The amount of property the federal government allows a person to transfer during life or after death without paying gift or estate taxes (together called transfer taxes ). The amount of us$4,577,800 represents the amount of

Here Are The 2020 Estate Tax Rates The Motley Fool

This means that an individual is currently permitted to leave up to $11.7 million to heirs without any federal or estate gift taxes being applied.

Unified estate tax credit 2020. The estate tax is a tax on your right to transfer property at your death. For 2020, us residents (and citizens) are entitled to a us estate tax unified credit of approximately $4,577,800, which essentially exempts $11.58 million of property from estate tax. For example, for 2020, the u.s.

However, the unified tax credit has a set amount that an individual. Estate tax exemption amount is us$11.58 million, which if expressed as a unified credit amounts to us$4,577,800. The amount of the unified credit is currently higher than it has ever been while an estate tax is in effect—$11.58 million for 2020—due in large part to a temporary increase provided in the tax cuts and jobs act of 2017.

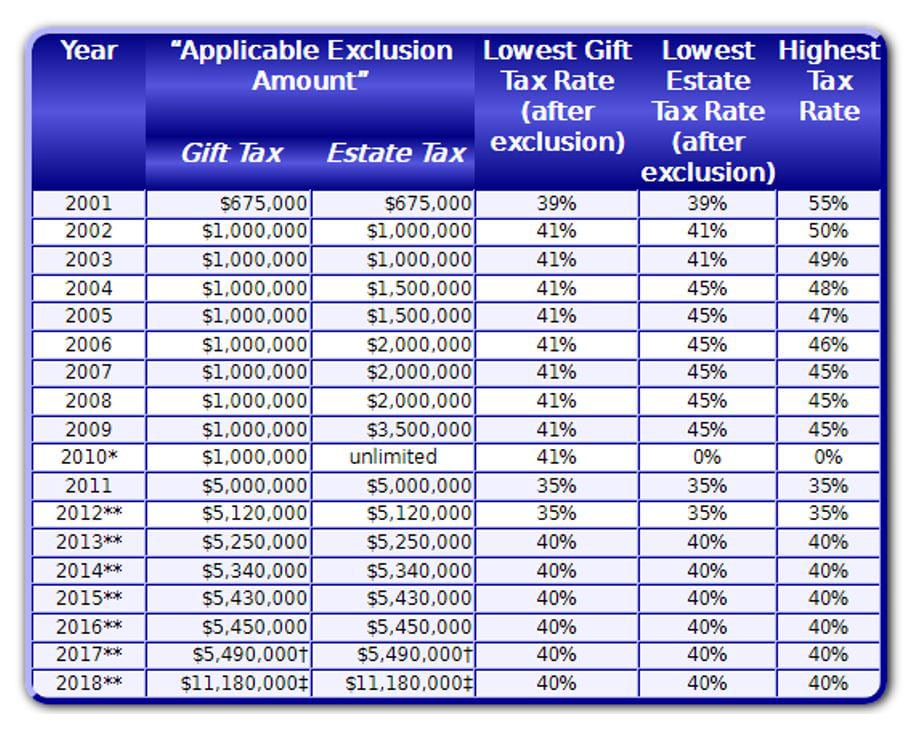

Qualified small business property or farm property deduction. Since 2000, the estate and gift tax (collectively called the “transfer tax”) has gone from an exemption of $675,000 and a top marginal rate of. The lifetime gift tax exclusion in 2020 is $11.58 million, meaning the federal tax law applies the estate tax to any amount above $11.58 million.

That number is used to calculate the size of the credit against estate tax. A person gives away $2,000,000 in their lifetime and dies in 2021 and is entitled to an individual federal estate tax exemption of $11,700,000. Special transfer tax credits, exemptions and deductions unified credit.

The $11.7 million exemption applies to gifts and estate taxes combined—whatever exemption you use for gifting will reduce the amount you can use for the estate tax. As of 2021, the federal estate tax is 40% of the inheritance amount. For 2020, the basic exclusion amount will go up $180,000 from 2019 levels to a new total of $11.58 million.

Estate tax purposes, a “unified credit” is available which effectively exempts a portion of one’s estate from estate tax. The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them. The unified credit is per person, but.

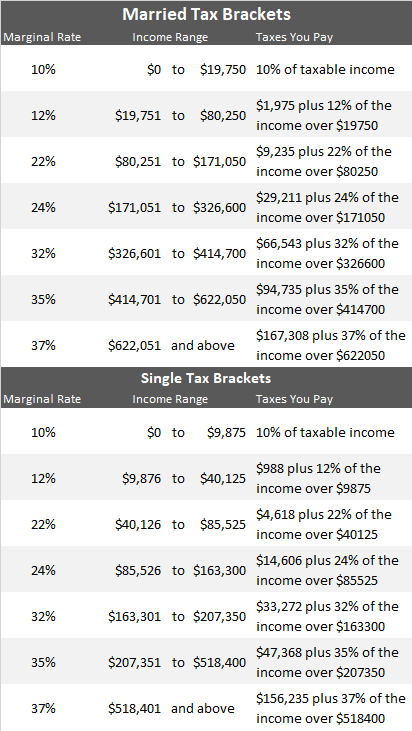

The previous limit for 2020 was $11.58 million. It will then be taken as a credit against any estate tax owed. For 2020, estate tax rates start at 18%, and reach 40% for assets worth more than $1 million.

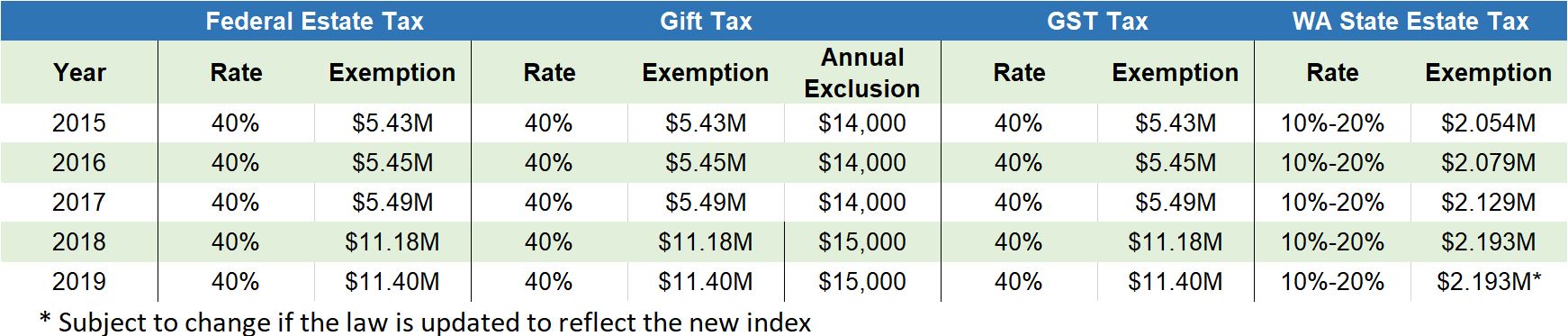

In addition, any portion of the unified credit that is unused can be used as an amount to be passed to a surviving spouse. Tax year 2020 unified estate tax rate schedule taxable amount (dollars) marginal tax rate source: Estate and gift taxes estate taxes 2020 2019 estate tax exemption $ 11,580,000 $ 11,400,000 unified estate tax credit $ 4,577,800 $ 4,505,800 top estate tax rate 40% 40% gift taxes 2020 2019 lifetime gift tax exemption $ 11,580,000 $ 11,400,000 annual gift tax exclusion gifts per person $ 15,000 $ 15,000

You’d have just $6.7 million left of that $11.7 million credit with which to shield your estate from taxation at the time of your death. Beneficiaries or estates that wish to take advantage of this lifetime credit must complete irs form 706. That exemption amount is $2 million in 2008 and will go up to $3.5 million in 2009.

Residents, the unified credit represents the tax on an effective exemption amount of $11,580,000 for 2020 and $11,700,000 for 2021. Estate and gift taxes estate taxes 2021 2020 estate tax exemption $ 11,700,000 $ 11,580,000 unified estate tax credit $ 4,577,800 $ 4,577,800 top estate tax rate 40% 40% gift taxes 2021 2020 lifetime gift tax exemption $ 11,700,000 $ 11,580,000 annual gift tax exclusion Applicable exclusion amount under the 2010 tax relief act, the lifetime estate and gift tax basic exclusion amount was $5,000,000 and this.

In 2010 the estate tax will be repealed and then reinstated in 2011. The lifetime estate exclusion amount (also sometimes called the estate tax exemption amount, the applicable exclusion amount, or the unified credit amount) has been increased for inflation beginning january 1, 2020. While congress can vote to make the $11.7 million exception permanent, the biden administration has pledged to drastically decrease the unified credit for estate taxes from $11.7 million to $3.5 million, and the credit for gift taxes to $1 million.

The top estate tax rate for 2020 and 2021 is 40%. It consists of an accounting of everything you own or have certain interests in at the date of death (refer to form 706 pdf (pdf)). If you are like most people, you are probably asking, “what does that actually mean?” what is the estate & gift tax exemption?

Gifts and estate transfers that exceed $11.7 million are subject to tax. The basic exclusion amount for determining the unified credit against the estate tax will be $11,580,000 for decedents dying in calendar year 2020, up from $11,400,000 in 2019. Situs property transferred to your heirs please contact us

For 2021, the estate and gift tax exemption stands at $11.7 million per person. A unified credit of up to us$4,577,800 (in 2020) which can be applied to reduce their u.s. Estate tax exemption (which may also be expressed in the form of a unified credit).

To claim a portion of a u.s. The internal revenue service (irs) just announced that the estate and gift tax exemption for 2020 is increasing to $11.58 million per person — up from $11.40 million in 2019.

History Of The Unified Tax Credit – Apple Growth Partners

Taxpolicycenterorg

Rbcwm-usacom

How To Advise Your Clients Under The New Estate Tax Law – Ppt Download

Brentmarkcom

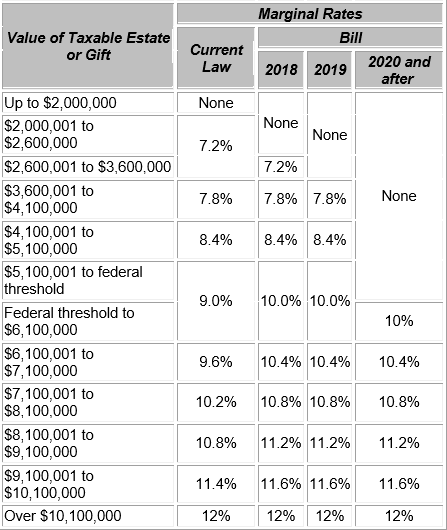

2019 Estate Planning Update

Exploring The Estate Tax Part 2 – Journal Of Accountancy

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Estate Tax Primer For German Investors In Us Real Estate Partnerships Dallas Business Income Tax Services

2021 Cost Of Living Adjustments And Estate Gift Tax Limits – Cpa Boston Woburn Dgc

Acct 3220 – Taxation Midterm Ch1 Flashcards Quizlet

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Irs 2020 Tax Tables Deductions Exemptions Purposefulfinance

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care – Waldron Schneider

Historical Estate Tax Exemption Amounts And Tax Rates 2022

A Look At 2020 – Cost Of Living Adjustments And Estate Gift Tax Limits – Cpa Boston Woburn Dgc

Estate Tax Primer For German Investors In Us Real Estate Partnerships Dallas Business Income Tax Services

Tax-related Estate Planning Lee Kiefer Park

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far – Youtube