The exit tax occurs from u.s. Under the substantial presence test of irc

How To Get Tax Refund In Usa As Tourist For Shopping 2021

For someone who became a lawful permanent resident in 2010 (and who has always filed form 1040 since then), 2017 is the eighth year of holding the visa status.

Us exit tax form. Ad vast library of fillable legal documents. In most cases, expatriation tax is assessed upon change of domicile or habitual residence; Became at birth a citizen of the u.s.

An expatriation tax or emigration tax is a tax on persons who cease to be tax resident in a country. The us imposes an ‘exit tax’ when you renounce your citizenship if you meet certain criteria. Exit tax should apply to the assets of americans abroad”

If you are a u.s. Would not have been considered a resident of the u.s. This determines the gain on your assets, as well as the taxable amount of this (above the threshold).

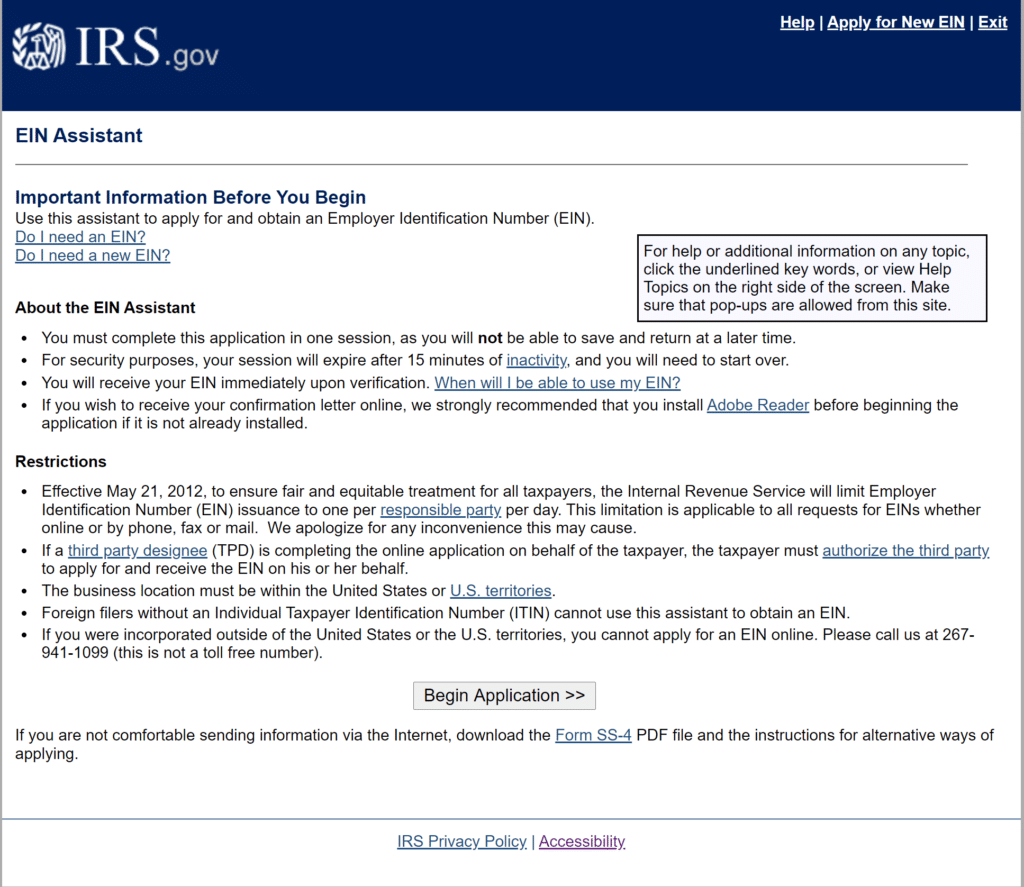

Exit tax is calculated using the form 8854, which is the expatriation statement that is attached on your final dual status return. This tax is based on the inherent gain (in dollar terms) on all your assets (including your home). Currently, net capital gains can be taxed as high as 23.8%, including the net.

At that time, the covered expatriate will evaluate their potential tax liability had they sold all of their assets on the day before. The basics of expatriation tax planning: If a person is a u.s.

Form 8854 department of the treasury internal revenue service initial and annual expatriation statement for calendar year 2020 or other tax year beginning, 2020, and ending, 20. The exit tax rules impose an income tax on someone who has made his or her exit from the u.s. In 2017, that threshold was $162,000 per year.

Exit tax and expatriation involve certain key issues. This often takes the form of a capital gains tax against unrealised gain attributable to the period in which the taxpayer was a tax resident of the country in question. Irs tax rules for expatriation from the united states requires a complicated tax analysis to determine if the expatriate must pay u.s.

Unfortunately, i don't have any tips for you on this one. The defining feature is that assets are treated as if they are sold on the day before citizenship or resident status is terminated. The united states exit tax | 5 a.

Three tests to determine if you are a covered expatriate We will summarise the exit tax, and how citizens & green card holders may be able to avoid it. If you have a net worth of us$2 million or more or if you have had an average annual tax liability of us$157,000 or more (that’s the figure for 2014) for the five tax years prior to your expatriation date, then you have to complete the income and asset section of form 8854.

Generally, if you have a net worth in excess of $2 million the exit tax will apply to you. Best tool to create, edit & share pdfs. The percentage of exit tax is different for everyone as it is based on your marginal tax rates.

Persons at the time of expatriation from the united states. For instructions and the latest information. Taking one of the actions specified in the code will make trigger application of the exit tax rules.

The exit tax is computed as if you sold all your assets on the day before you expatriated, and had to report the gain. Federal tax obligations for the 5 years preceding the date of your expatriation or termination of residency. 2801, he or she may consider filing a protective form 708 (prop.

2

2561 Statute Of Limitations Processes And Procedures Internal Revenue Service

Common Us Expat Tax Forms For Americans Living Abroad

Us Citizenship Renunciation What You Need To Know – Online Taxman

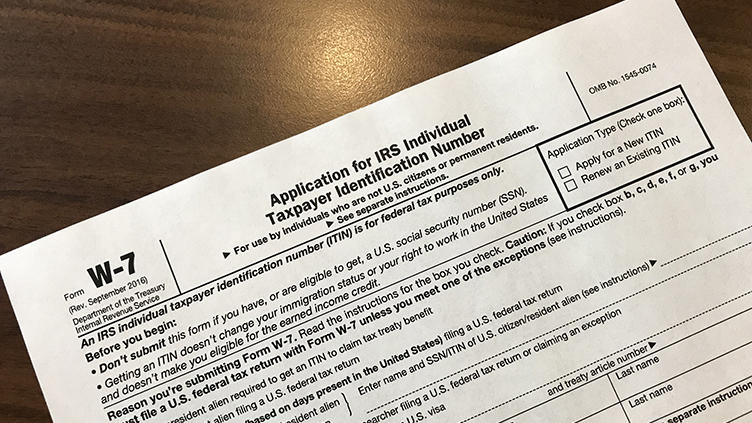

Individual Taxpayer Identification Numbers – Students

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax For Renouncing Us Citizenship Or Green Card Hr Block

Exit Tax Us After Renouncing Citizenship Americans Overseas

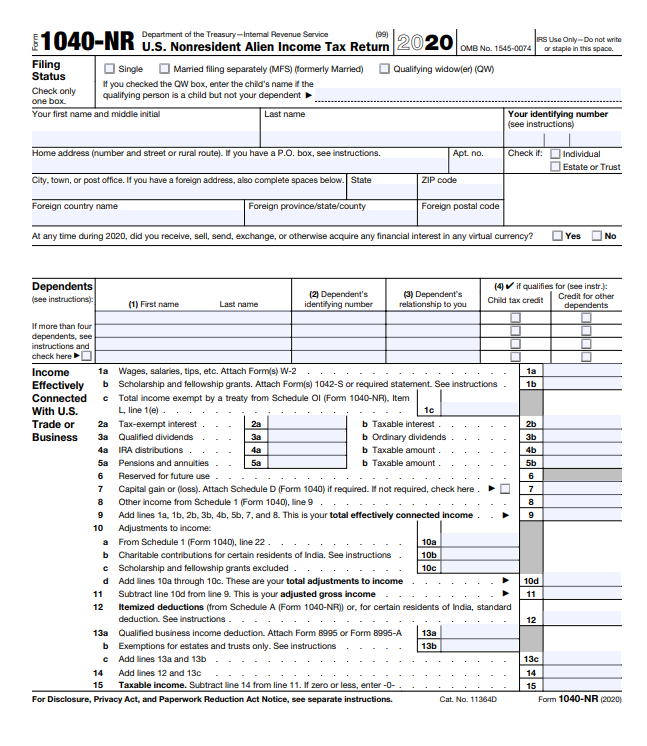

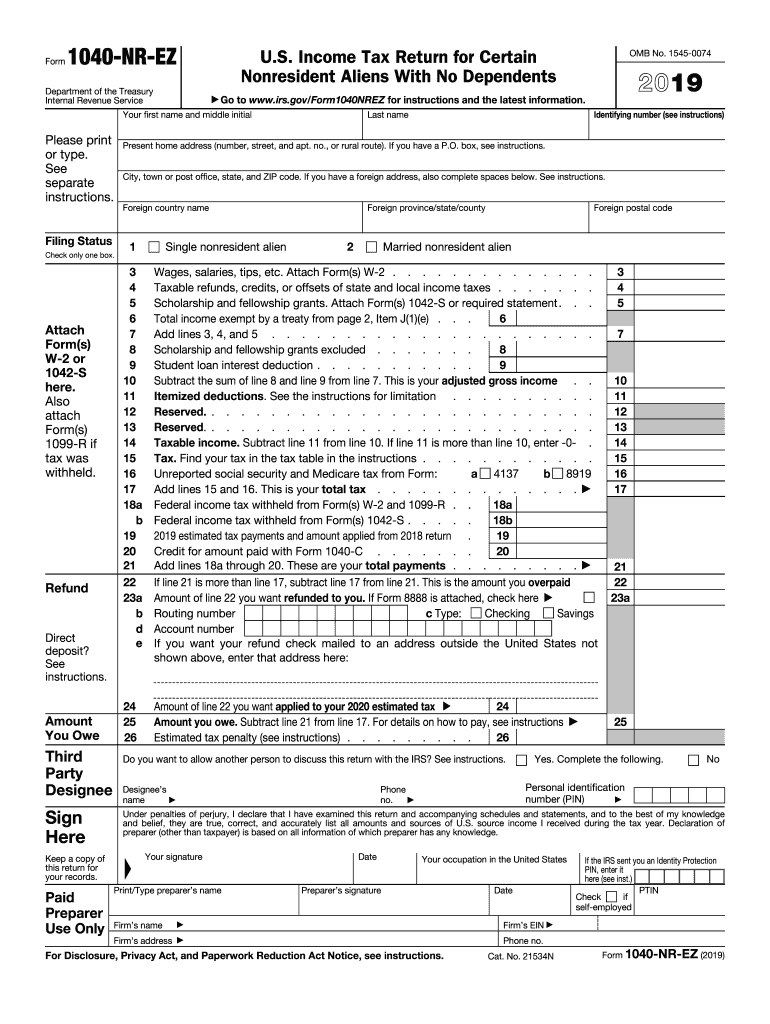

Forms 1040 1040nr And 1040nr-ez – Which Form To File 2021

What Is Expatriation Definition Tax Implications Of Expatriation

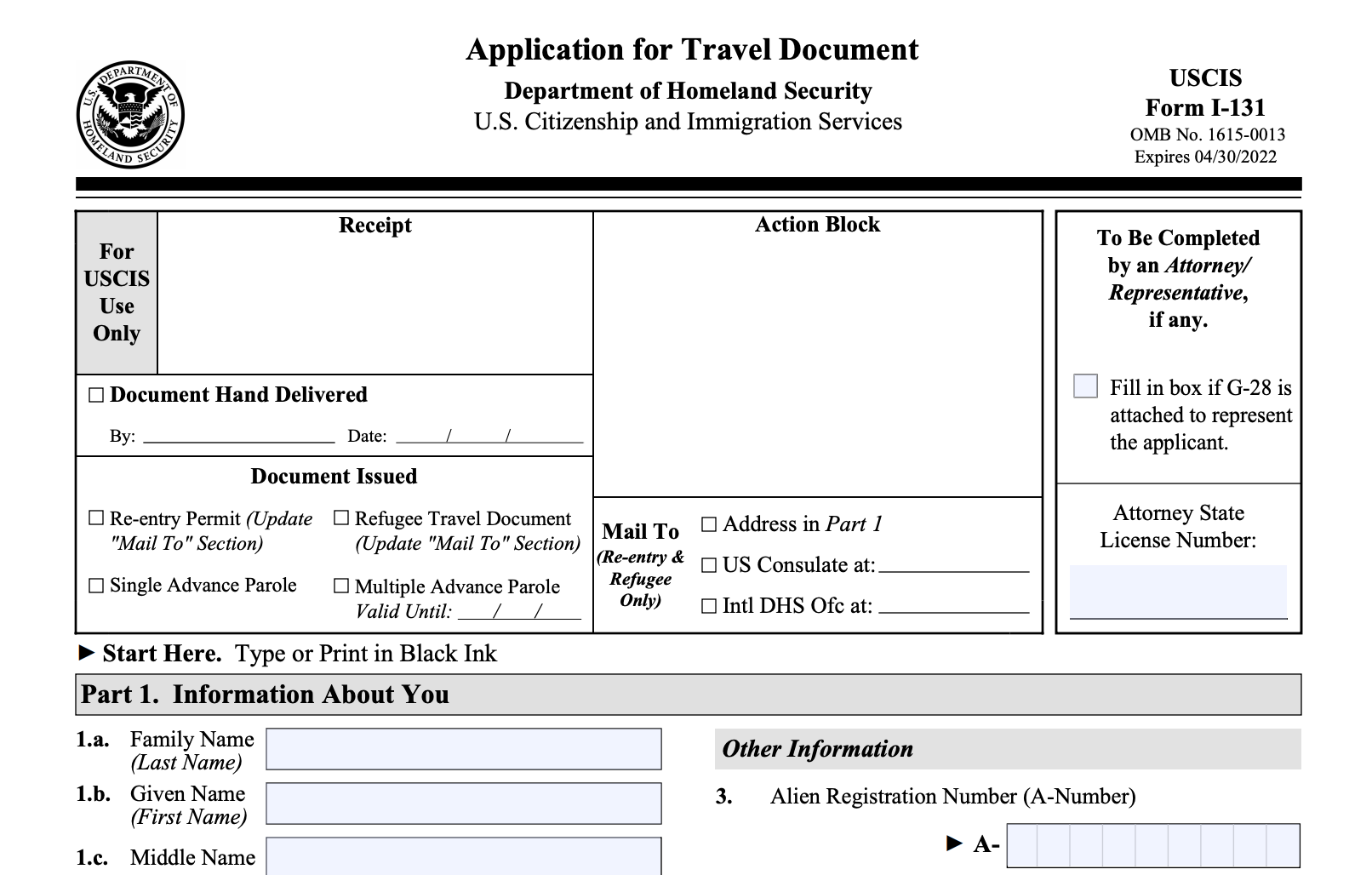

What You Need To Know About Re-entry Permits For Green Card Holders

Pin On Form 8854

2

Forms 1040 1040nr And 1040nr-ez – Which Form To File 2021

How To Apply For An Estate Ein Or Tin Online 9-step Guide

2561 Statute Of Limitations Processes And Procedures Internal Revenue Service

Instructions For Form 1040-nr 2020 Internal Revenue Service

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Tax Resident Status And 3 Things To Know Before Moving To Us