Sources into your ib account may have u.s. If the foreign person qualifies for benefits under an income tax treaty with the u.s., the withholding tax rate may be reduced.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Lob provisions are aimed at eliminating treaty shopping.

Us germany tax treaty limitation on benefits. The protocol would substantially modify the limitation on benefits article of the existing treaty—that is, the article intended to reduce treaty shopping by limiting the extent to which a resident of the united states or of germany is entitled to the benefits of the treaty. Limitations on treaty benefits new limitation on benefits provision. Per spective can only be analyzed in.

Model treaty with only minor changes to the clause. 3 german income tax act), in the form of significant aggravations. While the clause in the dtaa with japan is a little unique.

In order to qualify for benefits under an income tax treaty, a foreign person must satisfy the limitation on benefits (“lob”) article of the treaty. For further information on tax treaties refer also to the treasury department's tax treaty documents page. The ‘limitation of benefit’ clause has only been included by australia in their treaty with japan and the unites states.

The convention further provides both states with the flexibility to deal with hybrid financial instruments that have both debt and equity features. Income payments (dividends and payment in lieu) from u.s. 61 rows summary of us tax treaty benefits.

The ‘limitation of benefit’ clause with the us has been formulated based on the 1996 u.s. Income tax treaty, a person must satisfy a number of requirements, including residence in one of the treaty countries. The complete texts of the following tax treaty documents are available in adobe pdf format.

The limitation on benefits clause in each treaty contains certain tests to determine the applicability of the treaty to international transactions. Residents of a country whose income tax treaty with the united states contains a “limitation on benefits” article are eligible for benefits only if they satisfy one of the tests under the limitation on benefits article. In order to enjoy the benefits of a u.s.

To restrict benefits, a limitation on benefits clause has been included in the tax conventions and treaties to which the united states is a party. If you have problems opening the pdf document or viewing pages, download the latest version of adobe acrobat reader. The limitation on benefits (lob) article in u.s.

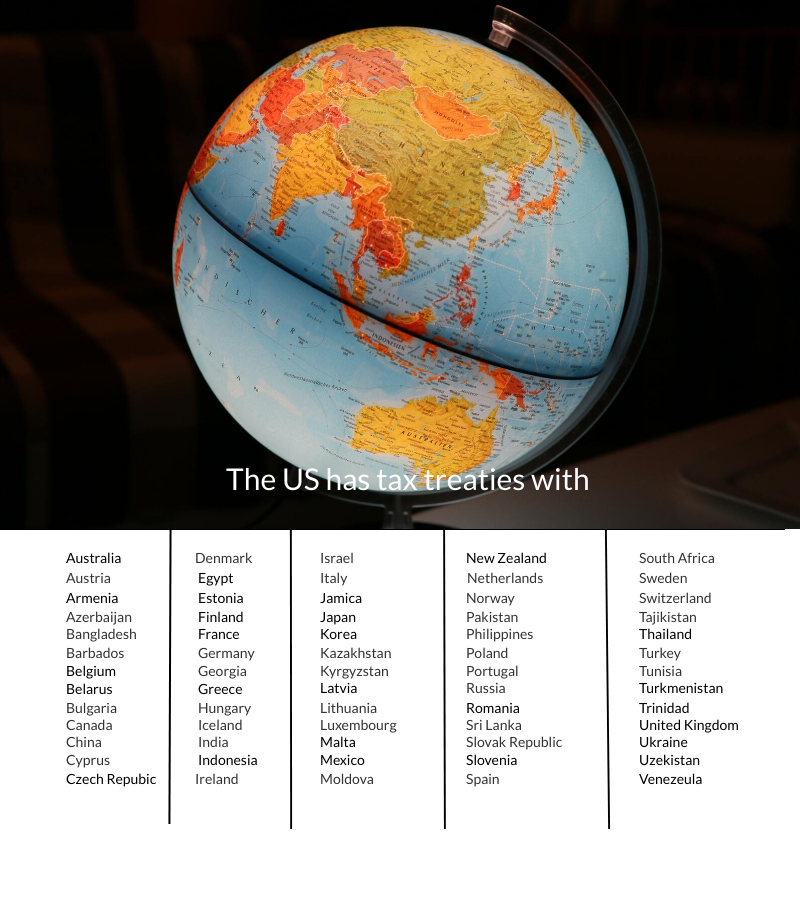

The united states is a party to numerous income tax treaties with foreign countries. In addition, the convention will provide for exemption of german residents from united states tax on united states social security benefits. Limitations on benefits provisions generally prohibit third country residents from obtaining treaty benefits.

For example, a foreign corporation may not be entitled to a reduced rate of withholding unless a minimum percentage of its owners are citizens or residents of the united states (or the treaty country). In the corporate context, the most common test applied is the publicly In the federal republic of germany this will include sleeping partnership interests and in the united states.

Northwestern pritzker school of law Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the u.s. Tax treaties is intended to prevent “treaty shopping,” whereby residents from third countries not party to the treaty manipulate treaty residence rules or corporate shareholdings in order to obtain treaty benefits.

Residence alone, however, is not sufficient. First, the treaty provides relief from double taxation by allowing the parent to apply the german tax exemption method with respect to its dividend income. While limitation on benefits clauses vary from treaty to treaty, they all have some common elements.

Under us domestic tax laws, a foreign person generally.

Filing J-1 Visa Tax Return In The Us – All You Need To Know

Difference Between Wire Transfer Swift And Ach Automated Clearing House Automation Transfer Wire

Corporate Tax Reform In The Wake Of The Pandemic Itep

New Corporate Income Tax In Latvia How To Benefit From It

How To Design A Regional Tax Treaty And Tax Treaty Policy Framework In A Developing Country In Imf How To Notes Volume 2021 Issue 003 2021

Luxembourg Staff Report For The 2018 Article Iv Consultation In Imf Staff Country Reports Volume 2018 Issue 096 2018

2

Expatriates 10 Tax Issues To Be Considered In Germany

2

2

Tax Incentives In The Philippines A Regional Perspective In Imf Working Papers Volume 2001 Issue 181 2001

How Nri Can Exchange Rs 5001000 Notes Outside India Old Rs Olds Notes

Are You A Beat Taxpayer Bkd Llp

6 Recent Tax Policy Trends And Issues In Latin America In Policies For Growth

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

2

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

2

China Enhances Rd Super Deduction For Manufacturing Extends Multiple Tax Breaks For Doing Business In China Mne Tax