We also make arrangements with cra for payment plans to resolve tax debts. Depending on your citizen and residency status, green card, etc if you have tax return obligations with irs we can help under different programs like streamlining that deals with more than 3 years of outstanding filings.

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

The cra is a very large and powerful agency.

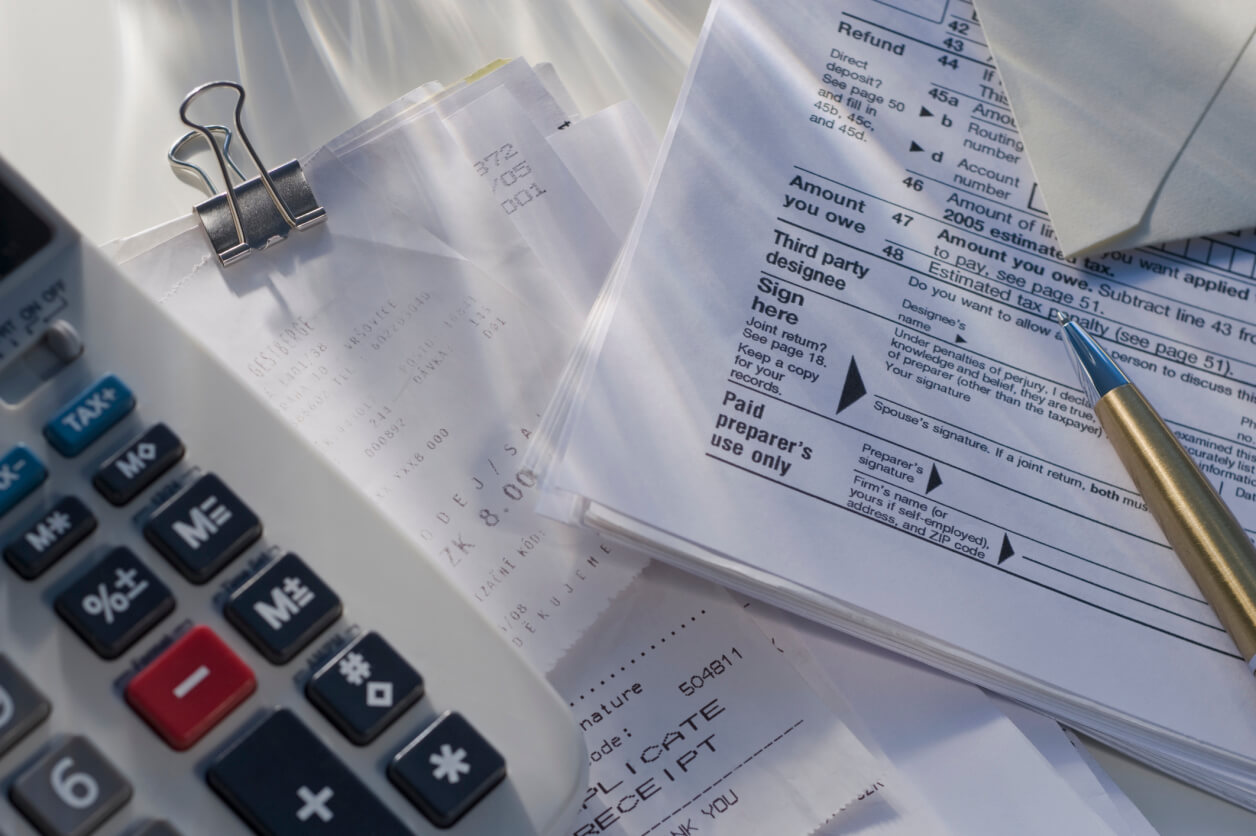

Unfiled tax returns canada. Dealing with unfiled tax issues. One of our professional canadian tax lawyers at our toronto tax law firm can advise you if you. And errors, mistakes or omissions not included in your previous dealings with the cra.

Problems with unfiled taxes are nothing to be taken lightly. Before you file any tax returns it is important that you know which returns you are required by law to file. Haven’t filed your tax return in years?

If you or your small canadian business has unfiled gst or unfiled hst returns then provided that cra has not contacted you about the unfiled returns you should be eligible for the voluntary disclosure program and not be subject to prosecution or penalties. You have to pay interest on the amount owed, and the interest is compounding daily. You can also consider speaking to a tax professional to get some unfiled tax returns in canada further.

We order the information, check it all out, file what needs to be filed and proceed on the best resolution. Contact from the canada revenue agency may never come, but it might already be in the mail! We can get this file before we get started on your tax returns ensuring we have everything we need.

Easy way to deal with unfiled tax returns. Unfiled tax return in canada can cost you. If you are living in the toronto area and you are experiencing issues with revenue canada over unfiled taxes you should seek professional tax help as soon as possible to prevent the late filing penalties from getting worse.

You could miss out on tax refunds. If we cannot help you we’ll tell you. Submit the present tax returns on schedule.

If you are repeat late filer, the costs are even more. Has the canada revenue agency (“cra”) created a tax debt for you without the proper information? But what happens if you incorrectly reported your income or have not filed your tax returns for multiple years?

If you have unfiled, or incorrectly filed tax returns don’t delay. As a resident of canada receiving taxable income, you are obligated to file an annual t1 income tax return each year. If this occurs, not only are you still responsible for the taxes on the balance of the unreported income and overdue tax returns, but severe penalties can be imposed.

At cra tax rescue, we specialize in providing a comprehensive solution for your corporation tax returns in canada issues. Once cra discovers unfiled tax returns and is not satisfied with communication outcomes they often have to get attention by issuing notional (estimated) assessments (tax bills). Canadian corporations have an obligation to file annual t2 income tax return.

They will also do this for outstanding gst returns. If you don’t file your tax returns, the cra could potentially start. Regulation 105, part xiii, gst/hst);

Taxwatch can assist with bookkeeping and review financial records and transactions to complete returns and provide the backup if cra questions the returns. Unreported income earned inside or outside canada while a resident of canada; We will analyze all the risks and problems associated with your unfiled corporation tax returns and recommend the most protective solution to achieve the best results for your corporation.

The cra can and will impose hefty penalties. Have draft returns prepared for all unfiled years. The probability of a cra audit (even for multiple years) is low.

Do you have unfiled tax returns? Tax defenders tm provides help, assistance, advice in case of unreported income tax or unfiled tax return or sales taxes, information on penalty for not filing a tax return in canada and how to avoid, eliminate or reduce that penalty and interests, how to file late income tax return for previous years, voluntary disclosure of back income tax and taxes, tax pardon, tax amnesty. When coping with back tax questions, you must prepare and submit your current tax taxes on investment next year.

It will recognize that you have not filed your tax returns on time and the longer you go without filing, the more potential trouble you could find yourself in. If you haven’t filed your tax returns the canada revenue agency has the ability to assess you on any taxable income and benefits they believe you may have received in the year. When the cra reviews your account, you must be present to file the most recent tax return.

Cra will proceed against you. The situation discussed above refers to back taxes. Consequences of unfiled returns if you have several years of outstanding returns , the cra could issue arbitrary notice of assessments which demand that you pay tax on false earnings.

We only submit settlements that can be accepted. You can be charged a late filing penalties of up to 50%. You may not know, but the canada revenue agency keeps files on all taxpayers.

These types of assessments typically require you to pay more. Ad ask verified tax pros anything, anytime, 24/7/365. No false promises for settlements.

These assessments are valid tax debts until you file the correct tax returns. It is in your best interest to file all outstanding returns to replace the inflated fake returns issued by the cra. Ad ask verified tax pros anything, anytime, 24/7/365.

If you have unfiled tax returns and the cra believe you owe taxes, they can freeze your bank accounts, garnish your wages, seize your car and sell your house. That is rhalf of your tax owing.

Unfiled Returns Back Taxes Canada And Us Accounting Firm Mississauga Toronto Ottawa London

Canada-relocation-tax-helpcom Moving Or Relocating To Or From Canada Relocation Canada Tax Help

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

Get Your Late Tax Returns Done Get Rid Of The Stress Solid Tax

Infographic What To Tell Your Bankruptcy Trustee Personal Finance Blogs Bankruptcy Tax Debt

Unfiled Tax Returns Faris Cpa Toronto Tax Accountant

Unfiled Tax Returns Faris Cpa Toronto Tax Accountant

Httpwheretoinvestukcominvestment-mastery Book Worth Reading Worth Reading Investing

Back Taxes Unfiled Tax Returns Tax Doctors Canada

What To Do If You Havent Filed Taxes In 10 Years – Debtca

Pin On Tax Help Toronto

Pin On Best Tax Lawyer

Fatca Servicesca Fbar Form 8938 Form 8891 Form 3520 Tax Help Tax Services Talk Show

How To Resolve Your Irs Tax Debt Problems Anyone Contemplating Self-representation Before The Internal Revenue Service Must Read This Book First Lawrence M Lawler Haarlander Cpa Mba Ms-tax Frank Haarlander Ea F Bryan 9781540773494

Fix Back Taxes Problem Tax Fix Solutions

What Happens If I Dont File My Tax Returns Taxwatch Canada Llp

Late Returns Unfiled Taxes – James Abbott Cpa

Unfiled Taxes What If You Havent Filed Taxes For Years Kalfa Law

How To File Overdue Taxes – Moneysense