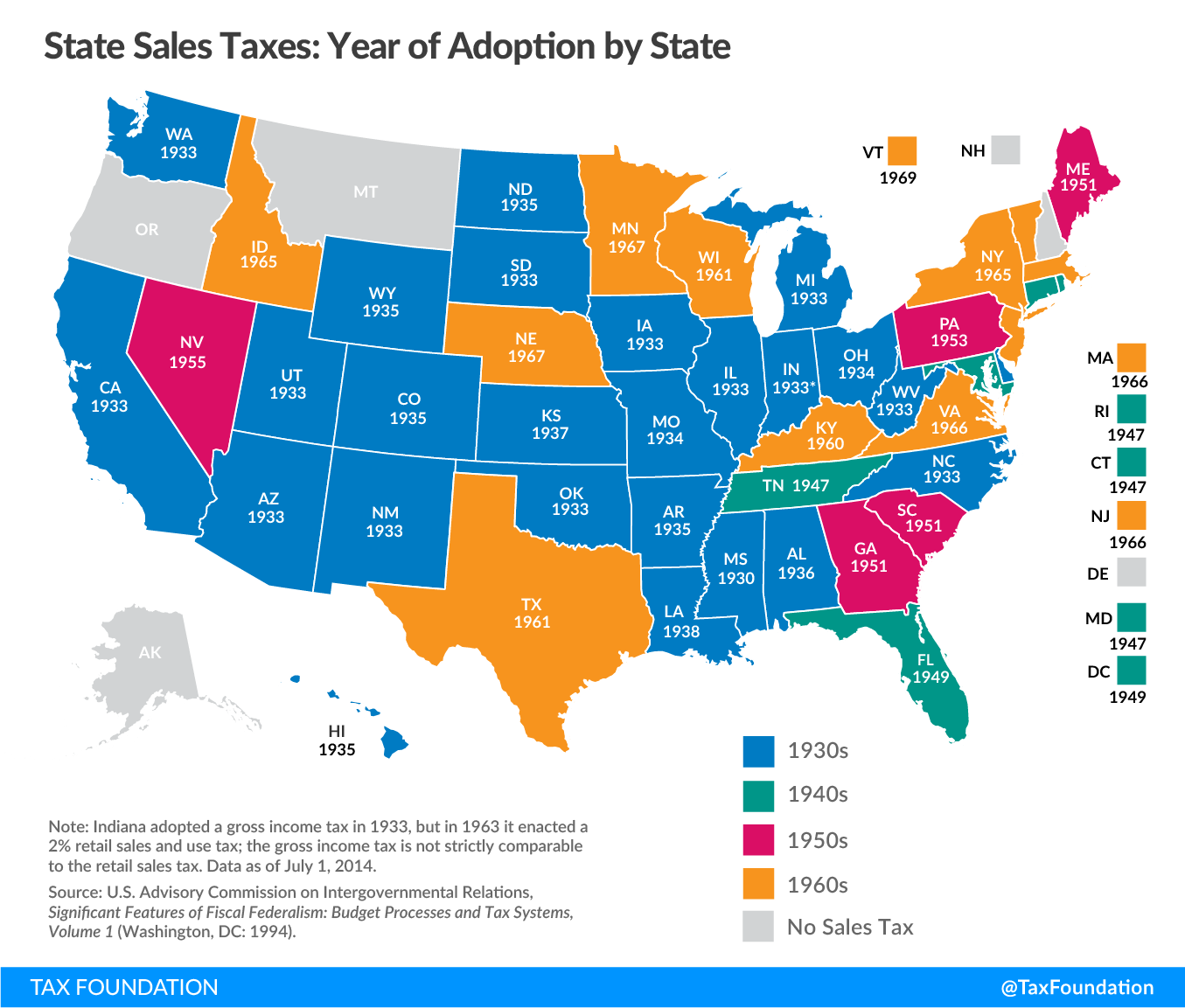

States With Highest And Lowest Sales Tax Rates

Utah Sales Tax Rate Increases Take Effect April 1 2019