Newsnow aims to be the world’s most accurate and comprehensive capital gains tax news aggregator, bringing you the latest headlines automatically and continuously 24/7. Proposed capital gains tax increase?

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

Capital gains tax rates in other states

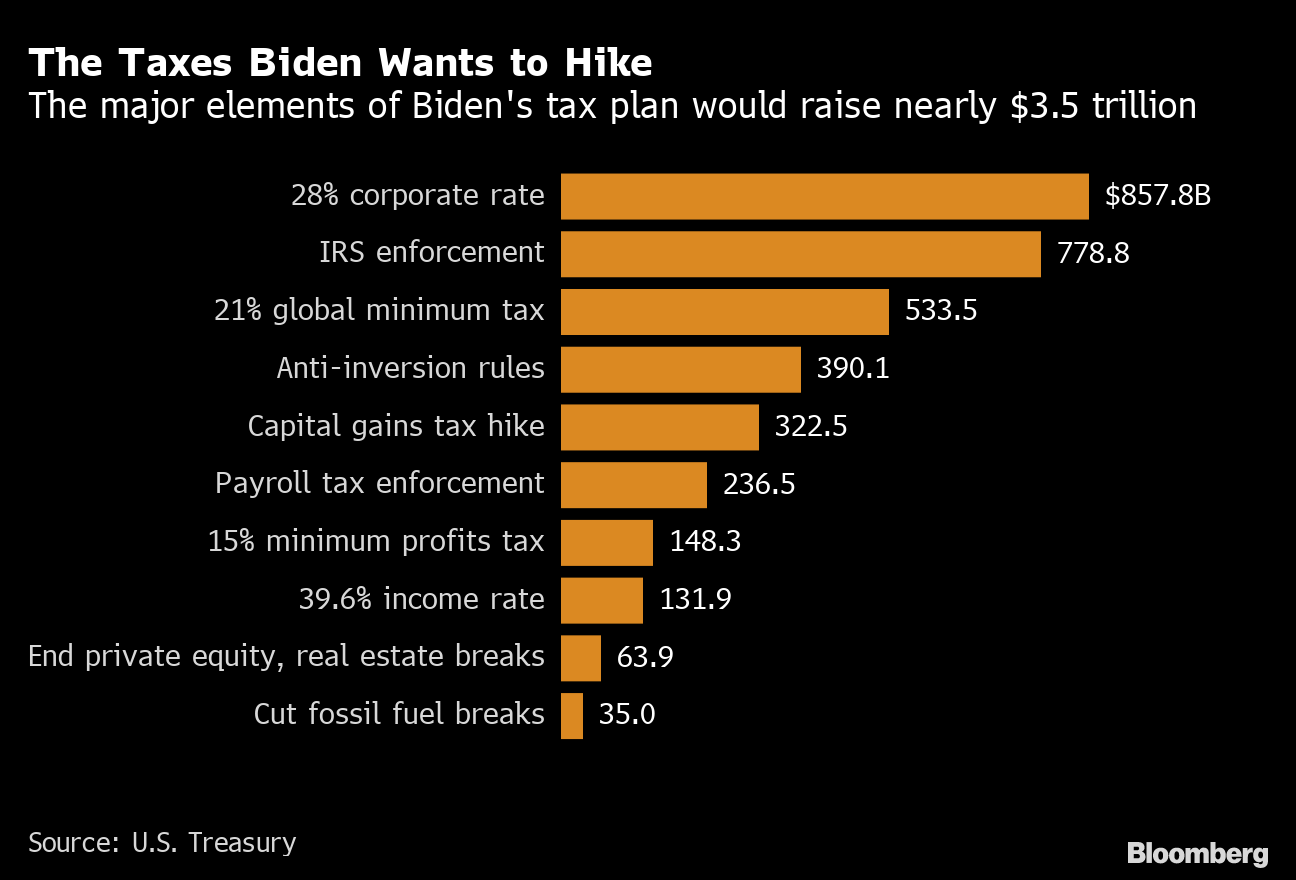

Us capital gains tax news. President biden unveils unrealized capital gains tax for billionaires. If a citizen who makes $5 million per year earns capital gains of $1 million, that individual could pay roughly $434,000 in capital gains tax, and this does not include state taxes. Under the proposal, the capital gains tax would increase to 39.6% from the current rate of 20%, or to 43.4% from 23.8% if the net investment income tax is taken into account.

Federal income tax on the net total of all their capital gains. In the united states of america, individuals and corporations pay u.s. Capital gains tax rates for.

The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Secretary janet yellen has been discussing in various media, the biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Capital gains taxes on collectibles.

There's an additional 3.8% surtax on net investment income (nii) that you might have to pay on top of the capital gains tax. If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15% or 20% rate. Additionally, a section 1250 gain, the portion of a gain on a sale that was previously depreciated, is.

Capital gains taxes are around 20% and the marginal rate of 39.6% is meant to be applicable to wealthy americans. Tax on net investment income. The number of stock deals over the same period also rose 63.6% year over year.

The current maximum federal capital gains tax is 23.8%. Gains from stocks, mutual funds or other capital assets are taxed at either a zero percent, 15 percent or 20 percent rate, which solely depends on the income of the taxpayer. The capital gains tax rate reaches 7.65%.

House democrats on monday proposed raising the top tax rate on capital gains and qualified dividends to 28.8%, one of several tax reforms aimed at. Capital gains tax rate to. The plan will be included in the democrats’ us$ 2 trillion reconciliation bill.

All shorten was proposing was to wind back the capital gains tax exemption (which exempts from tax half of each profit made from buying and sell real estate and other assets) for future. President joe biden will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6%, which, coupled with an existing surtax.

Understanding The Tax Implications Of Stock Trading Ally

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole – Bloomberg

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Biden Budget Reiterates 434 Top Capital Gains Tax Rate For Millionaires

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax 101

How To Pay 0 Capital Gains Taxes With A Six-figure Income

What Is Capital Gains Tax And How Is It Calculated Capital Gains Tax Capital Gain What Is Capital

Rethinking How We Score Capital Gains Tax Reform Bfi

Capital Gains Tax Advice News Features Tips Kiplinger

Whats In Bidens Capital Gains Tax Plan – Smartasset

Cryptocurrencyonlineco -nbspthis Website Is For Sale -nbspcryptocurrencyonline Resources And Information Bitcoin Brief Words

Yxarq9e6xulnsm

Taxes The Uk Government Has Said That Individual Investors Will Be Liable To Pay Capital Gains Tax Each Time They Sell Crypto Bitcoin Bitcoin Price Investing

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe