Many taxpayers have questions about unfiled tax returns, and rightfully so. $12,000 for single filers or married filing separate returns.

Astonishingly Irs Non Filers Have 10 Years Of Unfiled Taxes

These amounts changed with the passage of the tax cuts and.

Unfiled tax returns 10 years. First, you need to see what they have filed for you if anything. Once you start repaying your unfiled returns from the past, you activate the statute of limitations and buy yourself enough time to. The irs pays refunds for only the last three years, so the sooner you file, the more you can get back.

After that incident 10 years ago, she didn’t file any returns and hasn’t since then (out of fear the irs would “find her” over the 40k), compounded each year by the number of unfiled returns. If you need help, check our website. If you have unfiled returns but have paid your taxes, waiting can be costly.

Any state withholding or estimated tax payments you made. However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term. For the 2018 tax year, these amounts were as follows:

Sometimes the irs skips old years or does a year for you with a lower balance and you are lucky. Most likely, unfiled returns less than 10 years old are not going to be expired yet, but some may be closed already. If you missed the above deadlines, then you will not obtain the refund.

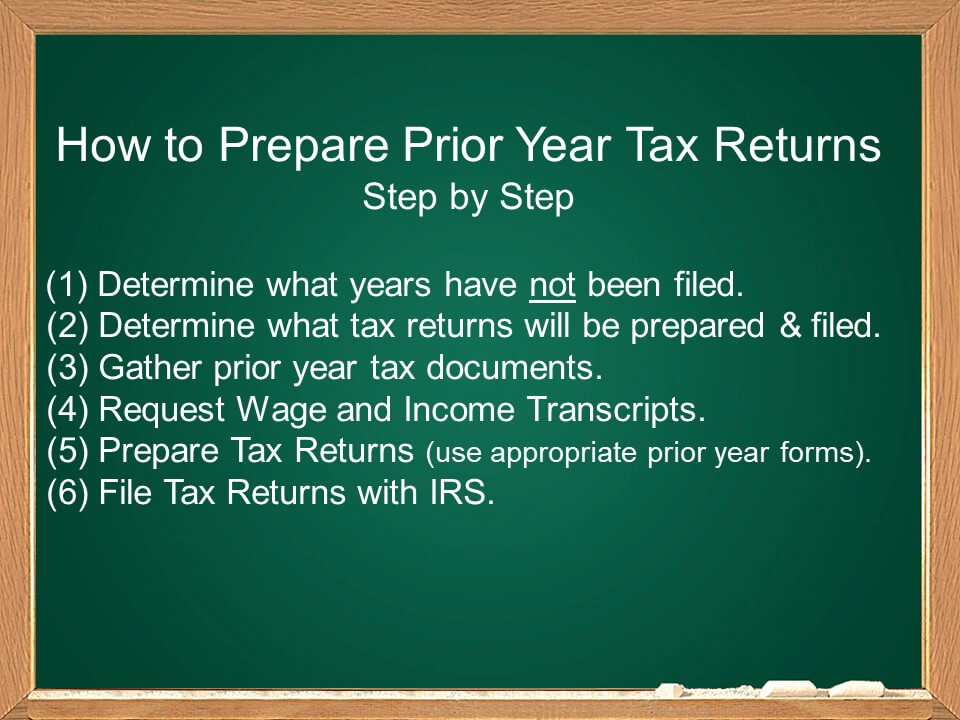

Filing returns that are required is often the best option. In most cases, the irs requires you to go back and file your last six years of tax returns to get in their good graces. Systemically holds an individual taxpayer's income tax refund when their account has at least one unfiled tax return within the five years surrounding that return.

There is no need to go as far as 10 years back in your attempt to get back into the good books of the irs. You can make payment arrangements at that time, but you may be asked to file returns for tax years 2010 and 2011 to be considered filing compliant. Tax debts do have expiration dates.

The irs gives you 3 years from the due date of the return, plus extensions, to file your tax returns and 2 years from the date of payment, whichever is later, to claim your refund. Many have not filed tax returns for 10 years, or even 15 years, or maybe never. Once the return is processed, you will receive a notice with the balance due, including penalties and interest, after about 8 weeks.

In addition, the irs is also working with key partners to better educate taxpayers and tax professionals on filing requirements. The good news is that the irs does not require you to go back 20 years, or even 10 years, on your unfiled tax returns. Filing a bankruptcy, an offer in compromise, or a collection due process hearing will.

Haven’t filed taxes in 1, 2, 3, 5, or 10+ years? There’s no time limit on the collection of taxes. There is a general rule for the irs according to which taxpayers can get back into the good books of the irs if they file back tax of 6 years to the agency.

The irs can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed. Know the consequences you may face by year if you owe tax or are owed a refund. However, you may still be on the hook 10 or 20 years later.

Many times it can just mean a loss of a refund, but other times it can lead to serious tax penalties and collection problems. Then ask about “140 codes” on any unfiled years and ask if they’re still looking for it. You may also face late filing penalties.

Waiting can also make it worse, with the irs growing impatient and taking matters into their own hands and filing estimated tax returns for you. There are, however, things you can do that will ‘toll’ the statutes. If you owe taxes and did not file your income tax return on time, the cra will charge you a late filing penalty of 5% of the income tax owing for that year plus 1% of your balance owing for each full.

There are several things you may need over the course of your life that require you to show tax returns: The irs has a statute of limitations for collections of 10 years. According to the irs statute of limitations, the government has up to ten years to collect the debt on unfiled tax returns.

If you have old, unfiled tax returns, it may be tempting to believe that the irs or state tax agency has forgotten about you. Many are worried about what the statute of limitations is on unfiled tax returns. If you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not filing the required return.

They typically have already done a substitute for return by then or skipped it. If you owe on any return, file it as soon as possible. In some cases, irs may ask the individual to file back returns for more than 6.

And then, to make arrangements on payment of what is owed. A copy of your notices, especially the most recent notices, on the unfiled tax years. We have tools and resources available, such as the interactive tax assistant (ita) and faqs.

Information needed to complete your tax return. What to do with federal tax returns not filed for more than 10 years. Short and long term consequences of not filing for ten years.

The irs is probably not looking for anything that is older than 10 years. $18,000 for head of household filers. Each year that taxes remain unfiled, the consequences change.

Bring these six items to your appointment. Here we touch on what to do in situations where you have not filed taxes specifically for 10 years or more.need help? Now, with 10 years of unfiled returns, the irs has started contacting her regarding her them.

$24,000 for married taxpayers filing jointly. Meaning, once you file your taxes, the collection period begins, and if your debt has not been collected within 10 years, the remaining balance of your debt will be removed and you will no longer be liable to pay it.

Understanding The Law On Unfiled Tax Returns Family Law Irs Taxes Law

Pin Oleh Kuotabro Com Di Trik Kuota Internet Pajak Penghasilan Hukum Pidana

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Did You Know Youre Committing A Crime If You Have Unfiled Tax Returns Tax Return Tax Refund Tax

Unfiled Tax Returns – Mendoza Company Inc

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What To Do If You Havent Filed Taxes In 10 Years – Debtca

The Byzantine Empire Had High Taxes But Low Food Costs Tax Lawyer Tax Day Indirect Tax

Irs Releases Draft Form 1040 Heres Whats New For 2020 Tax Return Irs Forms Income Tax Return

What Should I Do If I Have Years Of Unfiled Tax Returns – Nj Taxes

Tax Information Center – Tax Tips Hr Block Filing Taxes Income Tax Tax Guide

Irs Letter 5972c – You Have Unfiled Tax Returns Andor An Unpaid Balance Hr Block

Unfiled Irs Tax Returns – Best Tax Relief Company Is

Unfiled Tax Returns – Law Offices Of Daily Montfort Toups

Thousands Facing Hmrc Fines For Late Tax Returns Tax Return Tax Refund Certified Accountant

Unfiled Tax Returns – Tax Champions Tax Negotiation Services

Httpsirsprobcomirsprob-com-wins-again-2 Internal Revenue Service Cpa Irs

Unfiled Tax Returns Archives – Irs Mind

Unfiled Tax Returns Notice Of Deficiency J David Tax Law