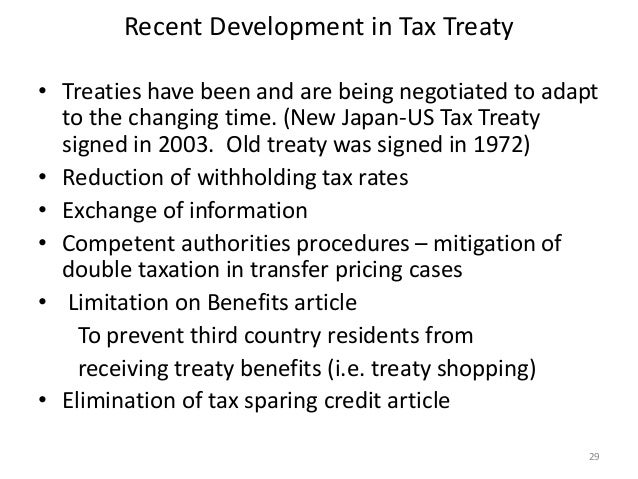

Under the protocol, contingent interest may be taxed in the source country (the country in which the interest arises); Application form for income tax convention, etc.

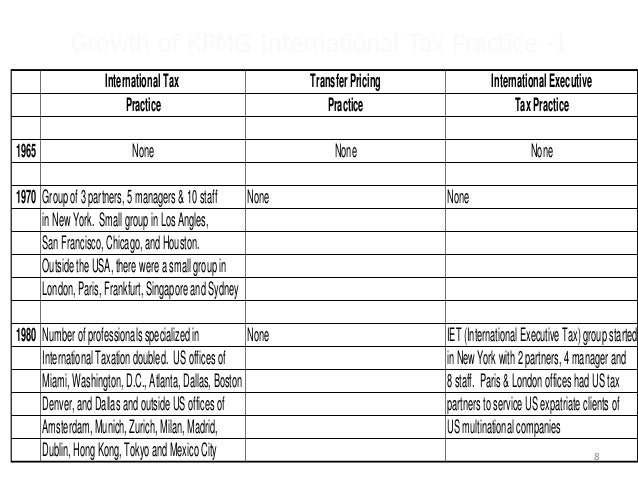

International Taxation

Tax treaty january 31, 2013 similarly, the protocol expands japan’s taxation rights in respect of real property situated in japan.

Us japan tax treaty withholding rate. Paying agent would withhold on that dividend at the appropriate treaty rate (assuming the payee is otherwise entitled to treaty benefits) because reduced withholding is a benefit enjoyed by the resident of japan, not by the dual resident company. These tables may provide information about the rate of tax that the treaty partner could imposed on u.s. From united states tax to interest received by residents of japan on debt obligations guaranteed or insured or indirectly financed by those japanese banks or insured by the government of japan.

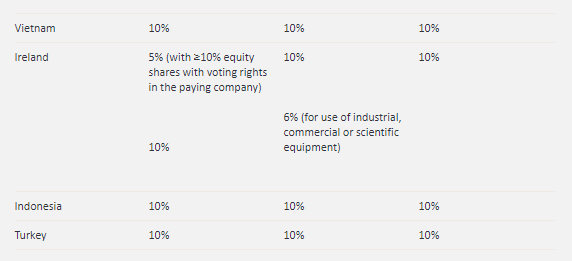

Bilateral tax treaty currently in force. 5% for holding at least 10% (direct or indirect) shares for six months. The corporate tax rate for a branch is the same as for a subsidiary.

(updated to august 1, 2015) country interest 86 rows (m) rate applies to payments to a financial institution by an enterprise engaged in an. The protocol was originally signed by japan and the us on january 24, 2013.

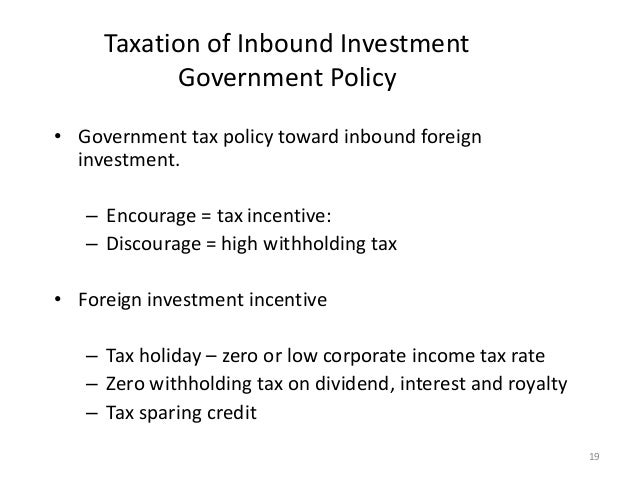

Japan is a member of the united nations (un), oecd, and g7. The parliament has adopted a 15% withholding tax rate on. The provisions of tax treaties supersede those of domestic law.

Exempted when holding at least 25% for 18 months; Residents deriving that category of income from the treaty country. In cases where the dtt rate is lower than 15.315% rate, the dtt rate will be applied.

However, if the beneficial owner of the interest is a resident of the other contracting country, the tax imposed by the source country may not exceed 10%. Which is treated as japan source income for tax purposes are subject to withholding tax at the rate of 15.315%. For the purpose of claiming tax treaty benefits (pdf/207kb)

International tax treaty rates 1 (%) 1 withholding tax rates applied by canada to certain payments to residents of selected countries with which it has signed international tax treaties. Certain exceptions modify the tax rates. However, ‘contingent interest’ ((a) or (b) indicated below) will be subject to tax at a rate not exceeding 10 percent in the source country under the amended tax treaty.

Under the protocol, japan is permitted to tax u.s. Interest income on bank deposit or bonds, etc. In accordance with the special taxation measure law, the tax rate imposed on dividends derivedfrom listed shares, etc.** is 15.315%*** until 31 december 2037.

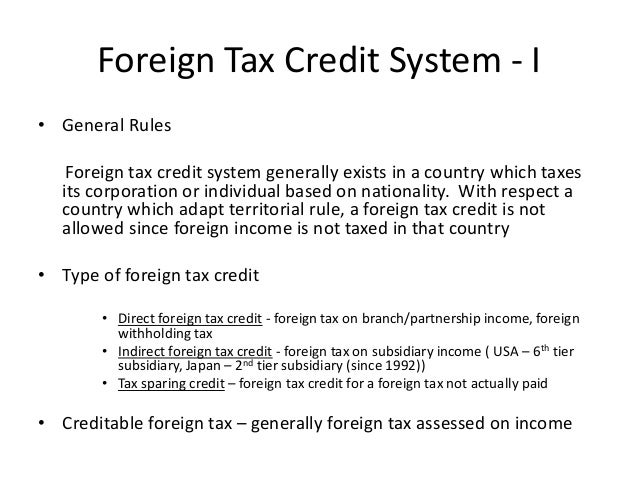

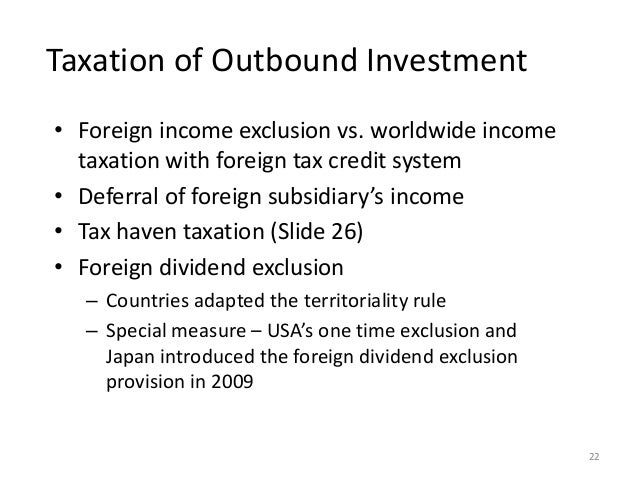

Withholding tax should provide more flexibility in relation to treasury operations for multinational groups headquartered in the us or japan and entitled to benefits under the treaty, subject to any other restrictions on interest deductibility under either us or japanese domestic law (e.g., beat in the former and earnings stripping in the latter). Withholding agents under the withholding tax system, persons are obliged to withhold income tax and special income tax for reconstruction subject to withholding, and pay it to the government are called “withholding agents.” all Japan has a foreign tax credit system and dividend exclusion system in order to avoid international double taxation.

Residents on capital gains arising from the sale of shares of a company holding real property situated in japan. Exempted when paid by a company of japan, holding at least 15% (direct or indirect) or 25% (direct) shares for six months; Japan also has concluded tax treaties with many countries for the purposes of avoiding double taxation of income internationally and preventing tax evasion.

25 / 0 / 0. Outline of japan's withholding tax system related to salary (the 2020 edition) for those applying for an exemption for dependents, etc. In some instances, however, the rates applied are not bilateral, and the other country could apply a.

Application form for certificate of residence in japan. Dividend to a resident of japan, the u.s. Subject to “separate withholding tax” that tax payment is completed only by withholding.

Convention between the united states of america and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, signed at tokyo on march 8,1971. 3.the definition of direct investments for purposes of the 10 percent withholding rate on dividends would be 5% when holding at least 10% for six months;

International Taxation

Pdf German Tax System Double Taxation Avoidance Conventions Structure And Developments

Corporate Tax 2021 Laws And Regulations Indonesia Iclg

Top 8 Things To Know About Us Taxes Living Abroad In Indonesia

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

Taxation Bkpm Japan

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

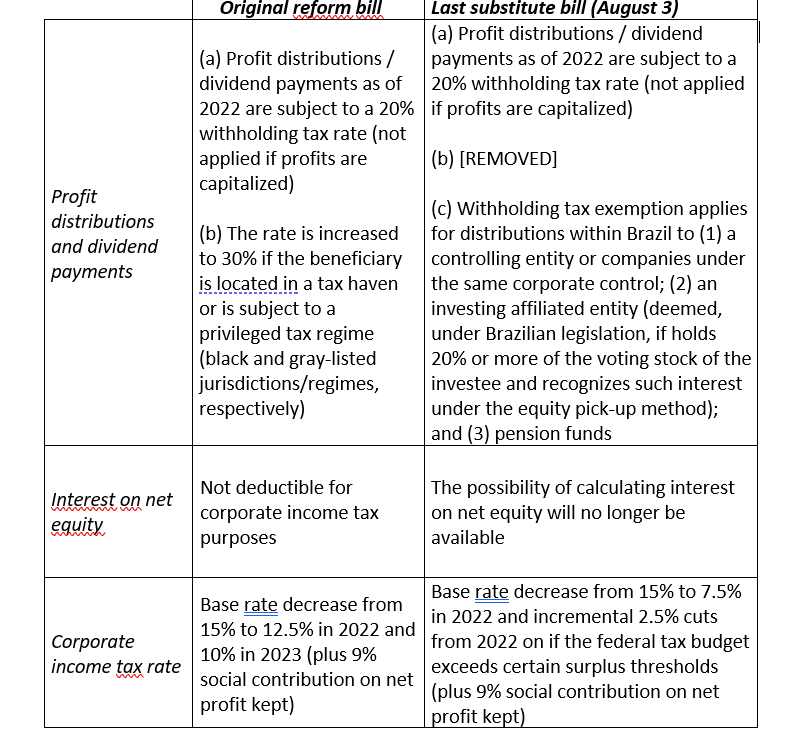

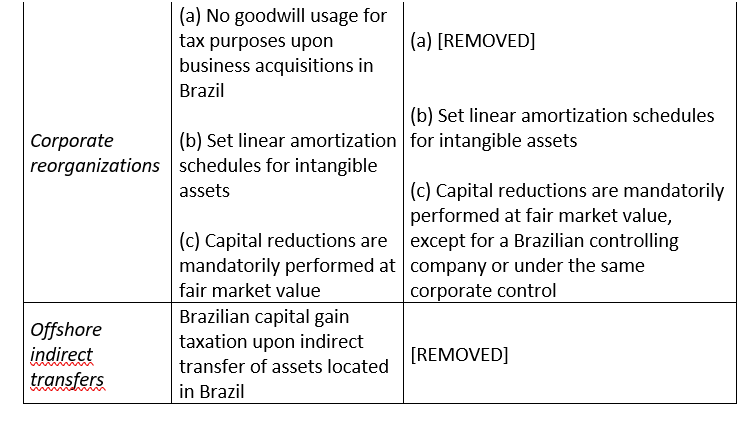

Brazils Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

International Taxation

18 International Aspects Of Income Tax In Tax Law Design And Drafting Volume 2

Brazils Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Unraveling The United States- Japan Income Tax Treaty And A Closer Look At Article 46 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Singapore New Income Tax Treaty With Indonesia – Kpmg United States

International Taxation

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

Estimated Tax Revenue Loss As A Share Of Gdp For Low-income Download Scientific Diagram

Withholding Tax Martin Hearson

International Taxation

The Aca Tax Return Preparer Directory Is An Online Directory For Overseas Taxpayers Search Results In Irs Listed