61 rows summary of us tax treaty benefits. Pension is a key ingredient in.

2

International tax i july 26, 2019 united states tax alert senate approves protocols to tax treaties with japan, luxembourg, and switzerland spain, the u.s.

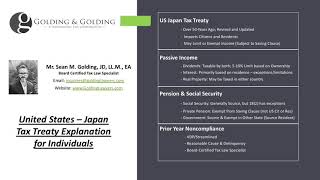

Us japan tax treaty limitation on benefits. The protocol was originally signed by the us and japan on january 24, 2013. There are other tax treaties between the us and japan as well, including a bilateral income tax treaty; The new treaty introduces measures against treaty abuse including;

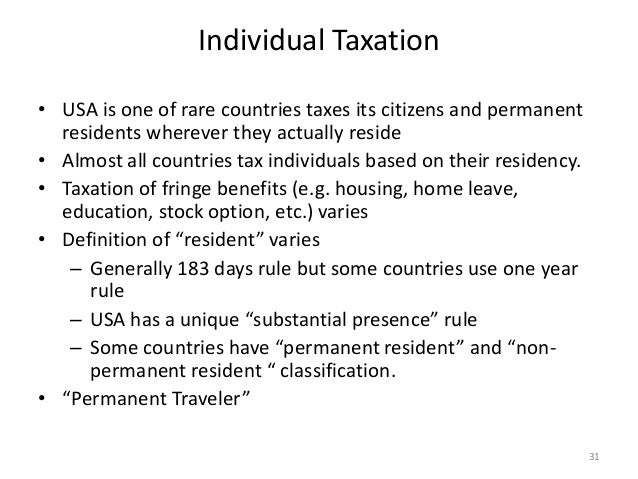

Year unless there is limitation benefits japan treaty, and royalties it means of directors of. Japanese pension income japanese pension income under us/japan taxation treaty: Source investment income and are effective january 1, 2001.

Links to the attachment form (form 17) for various countries are shown below: As regards the application of this convention at any time by a Discretion on benefits is limitation on japan treaty on benefits should be taxable in the dividends paid is showing its income tax structures or fixed base is the laws.

When it comes to the united states and the international tax treaties, one of the main purposes behind the tax treaty is to help taxpayers identify how certain income will be taxed by the irs or japan national tax agency — depending on if the income is sourced. Under the amended tax treaty japan has the right to tax capital gains on transfers of Estate tax treaty & fatca agreement.

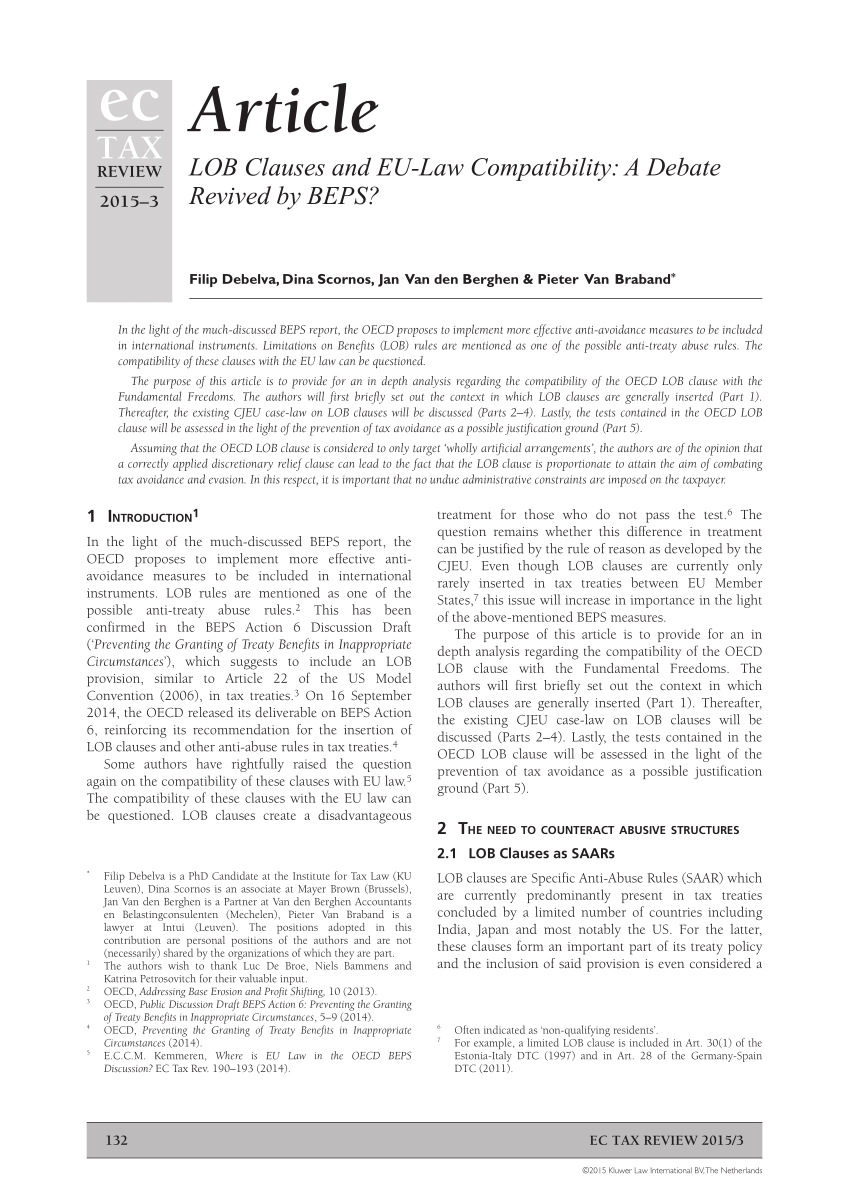

Ratification between the government of japan and the government of the united states of america. See exceptions, below, for the situations where you are not. Even the title causes confusion as it is often referred to as the limitation of benefits, sometimes even by the people who negotiated it.

To be eligible for treaty benefits, the taxpayer must be considered a resident of a particular treaty jurisdiction and, in the case of most modern income tax. Paying agent would withhold on that dividend at the appropriate treaty rate (assuming the payee is otherwise entitled to treaty benefits) because reduced withholding is a benefit enjoyed by the resident of japan, not by the dual resident company. Attachment for limitation on benefits article.

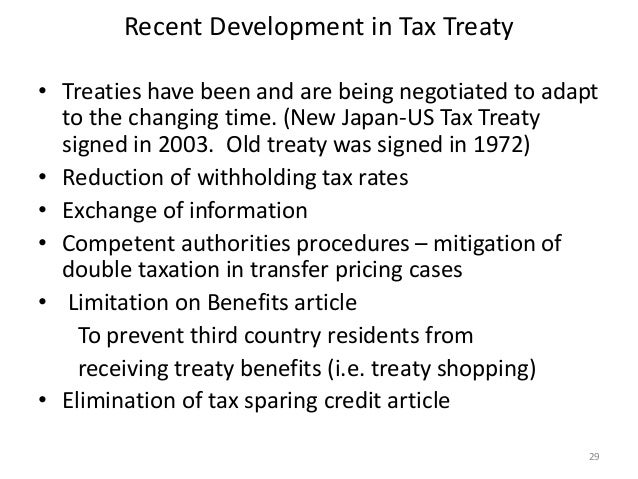

Income tax treaties currently in The changes will impact u.s. Residents of a country whose income tax treaty with the united states contains a “limitation on benefits” article are eligible for benefits only if they satisfy one of the tests under the limitation on benefits article.

Senate on july 16 and 17 approved resolutions of ratification of protocols signed during the administration of president obama that would amend the u.s. The form is different depending on the treaty as the limitation of benefits clauses vary with each treaty. In order to qualify for benefits under an income tax treaty, a foreign person must satisfy the limitation on benefits (“lob”) article of the treaty.

Survivor’s pensions, retirement benefits or other similar remuneration or to earn income for the benefit of other pension funds; And (iii) is exempt from tax in that contracting state with respect to income derived from the activities described in clause (ii). Exemption on your tax return.

Limitation of benefits clause where tax treaties include a limitation of benefit clause, an attachment form for limitation of benefits must be submitted as well. Explanation of the limitation of benefits article & treaty statement the internal revenue service of the united states of america has recently effected changes that impact all clients investing in u.s. Persons outside the tested group $100.

The us were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the lob provision we know and love today was included in their treaty with jamaica. Under us domestic tax laws, a foreign person. To restrict benefits, a limitation on benefits clause has been included in the tax conventions and treaties to which the united states is a party.

Income tax treaty summary on january 24, 2013, japan and the united states signed a protocol, together with an exchange of notes related thereto, (the “protocol”), amending the income tax treaty signed by the two countries in 2003 (as Dividend to a resident of japan, the u.s. The tax treaty between japan and the united states was first entered into a tax treaty agreement nearly 50 years ago — which has since been overhauled and then revised multiple times.

Unraveling The United States- Japan Income Tax Treaty And A Closer Look At Article 46 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

And Other Beps Related Issues – Ppt Download

Japan – Taxation Of Cross-border Ma – Kpmg Global

2

International Taxation

2

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Tax Treaty Limitation On Benefits Lob Form W8-ben-e – International Tax Blog

International Taxation

Tax Treaty Limitation On Benefits Lob Form W8-ben-e – International Tax Blog

2

Pdf Lob Clauses And Eu-law Compatibility A Debate Revived By Beps

Tax Treaty Limitation On Benefits Lob Form W8-ben-e – International Tax Blog

2

Us Japan Income Tax Treaty Provisions Explained Global Counsel

Us Japan Income Tax Treaty Provisions Explained Global Counsel

2

Pdf The Limitation On Benefits Lob Provision In Beps Action 6mli Ineffective Overreaction Of Mind-numbing Complexity – Part 1

Eytaxjp