Thus, capital gains and losses are reported in the year in which the investment fund. November 29, 2021 by brian a.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Unrealized capital gains tax ‘commit to equity coalition’ demands ca billionaire tax, millionaire tax, and additional tax on stock gains.

Unrealized capital gains tax california. Such as how values will be established to tax unrealized gains. Fifth, a tax on unrealized capital gains is flatly unconstitutional. Normally of course you don’t pay taxes on gains until you sell assets and establish a profit.

30 2021, published 10:40 a.m. The problem may be with your improper use of the terms realized and unrealized earnings. In addition to encouraging taxpayers to leave the country, it would result in taxpayers leaving states with high capital gains taxes, like california to states with no capital gains tax.

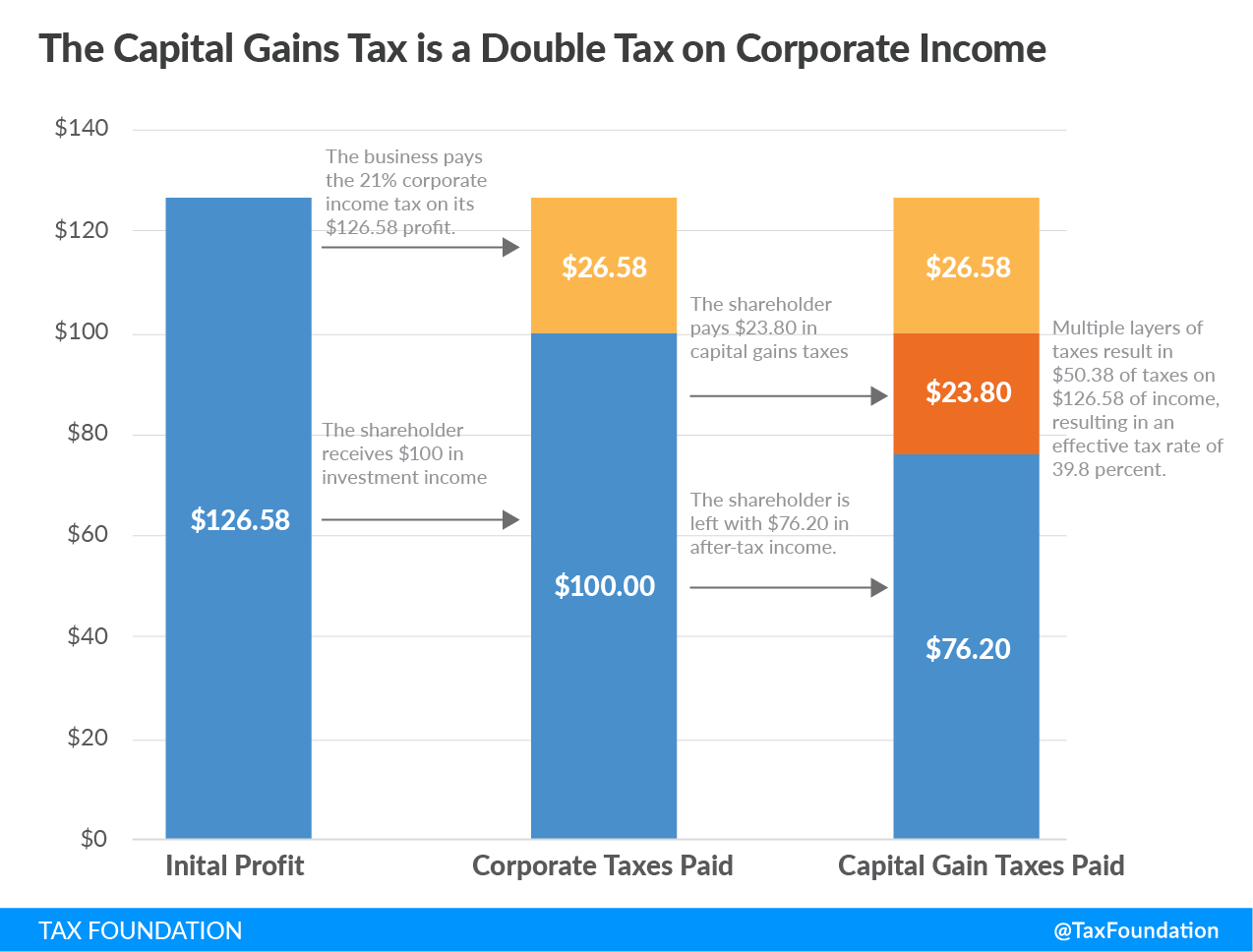

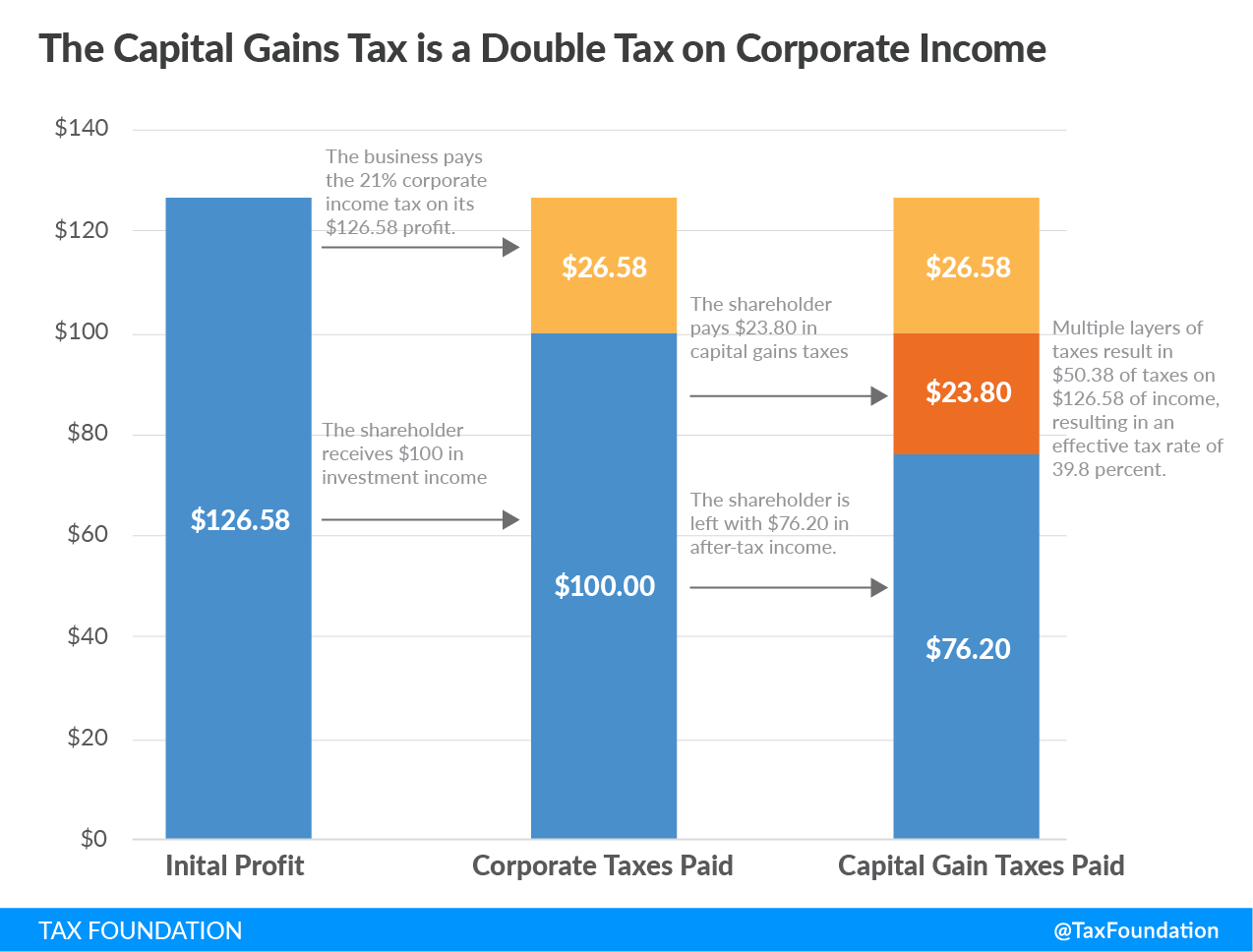

Rather, there is a proposal floating around that would impose a 15% minimum tax on all corporations, as the former alternative minimum tax was repealed in 2017. It will have an effect on individuals with $1 billion in belongings or those that have reported not less than $100 million in earnings for 3 consecutive years, in response to information reviews. Federal long term capital gain rate — 39.6% (biden/yellen proposal) v 20% today.

December 31st passes and under the proposed tax law you now owe taxes on those unrealized capital gains. Total long term capital gain rate — 43.4%% What does the proposal to tax unrealized capital gains mean for americans?

California long term capital gain rate — 13.3%. This means interest, dividends, capital gains distributions and capital gains from the sale of appreciated marketable securities are all considered taxable income. A texas resident would see the following taxes:

Total long term capital gain rate — 56.7%. How much is capital gains tax in california? Regardless of the year, the california capital gains tax rate of 2021 is based on the type of asset that made profitable gains that need to be assessed.

August 20, 2020 7:23 pm august 20, 2020 7:23 pm. “this tax is designed as a prepayment on future. Blue states would like to ensure their state capital gains tax would apply to unrealized gains so taxpayers would be hit twice in many states.

National investment income tax — 3.8%. Obviously this proposal is very controversial, and still very opaque, with many potential problems. In california, hsa accounts are treated as a normal investment account.

An unrealized capital gains tax on corporate assets could hit those with real estate. National investment income tax — 3.8%. The taxation on unrealized capital gains is expected to affect people with $1 billion in assets or $100 million in income for three consecutive years.

Let’s assume that the unrealized capital gains rate is the same as the long term capital gains rate: The constitution forbids “direct taxes” unless they are apportioned among the states according to population. Nov 11, 2021 3:00pm est.

“an unrealized capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy,” according to the letter. That would be impossible with wyden’s wealth tax for the simple reason that there are many more billionaires in new york and california than in mississippi. California just treats hsa accounts as if they are taxable accounts.

The secretary of the treasury (including any delegate of the secretary) or any other federal government official shall not require or impose the implementation of taxation on unrealized capital gains, from any taxable asset, including but not limited to covered and noncovered tradable assets, gifts, bequests, and transfers in trust, except to the extent that such reporting is required under. Billionaires may very well be taxed on unrealized capital features on their liquid belongings, democratic officials said yesterday. This time in the form of annual taxes on unrealized investment gains.

Texas long term capital gain rate — 0%. “there are two tax codes in america,” wyden said in a statement on wednesday. “the first is mandatory for workers who pay taxes.

If an unrealized capital gains tax is enacted, it could have major ramifications for the economy and create a dangerous precedent. The homeowner has two options to remedy their $40,000 tax liability.

Californias Public-employee Unions Want Tax On Unrealized Capital Gains – San Francisco Business Times

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Unrealized Capital Gains Tax Archives – California Globe

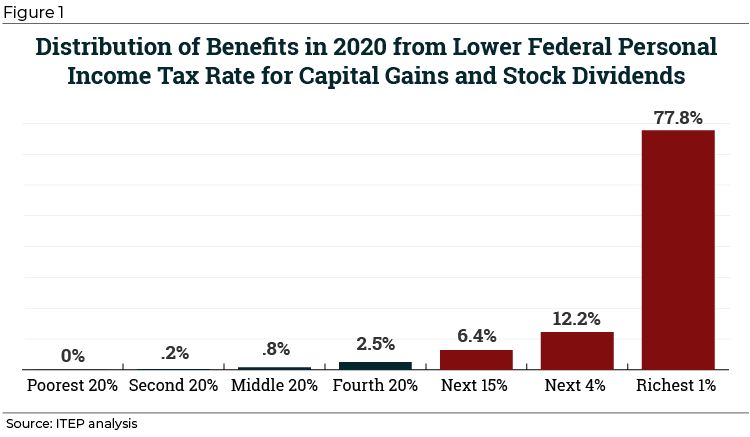

Capital Gains Tax Breaks Are Finally On The Defensive Itep

Unrealized Capital Gains Tax Stock Bitcoin – Bitcoin Magazine Bitcoin News Articles Charts And Guides

State Taxes On Capital Gains Center On Budget And Policy Priorities

Epic Games Tim Sweeney Says Democrats Unrealized Capital Gains Tax On Billionaires Would Crush Entrepreneurs Fox Business

An Overview Of Capital Gains Taxes Tax Foundation

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

An Overview Of Capital Gains Taxes Tax Foundation

Taxing Unrealized Capital Gains A Bad Idea National Review

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains – The New York Times

Biden Estate Tax A 61 Tax On Wealth Tax Foundation

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age – Youtube

Capital Gains Tax 101

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Unrealized Capital Gains Tax For Billionaires Explained

Hiltzik Why Elon Musks Taxes Are Important – Los Angeles Times