The effective date of specific provisions. The protocol with japan entered into force on august 30, 2019, and the protocol with spain will enter into force on november 27, 2019.

2

International tax i july 26, 2019 united states tax alert senate approves protocols to tax treaties with japan, luxembourg, and switzerland spain, the u.s.

Us japan tax treaty protocol 2019. The protocol with spain updates a 1990 tax treaty and is scheduled to enter into force on nov. Protocol to tax treaty between japan and the u.s. Paragraph 4 of article 4 (residence) is replaced, including that where a person.

Entered into force on 30 august 2019. With respect to withholding taxes, the japan protocol is effective for amounts that are paid or credited on or after november 1, 2019. For other taxes, the protocol will apply to taxable years beginning on or after 1.

The protocol was originally signed by japan and the us on january 24, 2013. Click here to view the. Convention between the united states of america and japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income, signed at tokyo on march 8,1971.

The effective date of specific provisions within the protocols are described in this alert. It will also provide for mandatory binding arbitration to streamline dispute resolutions between the two countries’ tax administrations. Protocol signed at washington on january 14, 2013 amending the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect.

The protocol, signed 24 january 2013, provides for the following main changes: The protocol to the 1990 tax treaty between spain and the united states will enter into force on november 27, 2019. With respect to other taxes, the japan protocol is effective from january 1, 2020.

Japan is a member of the united nations (un), oecd, and g7. The us tax treaty protocols will enter into force between us and the countries of japan and spain. Summary of provisions in protocols

Income tax treaty summary on january 24, 2013, japan and the united states signed a protocol, together with an exchange of notes related thereto, (the “protocol”), amending the income tax treaty signed by the two countries in 2003 (as Although the protocol was signed on 25 january 2013 (japan time) and approved by the japanese diet on 17 june 2013, On august 30, 2019 the japan protocol entered into force.

The details for japan and spain are below: The protocol with japan entered into force on august 30, 2019, provides the following amendments to the 2003 tax treaty: The protocol with japan entered into force on 30 august 2019, and the protocol with spain will enter into force on 27 november 2019.

The government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income the government of the united states of america and the government of japan, desiring to conclude a new convention for the avoidance of double taxation and the Senate on july 16 and 17 approved resolutions of ratification of protocols signed during the administration of president obama that would amend the u.s. For effective dates of specific provisions within each of the protocols, taxpayers should refer to the specific agreements.

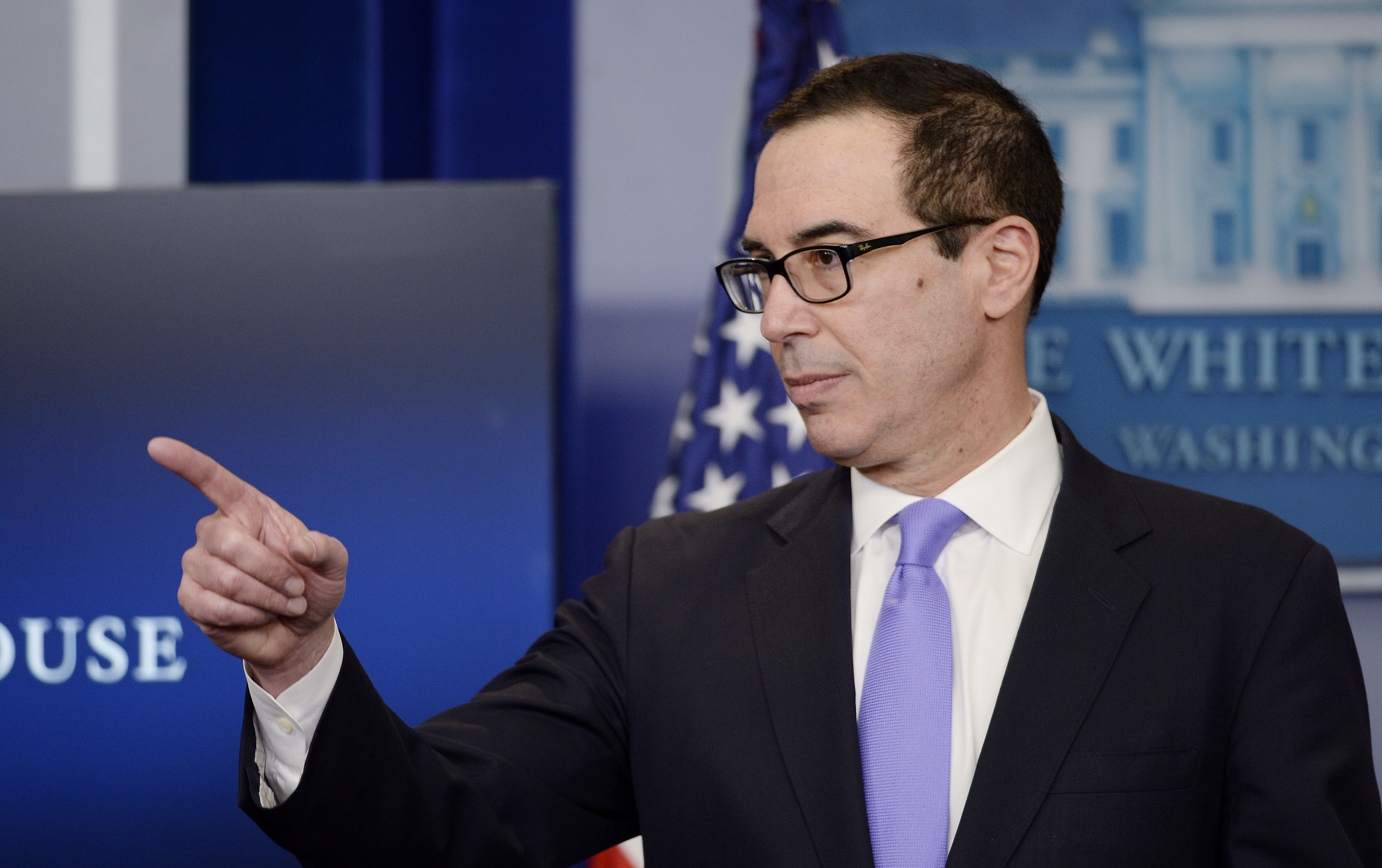

Senate approves protocols with switzerland, luxembourg, japan. “these tax treaty protocols will help to create a level playing field for american businesses and workers, and foster stronger economic growth for both the united states and our trading partners,” said treasury secretary steven t. Senate today approved protocol s amending the existing income tax treaties with switzerland, luxembourg, and japan.

The amending protocol to the 2003 income tax treaty between japan and the u.s. Income tax treaties currently in The protocol entered into force on 30 august 2019, the date japan and the us exchanged instruments of ratification, and applies to withholding taxes on dividends and interest paid or credited on or after 1 november 2019.

The japanese protocol will have effect for withholding taxes (e.g., related to dividends and interest) for amounts paid or credited on or after the first day of the third month following the date on which the protocol enters into force — that is, 1 november 2019. Both protocols were approved by an overwhelming majority in the us senate, the us treasury said, adding that.

2020 Updates Usa Green Light To Amendments To The Tax Treaties With Luxembourg Japan Switzerland And Spain – Auxadi

Japan-us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Us Senate Approves Tax Treaty Protocols – Us Embassy Consulate In Spain And Andorra

Jrfm Free Full-text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnams Relations With Asean And Eu Member States Html

Entry Into Force Of The Protocol Amending Tax Convention Between The Government Of Japan And The Government Of The United States Of America Ministry Of Foreign Affairs Of Japan

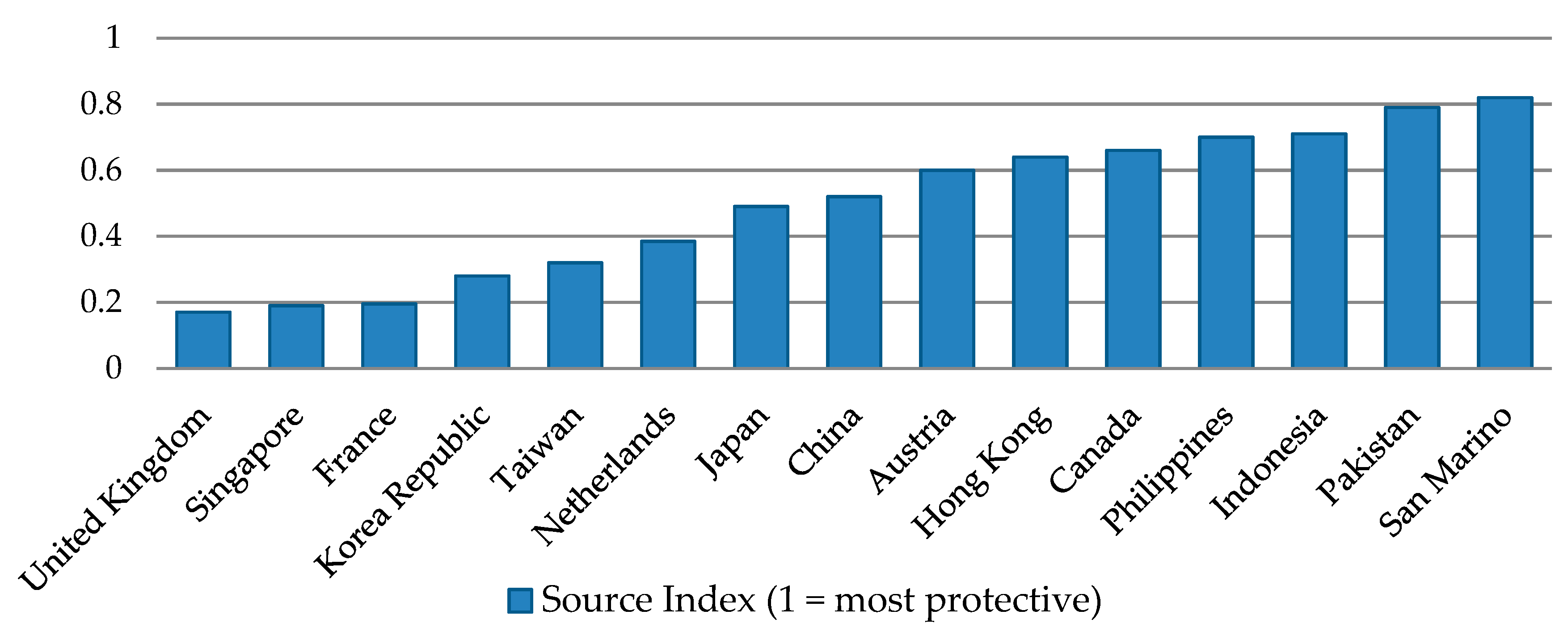

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Us Income Tax Treaties In Force

Us Expat Taxes For Americans Living In Japan Brighttax

Forum A Look At The Amended Japanus Tax Treaty

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

2

Changes To The Us-japan Tax Treaty International Tax Accountant

Us Updates Tax Treaty Protocols With Japan And Spain Accounting Today

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Entry Into Force Of The Protocol Amending Tax Convention Between The Government Of Japan And The Government Of The United States Of America Ministry Of Foreign Affairs Of Japan

Us Releases Details About Tax Treaty Protocols With Japan Spain Tp News

Us Tax Treaty With Japan Now In Force Spain To Follow

Pdf Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnams Relations With Asean And Eu Member States

2