The japanese protocol will have effect for withholding taxes (e.g., related to dividends and interest) for amounts paid or credited on or after the first day of the third month following the date on which the protocol enters into force — that is, november 1, 2019. Residents on capital gains arising from the sale of shares of a company holding real property situated in japan.

2

Where by reason of the provisions of paragraph 1 an individual not described in

Us japan tax treaty interest withholding. The dual resident company that paid the dividend would, for this purpose, be treated as a resident of the united states under the convention. The protocol entered into force on 30 august 2019, the date japan and the us exchanged instruments of ratification, and applies to withholding taxes on dividends and interest paid or credited on or after 1 november 2019. Interest income on bank deposit or bonds, etc.

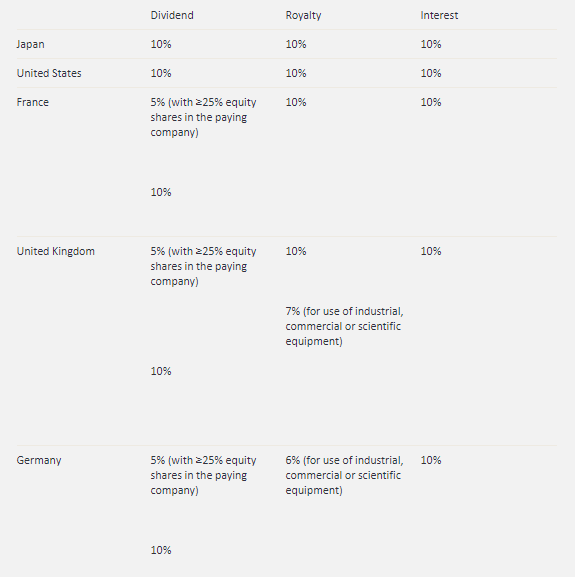

Application form for certificate of residence in japan for the purpose of claiming tax treaty benefits (pdf/207kb) The appropriate treaty rate (assuming the payee is otherwise entitled to treaty benefits) because reduced withholding is a benefit enjoyed by the resident of japan, not by the dual resident company. Withholding tax rates on dividends and interest under japan’s tax treaties the list below gives general information on maximum withholding tax rates in japan on dividends and interest under japan’s tax treaties (as of 18 january 2021).

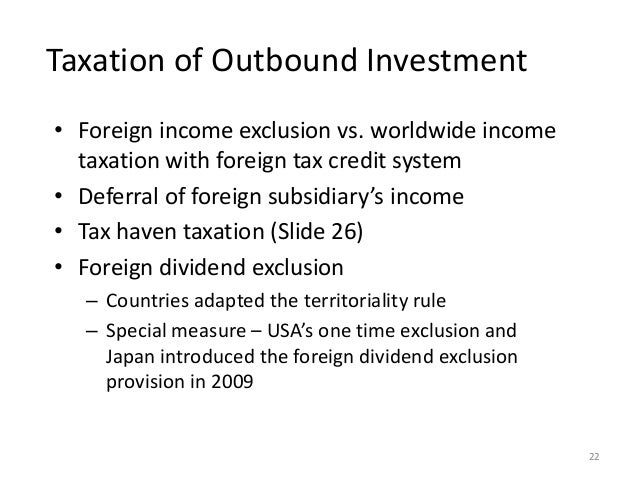

Treatment of pass through entities. Under the protocol, japan is permitted to tax u.s. While japan ratified the protocol in the diet on june 17, 2013, ratification on the us side had been held up in the senate, which finally ratified it on july 17, 2019.

For other taxes, the protocol will apply to taxable years beginning on or after 1 january 2020. Notable changes in the protocol are enlarged exemptions of taxes required to. The treaty will apply, in respect of withholding taxes, as from 1 january 2020 and, in respect of income taxes, to taxable periods starting as from 1 january 2020.

Film royalties are taxed at. The tax treaty with brazil provides a 25% tax rate for certain royalties (trademark). For all other taxes, the japanese protocol will apply to tax years beginning on.

From united states tax to interest received by residents of japan on debt obligations guaranteed or insured or indirectly financed by those japanese banks or insured by the government of japan. (a) in respect of taxes withheld at source, for amounts paid or credited on or after november 1, 2019; Which is treated as japan source income for tax purposes are subject to withholding tax at the rate of 15.315%.

The government of the united states of america and the government of japan, desiring to conclude a new convention for the avoidance of double taxation and the. Withholding taxes the treaty boasts 0% for certain dividends, interests and royalties and also the higher treaty rates for (withholding) tax have been significantly reduced. Recipient’s country (alphabetical order) maximum tax rates (%) remarks dividends interest redemption

The protocol was originally signed by japan and the us on january 24, 2013. The tax treaty was concluded mainly for the purpose of information exchange. Paragraphs 1 to 4 of article 11 (interest) are replaced, providing a general exemption from withholding tax on interest, although a 10% withholding tax rate will apply on interest arising in a contracting state that is determined by reference to receipts, sales, income, profits, or other cash flow of the debtor or a related person, to any change in the value of any.

3.the definition of direct investments for purposes of the 10 percent withholding rate on dividends would be Outline of japan's withholding tax system related to salary (the 2020 edition) for those applying for an exemption for dependents, etc. Revenue authorities of the united states and japan have been unable to resolve after a reasonable period of time (i.e., 2 years).

Although the protocol was signed on 25 january 2013 (japan time) and approved by the japanese diet on 17 june 2013, Taxation between japan and a state other than the united states, is not a resident of that state. Application form for income tax convention, etc.

Tax treaty january 31, 2013 similarly, the protocol expands japan’s taxation rights in respect of real property situated in japan. The president signed it into law on august 6, 2019. Effective date in principle, the protocol shall have effect:

2

Pdf Can Capital Income Taxes Survive And Should They

Us Senate Approves Tax Treaty Protocols – Us Embassy Consulate In Spain And Andorra

The Aca Tax Return Preparer Directory Is An Online Directory For Overseas Taxpayers Search Results In Irs Listed

International Taxation

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Russias Double Tax Agreement With Hong Kong – Reducing Taxes In Bilateral Trade – Russia Briefing News

Pin On Happy May

Tax Form W8ben – Step By Step Guide Envato Author Help Center Tax Forms Step Guide Form

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest – Lexology

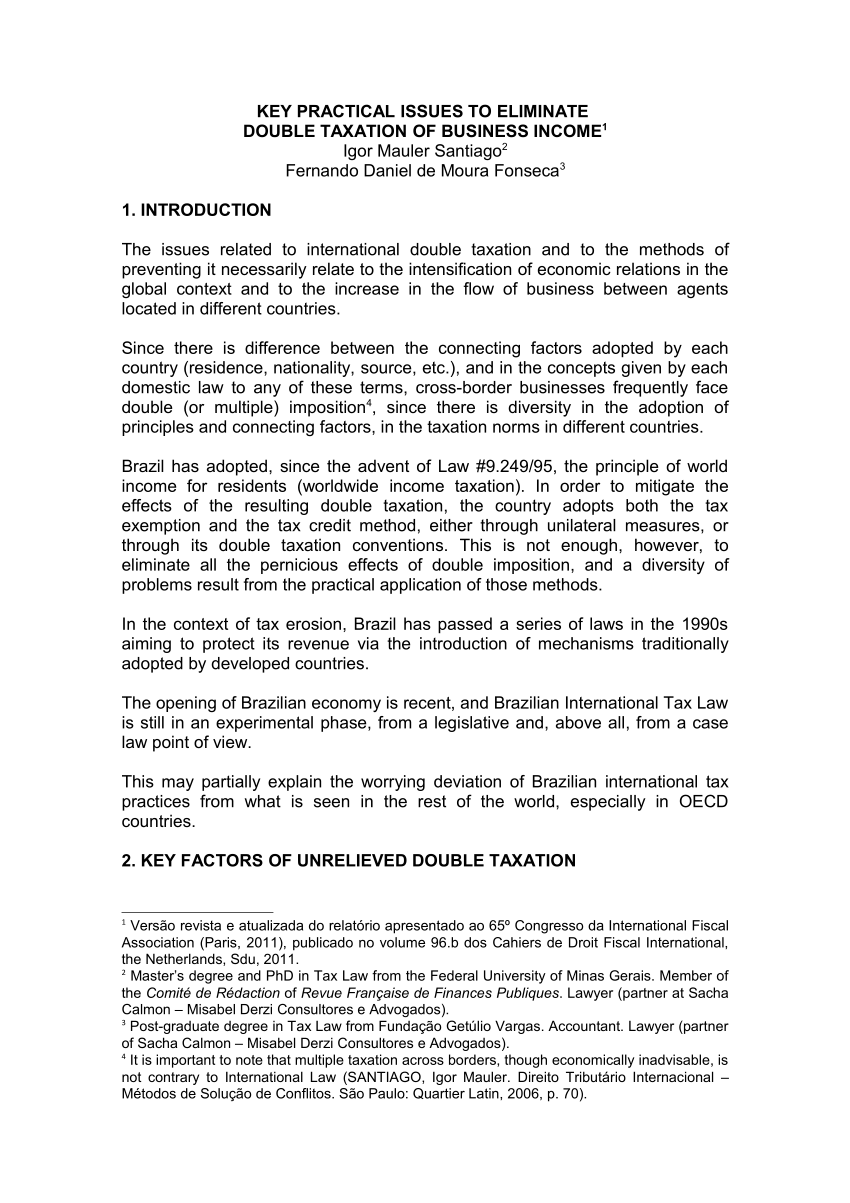

Pdf Key Practical Issues To Eliminate Double Taxation Of Business Income

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Singapore New Income Tax Treaty With Indonesia – Kpmg United States

Unraveling The United States- Japan Income Tax Treaty And A Closer Look At Article 46 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Pajak Internasional – Solusi Pajak

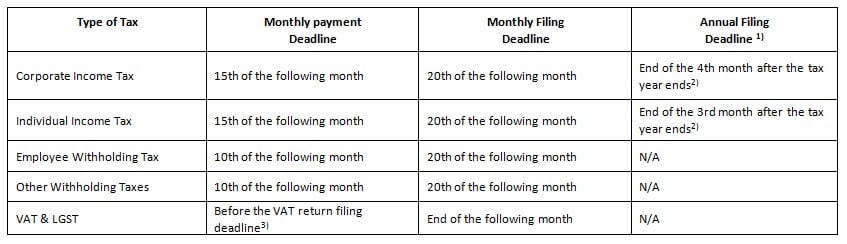

Income Taxation System In Indonesia

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021